California's Desal Own Goal

California regulators have just put the kibosh on a desalination plant in the midst of a scorching drought. Last Thursday, they "rejected a $1.4 billion desalination plant on environmental grounds, dealing a setback to Governor Gavin Newsom, who had supported the project as a partial solution for the state's sustained drought," Reuters reports.

The plant was to be owned by Poseidon, who already operates a desalination plant in the state. It was going to convert ocean water into 50 million gallons of drinking water per day. "That is enough for 400,000 people, but the plant would use a process that staff experts at the commission said would devastate marine life and expose the plant to future risk of sea-level rise while producing expensive water too costly for low-income consumers," Reuters reports.

The California Coastal Commission voted 11-0. Environmentalists exploded in celebration at the Costa Mesa hotel conference room after the vote. They have opposed the project for years. They claim they're not opposed to more desalination plants, but that they must be built the "right way." The commission has approved other desalination plants, but some were built before statewide desalination programs took effect.

"The project has undergone 20 years of environmental planning. It’s certainly the most extensively studied desal facility in the state, if not the world, and it has been approved by multiple agencies including the State Lands Commission, including the Regional Water Quality Control Board," said DJ Moore, Poseidon's lawyer.

Governor Gavin Newsom, meanwhile, said that denying the project would be “a big mistake, a big setback” to kill the project. California is in the middle of a brutal drought that's even sapping its hydroelectric power.

EU Caves on Gas for Rubles

The European Union has softened its stance on Russia's rubles-for-gas program without explicitly endorsing Moscow's payment regime.

Earlier in the year, Russia demanded that companies who want Russian gas from its national gas giant Gazprom would have to open an account in Gazprombank. The companies would then put their euros or dollars into the account so they could be converted into rubles. This is Moscow's shrewd play to bolster its currency while undermining Europe's sanctions.

The EU's guidance now states that sanctions "do not prevent economic operators from opening a bank account in a designated bank for payments due under contracts for the supply of natural gas in a gaseous state, in the currency specified in those contracts. Operators should make a clear statement that they intend to fulfill their obligations under existing contracts and consider their contractual obligations regarding the payment already fulfilled by paying in euros or dollars, in line with the existing contracts.”

Bloomberg reports, "The guidance does not prevent companies from opening an account at Gazprombank and will allow them to purchase gas in accordance with EU sanctions following Russia’s invasion of Ukraine. But it stops short of addressing the requirement by Moscow to open a second account in rubles, which according to a decree by President Vladimir Putin is needed to make the payment complete."

The response has been divided. On the one hand, Germany's pleased with the revisions. The country has been sweating what full-scale Russian energy sanctions would do to its economy. Bloomberg reports, "German Economy Minister Robert Habeck expressed optimism Monday that German utility companies will be able to make their next gas payments to Moscow, despite the sanctions regime and Moscow’s new rules."

Habeck sees the change as "in conformity with the sanctions, also according to the EU commission."

Poland is far less enthused. On Sunday, Polish Prime Minister Mateusz Morawiecki said, "I am disappointed to see that in the European Union there is consent to pay for gas in rubles. Poland will stick to the rules and will not yield to Putin’s blackmail."

"European gas prices extended losses on Monday," according to Bloomberg.

Europe Eyes African Gas as Russian Replacement

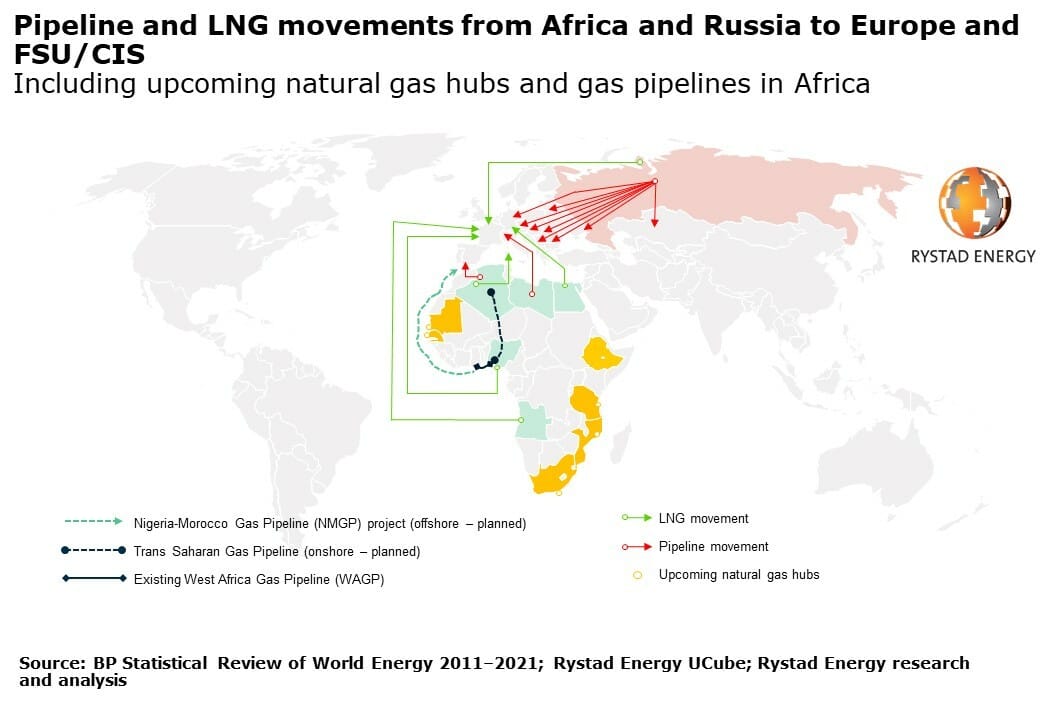

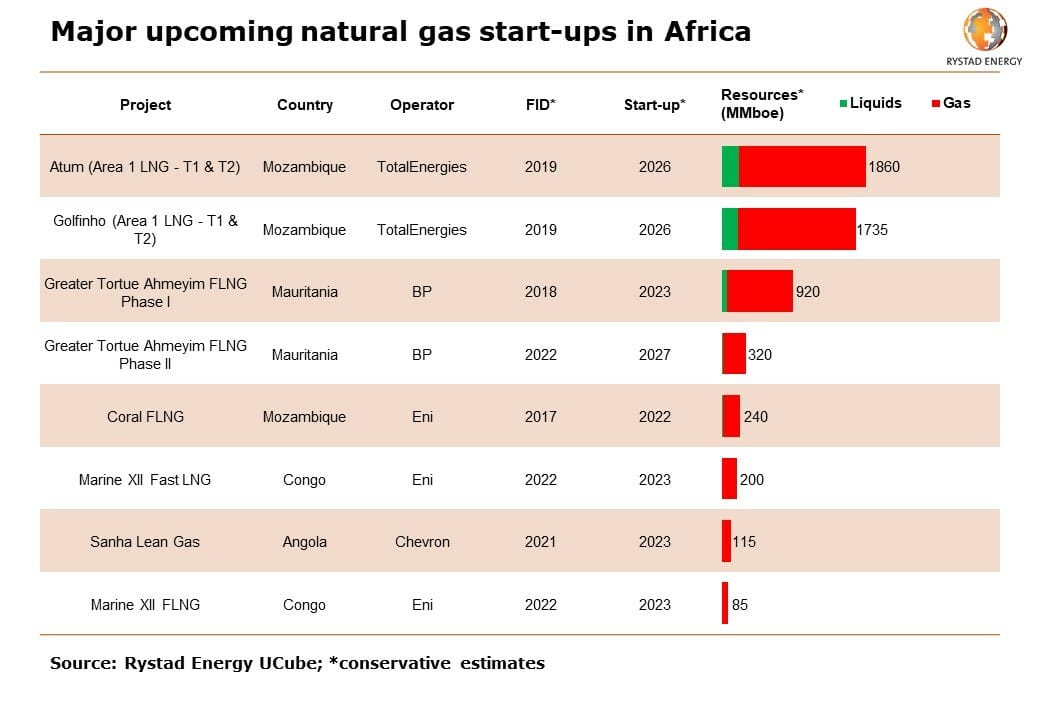

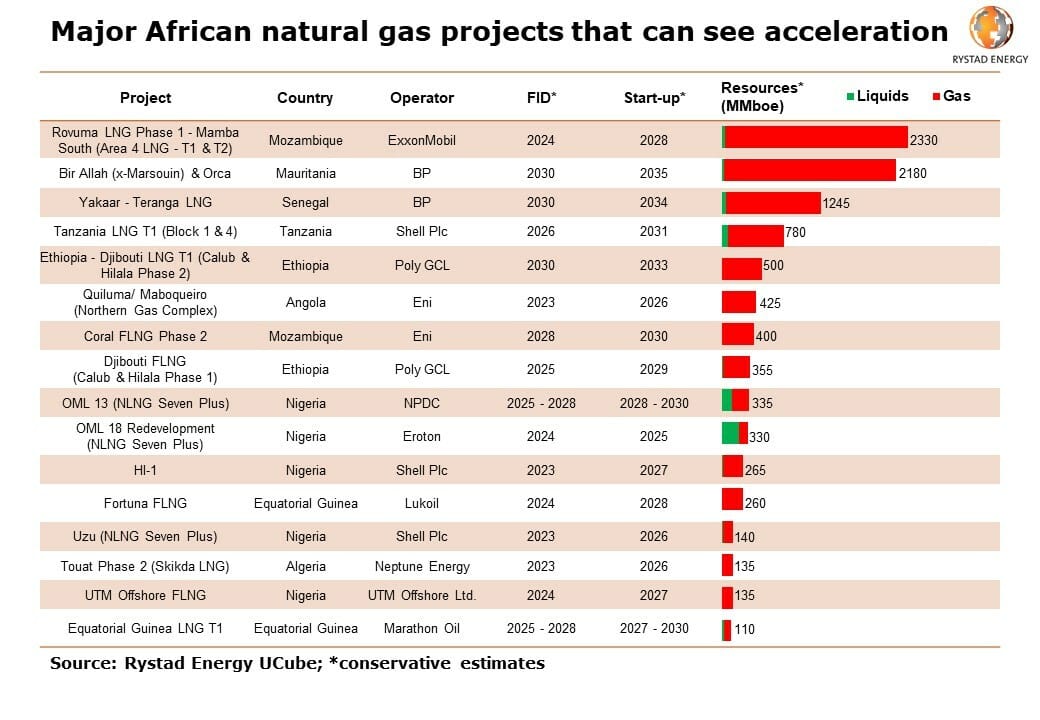

A new report from Rystad Energy says that African natural gas might be called upon to fill in the gap left by sanctioned Russian energy.

"Africa is conservatively forecast to reach peak gas production at 470 billion cubic meters (Bcm) by the late 2030s, equivalent to about 75% of the expected amount of gas produced by Russia in 2022," according to their research.

"Russia has historically been the dominant natural gas supplier to Europe, with an average of about 62% of overall gas imports to the continent over the past decade," they write. "Africa has also been a consistent gas exporter to Europe during that time, with an average of 18% of European gas imports coming from Africa."

Yet African gas projects have been seen as too risky and vulnerable to delay due to high development costs, barriers to financing, troubled fiscal regimes, and other risks.

"Recent signals from oil and gas majors such as BP, Eni, Shell, ExxonMobil, and Equinor indicate a shift, however, in strategy towards further investment in Africa, with several projects that were previously on ice – including liquefied natural gas (LNG) projects – as they consider restarting or accelerating previously shelved projects in response to rising global demand."

Check out the rest of their research here.

Conversation Starters

Electricity prices in PJM and New England have skyrocketed in Q1. PJM's prices jumped 51%, to $80.28/MWh, in the first quarter of 2022 from $53.30/MWh last year Q1. Meanwhile, New England's wholesale power costs leaped 83%, to $137/MWh, in Q1 2022 compared with $75/MWh in Q1 2021.

China's recent lockdown has poured cold water on the cobalt market.

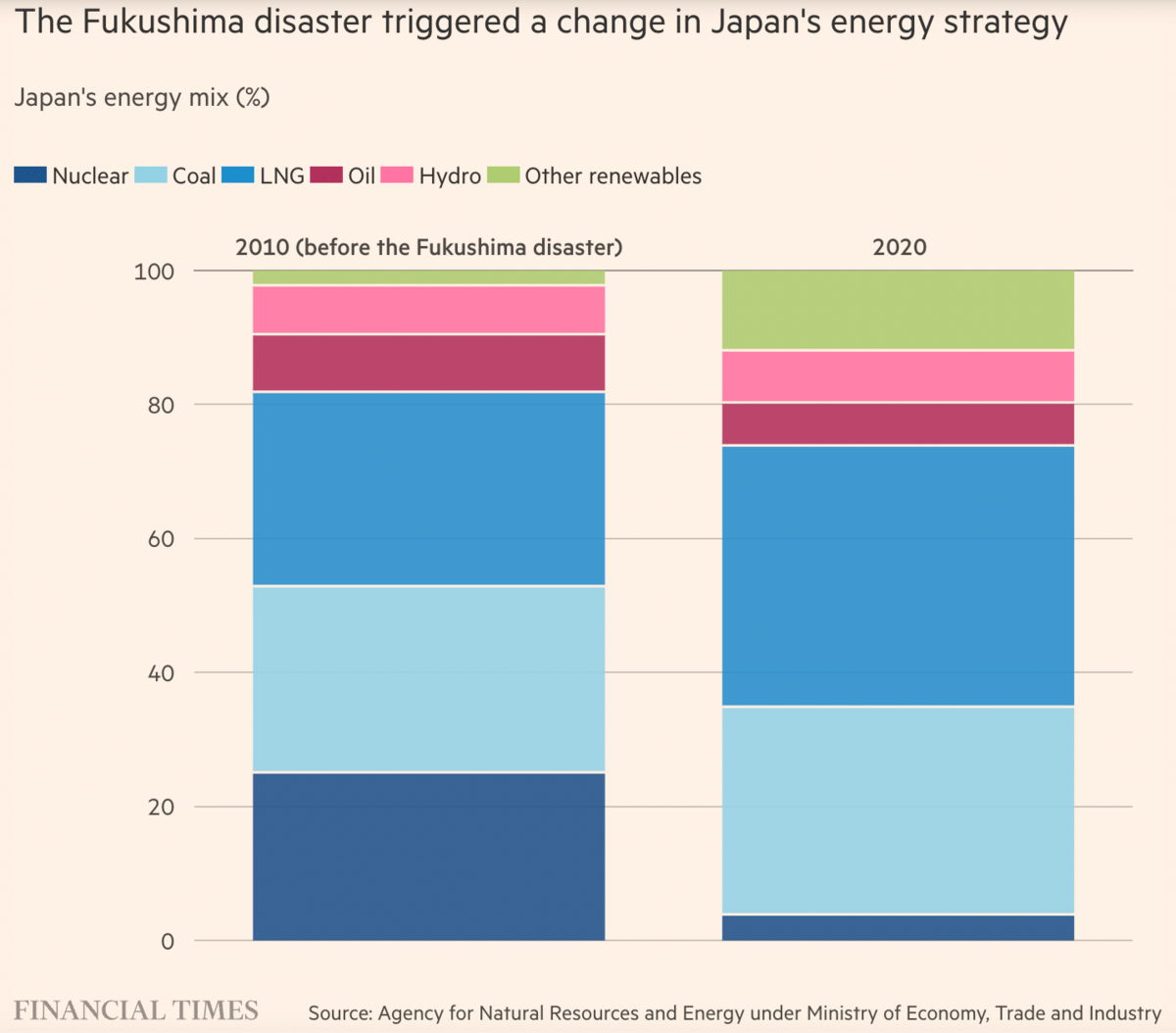

Akihiko Kato, nuclear division head at Mitsubishi Heavy Industries, told the Financial Times that the Ukraine War was the best opportunity for a nuclear resurgence since Fukushima. Nuclear energy is now seen as a safer alternative to Russian fossil products.

Crom's Blessing

Read this thread. We have always been Promethean.