Welcome to Grid Brief! Here’s what we’re looking at today: European solar firms flee to America for rescue, American firms are drilling faster than they’re fracking, and more.

European Solar Firms Head to US

European solar firms have suffered over the years, squeezed in a pincer of Chinese industry dominance and American subsidies.

“China is expanding solar output and now accounts for 80% of the world's solar manufacturing capacity. The cost of producing panels there is around 12 cents per watt of energy generated, compared with 22 cents in Europe, according to research firm Wood Mackenzie,” reports Reuters. “U.S. subsidies announced as part of the 2022 Inflation Reduction Act allow some renewable energy manufacturers and project developers to claim tax credits, which are attracting businesses from within the European Union and beyond.”

The escape of some solar manufacturers to America, as covered by Reuters, comes at a time when Europe is debating on how best to save its solar panel manufacturers. Earlier this month, EU parliament and Green Party member, Michael Bloss, issued a petition calling for continent-wide collaboration to rescue the industry.

Bloss wants the European Commission to create a 200 million euro ($213 million) fund to snatch up unused European-made solar panels.

"We are -- in headlines and Sunday speeches -- very much in favour of creating our own solar industry, but then in action, nothing happens," Bloss said. "The charter will be more like a political declaration signed by member states, solar companies and the Commission, it's more long term, it has no immediate effect."

So far, the European Commission hasn’t been willing to take on Bloss’s strategy. Whatever the EU decides to do, for some solar manufacturers, it will be too late.

The “Frack-log” Grows

Ever heard of the “frack-log”? It’s an industry term that describes when drillers prepare a well for fracking, but wait to switch it on in hopes of rising prices. And last month, US oil companies added to this tally of drilled yet uncompleted wells for the first time in a year.

“Any slowdown in the US production growth would be a key consideration for OPEC and its allies when they gather in June to decide whether to allow supply curbs to lapse,” reports Bloomberg. “International crude prices have surged almost 20% this year amid concerns about the potential for global supply shocks, and analysts from JPMorgan Chase & Co. and elsewhere are warning oil may be headed for the $100 mark.”

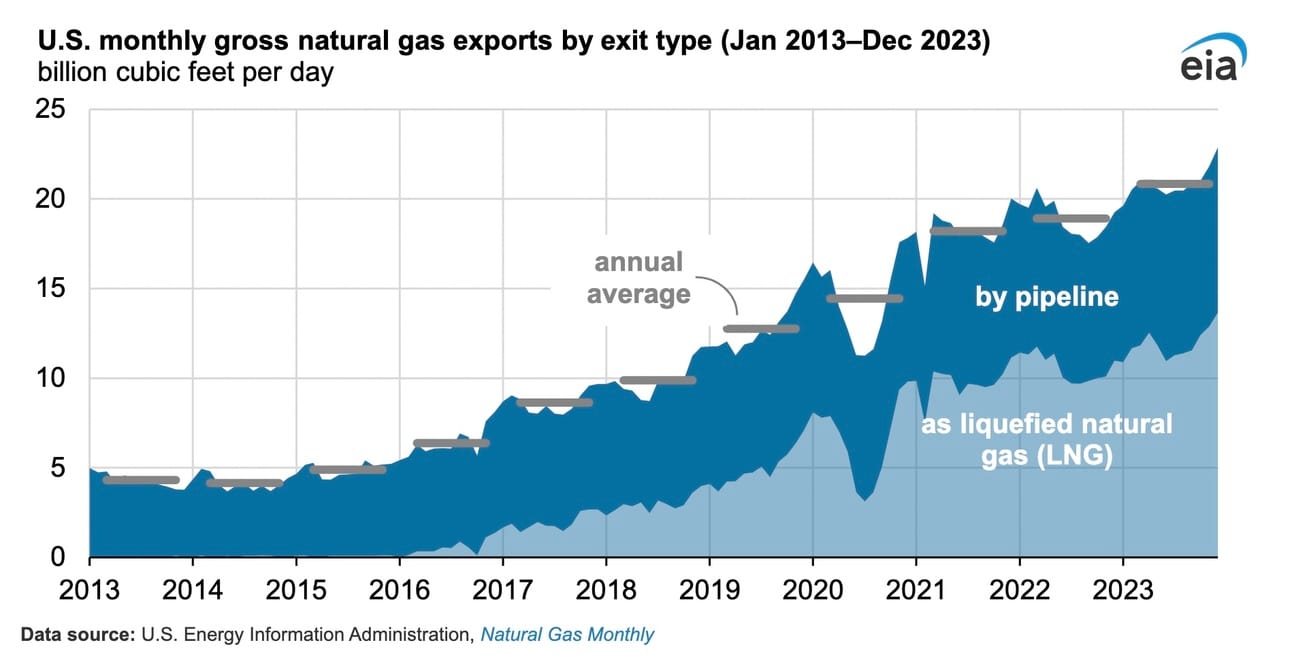

In March, America’s frack-log lifted by 9 to 4,522. Yet none of the major fracking regions have seen their production levels return to December of 2023’s high. Last year, America exported 10% more natural gas than in 2022, a jump brought on by efficiency gains that had begun to eat into the frack-log. This year looks less likely to deliver such a boom. According to Bloomberg, this is all good news for oil bulls.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

US emissions have dropped 17% since 2005. “U.S. greenhouse gas emissions rose 1.3% in 2022, reflecting post-COVID economic recovery, but declined 17% since 2005, according to the Environmental Protection Agency’s (EPA) Annual US Greenhouse Gas Inventory (GHG Inventory), released every April,” reports Oilprice.com. “The EPA’s neutral policy report has been released annually since its inception in 1993, in accordance with the Paris Agreement and the United Nations Framework Convention on Climate Change. Total gross U.S. emissions decreased by 3% from 1990 to 2022, down from a high of 15.2% above 1990 levels in 2007. From 2021 to 2022, gross emissions increased by 0.2%, while overall net emissions increased by 1.3% during that same time period.”

Russian refinery capacity recovers after Ukraine drone strikes. “Russia has been able to swiftly repair some of key oil refineries hit by Ukrainian drones, reducing capacity idled by the attacks to about 10% from almost 14% at the end of March, Reuters calculations showed. Ukraine stepped up drone attacks on Russian energy infrastructure since the start of the year, hitting some major oil refineries across the world's second largest oil exporter in attacks that sent up oil prices,” reports Oilprice.com. “Russia says the drone attacks amount to terrorism. Ukraine says its drone attacks on Russia are justified because it is fighting for survival as Russia has made ‘massive retaliatory; strikes on Ukrainian energy infrastructure. There have been no reports of successful attacks on Russian large refineries since the Taneco plant was hit on April 2. Russia is repairing its refineries fast, despite difficulties in obtaining Western know-how.”

Japan ponders further emissions cuts. “Japan will consider slashing emissions 66% by fiscal year 2035, from 2013 levels, as the nation kicks off a review of its energy mix strategy, the Nikkei reported Monday without attribution,” reports Bloomberg. “The government aims to provide companies a better long-term outlook for investment decisions through a revised energy mix target that will extend to fiscal 2040, the report said. The current strategy, which was last updated in 2021, includes targets for power generation as far as fiscal 2030, with a goal to reduce emissions by 46% by that year.”

Crom’s Blessing

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!