Welcome to Grid Brief! Here’s what we’re looking at today: Hilary’s impact on CAISO, EU gas prices shoot up, a heatwave is smothering MENA’s energy systems, and more.

How CAISO Handled Hurricane Hilary

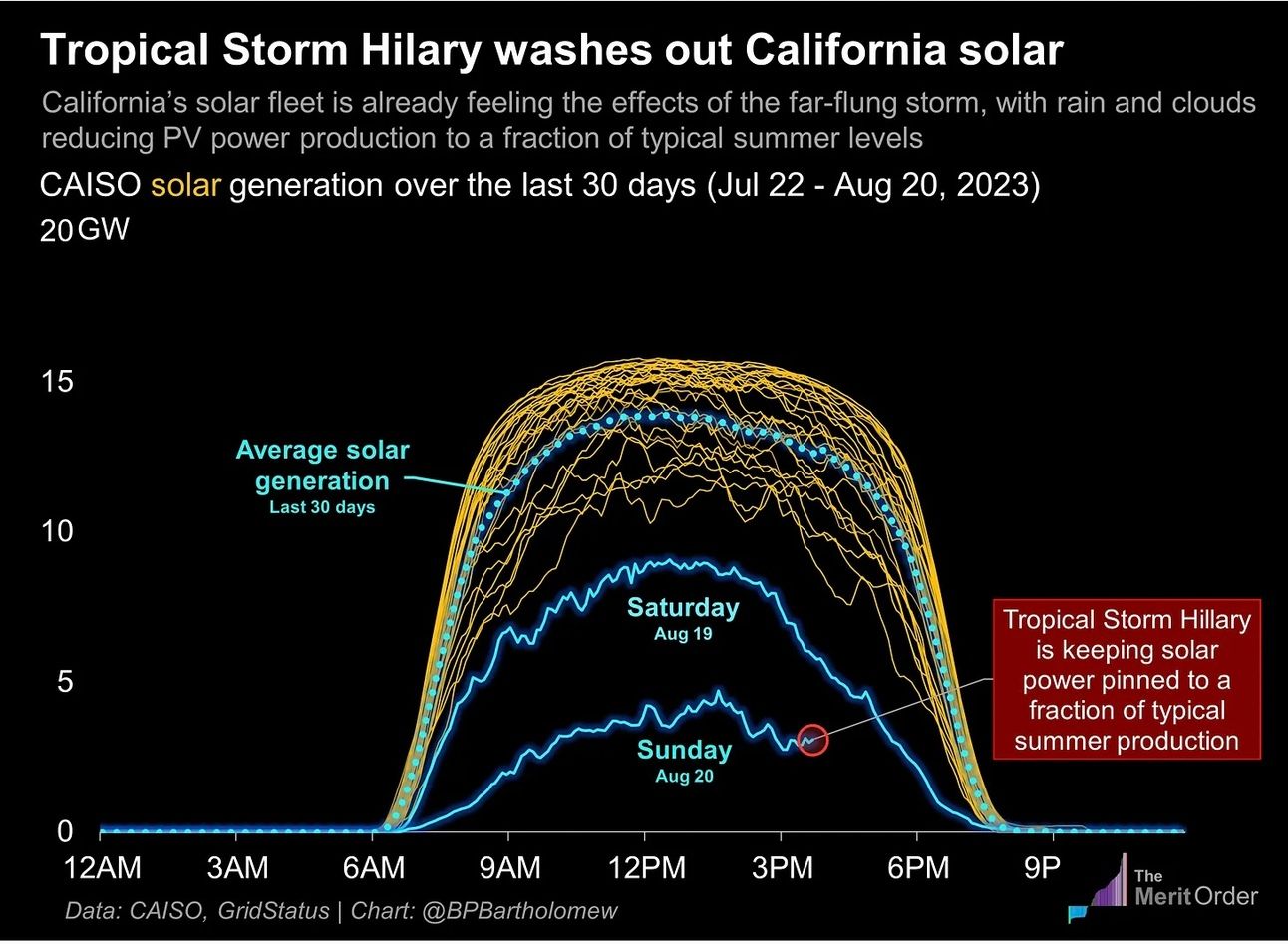

As Hurricane Hilary made landfall in Mexico and swept upwards into California, it put pressures on the Golden State’s power system with illuminating results.

As the storm swallowed the sky, solar dropped to historic August lows over the weekend. But the storm also pushed power demand with it, as it cooled temperatures, thus giving CAISO an easier time.

“This extreme weather is a much smaller challenge to balancing California power supply and demand than the previous week, when high temperatures pushed CAISO SP15 day-ahead energy prices over $1,000/MWh and well beyond the soft offer cap in the fifteen-minute market,” reports the Merit Order.

But the heatwave leading up to the storm betrayed a worrying trend for California’s grid: it’s running low on imports. Since 2018, California’s power imports have diminished greatly, according to the Merit Order.

Why? Simply put: California’s neighbors are pursuing energy policy California style by retiring thermal generators and building more renewable energy sources. Lackluster hydropower performance in the Pacific Northwest and swelling regional load has swallowed the power California used to import.

Europe’s Natural Gas Prices Soar

As a potential strike looms over Australia’s LNG sector, European LNG prices have begun to climb.

“The front-month futures at the Dutch TTF hub, the benchmark for Europe’s gas trading, had jumped by 8.7% to $48.28 (44.35 euros) per megawatt (MWh) as of 12:07 p.m. GMT on Tuesday, as workers and LNG facility owners in Australia continue to discuss a possible resolution to the dispute about pay and work conditions,” reports Oilprice.com.

But analysts say that prices will only stay spiked if: a) the strike happens; b) it lasts at least a month. Stoppages have largely been priced into the market and high LNG storage levels across Asia and Europe cancel out any problems a short-term strike would pose, according to analysts interviewed by Reuters.

Woodside Energy and Chevron operations contribute approximately 10% of the world's LNG production all told. Should the three Australian plants that are at risk of strikes halt production, it could result in a monthly loss of 4 to 5 billion cubic meters of output.

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

MENA Heatwave Triggers Energy Crisis

A sweltering heatwave is putting the hurt on energy systems across the Middle East and North Africa (MENA).

“While the region is historically known for its intense summer heat, current heat waves are extreme even for those used to the desert climate, with the heat index topping 150 degrees fahrenheit – nearing the limit for human survival – in many locations,” reports Oilprice.com. “Numerous countries including Algeria, Tunisia, and Jordan have broken previous records for high temperatures, and wildfires are raging across the region.”

Egypt, Iran, and Iraq are grappling with power outages and electricity grid failures due to dangerous heatwaves. Iran has even implemented a two-day shutdown to get people to stay home and shield themselves from the heat. In Baghdad, energy insecurity has led to civil unrest.

This pattern of political instability due to energy shortages is common in the region. Egypt's previous issues with oil and gas supplies played a role in the removal of President Mohammed Morsi in 2013. Presently, Egypt is facing renewed challenges with natural gas supplies; although the government denies the country is running out, experts suggest that supplies are dwindling.

Conversation Starters

Petrobras expects to be producing oil for decades to come. “Brazilian state-run oil company Petrobras expects to continue to produce oil for the next four decades, while also boosting investments in renewables as it seeks to drive an energy transition, an executive said on Tuesday,” reports Reuters. “Joelson Mendes, the firm's Chief Exploration and Production Officer, said at an event hosted by Santander that Petrobras understands global oil demand will drop in the future, but thinks there will still be room to commercialize its fossil fuels. Mendes said the company is likely to maintain a ‘balanced portfolio’ throughout the next decade, reconciling investments in both oil and renewable energy while keeping Petrobras' proven reserves ‘roughly stable.’”

Europe locks in more US LNG to feed its industries. “Germany’s BASF to buy 0.8 million tons/year from Cheniere for ~17 years to 2043,” reports Bloomberg’s Stephen Stapczynski. Previously, BASF had shuttered operations due to a lack of flows from Russia, but new LNG from America should stabilize its supplies.

A key hearing on a carbon capture and storage pipeline in Iowa is underway. “Iowa residents living along the route of the U.S.'s largest proposed carbon capture and storage (CCS) pipeline told state regulators they were worried about possible ruptures and land takings at the start of a hearing that will determine the fate of the project,” reports Reuters. “The hearing, which could last weeks, is a major test for the $5.5 billion pipeline proposed by Iowa-based Summit Carbon Solutions, and for CCS, which the administration of U.S. President Joe Biden sees as a critical tool in fighting climate change. Summit's pipeline would span 2,000 miles (3,218 km) across five states - with the most miles in Iowa - and transport as much as 18 million tons of captured carbon dioxide from 35 Midwest ethanol plants to an underground storage site in North Dakota.”

Crom’s Blessing

Interested in sponsoring Grid Brief?

Email [email protected] for our media kit to learn more about sponsorship opportunities.