European Pipeline Sabotage

Europe's gas storage is full--praise be. But dangers still lurk on the horizon. "Economists have identified two main risks: a prolonged cold snap, and a catastrophic incident at a gas pipeline, reserve storage facility or other crucial piece of infrastructure. Such installations were largely unprotected, making them the softest of targets," security officials told The Wall Street Journal.

After the attack on Nordstream 2 and suspicious drone sitings over Scandinavia, the continent is on high alert for pipeline sabotage.

But Europe isn't necessarily up to the task. Hans Tino Hansen, CEO of Risk Intelligence, a Copenhagen-based security firm specializing in maritime threats, said that European armed forces have neither the manpower nor the resources to protect their energy infrastructure.

“If you operated in the North Sea or in the Baltic after the Cold War, you gave security risk assessments very little consideration,” he told WSJ. “There were lots of assessments on the impact of energy projects on the environment, on birds or water flows, but very little on security.”

NATO has beefed up its presence in the North and Baltic Seas to protect pipeline there. Norway, now the regions largest gas provider, has elevated the security needs in the North Sea.

Mexico's Climate Pledge

Mexico's climate pledge at COP27 was met with skepticism. American leadership believes the Mexican government is double-dealing; the US has little confidence the Mexican government actually plans to slash its emissions 35% by the end of the decade.

"Under the leadership of President Andres Manuel Lopez Obrador, known as AMLO, Mexico has increasingly shifted toward a more fossil fuels-heavy energy policy steered by the country’s state-owned energy companies at the expense of private sector-led renewables projects," Bloomberg reports. America believes Mexico has violated trade policy to favor state-owned fossil assets against private wind and solar assets for electricity generation. Mexico's regulator "has also prevented foreign companies from advancing clean energy projects by not granting them permits to operate," reports Bloomberg.

“The biggest mover right now is actually AMLO trying to postpone US action under USMCA over the energy legislation,” said Duncan Wood, the Wilson Center’s vice president of Strategy & New Initiatives. “What he’s doing is he’s playing for time in the negotiation over the consultation and hence the panel. He’s trying to put that off for as long as possible.”

That AMLO's renewable-energy ambitions seek state-owned wind and solar tells Wood AMLO is simply not serious about climate goals. Accord to Wood, the Comision Federal de Electricidad doesn't have the resources for such a maneuver. (Though AMLO is refurbishing and building out Mexico's hydropower infrastructure).

Perhaps Wood is right that AMLO isn't serious about owning renewables. Should he be? After all, renewables have been a blight on the American grid. Stripping away the public/private politics, what CFE has done is privilege reliable assets over fundamentally unreliable assets when it comes to grid dispatch. From a grid management perspective, this is a materially sound position. Perhaps AMLO and the CFE have seen what renewables have done to California and Texas and have chosen a different path.

Thank Canada!

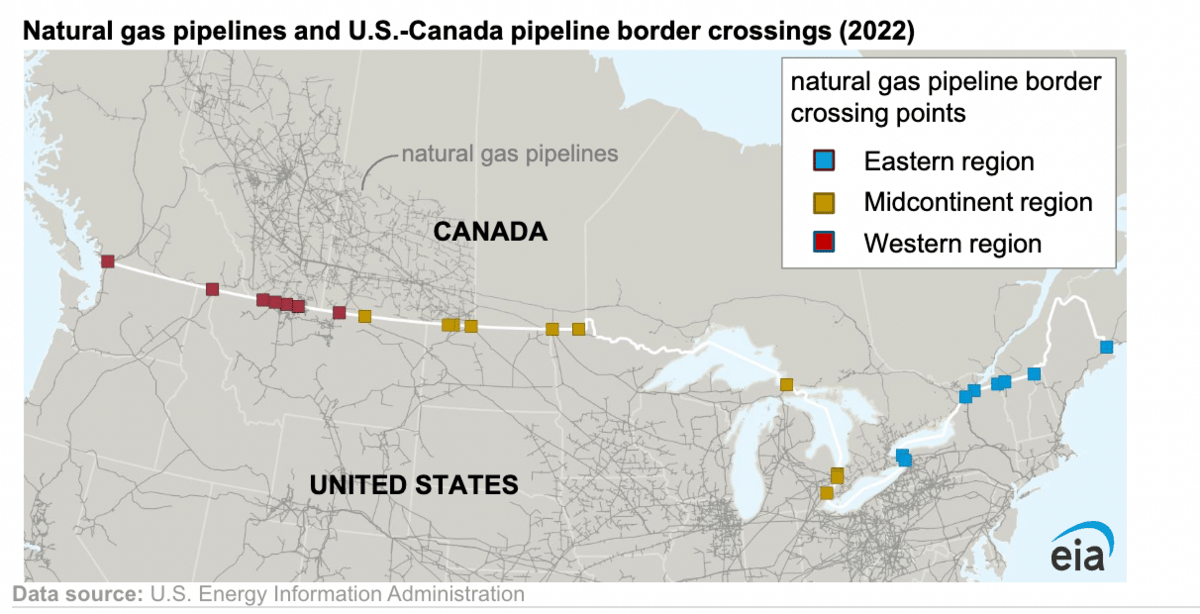

Canadian natural gas imports are keeping America electricity markets alive. "Because of ample capacity on pipelines and in storage facilities in Canada, suppliers can rapidly increase flows, which helps to stabilize the U.S. market during periods of supply and demand imbalance, such as during cold winter months," reports the Energy Information Administration.

Canada's role in helping America balance its grid has continued in importance despite a significant drop in imports. In 2005, 17% of America's dry natural gas came from Canada. The shale boom changed this--between 2005 and August of this year, dry natural gas from Canada dropped by 9%. Over the same period of time, America exports to Canada rose from 9% to 24%.

Canadian imports have had a particularly salutary effect on the American West. "So far this year, they have increased 4.1% compared with the same period in 2021," reports the EIA. "The border-crossing points at Sumas, Washington, and Eastport, Idaho, principally supply metropolitan areas in the Pacific Northwest and California, where several factors have challenged supply and demand balances this year:

More demand for electric power to run air-conditioning due to sustained high temperatures and an extreme heat wave this summer

Less hydroelectric power generation due to drought

Reduced natural gas inflows from the Permian Basin due to pipeline constraints"

The Canadian import/export relationship with America's East Coast is seasonal. "Since 2012, imports into the eastern United States have generally peaked in January or February at approximately 2 Bcf/d and then again in July or August at approximately 1 Bcf/d, when high temperatures drive demand for air-conditioning," reports the EIA. "During the shoulder seasons (spring and fall), net flows of natural gas reverse, flowing into Canada to build inventories."

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Anti-lockdown protests are heating up in China. "Protests against Covid restrictions spread across China on Sunday as citizens took to the streets and university campuses, venting their anger and frustrations on local officials and the Communist Party," reports Bloomberg. "There was heavy police presence in some areas where huge crowds gathered in Shanghai, after protesters at one of the locations on Saturday called for President Xi Jinping to step down, a level of national dissent unheard of since he took power a decade ago."

America's diesel crunch is finally destroying demand. "American distillate inventories are still below the five-year average, but the gap in stocks compared to previous years has slowly started to narrow, suggesting that high prices are hitting demand, while encouraging more refinery output thanks to solid refining margins," reports Oilprice.com. "In this week’s inventory report, the U.S. Energy Information Administration said that distillate stocks rose by 1.7 million barrels in the week to November 18, with production rising to an average of 5.1 million barrels per day (bpd). Distillate fuel inventories are still about 13% below the five-year average for this time of year, but two months ago, they were more than 20% below the five-year average for that time of the year."

Uranium production is returning to Wyoming. "The company's Board of Directors has made the financial investment decision that will see production activities begin at the Lance project during the first quarter of 2023, for delivery into existing offtake contracts in the final quarter of the year," reports World Nuclear News. "It is with a tremendous sense of excitement that we are advancing the Lance Projects back into production," said Wayne Heili, managing director and CEO of Peninsula Energy.

Crom's Blessing