China Raises Crude Export Quotas

China is ramping up its export quotas for refined oil products in a bid to boost its refinery output, snatch up fatter export margins, and speed up sluggish domestic demand.

The quota increase is a 46% jump from last year's numbers and covers mostly gasoline, diesel, and jet fuel. That could encourage Chinese refiners to process more crude and maintain fuel exports at record levels in the first half of the year. If Chinese refiners can crank out fuel, they could potentially offset any sanctions-induced reduction in Russian diesel exports. This would benefit Europe, as diesel vehicles make up much of its shipping fleet and nearly a quarter of its passenger vehicle fleet.

But the increased quotas may also reflect weak domestic fuel consumption due to a recent surge in COVID-19 cases, which has impacted travel and economic activity. "It will take a while before consumption comes back given the current COVID situation," an analyst told Reuters.

Is The Ukraine War Oil Crisis Over?

Are we about to see the end of the high energy prices?

Since Russia rolled into Ukraine last February, commodities prices have seen staggering increases with oil and gas prices hitting multi-decade highs, coal leaping by nearly 70%, and wheat by 60%. Not to mention the prices of metals exported by Russia-- nickel, palladium, and aluminum--have all increased significantly.

But new signs indicate that the disruption may be coming to an end. Crude oil, natural gas, and food prices are all falling back to pre-war levels. Even the euro has staged a 7% rally against the dollar over the past three months.

So who's winning? The bulls or the bears?

According to researcher and investor Alex Kimani, crude futures have slipped into backwardation, which means that the price of oil in the future is expected to be lower than the current spot price. This suggests that traders expect Brent crude prices to keep falling.

Credit Suisse agrees with the bearish view: “The market remains well below its 55-Day Moving Average and 200 DMA at 89.01 and 100.67, and with medium-term momentum declining and global growth concerns looming, we think further weakness is likely to follow. Brent is likely in due course to see further downside towards the 61.8% retracement at 63.02, where we would have higher confidence of a more stable floor and for a consolidation phase to emerge."

But hedge fund manager Pierre Andurand believes there's a strong bull case to be made. He argues global oil demand could could rise by as much as 4% this year if the world can leave its Covid restrictions behind. According to Bloomberg, Andurand's main commodities fund gained 50% in 2022.

"Likewise, some analysts believe that many of the headwinds that have cut short the oil price rally this year, including China’s zero-Covid policy and the coordinated SPR releases by several governments, will no longer be there in 2023," reports Oilprice.com. "Coupled with sanctions on Russia’s oil and gas, this should elevate oil prices."

Belgium to Shutdown Nuclear Plant

Belgium keeps switching off nuclear plants.

Last year, the country's Doel 3 reactor went silent after its last legal fuel cycle. By the end of this month, the Tihange 2 reactor will be permanently disconnected from the grid. After that, Belgium will be down to five nuclear plants--all of which are slated for closure in 2025.

"However," reports the Brussels Times, "the Federal Government is currently negotiating with operator Engie over extending the Doel 4 and Tihange 3 reactors for another ten years, but the negotiations are not going smoothly and Engie previously confirmed that they have been 'delayed.'"

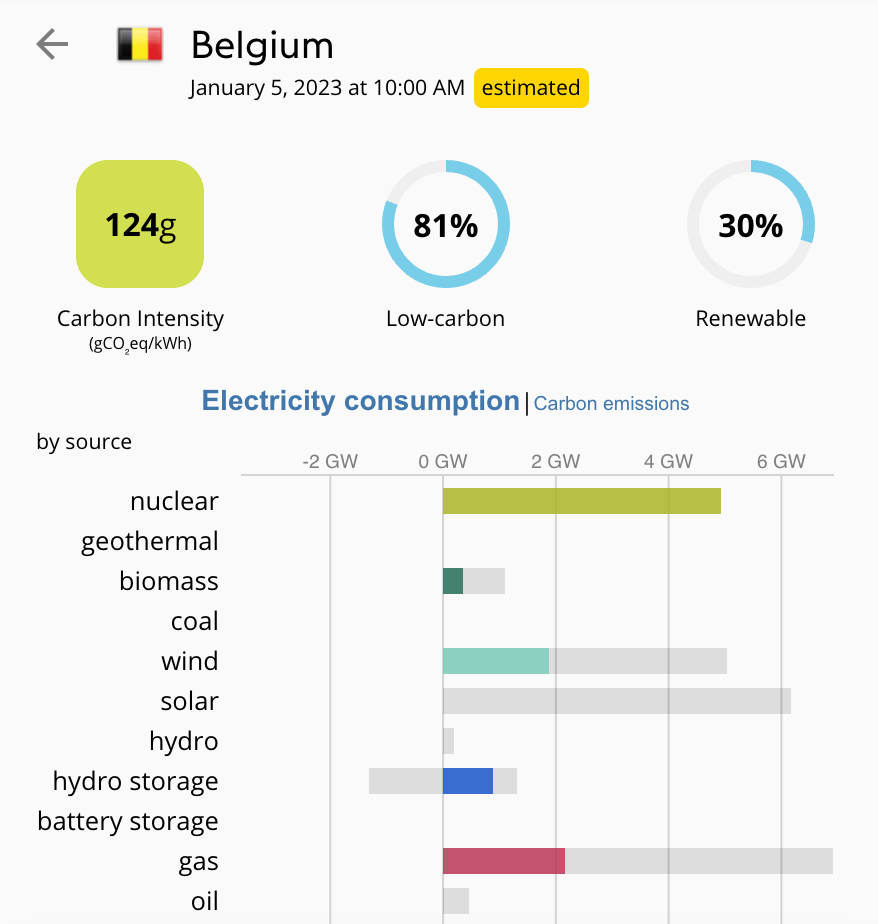

Fossil fuels will likely replace the lost nuclear generation.

Here's a snapshot of Belgium's electricity consumption:

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Yankee regulators are attacking Eversource for its recent rate hike. "Connecticut and Massachusetts regulators on Tuesday called on Eversource Energy to defend the doubling of its its standard offer supply rate, to 24.2 cents/kWh that took effect Jan. 1," reports Utility Dive. "Eversource told regulators natural gas prices have the biggest impact on the cost of electric supply in its service territory and gas pipeline capacity is 'severely constrained' for electric generation on the coldest days, limiting capacity and leading to higher prices. Liquefied natural gas supplies also are costly, pushed up by global market demand and the loss to Europe of natural gas from Russia following its assault on Ukraine, the utility said."

Warmer weather is easing Europe's energy crunch. European power prices have fallen to pre-Ukraine invasion levels for winter contracts, as a combination of ample LNG supply, mild weather and a weak economy weighed on the market, while prices further out were firmly higher on the year, analysis by S&P Global Commodity Insights showed Jan. 5," reports S&P Global. "In Germany -- the benchmark European power market -- the front-month price averaged below Eur180/MWh ($190/MWh) this year so far. This was 16% below the whole of January 2022 for the corresponding contract, before Russia's military invasion of Ukraine Feb. 24 that exacerbated already tight natural gas and power supply across Europe."

A lease sale in Alaska attracted a single bid. "The Bureau of Ocean Energy Management (BOEM) has revealed that Cook Inlet Oil and Gas Lease Sale 258, which was held on December 30, generated one bid for one tract," reports Rigzone. "The bid, in the amount of $63,983, was submitted by Hilcorp Alaska LLC, BOEM noted. Following the sale, the bid will go through a 90-day evaluation process to ensure the public receives fair market value before a lease is awarded, and a Department of Justice review of antitrust considerations, BOEM outlined."

Crom's Blessing