Dow Chemical Goes Nuclear

Dow Chemical will put advanced nuclear reactors at one of its Gulf Coast sites to supply it with low-carbon electricity and heat for its chemical processing.

"Dow signed a letter of intent with reactor developer X-energy, and plans to buy a minority stake in the company," reports The Chemical Engineer. "The plan is to deploy X-energy’s Xe-100 high-temperature gas-cooled reactor technology at one of Dow’s Gulf Coast complexes, with operations expected to begin by 2030."

"Advanced small modular nuclear technology is going to be a critical tool for Dow's path to zero-carbon emissions,” said Dow CEO Jim Fitterling. “This is a great opportunity for Dow to lead our industry in carbon-neutral manufacturing by deploying next-generation nuclear energy."

Dow claims it's the first company to bet on advanced SMRs as means of achieving its decarbonization goals by 2050. In 2020, the Royal Society published a study that revealed 65% of nuclear's energy is lost as waste heat. SMRs could help heavy industries benefit from the reactors' electricity and heat production alike to more successfully decarbonize--unlike trying to decarbonize with renewables which provide neither heat nor reliability.

Ironically, this dream of using "co-generating" facilities that can take advantage of electricity production and waste heat arose in the anti-nuclear movement as a way to focus on energy efficiency rather than production. This impetus crystalized in President Jimmy Carter's utility reforms that began the process of electricity restructuring. You can read more about that history in a deep dive I wrote for American Affairs.

American Renewables Struggle

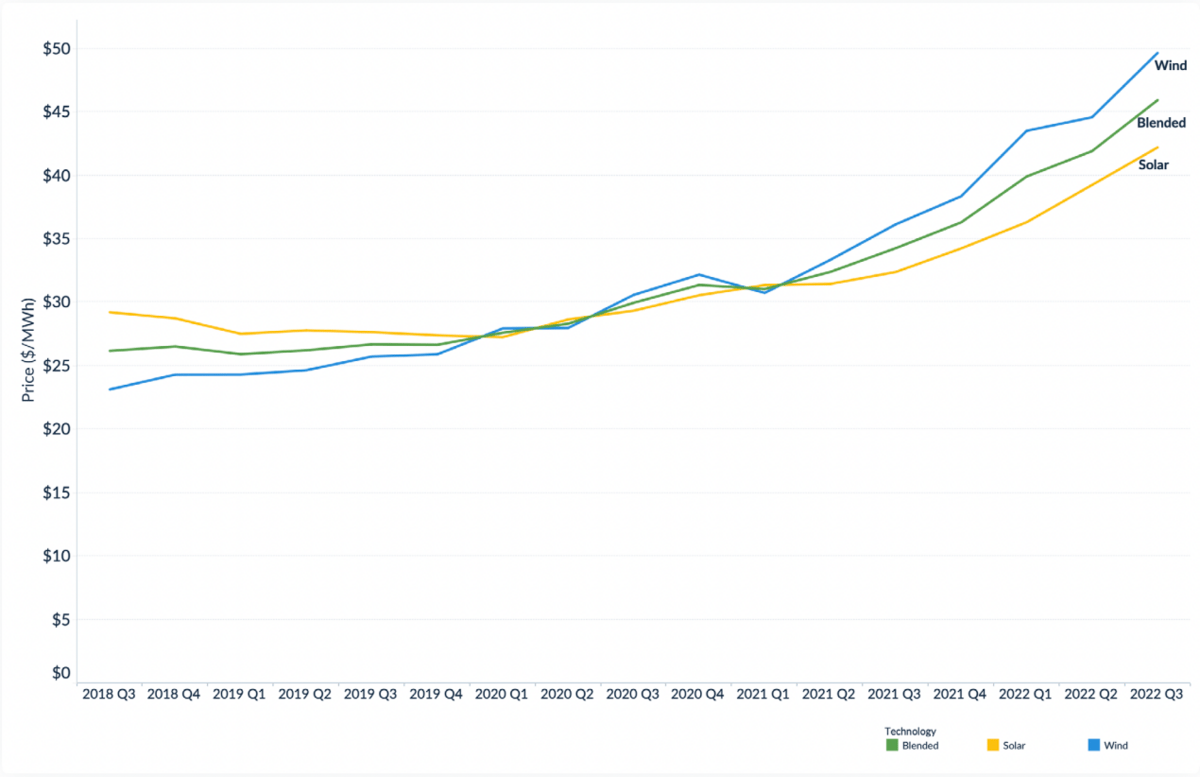

Renewable Power Purchase Agreements (PPAs) have seen a nearly 10% hike (averaged to around $45 per MWh) in Q3 according to a recent report from LevelTen. Renewable PPA prices are about 34% higher than they were this time last year.

Solar PPA prices increased by 7.5% while wind PPA prices increased by 11.4%. Here's the market averaged national index:

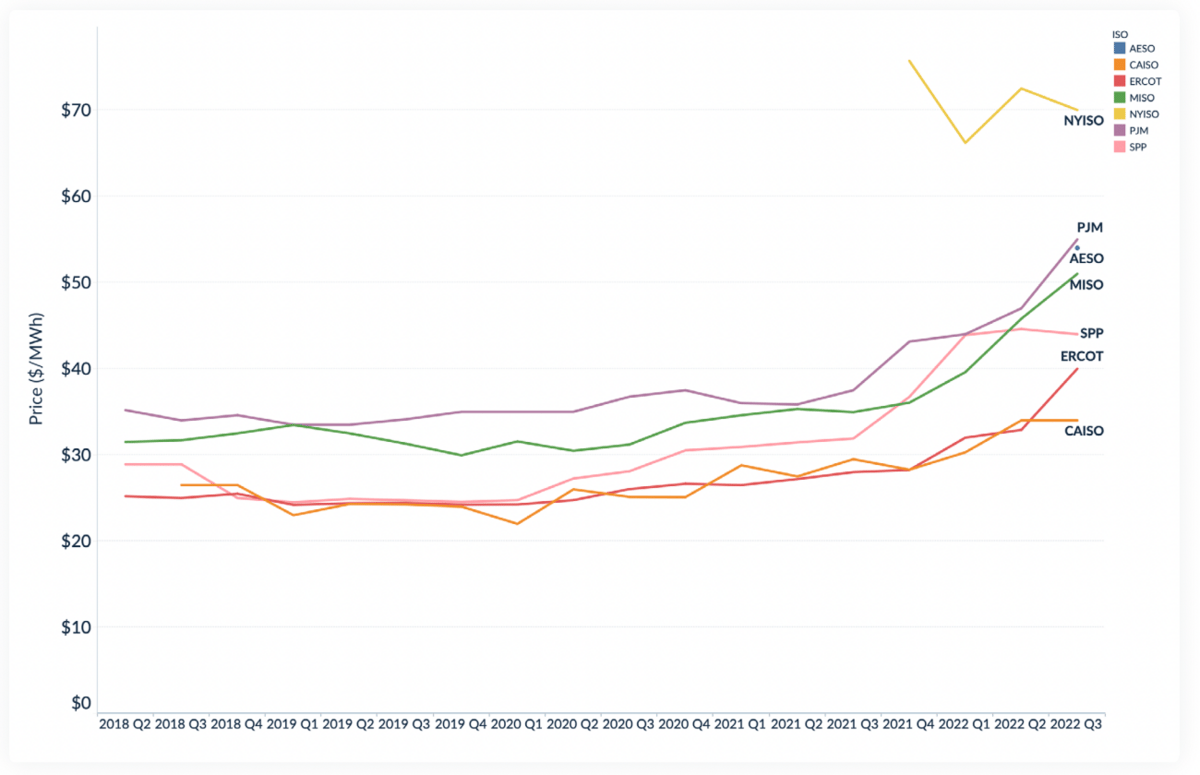

Here are solar PPA price trends broken down by ISO:

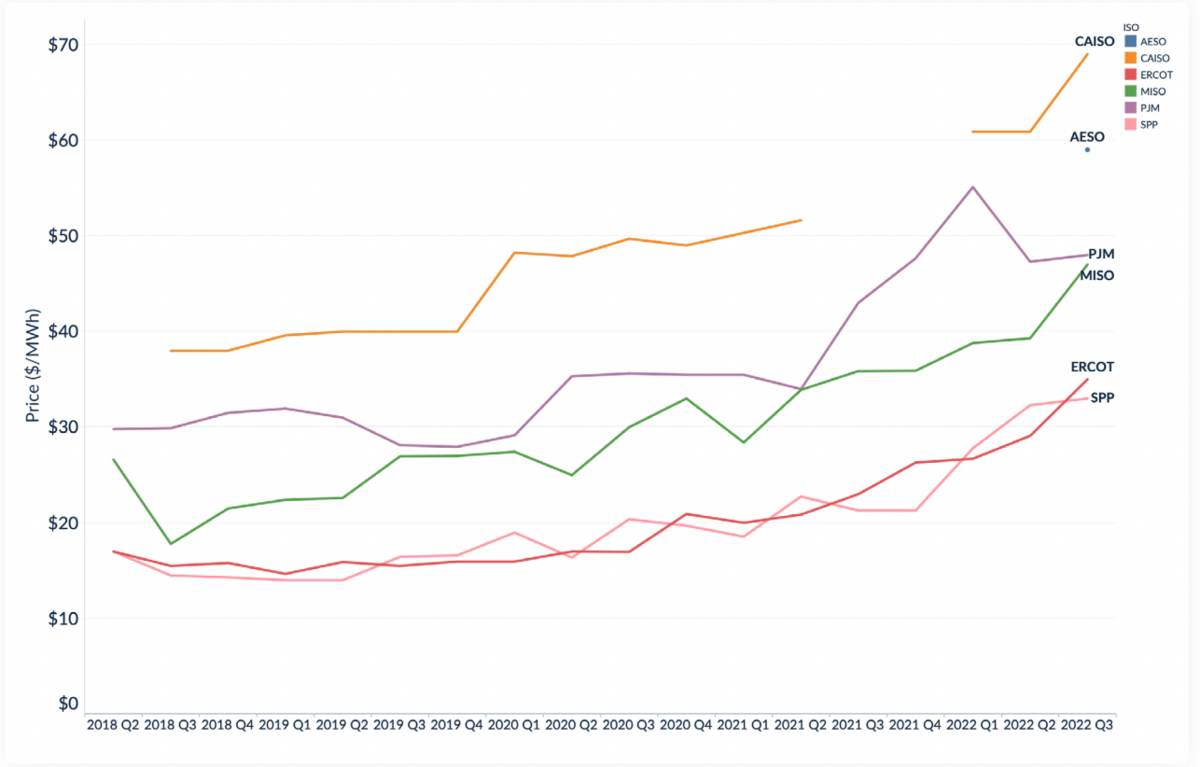

Here are wind PPA price trends broken down by ISO:

Gia Clarke, LevelTen's senior director of developer services, said multiple factors were at play, including supply chain issues, but that the main culprit remains interconnection bottlenecks.

“[I]nterconnection is really a binary,” Clark told Utility Dive. “Can you build a project, yes or no? If it’s a yes, then you get into the supply chain challenges. But when you are thinking about how big a factor it is, the binary is likely to be the biggest impact because that’s the ‘Can you do it or not?’ piece.”

In addition to interconnection issues, supply chain issues, and PPA price increases, new building standards that demand renewables prove more resilient in extreme weather events threaten yet more pressure on the industry. The new building standards have come under fire from renewable energy developers like Xcel, First Solar, and renewable industry trade groups.

A Federal Emergency Management Agency advisory panel proposal aims to increase construction standards so that wind and solar projects operate even during extreme weather. The renewables industry has said that an increase in standards that would increase their reliability during emergencies would "doom" many projects by driving up costs, according to Utility Dive.

"The stated goal of FEMA’s proposal is increased grid reliability, but when you needlessly make it harder to build resilient clean energy, the obvious effect is a reduction in reliability,” Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association, said in a statement. “This overreach is being made in an opaque process without input from experts on economic impacts, electric reliability and climate change.”

In other words, when it's more difficult to build fundamentally unreliable electricity sources, the grid becomes more unreliable. Sure.

Four 125-year-old German Companies Insolvent in 24 Hours

Four German firms, all over a century old, declared bankruptcy within 24 hours.

The companies--construction company Wolff Hochund Ingenieurbau (over 125 years old), candy company Bodeta (130 years old), car component supplier Borgers (156 years old), and soap maker Kappus (175 years old)--have all been hammered to bit by the energy crisis.

"Germany has the biggest economy in the European Union, with a GDP of over 3.57 trillion Euros [3.51 trillion USD] in 2021," reports Gript. "Its position as the fourth largest economy in the world is based on exports of high-quality manufactured goods including vehicle construction, electrical industry, engineering and chemical industry."

Germany has become a net importer over the course of this year.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Chinese President Xi Jinping made it clear that China will not sacrifice reliability and stability for decarbonization. “We will work actively and prudently toward the goals of reaching peak carbon emissions and carbon neutrality,” Xi said in a recent address. “Based on China’s energy and resource endowments, we will advance initiatives to reach peak carbon emissions in a well-planned and phased way, in line with the principle of getting the new before discarding the old.”

Venezuela's largest refinery, Paraguaná Refinery Complex, which produces 955,000 barrels per day, just shut off due to a fire and a blackout. "A small fire erupted at a vacuum tower at the Amuay oil refinery, which, together with the Cardon refinery, makes up the huge refinery complex. The blackout is widespread in the complex, and all operations are halted," reports Oilprice.com.

Households using oil or propane for heating this winter will pay more, according to the Energy Information Administration. The EIA expects "that households that use heating oil as the primary fuel for space heating will spend 27% more money on these fuels this winter than last winter, in nominal terms (not adjusted for inflation)." Houses that use propane can expect a more modest jump. "We expect households in the Northeast, Midwest, and South that use propane will spend about $1,668 this winter, a 5% increase from last winter, due to a higher retail markup on wholesale propane prices."

Crom's Blessing