2022: Banner Year for Transmission Value

A new report from the Lawrence Berkeley National Lab says that the potential savings from new power lines in 2022 were higher than any other year going back a decade. Why?

Two reasons: high power prices and extreme weather.

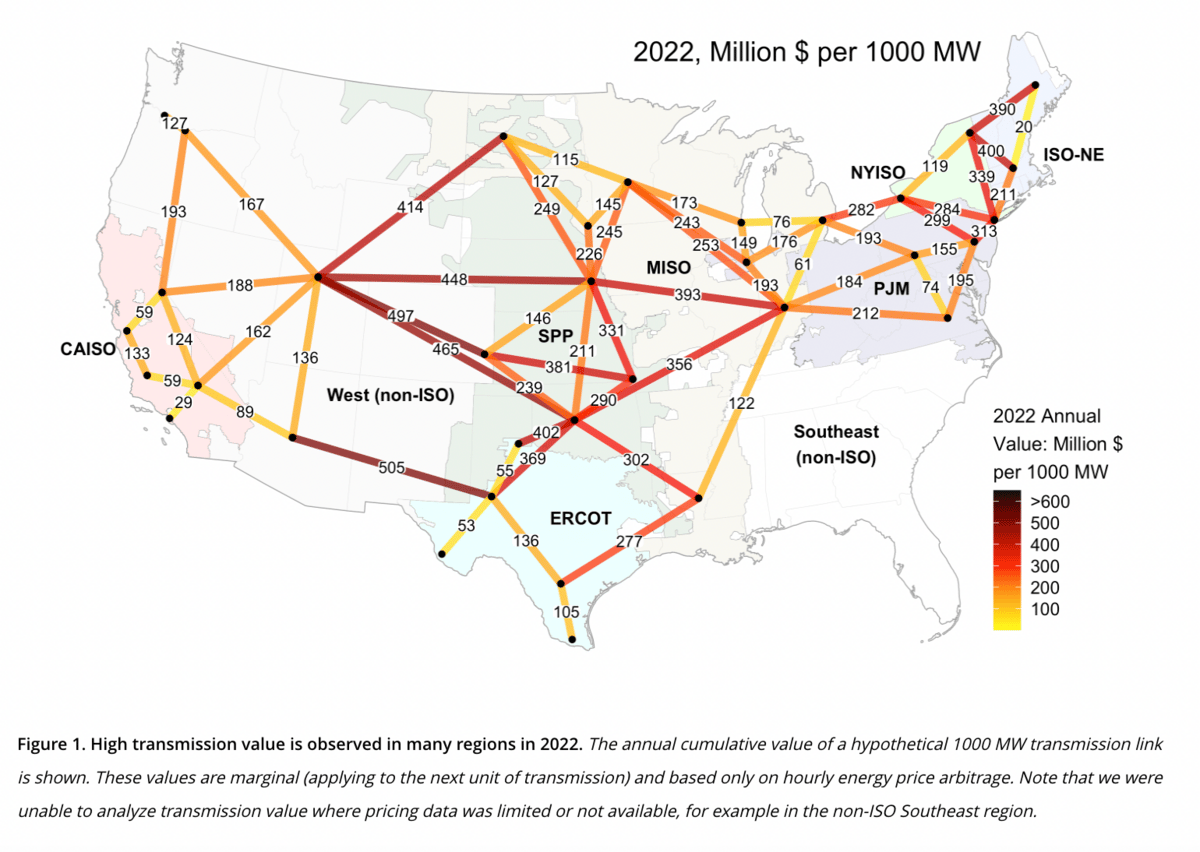

"The report supports previous analysis that indicated many transmission planning approaches are likely understating the economic value of new transmission infrastructure. The analysis is based on 64 potential transmission lines and the electricity price spread between the ends of the lines," reports Utility Dive. "The average hourly price spread across each pair of locations last year ranged from $3/MWh to $58/MWh, according to the report. The hypothetical line with the largest spread was between West Texas and central Arizona."

The findings show that the value of a hypothetical 1,000-MW line of unspecified length last year ranged from $29 million to $505 million, depending on the location, and that the value of transmission was concentrated within a small number of hours. Winter Storm Elliott increased transmission values in certain areas.

"Winter Storm Elliott in late December increased transmission values in the Midcontinent Independent System Operator, PJM Interconnection and the Northeast, according to the report," reports Utility dive. "The cold snap provided 10% to 22% of the total annual value of 13 hypothetical links in those areas."

No doubt reports like these will be used to advocate for permitting reform that will allow for more interconnection.

Solar Booms in the Midwest

Ohio and Indiana, two Republican-led US states that rely heavily on coal power, are expected to see a solar-farm boom with the installation of 15 GW of photovoltaic panels by 2027.

Part of the reason why renewables have taken off in these states is because of their low interconnection costs. "Ohio and Indiana have some of the lowest grid-connection costs in the electric grid that stretches from Washington, DC to Chicago," reports Bloomberg. "Across both states there are 23 development-stage projects that would each generate more than 300 megawatts of power, BNEF’s data shows." That's about half the capacity of a natural gas plant, but intermittent, non-dispatchable, and with a capacity factor that tops out at around 25%.

In Ohio, the low cost of solar power, promise of construction and manufacturing jobs, and pressure from large electricity customers have sweetened the deal. Indiana, meanwhile, doesn't require its power to come from renewable sources, but some of the state's farmers have found they can place solar panels in their soy fields because the flat farmland is useful for tracking the sun. Placing solar in soy fields also lowers interconnection costs.

But it's not all roses. First of all, solar performance in the Midwest is not what it is in the Southwest to say the least. Winter lasts what feels like half the year, the sun starts setting at 3:30pm during the season, and much of the year is cloudy. Winter is also the most demanding season for the Midwestern power system.

Not only that, but renewables rejections have swept over Ohio, according to the Renewables Rejection Database. In 2022, Ohioans rejected 86 renewables projects. This year alone, Ohio has seen two solar and one wind installation rejected. But Indiana only saw three rejections last year and none so far this year.

EIA: Coal and Oil Rescued New England

Coal and oil saved New England last week when extreme cold and intense wind chill swept over the region.

"Over the three days of extreme cold, hourly electricity demand in ISO-New England (ISO-NE), the power grid operator for the region, peaked at 19,487 megawatthours (MWh) at 7:00 p.m. eastern time on Friday, February 3," reports the Energy Information Administration. "Demand approached that level again on the evening of Saturday, February 4, when it reached 19,287 MWh. The all-time high in winter peak demand in ISO-NE was 22,817 MWh in January 2004."

ISO-New England used 5,000 MW from oil-fired power plants and the Merrimack Station coal-fired plant to meet the demand.

The mix of electricity sources used was similar to that during Winter Storm Elliott in Dec 2022. The extreme weather event has prompted the North American Electric Reliability Corporation and the Federal Energy Regulatory Commission to launch a national study on electric supply reliability.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Natural gas prices are expected to drop. "The U.S. Energy Information Administration lowered on Tuesday its 2023 natural gas Henry Hub price by 30.5%, according to its latest Short Term Energy Outlook (STEO). The EIA now sees the 2023 natural gas price at Henry Hub at $3.40 per MMBtu, down from $4.90 per MMBtu in its previous forecast. The Henry Hub natural gas price last year was $6.42 per MMBtu last year," reports Oilprice.com. "The EIA said it revised its outlook for Henry Hub prices 'as a result of significantly warmer-than-normal weather in January that led to less-than-normal consumption of natural gas for space heating and pushed inventories above the five-year average,' the agency said in its STEO."

Oil prices also appear to be on the downswing. "Global oil prices have been in a turbulent downtrend since the middle of 2022. That’s what BofA Global Research stated in a new report sent to Rigzone on Tuesday, highlighting that oil has fallen $40 per barrel since early June," reports Rigzone. “'It now appears Russia may continue to operate with limited supply losses, which goes against the expectations of many market watchers,' BofA Global Research said in the report. 'Furthermore, warmer weather has limited heating demand for oil and caused global gas prices to collapse, which may facilitate an unwind of some gas-to-oil switching from 2022. These factors have contributed to oil price weakness, even as the broader macro has held up better than expected,' BofA Global Research added in the report."

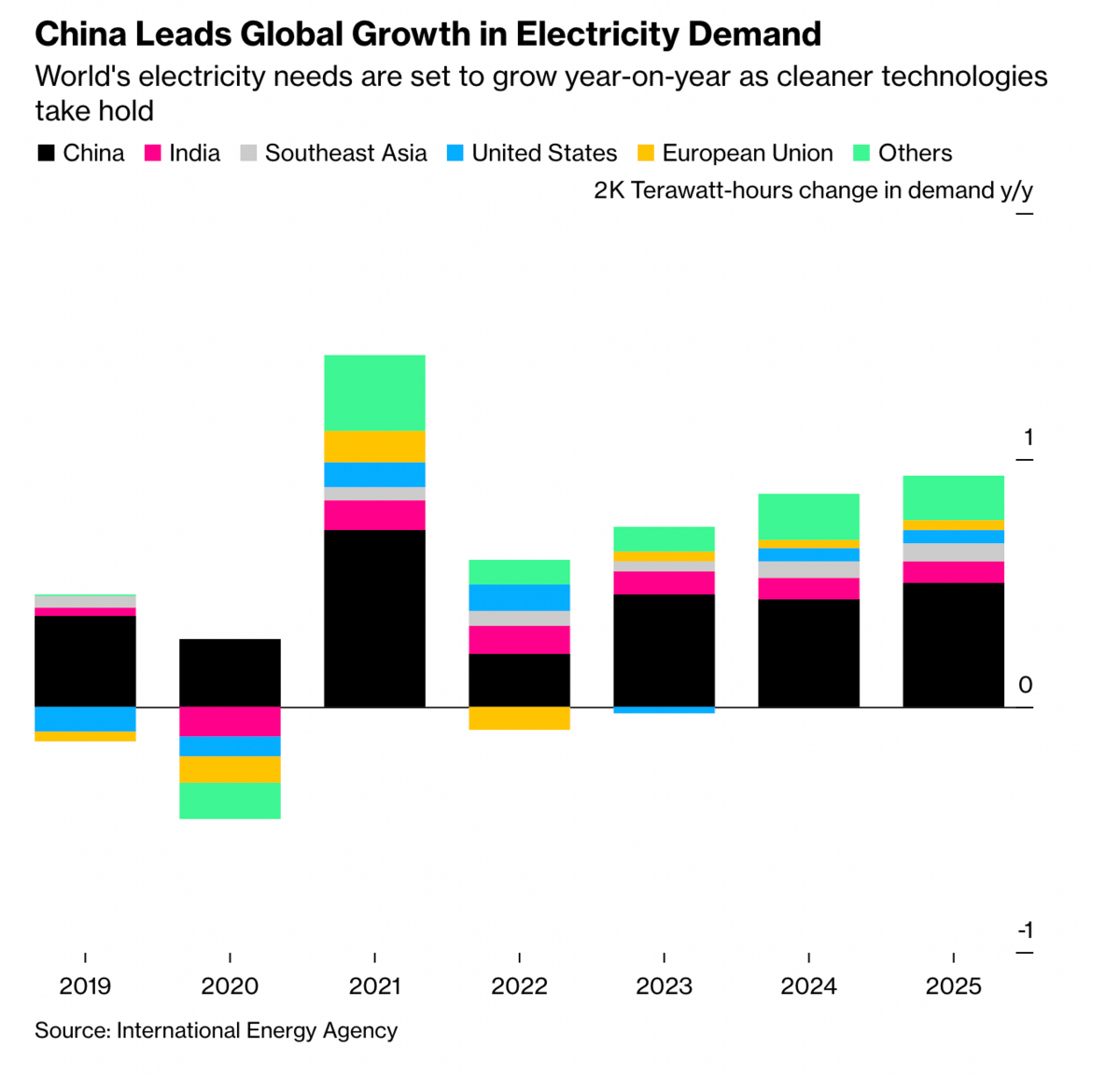

China's electricity demand trounces the rest of the world's. "The increase in worldwide consumption each year through 2025 will be roughly equivalent to what the UK and Germany use now, according to the International Energy Agency’s annual electricity report. China is predicted to account for a third of electricity demand by then," reports Bloomberg. "Electrification is increasing across the world as countries subsidize greener technologies and aim to decarbonize heating and industrial processes to meet ambitious climate goals. That requires more investment from utilities to build power stations, supplement fossil fuels with renewable sources and bury more cables to expand grid capacity."

Crom's Blessing