The Energy Crisis Is Bringing America and Venezuela Together

US officials quietly visited Venezuela again, the superficial reason being to negotiate for the release of several US prisoners including oil executives. For his part, Maduro said that the purpose of the visit was to "give continuity to the bilateral agenda between the government of the United States and the government of Venezuela."

But the sub rosa reason for the visit, and likely the quietness surrounding it, has to do with the energy crisis. Washington is turning to Caraccas for oil.

"In May, Washington said it would lift restrictions on Chevron in order for the company to return to its business in the South American country," reports Oilprice.com, "letting the supermajor negotiate terms directly with PDVSA [Venezuela's state-owned oil and gas company]."

Earlier this month, Washington eased restrictions further so that PDVSA could start exporting to Europe.

More recently, France has called for Venezuela to be re-integrated into the world oil market. A French official at the G7 summit said, "There are resources elsewhere that need to be explored. So there is a knot that needs to be untied if applicable... to get Iranian oil back on the market. We have Venezuelan oil that also needs to come back to the market."

US Gas Generators Scramble As Coal Exports Surge

"Rising US coal exports and soaring domestic prices promise to drive a wave of fuel switching this season as power generators look to natural gas to meet cooling demand amid potentially record summer heat," reports SPG.

Over the last year, American coal prices have tripled. That's encouraged people to switch over to gas. But the surge in coal prices has only been ramping up. "Over the past week, Appalachian Basin coal has traded up to $175/st – the highest on record since Platts began assessing the CAPP thermal market back in 2005."

To get a picture of what the switch to gas has looked like: "During second-quarter 2022, US gas-fired power demand has averaged over 30.9 Bcf/d, a record high for the period that has outpaced the prior peak-season of 2020, when gas prices below $2/MMBtu prompted an earlier wave of coal-to-gas switching."

This situation is exacerbated by two other trends: American coal retirements and the failure of the coal mining industry to bounce back from 2020.

Over the past year, America has retired nearly 13GW of coal--about 34 coal plants. Meanwhile, this year, "weekly US coal production has averaged about 11.2 million st, or nearly 13% below the prior five-year average of 12.8 million st."

This has made the US increasingly reliant on natural gas as its main power source. But gas supplies have tightened due to the Ukraine war. June and August look to be hot months which will increase demand and put further strain on the grid.

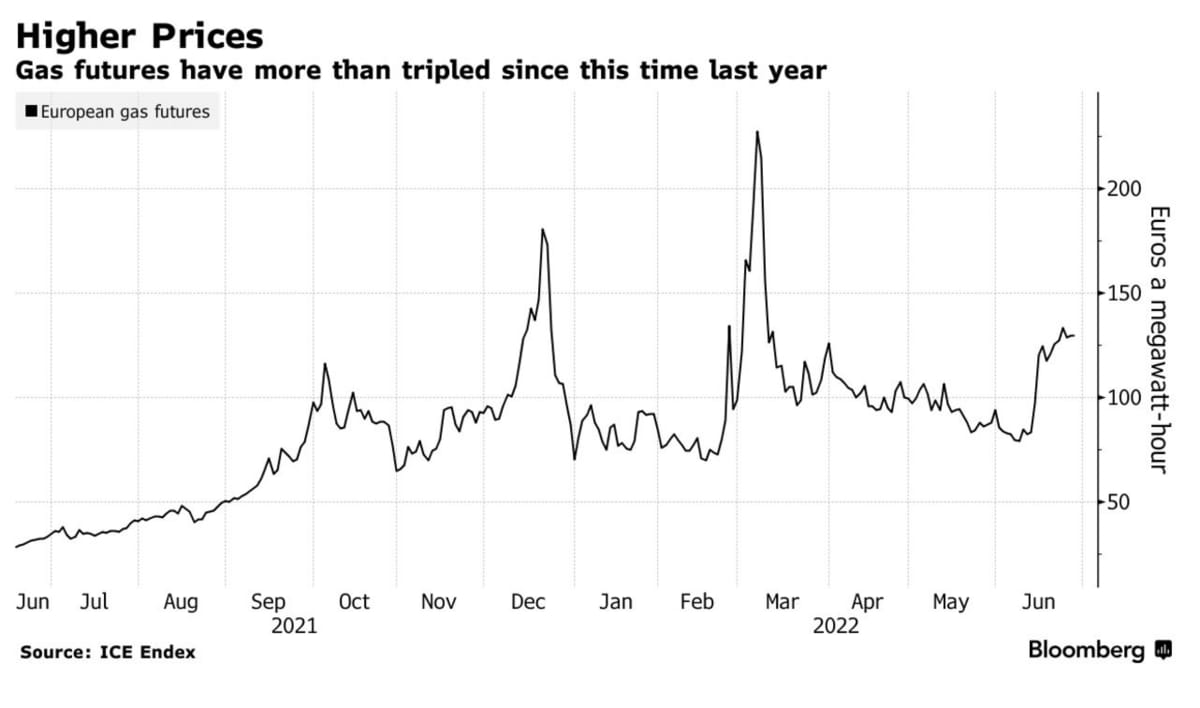

IEA: Europe Needs to Cut Gas Use by 30% by Winter

According to the IEA, Europe will need to lop off a third of its gas you by mid-February if it wants to survive a Russian gas flow cut-ff.

“Depending on its timing, a complete cut-off of Russian gas supplies to Europe could result in storage fill levels being well below average ahead of the winter, leaving the EU in a very vulnerable position,” Fatih Birol, executive director of the International Energy Agency, said. “In the current context, I wouldn’t exclude a complete cut-off of gas exports to Europe from Russia.”

"The bloc’s projections show that while storage filling rates are currently on track to hit 90% by Nov. 1, a cut-off would bring that level to below 75%," reports Bloomberg.

Birol suggests cutting gas use in industry and households today by as much as possible. This situation is looking dark.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Exxon Chief, Darren Woods, predicts that prices will continue to rise in oil and gas. “They always say that the cure to high prices is high prices. And that’s exactly what I think we’ll see. So it’s a question of how high prices eventually rise," he said.

FERC is investigating Salem Harbor Power Development in Massachusetts "for an alleged 2017 scheme to collect capacity market payments despite the company’s 674-MW gas-fired plant missing its planned operations date." FERC argues that ISO New England should have known Salem Harbor was going to miss its operation date and forced the gas plant to sell off its capacity obligations.

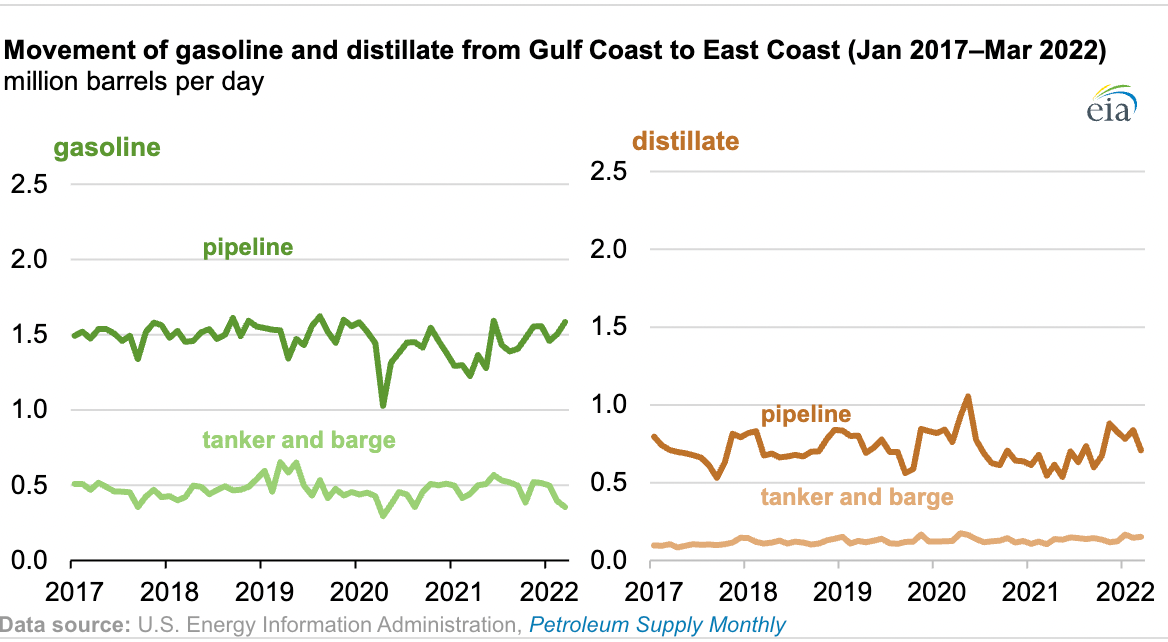

The Gulf of Mexico is moving serious amounts of gasoline and distillate to the East Coast. The EIA reports that in "March 2022, the East Coast received an average of 1.9 million barrels per day (b/d) of gasoline and 0.9 million b/d of distillate by pipeline, tanker, and barge from the Gulf Coast."