Washington just put real money behind SMRs, Big Tech’s power appetite is rewriting utility planning in real time, and Duke Energy is getting dragged in front of the Supreme Court for doing what regulated monopolies have been doing quietly for a century. The through-line: America is entering a decade where load grows faster than institutions can handle it, and the scramble to modernize the grid is forcing policymakers to pick winners—whether they admit it or not.

DOE Picks Its SMRs: $800M for TVA and Holtec

The federal government has finally stopped cheering for nuclear from the sidelines and started writing real checks. DOE’s Office of Clean Energy Demonstrations is putting $800 million behind two small modular reactor projects: TVA’s BWRX-300 at Clinch River in Tennessee, which receives up to $400 million to advance GE Hitachi’s 300-MW design at a site that’s waited for a reactor since the 1980s; and Holtec’s SMR-300 at Palisades in Michigan, which gets up to $400 million to pair a brand-new SMR with the recently revived 800-MW legacy plant.

If both move forward, TVA targets operation in the early 2030s and Holtec in the mid-2030s—marking the first time the U.S. would run an SMR alongside an existing reactor. It’s the closest thing America has had to nuclear industrial policy in decades, and a clear federal signal about which designs and developers are now considered “real.”

Why it matters:

DOE is effectively narrowing the U.S. SMR field to two designs. Capital flows follow federal signals, not conference slides.

Both sites tie directly into emerging load centers—TVA for industrial growth, Palisades for Midwest data centers.

The AI load boom (see Major 2) creates a political and economic tailwind for baseload nuclear that simply didn’t exist five years ago.

Grid Take:

This is the first time since the AP1000 era that the U.S. is trying to test a reactor design twice—which matters, because nuclear only gets cheap when you build the same thing repeatedly. Washington is basically saying: these are our prototypes; please build more of them.

Data Center Load Goes Vertical (106 GW) + BYOC Changes the Rules

BloombergNEF now projects U.S. data-center demand to jump from 25 GW today to 106 GW by 2035—a fourfold surge that’s already 36% higher than BNEF’s forecast from just a few months ago. More than 150 major data centers were announced last year alone, a quarter of them over 500 MW, and PJM could see 31 GW of new load in the next five years—more than its entire in-construction generation pipeline. DOE estimates the country will need 100 GW of new peak capacity by 2030, with roughly half driven by data centers.

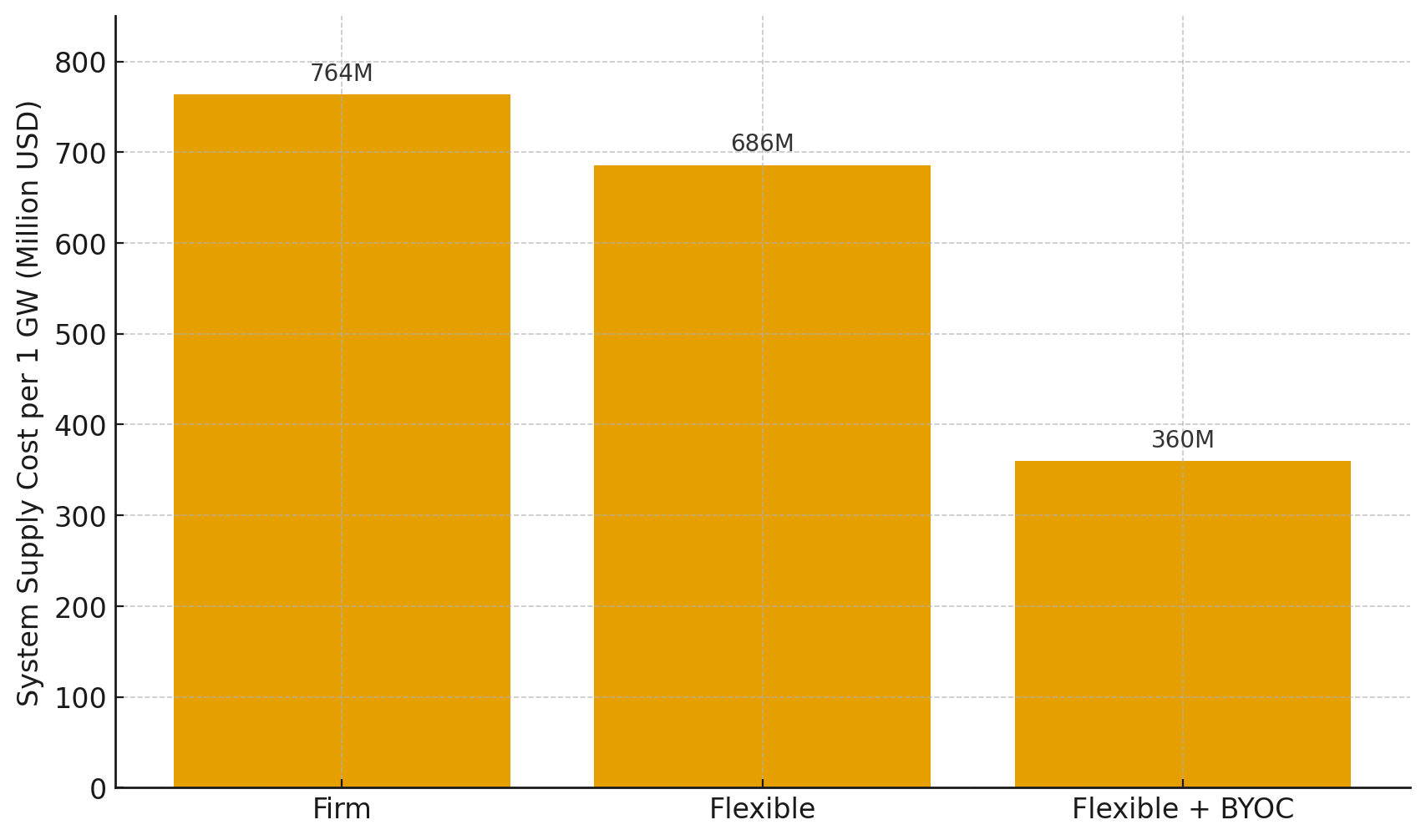

That kind of growth can’t wait in the interconnection queue, which is why the Camus/ZERO Lab framework leans on flexible connections and BYOC (“bring your own capacity”). If large loads accept conditional firm service, the grid avoids 273 MW of new build and saves $78 million per GW; add BYOC, and total system savings rise to $326 million per GW while cutting energization timelines from 5–7 years to about 2. It marks the shift from data centers as passive customers to active grid participants—and, increasingly, co-builders of their own power supply.

What this really means:

Hyperscalers are now quasi-utilities, bringing their own gas peakers, batteries, and renewables to the party.

Utilities shift from builders to validators—checking whether Data Center X’s BYOC portfolio meets reliability requirements.

States with fast-moving commissions (Virginia, Georgia, Ohio, Texas) will capture the next decade of AI infrastructure; slow ones won’t see a dime.

Grid Take:

The grid is no longer planned around climate goals or retirements—it’s planned around GPUs. And GPUs don’t wait for permitting reform.

Duke’s Antitrust Appeal Gets Torched by Trump’s Solicitor General

In a move that should terrify every IOU with a habit of “strategic interconnection management,” the Trump administration’s solicitor general urged SCOTUS to reject Duke Energy’s bid to overturn an antitrust case brought by NTE Energy.

The Allegations (from the revived lawsuit):

Duke allegedly sabotaged NTE’s 500-MW Reidsville gas plant by:

Slow-walking interconnection,

Claiming manufactured contract defaults,

And offering $325 million in concessions to keep Fayetteville from signing long-term offtake with NTE.

The Fourth Circuit revived the case under a “monopoly broth” theory—i.e., individually legal moves that are anticompetitive when combined.

Why the SG’s stance matters:

The SG explicitly calls Duke an “established monopolist” using anti-competitive tactics to block a cheaper rival.

It signals a new federal willingness to police utility conduct, especially where interconnection is weaponized.

If SCOTUS lets the case proceed, every IOU in America faces discovery risk on how they handle competitive entrants.

Grid Take:

This is a shot across the bow: If you’re a utility that treats interconnection as a moat instead of a duty, the antitrust bar just woke up and chose violence.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

MIT News — “What’s the best way to expand America’s grid?”

A clean comparison of optimized vs. prescriptive transmission policy—and how much reliability we’re buying with each extra gigawatt of wire.The Guardian — “UK burning more wood for power than ever, Drax figures show.”

A clean-energy success story that works only if you don’t look at the carbon coming out of the smokestack.The Economist — “Africa needs to generate more electricity.”

A blunt look at the continent’s industrial ceiling: big ambitions, tiny grids.

Chart of the Day: What $$$ Flexible Connections + BYOC Actually Save

Cost to Serve 1 GW of New Data-Center Load

Firm: The data center gets guaranteed, always-on power, and the utility must build all the new generation and infrastructure needed to serve it.

Flexible: The data center agrees to occasional, limited curtailments during grid stress, allowing the utility to build less new capacity.

Flexible + BYOC: The data center brings some of its own power resources (like batteries or generators), which lets the utility avoid even more costly grid upgrades.

New modeling from Camus, Princeton’s ZERO Lab, and encoord shows how expensive it really is to serve a gigawatt of new data-center load under the traditional firm-only interconnection model: about $764 million in system costs and 2.17 GW of new generation. But if hyperscalers accept 20% conditional firm service, the grid avoids 273 MW of new build and trims off $78 million per GW. Add bring-your-own-capacity, where the data center shows up with its own accredited gas, storage, or renewables, and system costs collapse to roughly $360 million—a 53% reduction. It’s the clearest quant we have yet that the future grid isn’t just built by utilities; it’s co-built by the customers who need power faster than the queue can deliver.

Good Bet / Bad Bet

Good Bet: GE Vernova (Indirectly).

If SMRs become the default AI-era baseload solution, the companies with legacy nuclear manufacturing and turbine expertise—GE Vernova chief among them—inherit a decade of demand without needing to evangelize for the technology. Owning the middle of the nuclear supply chain suddenly looks like owning the shovel business during a gold rush.

Bad Bet: Utilities Counting on the Old Moats.

If Duke loses its antitrust appeal, every IOU that has relied on “regulatory choreography” to keep competitors out now faces legal exposure and federal scrutiny. Betting on interconnection delays and municipal deal-sweetening as a business model is about to age as well as the guy who said renewables would “never amount to anything.”

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!