Welcome to the working week. Here's what we're looking at today.

Why American LNG Can't Save Europe

On Friday, Biden promised Europe the liquified natural gas they need to break their dependence on Russian energy. Sadly, if they try and cash that check it'll bounce. The US cannot do this.

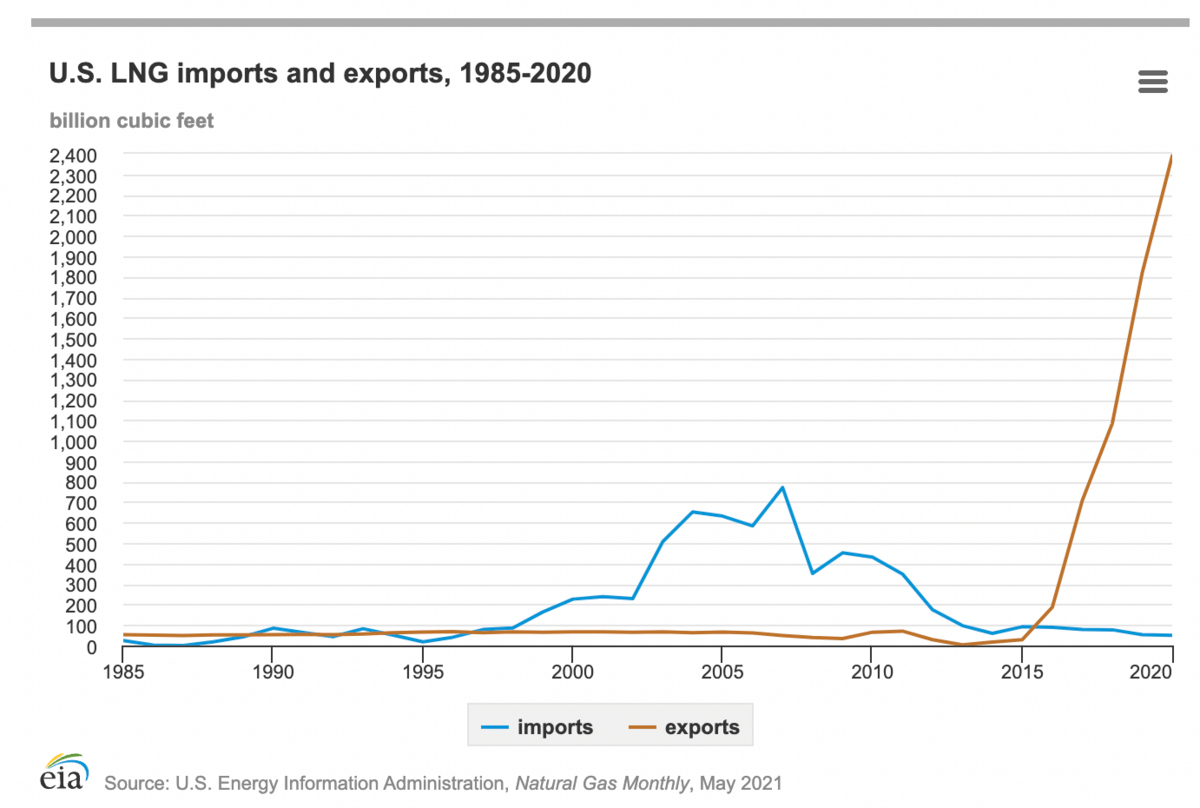

The first reason we can't do it is that American exporters have already maxed out their ability to ship to Europe. The NYT reports that "[t]he United States has already increased energy exports to Europe substantially. So far this year, nearly three-quarters of U.S. L.N.G. has gone to Europe, up from 34 percent for all of 2021."

Some export terminals are under construction--enough to increase exports by a third--but they won't come online until 2026. That brings us to the second problem.

Even if the US could send all that LNG to Europe, enough to replace 40% of their needs (what Russia currently provides the EU), they wouldn't be able to receive it. And won't be able to receive it for two to five years. Europe does not have enough import terminals to receive what they need.

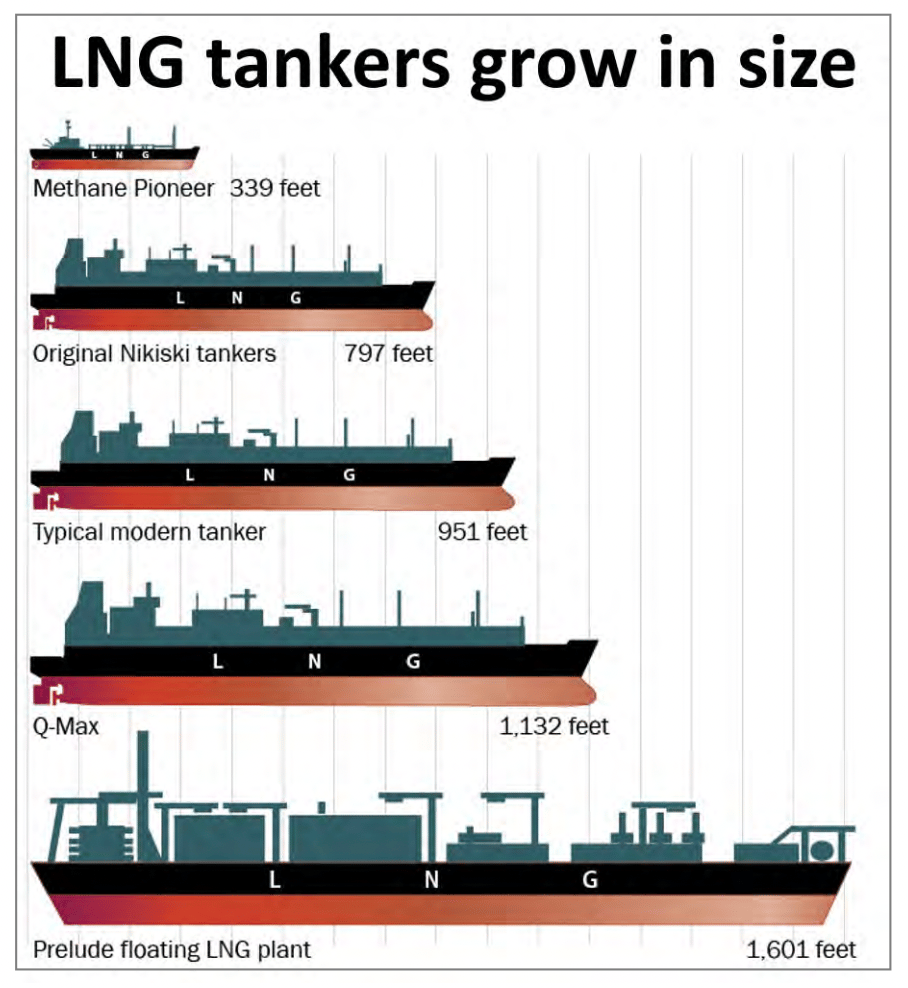

These are major infrastructure projects that take time and money. Here's how large the tankers are.

Just as we found out with fragile supply chains, these kinds of projects cannot be turned on a dime.

How Bad Will the Food Crisis Be?

Sanctions on Russia have prevented it from shipping out fertilizer. Russia is the world's largest exporter of fertilizer. So the Black Cascade climbs.

Here's this from the WSJ:

"Fertilizer prices were already high before the war. They have now reached record levels amid a precipitous drop in Russian supply, according to CRU Group, which analyzes commodity markets. At the same time, more-expensive natural gas, another Russian export and a crucial ingredient in fertilizer-making, has led European fertilizer factories to scale back production."

And here's this from Doomberg:

"Key sources of nitrogen, potassium, and phosphorous – important inputs into soil fertility, crop yield, and plant maintenance – have all gone vertical. Ammonia is derived directly from natural gas, and the price of natural gas outside of the US has gone vertical. It's no surprise that the price of ammonia has tripled over the past twelve months. Belarus is the third-largest supplier of potash in the world and its state-owned miner, Belaruskali, declared force majeure after sanctions were imposed by the US and Europe. The number two supplier of potash globally? Russia."

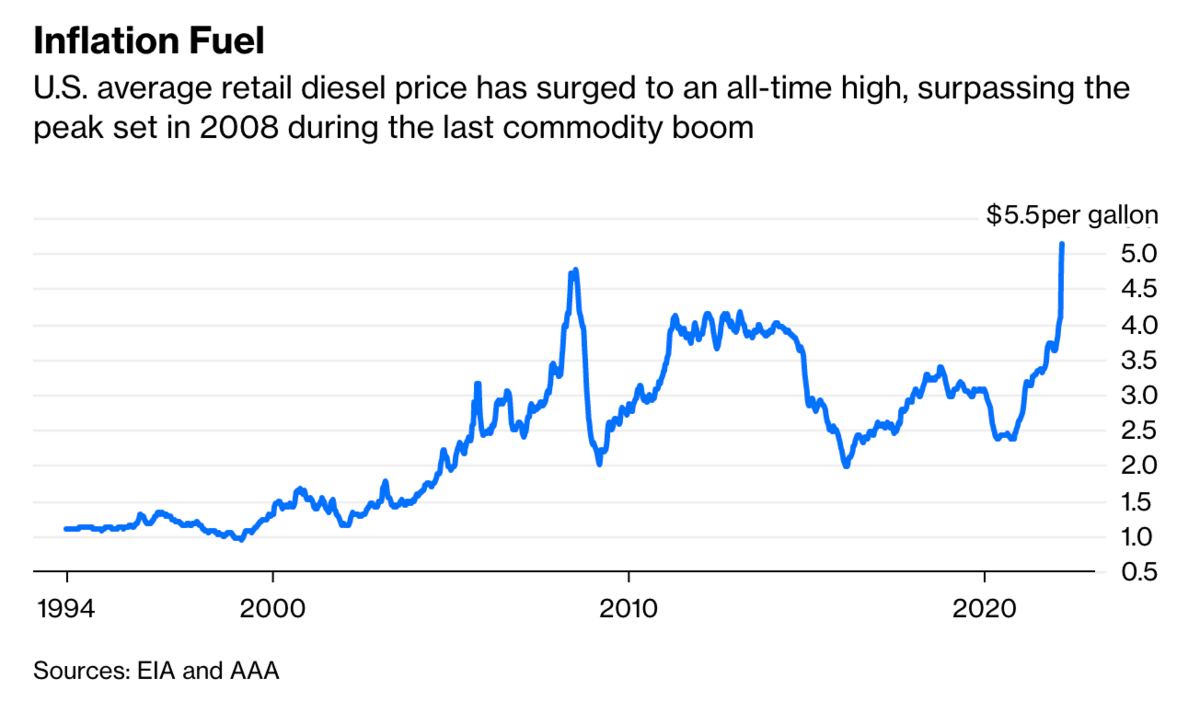

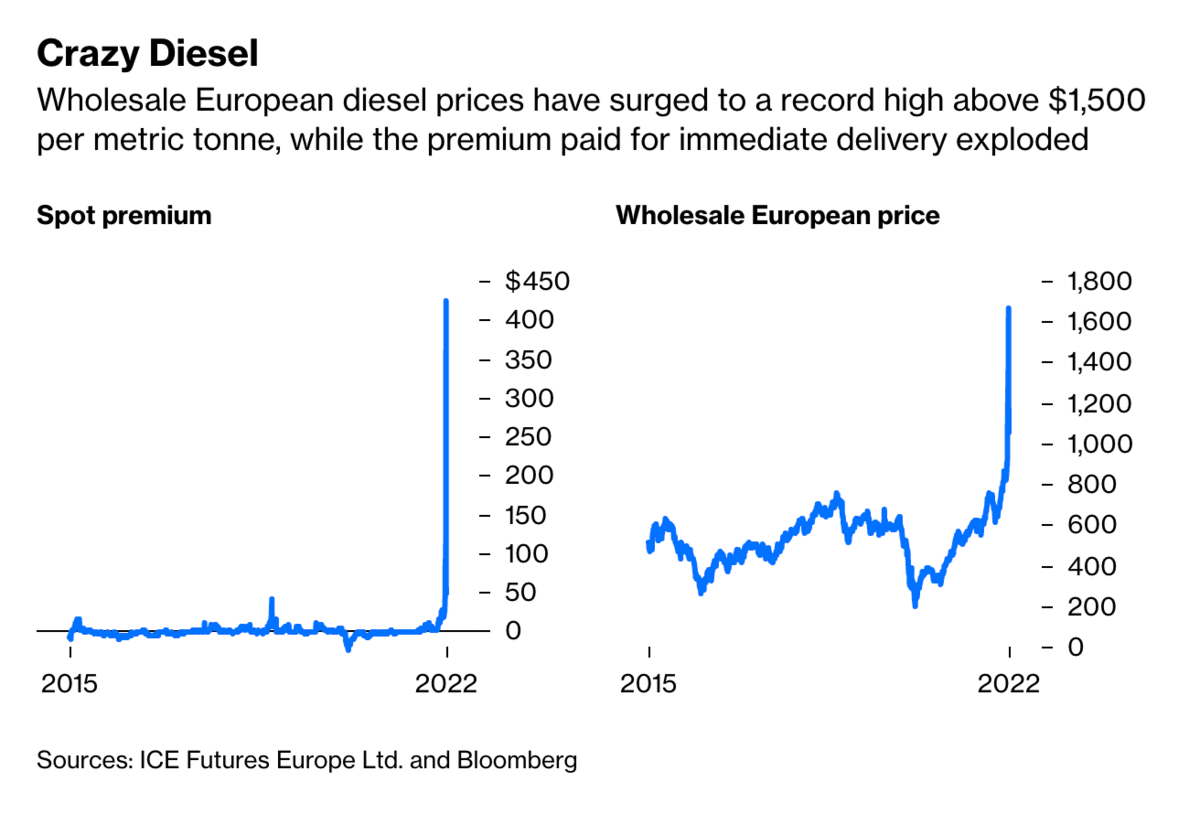

Diesel, another vital input for farming, has hit $5 a barrel for the first time. Here's a disturbing pair of graphs from Bloomberg's Javier Blas:

Inventories on diesel are low in both the US and Europe. Doomberg is convinced that "we are at the onset of a global famine of historic proportions." Blas thinks the diesel crisis is worse than the oil crisis. Energy rationing seems inbound--perhaps as early as next month.

I don't have a crystal ball, but if I did I wouldn't want to look at it.

Electric Unreliability Is Here to Stay

The Midcontinent Independent System Operator will face reliability problems for the next decade, MISO board members found out at a presentation this last week. The two prime movers are interrelated: weather and weather-dependent energy sources like wind and solar.

In 2020, wind and solar made up around 13% of MISO's generation mix. Depending on how aggressive the renewables-only climate legislation shakes out, MISO could be looking at an increase of 25%-46%.

Let's put that into perspective. SPG reports that "[i]n 2008, hourly wind output varied from near zero to about 1.8 GW, but in 2021, that number rose from a range of about 1 GW to a high of more than 20 GW, the presentation states." In other words, MISO plans to onboard more energy sources they can't predict the output of by an order of magnitude. That means between a quarter to a half of its energy portfolio will be wildly unpredictable.

But the other climate ambition is to "electrify everything" in order to decarbonize. So that means increasing loads. So, as electricity demand increases MISO expects that unreliable energy will expand.

Wayne Schug, MISO's VP for strategy and business development, told the board the following:

"We're seeing less predictable dispatchable generation. We're seeing retirements, we're seeing forced outage rates increase in those assets we depend on to manage that increasing variability and volatility. ... So while volatility is increasing, our ability to deal with it is decreasing simultaneously."

What we're seeing is the creation of energy austerity at a foundational level: our electricity supply. Unreliable electricity means expensive electricity. Expensive electricity means expensive everything. Expensive everything means poverty.

Headlines

Oil prices stay high as Russian crude shortage hits market. (WSJ)

EU intake of Russian gas remains high amid lower wind output. (OP)

Lithium price surge jeopardizes energy transition efforts. (OP)

Wintry weather extends US gas storage withdrawal season, lifting NYMEX. (SPG)

German nuclear industry says 'no legal or safety reasons' reactors cannot continue to operate. (NN)

Word of the Day

quebracho

1. n. [Drilling Fluids]

A powdered form of tannic acid extract from the bark of the quebracho tree, used as a high-pH and lime mud deflocculant. It was in widespread use until the 1950s, at which time lignosulfonate became widely available and performed the same function better and cheaper than quebracho. High pH was needed to neutralize tannic acids to form the tannates, which are red. The oilfield name red mud was applied to tannate-dispersed muds.

A legend of the oil patch holds that, back in the days when quebracho mud was all the rage (in the days when Hobby Airport was Houston's main airport), a mud man parked his old field car in the airport parking lot for several days. It was raining when he left, but sunny when he got back. The police were waiting to talk to him when he returned because someone noticed a dried blood-red stain under his car. The liquid had obviously leaked out of the trunk. When the mud man opened the trunk for the police, they found two wet sacks of quebracho. As you may have guessed, his trunk lid leaked. (Source)

Crom's Blessing

Director John Milius teaches Arnie how to wield a sword on the set of Conan, The Barbarian (1982).