Welcome to Grid Brief! Here’s what we’re looking at today: AWS acquires a nuclear-powered data center, high uranium prices spur American mining restarts, and more.

AWS Acquires Nuclear-Powered Data Center

Susquehanna Steam Electric Station

Amazon Web Services just acquired a $650 million data center sited next to a Pennsylvania nuclear power plant.

“Talen said AWS aims to develop a 960MW data center campus. The cloud company has minimum contractual power commitments that ramp up in 120MW increments over several years; AWS has a one-time option to cap commitments at 480MW,” reports DCD. “The cloud provider also has two 10-year extension options, tied to nuclear license renewals.”

Part of the deal includes a 10-year Power Purchase Agreement between AWS and Talen from its 2,494MW Susquehanna Steam Electric Station, one of America’s largest nuclear power plant.

"To supplement our wind and solar energy projects, which depend on weather conditions to generate energy, we're also exploring new innovations and technologies, and investing in other sources of clean, carbon-free energy. This agreement with Talen Energy for carbon-free energy is one project in that effort," an Amazon spokesperson said in a statement.

AWS’s acquisition speaks to the power intensity of AI computing. According to the Wall Street Journal, data centers accounted for 1% of the world’s electricity in 2010. Vrije Universiteit Amsterdam's School of Business and Economics told WSJ that it estimates “the amount of electricity required to power the world’s data centers could jump by 50%” by 2027, as a consequence of AI.

No doubt AWS is protecting itself from the potential “demand disconnect” we recently covered for premium subscribers.

The Race to Revive US Uranium Mining

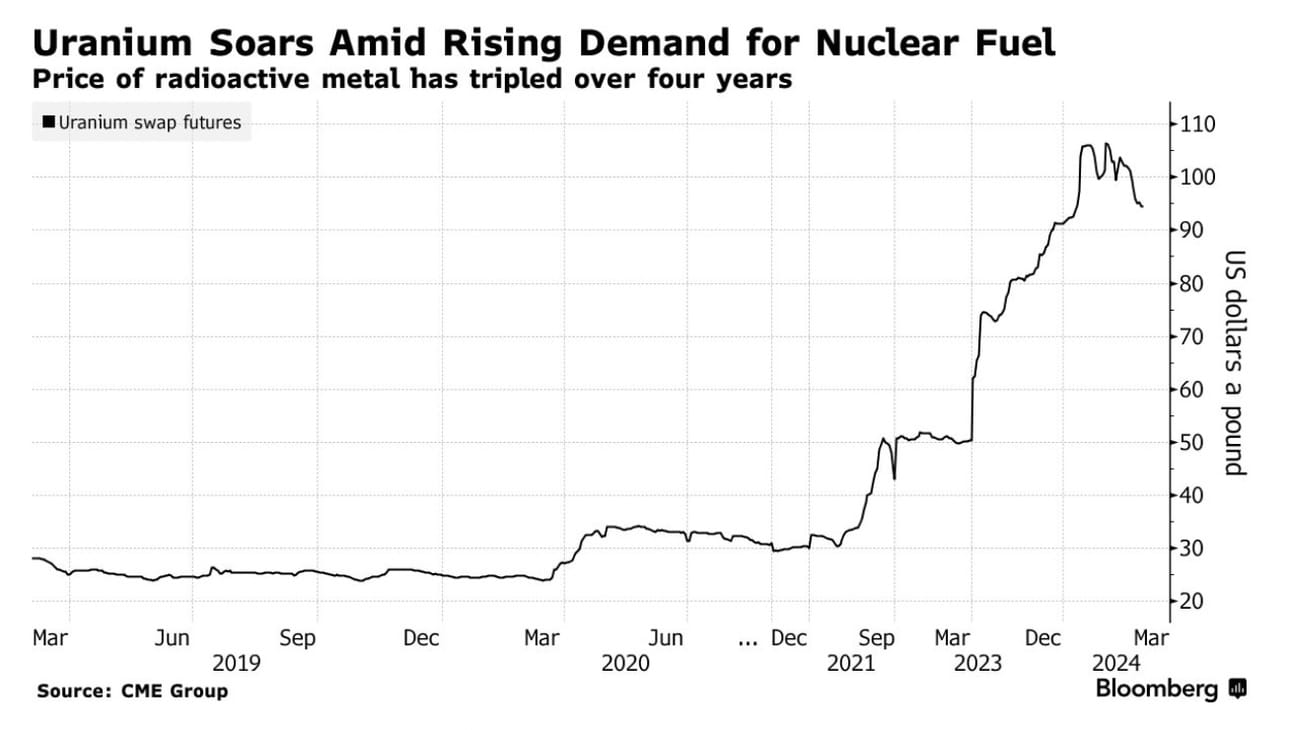

Nuclear power is resurgent, but a uranium supply squeeze seems imminent. Some American firms are restarting old mines to catch the wave.

“As countries increasingly consider nuclear power to address climate change, demand for uranium is expected to skyrocket,” reports Bloomberg. “The International Atomic Energy Agency estimates the world will need more than 100,000 metric tons of uranium per year by 2040 — an amount that requires nearly doubling mining and processing from current levels.”

Due to underinvestment, production has failed to keep up with demand. That’s why Energy Fuels Inc. initiated plans in 2023 to restart operations in Arizona, Utah and Colorado. Meanwhile, Ur-Energy Inc. plans to reboot an idled mine in Wyoming.

Yet Kazakhstan and the Canadian firm Cameco remain the top dogs in the field. These restarted American mines won’t make a huge dent in the global picture. Nationally, however, they signal a revival of an industry that previously appeared on the brink of vanishing but a few years ago.

“American uranium production hit an all-time low of 174,000 pounds in 2019 — a drop from its 44-million-pound peak in 1980 — as the US started increasing dependence on imports from countries like Canada, Australia, Kazakhstan and Russia,” reports Bloomberg.

Geopolitical tensions are also in the mix. The US is now committed to domesticating its uranium supply after its main supplier, Russia, invaded Ukraine.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

Britain announces a 1 billion pound renewable energy auction. “Britain’s next auction round to spur renewable power projects will be worth more than 1 billion pounds ($1.3 billion), government budget documents showed on Wednesday. The government has set targets for major increases in renewable power to help increase Britain's energy security and meet climate targets,” reports Reuters. “To help ensure projects are built, it holds annual auctions offering renewable power developers a guaranteed price for their electricity. ‘The government is providing clarity and certainty for investment into the UK’s renewables sector... setting the largest ever budget for a single round of over 1 billion pounds,’ the budget document said.”

Norway settles its dispute with reindeer herders over wind projects. “Norway has reached an agreement with Sami reindeer herders that allows the country's largest wind farm to stay in operation, ending a dispute over Indigenous rights, the energy ministry said on Wednesday. Norway's supreme court ruled in 2021 that the Storheia and Roan wind farms in Fosen in central Norway violated Sami rights under international conventions - prompting huge protests last year over the protracted process to implement the ruling,” reports Reuters. “An agreement was reached in December with one group of reindeer herders, in Fosen South, while a second group, Fosen North, had continued to oppose the wind farms. Wednesday's agreement encompassed the northern group of herders and operator Roan Vind, owned by Aneo, Germany's Stadtwerke Muenchen and Nordic Wind Power, the Norwegian ministry said. A spokesperson for the herders confirmed that a settlement had been signed.”

India drops Russian crude imports as US sanctions tighten. “India’s state-run oil refiners are shying away from contracted Russian crude supply as the once-booming trade becomes much harder under tighter enforcement of US sanctions,” reports Bloomberg. “The biggest state-owned refiner Indian Oil Corp. will likely reduce the amount of crude received under so-called term supply, while Bharat Petroleum Corp. and Hindustan Petroleum Corp. have decided against making firm commitments to take contracted oil next financial year, six people familiar with the matter said, asking not to identified because the information is private.”

Crom’s Blessing

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!