Belgium Shuts Down Nuclear Reactor

Germany is not the only government standing up against the tyranny of common sense--Belgium has joined the fight. Last week, the country shut down one of its nuclear power plants.

"Despite calls from members of the Federal Government to postpone the dismantling of the Doel 3 nuclear reactor, both the operator Engie and the reactor's director have confirmed that it will be permanently shut down on Friday," the Belgian Times reported last week.

Nearly twenty years ago, the Belgian government passed a law that all nuclear reactors would have to cease generating electricity 40 years after their installation. In 2011, the country decided to shutter its oldest reactors, and in 2015 and the remaining reactors by 2025. "In spite of this, the Doel 1 and 2, as well as the Tihange 1 reactors (that started producing power in 1985) were allowed to extend their operations until 2025," the Belgian Times reports. Doel 3 was not so lucky.

As we've seen in Germany, the plan was to replace nuclear with imported Russian natural gas. Now, Russia is slowing its flows to a trickle. The decision to shut down Doel 3 came two days after thousands of Belgians took to the streets to protest high energy bills. "In a recent Belgian media poll, 64% of Belgians are concerned that they might not be able to pay their energy bills," reports Oilprice.com.

The only thing more difficult than cooking up novel ways to describe the pain that will befall Europe this winter has been thinking of novel ways to describe the simultaneous follies such as this one from the Belgian government.

California's Grid Frays

The fight to provide central station electricity to the entire country ended in the 1960s. California once sat at the forefront of electrification--it lacked hydrocarbons but had a wealth of hydropower--"white coal" as they called it. Sixty years later it's now coming undone.

Taylor Farms, which sits in the part of California Steinbeck made famous just before the fight over rural electrification, feels like it can no longer rely on the California grid for the juice it needs. Taylor Farms needs its refrigeration, which keeps its harvested vegetables fresh for packaging, to stay reliable.

"So working with Bloom Energy Corp., Taylor Farms is installing a microgrid at its 450,000 square-foot facility near San Juan Bautista — its largest — powered by fuel cells, solar panels and batteries in an effort to end the plant’s reliance on California’s strained power grid," reports Bloomberg.

Bloom's system will generate 6 megawatts of electricity generated by natural gas. Solar panels and batteries add an extra 4 megawatts. The system will stay attached to the grid until Taylor Farms is satisfied it can run on its own.

Diesel backup in California is 24 times the size of its battery fleet and now companies are starting to turn away from relying on the Golden State's grid. The state is undeveloping.

Copper Chaos

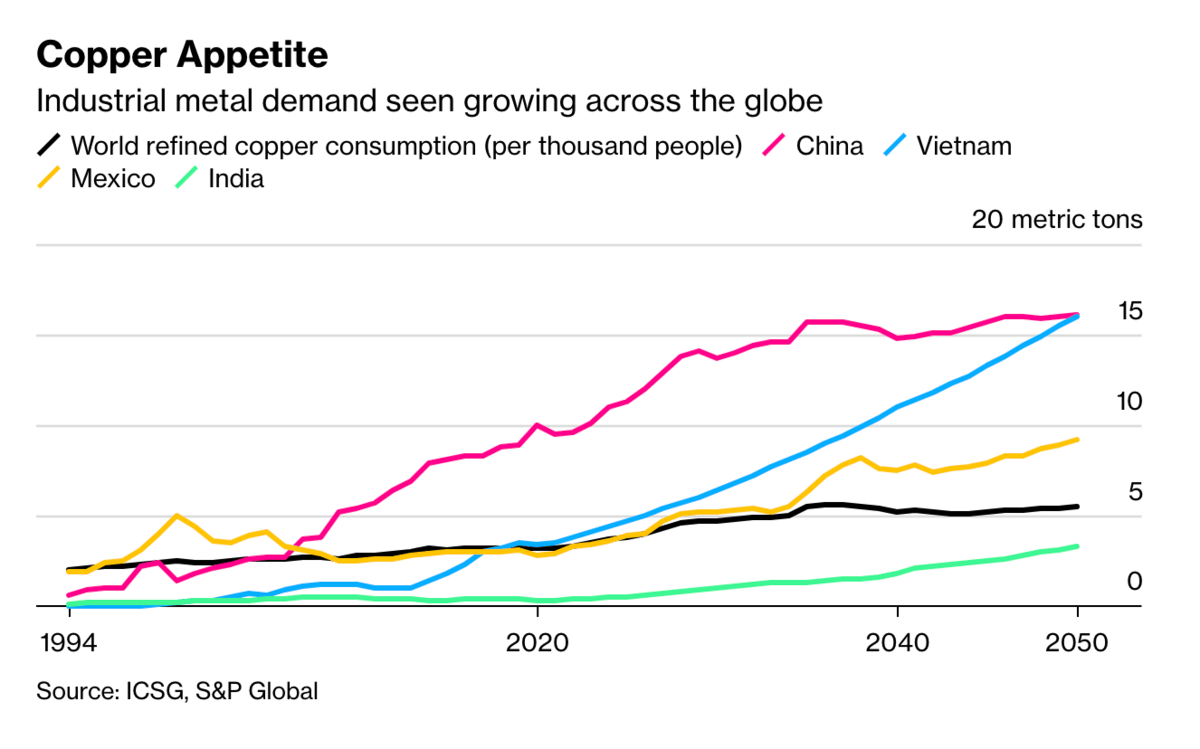

The first time I met Mark Nelson, president of the Radiant Energy Fund, was in 2017. I drank my morning coffee while he talked to me about the work he was doing as an energy analyst at Environmental Progress. He showed me Alfred Chandler's magisterial Scale and Scope: The Dynamics of Industrial Capitalism. "What matters," he told me while explaining the book, "is the stuff." He pounded on the table. "How the stuff gets made, where it comes from." Since then, my life has become about looking out the stuff. Copper is some of the most important stuff there is. And a great copper squeeze may be in store for us.

The price of copper has dropped a third since March. Investors fear a global recession will cripple demand for the metal, which goes into computer chips, wind turbines, air conditioners, cars, and homes.

"You wouldn't know it from looking at the market today, but some of the largest miners and metals traders are warning that in just a couple of years' time, a massive shortfall will emerge for the world's most critical metal — one that could itself hold back global growth, stoke inflation by raising manufacturing costs and throw global climate goals off course," Bloomberg reports. "The recent downturn and the under-investment that ensues only threatens to make it worse."

Commodities have been warning about a potential copper shortage for a while now. It's important to think in timelines. It takes a decade to develop a copper mine. That means that firms looking to invest in new copper mining today will have to take the world as it is. If the price isn't right, then the mines won't get developed.

"To put in perspective just how massive that shortage would be, consider that in 2021 the global deficit came in at 441,000 tons, equivalent to less than 2% of demand for the refined metal, according to the International Copper Study Group," reports Bloomberg. "That was enough to send prices jumping about 25% that year. Current worst-case projections from S&P Global show that 2035’s shortfall will be equivalent to about 20% of consumption."

Here's the punchline: While the near-term looks tough and it will impact the long-term, the push toward the electrification of everything as part of green economic policy may inspire greater demand and with it hire prices. Then again, the energy transition has its own contradictions that may undermine it before it fully takes off.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Cool fall weather is driving down the natural gas price in America. "On-day price drops were largely observed in a $1-$2/MMBtu range, preliminary settlement data from S&P Global Commodity Insights showed, with cash Henry Hub falling $1.04 to $6.71/MMBtu," reports S&P Global. "The National Weather Service described near-term weather expectations as "the first taste of autumn weather for nearly all of the eastern US," and attributed the shift to a surge of cool Canadian air in a Sept. 23 Short Range Forecast. Power sector demand for gas fell around 8.1 Bcf, or 20%, over the most recent two days to reach 33.5 Bcf/d on Sept. 23, which was nearly in line with the five-year average."

India's betting big on coal for the future. "The world’s third-biggest emitter of greenhouse gases will add nearly 56 gigawatts of coal power capacity unless there’s a substantial drop in the cost of storing electricity," reports Bloomberg.

South Korea has included nuclear energy in its green taxonomy. "The inclusion of nuclear energy in taxonomy will 'likely contribute to the rebound of Korea's nuclear industry by attracting investment in the nuclear sector, securing investors, and lowering funding rate,'" a spokesperson from Korea Hydro & Nuclear Power told the Korea JoongAng Daily.

Crom's Blessing