49% Russian, 100% Legal

It's called a "Latvian blend"--49.99% Russian diesel mixed in with 50.01% Latvian diesel. It's how companies like Shell are outmaneuvering sanctions to keep Europe's nearly-sapped diesel supplies from drying up.

Javier Blas of Bloomberg writes, "The typical trade goes from Primorsk, a Russian oil export town near St Petersburg, into Ventspils, a port in Latvia that has a large oil terminal and tanking capacity. That’s where the blending takes place. There are many other locations where blending is happening, including in the Netherlands, and on the high seas, in what traders call ship-to-ship transfers."

But this new diesel cocktail isn't so new after all. Iranian and Venezuelan crude turns up in the Far East with the labels "Malaysian blend" and "Singapore blend" slapped on them. And while not every European company or country accepts the Latvian blend, this does speak to something Anas Alhajii said on Robert Bryce's Power Hungry Podcast the other week: "Markets make people sin." Many want the moral high ground sanctions give them but at a discount--half off.

Russian Crude Flows to India and China

The EU remains divided on Russian oil and gas, though it just agreed to a coal embargo. For India and China, it's far less fraught: Russian crude's a bargain and they want more.

India imports about 80% of its energy, but no more than 5% of that has ever come from Russia. But since March, India has imported five cargoes of Russian oil, or about 6 million barrels. That's about half as much crude from Russia in a single month as it did in an entire year. With Russian oil going for as low as $25 a barrel, it's impossible to turn it down.

No wonder Delhi has ignored Washington's appeals to cut it out.

For China, the story's a little more complicated. It's already Russia's largest oil buyer, but in the opening months of the year, China's import percentage fell 9%. According to Oilprice.com, this is because "Beijing announced huge cutbacks in import quotas for the country's private oil refiners...The big reduction came as part of a government crackdown on private Chinese refiners known as teapots, which have become increasingly dominant over the past five years."

But, Ellen Wald of Transversal Consulting told CNBC that "China really would prefer much cheaper oil...If they can buy Russian oil at a discount, and some of these discounts are pretty significant — $30 off the benchmark, then I really don’t see what would be stopping China from purchasing a lot of Russian oil.”

The other reason why China will likely snap up Russian oil, according to Oilprice, is that Chinese refiners love crude from the Eastern Siberian Pacific Ocean oil pipeline. "The 4,188km-long pipeline with a capacity of 58 million tonnes a year is even longer than the Yamal-Europe pipeline and exports crude oil from Russia to the Asian Pacific markets of Japan, China, and Korea."

Even still, Russia will struggle mightily to make up for the hole European sanctions have put into its oil economy.

NextEra Lied, Eagles Died

One of the first major investigations in energy I ever did was a deep dive into how bird deaths get regulated. The project got mothballed, but I did learn it was a complete blackbox--the industry self-reports, they narrow the area around which carcasses can be counted to a small diameter around the turbine's base, and they enjoy such broad acceptance few are ever motivated to go after them.

Well, this recent report out from NPR, rarely an enemy to the renewables industry, on NextEra killing at least 150 bald eagles (likely an undercounting). "The company was warned prior to building the wind farms in New Mexico and Wyoming that they would kill birds," NPR reports, "but it proceeded anyway and at times ignored advice from federal wildlife officials about how to minimize the deaths, according to court documents." NextEra is one of the largest wind energy companies in the world.

It's a federal crime to kill the national symbol. After pleading guilty, the company will pay around $8 million in fines.

Here's Robert Bryce, who's covered this issue for decades, with more on this :

Conversation Starters

The solar industry is duking it out amongst themselves over Biden's tariff investigations. Companies dependent on likely Chinese-made solar panels are furious, and solar developers who want to grow the industry domestically welcome the investigation.

Nigeria's grid collapsed for the second time this month. High diesel prices, spotty power supply, and a failing privatization experiment have beset their electricity infrastructure.

Like many countries, Uzbekistan turned to Russia's Rosatom for help with a nuclear buildout. Now, during sanctions and an energy crisis, Uzbekistan worries it will anger Russia by canceling the nuclear projects, or face sanctions if they are completed.

Word of the Day

hydrocarbon

n. A naturally occurring organic compound comprising hydrogen and carbon. Hydrocarbons can be as simple as methane [CH4], but many are highly complex molecules and can occur as gases, liquids, or solids. The molecules can have the shape of chains, branching chains, rings, or other structures. Petroleum is a complex mixture of hydrocarbons. The most common hydrocarbons are natural gas, oil, and coal. (source)

Crom's Blessing

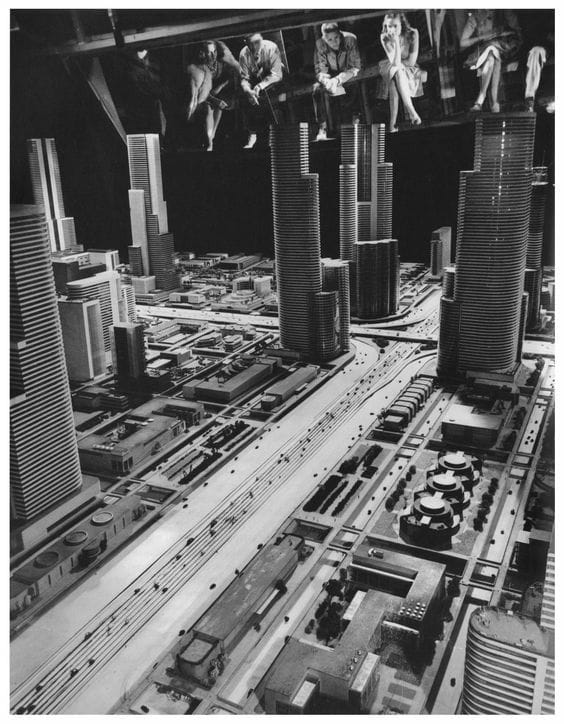

General Motors' Futurama exhibit at the 1939 World's Fair.