In this edition, we delve into significant developments shaping the energy landscape. From the U.S. Department of Energy's renewed focus on bolstering baseload power generation to the Baltic states' strategic move away from Russian energy dependence, these events underscore the dynamic nature of global energy policies.

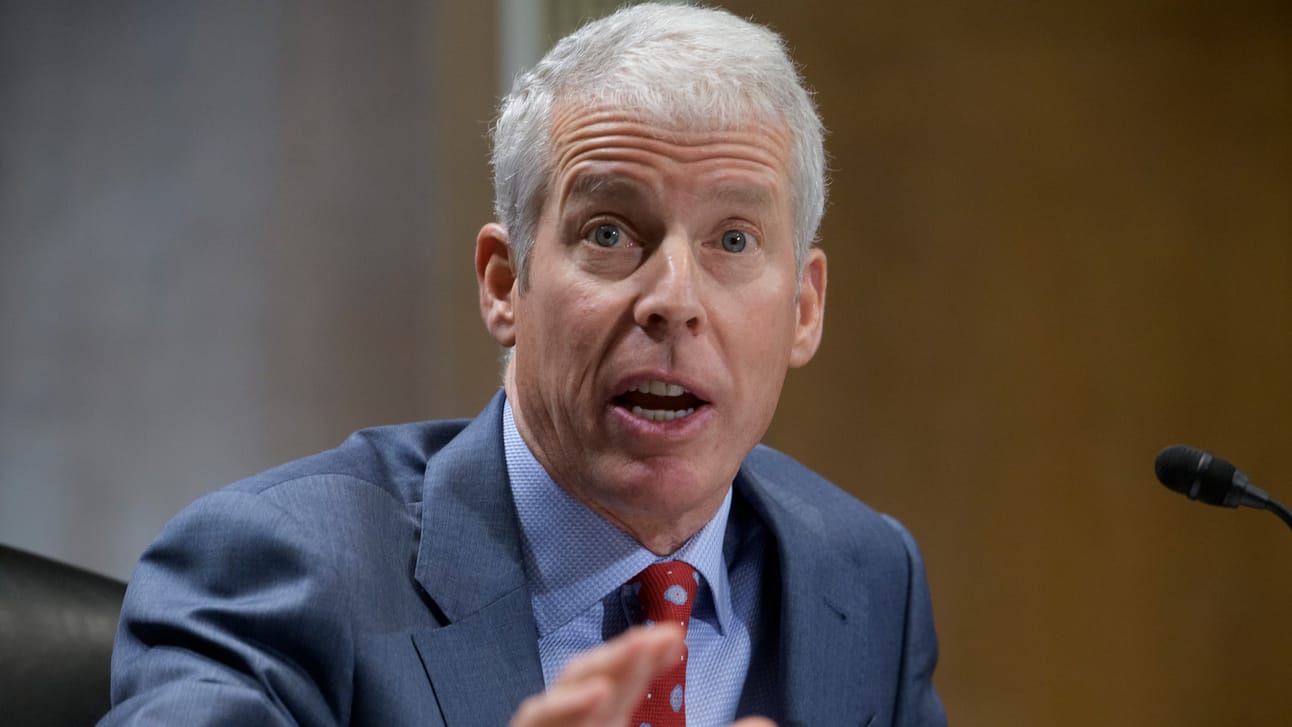

DOE Pivots to Baseload Energy

The U.S. Department of Energy, under newly confirmed Secretary Chris Wright, has issued its first major policy directive: a renewed focus on expanding baseload and dispatchable power to meet growing energy demand. Wright emphasized that net-zero policies have increased costs and jeopardized reliability while achieving little in emissions reductions. In response, the DOE will streamline permitting processes for large-scale energy infrastructure and remove regulatory barriers that delay power projects. Additionally, the agency will double down on nuclear energy development, advocating for faster deployment of next-generation reactors and enhancing support for fossil fuels equipped with carbon capture.

This shift represents a major break from the previous administration’s approach, which heavily incentivized intermittent renewables and demand-side management. Wright’s directive also hints at potential revisions to energy efficiency standards and an overhaul of the DOE’s research priorities. While proponents argue this will stabilize grid reliability and lower costs, critics contend it could weaken emissions policies and hinder investment in clean energy. The policy shift also comes at a time of mounting industrial power demand, with data centers, manufacturing, and AI infrastructure pushing utilities to rethink their generation portfolios.

Baltics Cut the Cord on Russian Power

On February 9, Estonia, Latvia, and Lithuania will officially disconnect from the BRELL electricity grid, a Soviet-era system linking them to Russia and Belarus. The move, years in the making, will integrate the Baltic states into the European Union’s power network, increasing energy security and reducing reliance on Russian electricity. The transition, however, comes with risks—especially potential cyberattacks, as Moscow has historically targeted energy infrastructure in response to geopolitical shifts. Officials across the three nations have reinforced cybersecurity measures, limited external access to grid operations, and taken steps to ensure operational stability during the transition period.

Beyond security concerns, the shift is expected to reshape regional energy markets. The Baltics will now have to rely more heavily on European electricity imports while ramping up domestic generation, particularly from renewables and natural gas. The shift also eliminates a long-standing source of Russian leverage over the region, cutting off what was once a key revenue stream for Moscow. Meanwhile, European policymakers are monitoring the transition closely as they continue efforts to reduce broader energy dependence on Russia in the wake of geopolitical tensions.

Pennsylvania Senate Votes to Exit RGGI

The Pennsylvania Senate has voted 31-18 to withdraw from the Regional Greenhouse Gas Initiative (RGGI), arguing that the cap-and-trade program imposes an unconstitutional energy tax on residents. The vote follows a Commonwealth Court ruling that deemed Pennsylvania’s participation illegal, asserting that Governor Josh Shapiro’s administration cannot unilaterally implement such a tax without legislative approval. The bill now heads to the state House, where opposition from RGGI supporters is expected. The debate hinges on whether the program strengthens Pennsylvania’s energy economy or hampers its competitive edge as a major electricity exporter.

The Commonwealth Foundation, a leading free-market think tank, has strongly supported the repeal, warning that RGGI would lead to higher energy costs and drive investment out of the state. “Senate lawmakers who voted to repeal RGGI understand what Gov. Shapiro does not—RGGI is an unconstitutional energy tax paid for by hardworking Pennsylvanians,” said Elizabeth Stelle, Vice President of Policy at the foundation. Critics argue that RGGI’s carbon pricing mechanism will result in a 30% spike in electric bills, while supporters claim it’s a necessary step toward reducing emissions and funding clean energy initiatives. With Pennsylvania’s energy future at stake, the battle over RGGI will have far-reaching consequences for the state’s natural gas, coal, and renewables sectors.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

Heritage Foundation – Trump’s Energy Moves and Grid Stability

A look at how recent executive orders could prevent long-term grid instability and rising blackout risks.CNBC – Trump to Help Spark a Nuclear Energy ‘Renaissance’

Investors see a major nuclear energy revival as the administration moves to accelerate next-generation reactor approvals.CNN World – Former Miss America Takes Nuclear Advocacy to Australia

Grace Stanke, a nuclear engineer and former Miss America, is on a speaking tour advocating for nuclear power in a country where it remains banned.

Good Bet, Bad Bet

Good Bet: BWX Technologies (NYSE: BWXT)

With the DOE prioritizing baseload power, BWX Technologies—one of the top suppliers of nuclear reactors for both commercial and military use—is well-positioned to benefit. The company is heavily involved in small modular reactors (SMRs), a sector expected to see fast-tracked regulatory approvals under the new administration. With growing demand for advanced nuclear solutions, BWXT stands out as a key player in America’s nuclear resurgence.

Bad Bet: “No Need for Oil by 2020” – U.S. Department of Energy (2004)

In 2004, the DOE’s official energy roadmap suggested that “the combination of biofuels, hydrogen, and renewables will likely displace most fossil fuels for transportation and energy by 2020.” Twenty years later, global oil demand is near all-time highs, and even the most aggressive net-zero plans still see petroleum in use well into the 2050s. Turns out, energy transitions take a bit longer than PowerPoint slides suggest.

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!