Dems Attack TVA

The green movement was born in defiance of the New Deal Order in the 60s and 70s. In gathering political, cultural, and economic power, it pulled from the traditional American view of monopoly: unfair conspiracies. This has been true even for public power. The anti-bigness bent amongst green progressives has continued up until this day. Congressman Steve Cohen has put the Tennessee Valley Authority in his crosshairs because as a monopoly it does not allow enough solar power onto the grid.

Cohen's bill "would remove TVA's exemption from outside competition and its inability to compete for customers outside its footprint," reports the Memphis Commercial Appeal.

“TVA’s outdated service model is from the 1950s and badly needs reform. Ratepayers deserve the benefits – lower costs and cleaner energy – that a competitive electricity market will provide. TVA’s ratepayers deserve to have access to alternative power supplies on a competitive and non-discriminatory basis. This measure will give greater access to clean energy and affordable energy bills in the TVA region," Cohen said in a statement.

But most of America's competitive electricity markets have dirtier energy portfolios than the TVA and have now encountered reliability and affordability problems that undermine the only arguments in their favor.

Cohen's bill arrives right when Memphis Light, Gas, & Water (the utility owned by the city of Memphis) is moving towards a long-term agreement with the TVA. "MLGW signing such a long-term deal would mean TVA has locked up most of its power customers for decades," reports the Memphis Commercial Appeal. "That's sparked the ire of environmental groups and renewable energy advocates, who have argued that such deals are bad for the environment and limit how ratepayers can hold the federal agency accountable for climate goals." Not to mention, the TVA seems to find nuclear, not renewables, a worthwhile longterm investment for replacing its coal fleet.

What's really happening is clear: Cohen and his ilk will pry apart every other institution in the country if it means more solar on the grid, regardless of the costs to the system or consumers. It's a big baptists and bootleggers machine built to reward the renewable industry trade groups that plow money into the Democratic party and various green NGOs, not to mention the financiers that benefit from the production tax credits that make renewables possible.

"We appreciate Congressman Cohen’s continued interest in TVA and the Tennessee Valley Public Power model," the TVA responded in a statement. "For nearly 90 years, TVA’s Congressionally mandated mission has been to serve the public good and improve the lives of the 10 million people we and our public power partners serve every day. The facts show we are fulfilling that mission today and are committed to evolving with the needs of the region to continue to serve future generations."

Iron Ore Carriers Used for Coal

China's downbeat demand for iron ore due to its Covid lockdowns has freed up carrier for a new use: shipping coal.

"Bulk ships typically seek out stable long-term contracts of one commodity and stick to it, but when profits are more attractive elsewhere, vessels can temporarily switch to pick up other types of cargoes," reports Bloomberg. "Some of the largest iron ore ships, known as Capesizes, are carrying Russian coal to China and India. In a normal market, this strategy is usually shunned by traders because Russian coal ports like Ust Luga don’t have waters deep enough for Capesize vessels to load up fully, forcing ships to take only partial cargoes."

Coal demand has rebounded this year as the beginnings of a global energy crisis accelerated after Europe sanctioned Russia for invading Ukraine.

American Diesel

A spike in demand for diesel in October coupled with a downswing in global production has created a diesel fuel crunch.

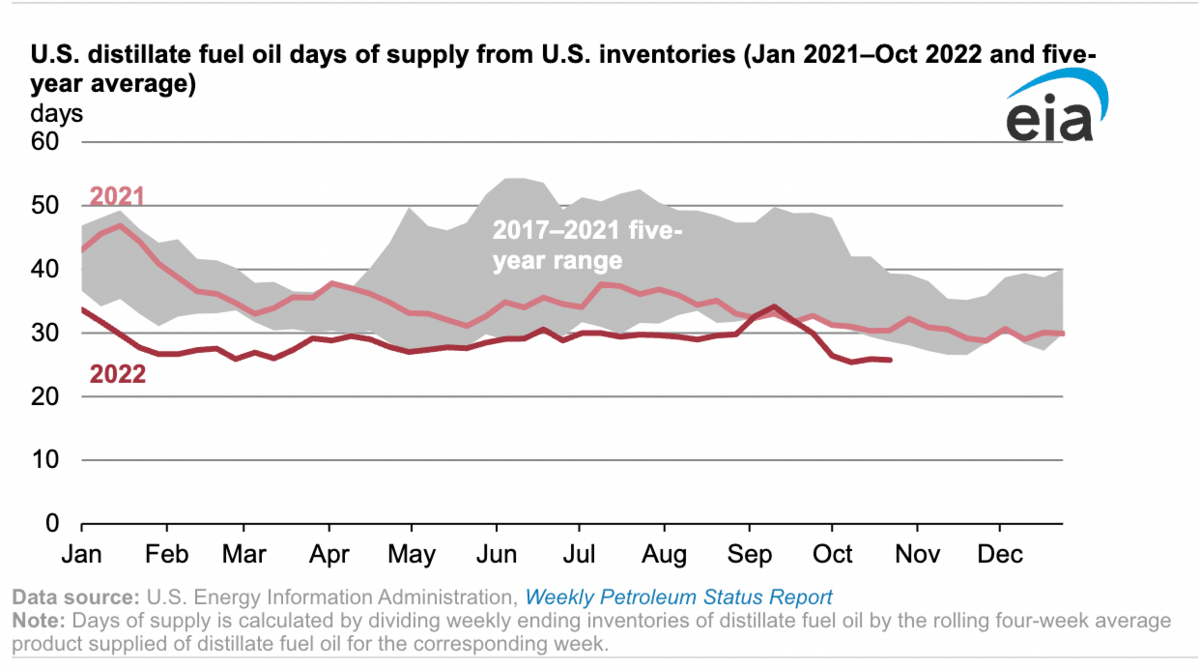

"Current inventories and our current estimate of future demand can be combined into a metric called days of supply, which is calculated by dividing the inventory (in barrels) by the estimated demand (in barrels per day) to get the number of days that inventories alone could meet demand," reports the Energy Information Administration. "In October 2022, the United States had 25 days of supply of distillate, the fewest since 2008. U.S. days of supply between 2017 and 2021 averaged 34 days. U.S. inventories of distillate fuel oil have been below the previous five-year (2017–21) low since the start of 2022."

Diesel inventories haven't been this low since 1982, when the government first started collecting data on it.

How did we get here? Alex Epstein points to three major factors: cancellation of the Keystone XL pipeline, the prevention or shutdown of American diesel refineries, and threatened diesel investments.

The threat diesel shortages pose for the global economy is immense. “The economic impact is insidious because everything moves across the country powered by diesel,” Tom Kloza, the global head of energy analysis at the Oil Price Information Service told the New York Times. “It’s an inflation accelerant, and the consumer ultimately has to pay for it.”

If the world slides into a recession, we could see demand for diesel slide with it. Right now, the diesel shortage is yet another inflationary pressure on American life--especially in the Northeast.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Natural gas has been discovered off the Israeli coast. "Energean PLC has announced a new commercial natural gas discovery of 13 billion cubic meters off the shore of Israel as a result of its exploratory drilling well dubbed Zeus-1," reports the Jerusalem Post. "It has also confirmed the presence of an additional 3.75 bcm at its Athena site. These discoveries have confirmed the company’s suspicions that the so-called 'Olympus area' located between the Karish and Tanin gas fields are both voluminous and commercially viable."

Despite its production cuts, OPEC+ is coming through for Asia. "Saudi Arabia’s state oil company has assured several buyers in Asia it will deliver full contracted volumes in December despite the OPEC+ decision to cut production," reports Oilprice.com "The assurance comes despite a commitment on the part of the Kingdom to reduce its production to contribute to the group-wide cut of some 1 million barrels daily, which was agreed at the latest meeting of OPEC+."

Utilities have stationed about 18,000 technicians to restore service as Hurricane Nicole approaches Florida. "As Tropical Storm Nicole approaches Florida, likely to become a hurricane before landfall, utilities have stationed thousands of technicians in strategic locations to restore service as soon as possible. Power and gas prices are likely to weaken as service disruptions sap demand," reports S&P Global. "The storm could also affect deliveries of refined fuels, as the state's Atlantic Coast ports were closed Nov. 9."

Crom's Blessing