China's Electricity Crisis

China's in the midst of a punishing heat wave that's breeding electricity shortages across the country.

"China has extended orders for industries to shut down production for five more days as heatwaves and extreme drought in its southwestern regions have boosted electricity demand while reducing hydropower production in the largest hydropower-generating province," reports Oilprice.com.

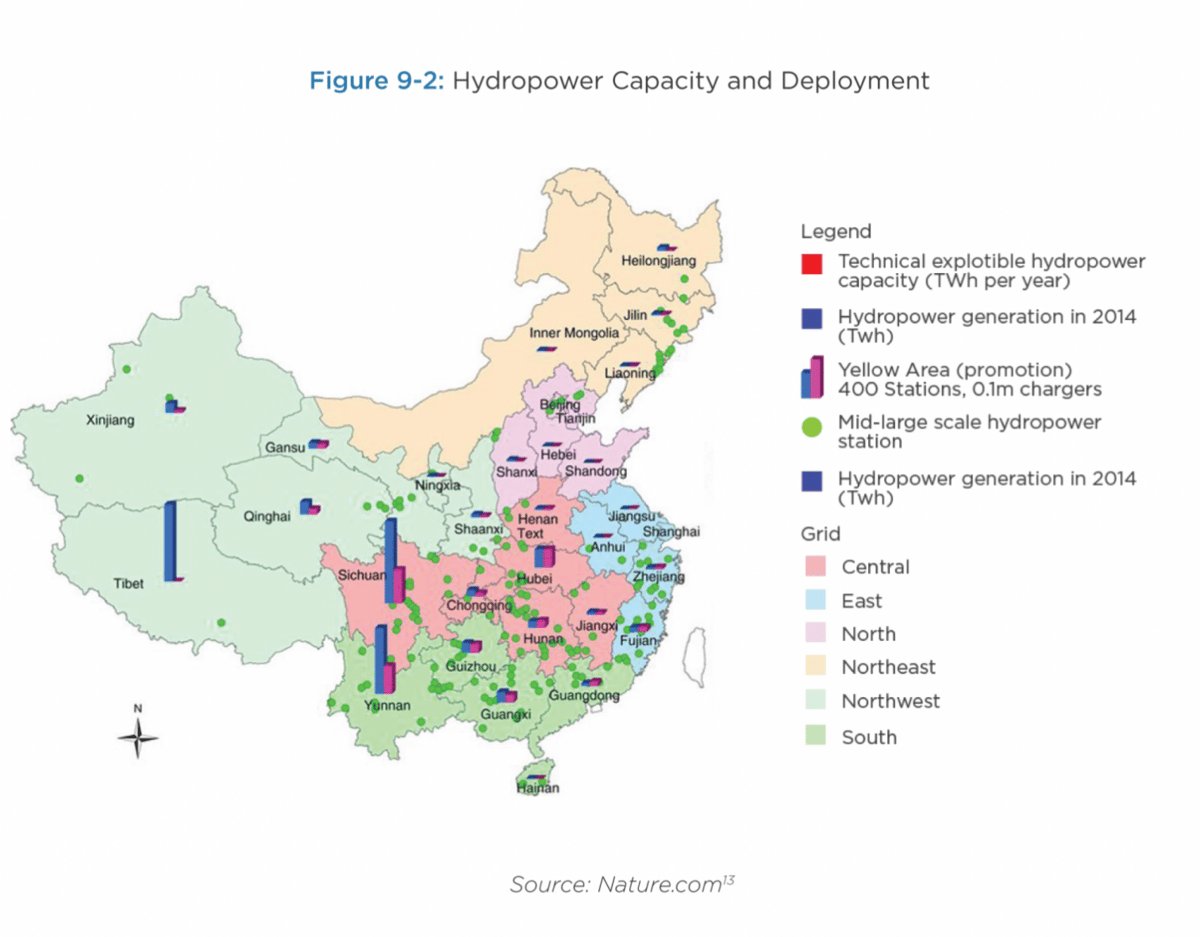

China's currently in the eleventh day of the heatwave has arrived during a 60-year record drought. The combination has lowered water reserves, sapping hydropower output in the Sichuan region. Nineteen provinces are seeing record-high electricity demand just as hydro's ability to supply kilowatts drops by half.

According to S&P Global, hydro made for nearly 8% of China's energy demand and 15% of its electricity mix--larger than its solar and wind fleet combined. "Hydropower accounts for 85% of Sichuan's generation mix," S&P reports, "and in normal times, the surplus is exported to developed coastal regions like Shanghai, Zhejiang, and Jiangsu with larger population density and energy demand."

Sichuan is home to 84 million people and many factories. The province has just announced that it's cutting energy supplies to manufacturing as it braces for hotter days ahead. The drought is punishing Foxconn, the world's largest contract electronic parts manufacturer located in Sichuan, which has suspended operations. Toyota has been forced to do the same.

But Sichuan isn't the only region hurting. "Lier Chemical, a Shenzhen-listed pesticide manufacturer, said in a filing on Monday that local officials had extended the industrial power cuts until Thursday," reports the Financial Times.

The electricity cuts to industry in these regions will send ripples through the polysilicon and lithium markets worldwide. China's ongoing covid struggles and its flagging real estate sector are also exerting downward pressure on the nation's economy.

Ford Slashes Jobs to Aid Energy Transition

Ford wants to go green and crank out electric vehicles. But where are they going to get the needed $50 billion to make this transition? By downsizing its workforce.

The company is cutting 3,000 jobs this week that will come mostly from America "while some positions also are being eliminated in Canada and India," reports Bloomberg. "The total includes 2,000 salaried workers and 1,000 contract personnel." Most of the cuts are coming from their internal combustion engine division.

“Building this future requires changing and reshaping virtually all aspects of the way we have operated for more than a century,” Farley and Executive Chairman Bill Ford told employees in a memo. “This is a difficult and emotional time. The people leaving the company this week are friends and coworkers and we want to thank them for all they have contributed.”

Ford wants to reach an output of 2 million EVs per year by 2026 in order to catch up to Tesla. Last year they made about 64,000 electric vehicles. Bloomberg anticipates an additional 8,000 jobs could be put on the chopping block.

Saudis: OPEC+ May Need to Cut Production

Oil prices have become so volatile that traders are exiting the market. Saudi Arabian Energy Minister Prince Abdulaziz bin Salman has said that the disconnect between the paper market and the physical fundamentals means that OPEC+ may have to cut production.

“Witnessing this recent harmful volatility disturb the basic functions of the market and undermine the stability of oil markets will only strengthen our resolve,” he told Bloomberg.

Bin Salman has characterized the situation thusly:

Thin liquidity and high volatility are interfering with the market's ability to find efficient prices. As a result, hedging and risk management have become too expensive for physical users.

"This has a negative impact on the smooth and efficient operation of oil markets, energy commodities and other commodities creating new types of risks and insecurities."

This cycle is then amplified by evidence-lite panic over demand destruction, "recurring news about the return of large volumes of supply," increased confusion over what price caps might do the market, and last but not least, embargoes and sanctions.

The Saudis are the most powerful and productive members of OPEC+'s 23-nation collective. The cartel meets next week to consider its output targets.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Peace no longer seems on the table for Russia and Ukraine. "Moscow sees no possibility of a diplomatic solution to end the war in Ukraine and expects a long conflict, a senior Russian diplomat has warned, as President Vladimir Putin’s full-scale invasion reaches the six-month mark this week," the Financial Times reports.

India has revived one of its oilfields after a decade and a half. Production has restarted at the Khagorijan field in the Indian state of Assam after a 15-year pause [...] adding that production was suspended in 2007 due to environmental and regulatory issues," reports Oilprice.com.

Smog in the Permian Basin has attracted the attention of the EPA. "The oil and gas sector and policymakers in Texas and New Mexico are on high alert over a notice posted to the Environmental Protection Agency's regulatory agenda that they fear could have a crippling impact on domestic oil production," reports S&P Global.

Crom's Blessing