California's "Perfect Storm" for Gas

California's gas market is getting crazy.

"On Thursday, Northern California’s PG&E Citygate recorded spot natural gas prices as high as $36.00/MMBtu. SoCal Citygate cash reached a $33.00 high, while Malin hit $32.00. And that only proved to be batting practice," reports Natural Gas Intelligence. "On Friday, the highest price on the West Coast hit $55.00, with offers up to $60.00."

While the Sierra Nevada region expects several feet of snowfall and precipitation is heavier than usual, it's still California. It's just not that cold. So what's going on?

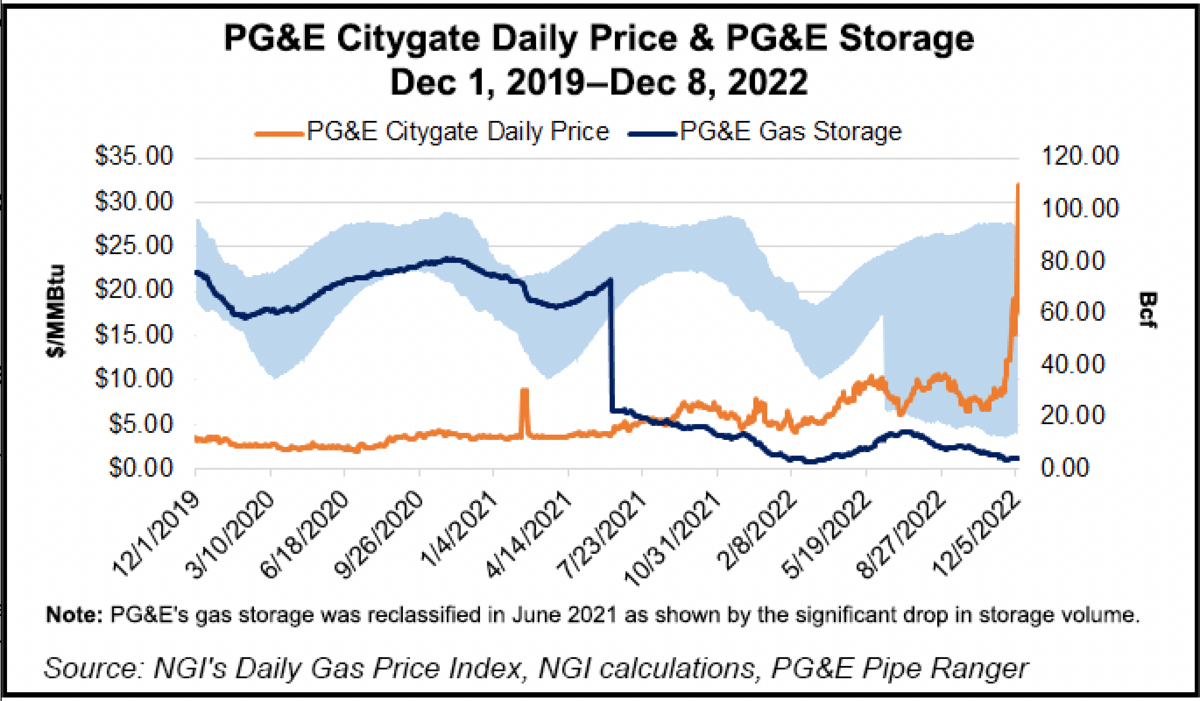

First, PG&E reclassified 51 bcf of its storage inventories from working gas ("the portion of the storage volume that can be removed from a storage reservoir for deliveries and still maintain pressure sufficient to meet design deliverability") to cushion gas ("the amount of gas that is permanently stored in a natural gas storage"). In other words, they reclassified a significant portion of their storage inventory as something that can be delivered to something that needs to hang around to maintain adequate pressure in its gas pipelines. It appears this might create an availability/supply problem.

But that might not be the only reason for the Golden State's gas crunch. A more straightforward supply problem throughout the state is underway.

"As of Dec. 2, Pacific stocks stood at only 217 Bcf, which is more than 18% below year-earlier levels and nearly 24% below the five-year average," reports NGI. "The Pacific is the only region that continues to fall significantly short of historical levels. After a string of above-average injections in the late fall, Mountain stocks sit about 6% below the five-year average. East inventories sit around 2% below that level. The South Central region, meanwhile, is now at a modest surplus."

The supply problem is exacerbating the lack of storage. Pile on coal delivery problems via rail and some pipeline distribution problems from the Permian and you've got California's perfect gas storm. California's grid relies heavily on natural gas. Here's an electricity price map from the California Independent System Operator from yesterday.

Arctic Blast Hammers European Gas Inventories

An arctic blast has spiked Europe's natural gas prices and begun to drain the continent's gas inventories.

Sure, it's taken winter a while to arrive at the continent, but now it appears the cold weather will hang around. Average temperatures over Northwest Europe are forecasted to keep slipping below a 30-year trendline to around 27 degrees Fahrenheit by the 18th.

"After building up inventories to nearly 96% full last month due to warmer autumn weather, the injection to withdrawal flip is about a month in and drained about 5% of storage to 90% full," reports Oilprice.com. "Seasonally, the withdrawal period is well underway, so draws will continue for the next several months (as long as there is cold weather)."

But the still-high storage percentage isn't guaranteed to last. "Gas storage sites are still relatively full for the time of year, but risks still linger that a severe cold spell could quickly deplete stocks, leaving the continent exposed to any new supply curtailments," reports Bloomberg.

But it's not just hurting Europe. The United Kingdom's electricity prices have been sky-rocketing due to the cold spell.

"The situation should start to improve from Monday evening as weather models forecast more wind, which should ease the tightness in the UK (and also in continental Europe). But demand will remain high due to below seasonal normal temperatures," tweeted Blas.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Here's some great reportage on the struggles of solar workers in Texas from The American Prospect. "The low quality of solar jobs is an open secret [...] But until recently, solar has remained a relatively niche industry, and workers have endured backbreaking conditions in relative obscurity," TAP reports. "Now, solar energy is at the core of Democrats’ political strategy to recapture working-class voters by creating good jobs in green industries. Jobs in installation are taking off, sped along by the Biden administration’s climate and jobs bill, the Inflation Reduction Act, which passed in August. A separate fight to stand up domestic solar manufacturing could create highly skilled, higher-paid jobs—and will also be an extraordinarily heavy lift to pull off."

OPEC+ has missed its recent production quota. "A new survey from Argus showed on Friday that OPEC+ production fell to 38.29 million bpd last month—1.81 million barrels per day short of its reduced quota," reports Oilprice.com. "The 19 OPEC+ members subject to the quota produced 310,000 bpd fewer barrels in November when compared to the month prior. But that’s still 1.81 million barrels per day short of its quota for November. November’s quota was a reduction of 2 million barrels per day off October levels, although it was understood at the time that the group might not be able to reach even that reduced target."

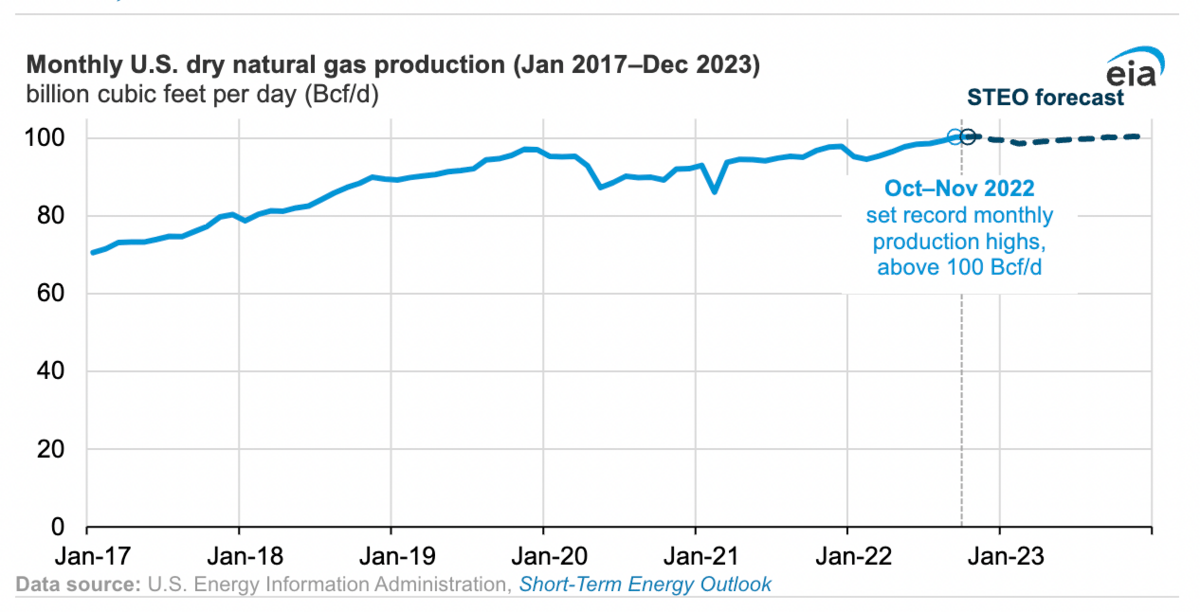

US dry natural gas production hit monthly records this year. "U.S. dry natural gas production has increased during 2022, averaging more than 100 billion cubic feet per day (Bcf/d) in October and November and exceeding pre-pandemic monthly production records from 2019," reports the Energy Information Administration. "We forecast that U.S. production of dry natural gas will average about 100.0 Bcf/d from December through March, down about 0.5 Bcf/d from November. This forecast production decrease is primarily due to weather, specifically the possibility of extreme winter weather events and freeze-offs. Mild weather in key producing regions could prevent those declines."

Crom's Blessing