European Squeeze Tightens

Three factors have recently sent European energy prices through the roof: France's neglected nuclear fleet's underperformance, sagging wind speeds, and a scorching heatwave.

"Benchmark German power for next year rose as much as 6.6% to a record 455 euros a megawatt-hour on the European Energy Exchange AG," reports Bloomberg. "The French contract was up as much as 7.8%, rising to 622 euros a megawatt-hour. That’s about $1,100 for the equivalent energy of a barrel of oil."

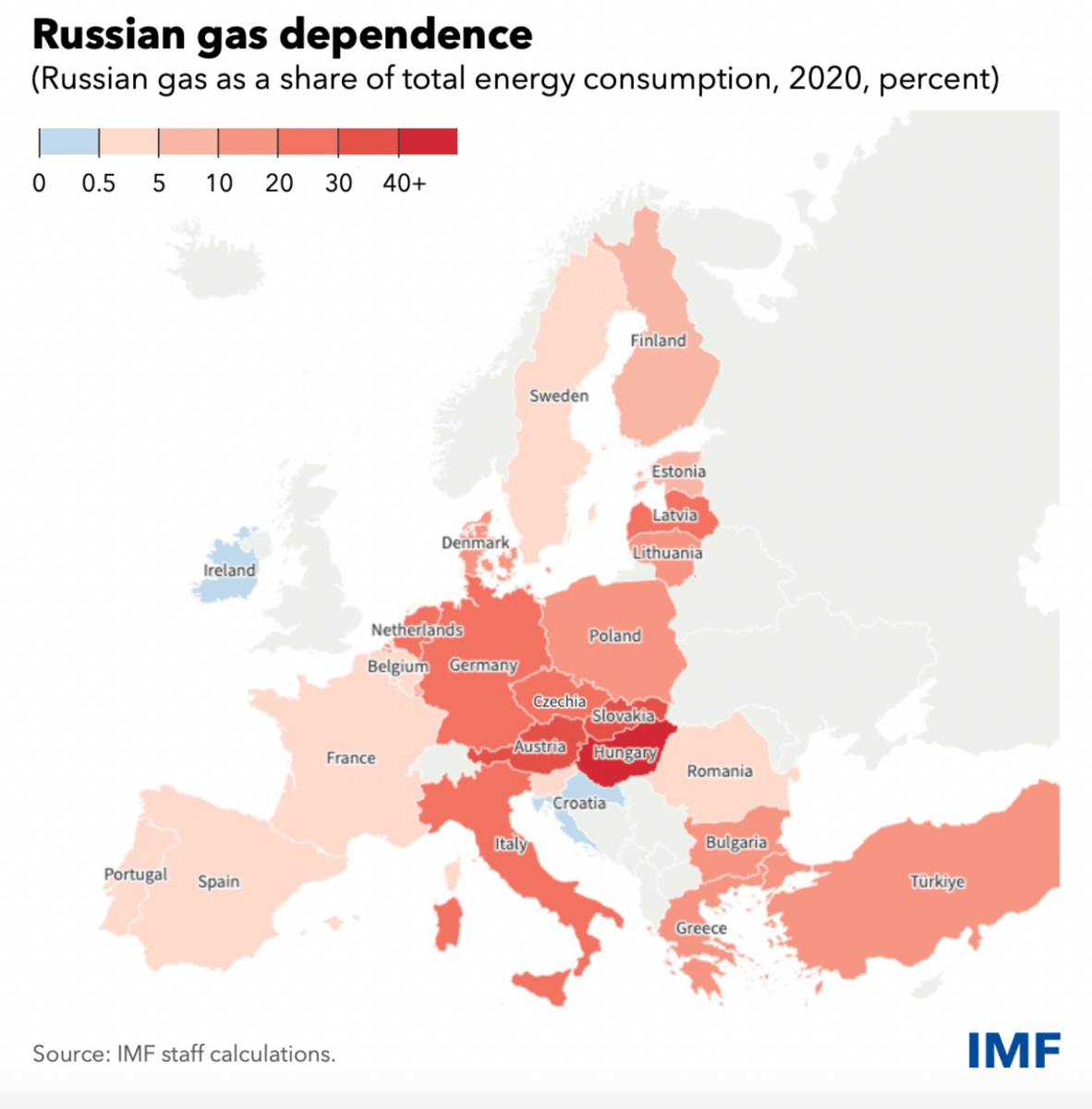

Beneath this brutal trifecta lies another pressure: flagging Russian gas flows. Russia's gas exports to Europe have dropped a staggering 60% over the course of the year according to the International Monetary Fund.

“If Russia cuts off the gas and there might not be enough gas for the whole demand, then there would be rationing,” Annegret Groebel, president of the Council of European Energy Regulators, said. She added that blackouts could be dodged, "but of course, it requires a lot of preparatory work that we are currently doing.”

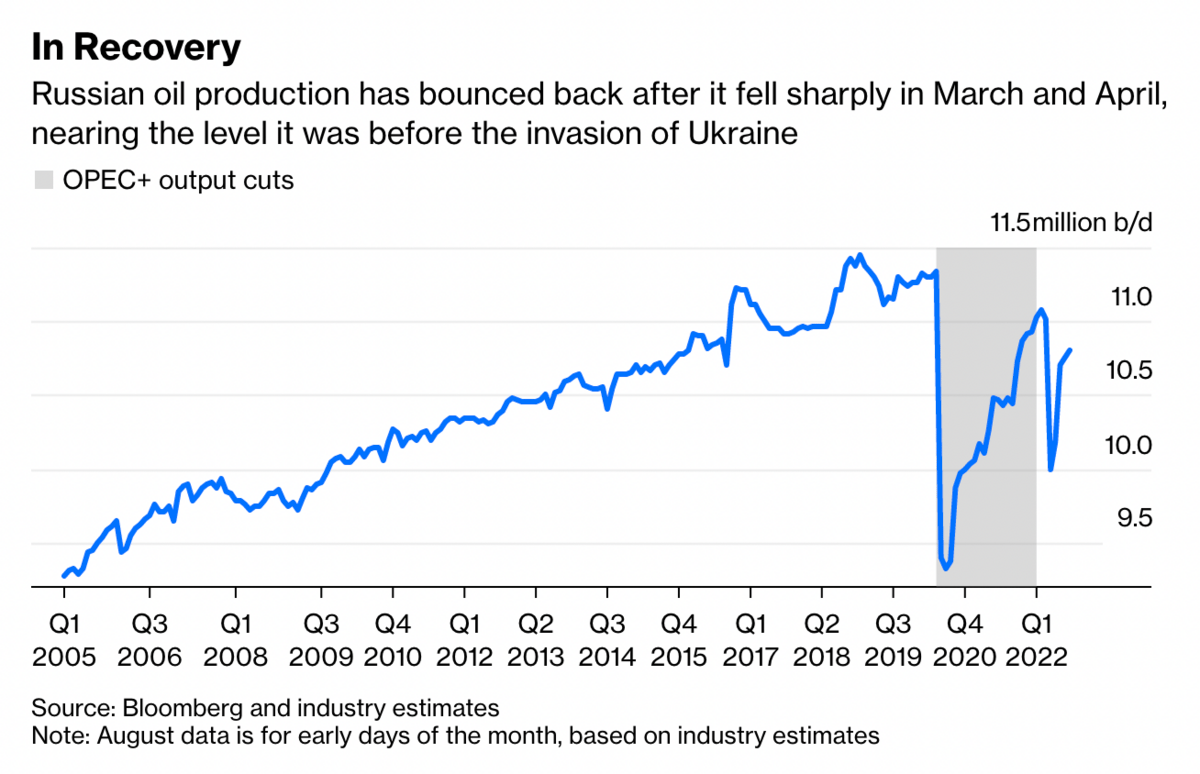

Meanwhile, the Russian oil industry has rebounded from the sharp drop in production it experienced at the beginning of Europe's sanctions.

"Russia has found new customers for the million barrels a day or so that European oil refiners have stopped purchasing due to self-sanctioning," writes Javier Blas. Most of it is going to Asia, especially India, as well as the Middle East. "And some is still showing up in Europe, with buyers still purchasing Russian crude ahead of the planned introduction of official sanctions in early November."

"Everyone who bet that Russian oil production would continue to drop," Blas concludes, "got it wrong."

Worse still, Europe's energy crisis has hemorrhaged into food. If Europe has to ration energy to make it through the winter, it will be tough on the gas-heavy fertilizer industry. Plus, reports Oilprice.com, "some food factories may have to be shut down as governments prioritize household energy security."

In the midst of all this, Europe's ban on Russian coal has gone into effect, depriving it of still more energy. Last year, Europe imported 46% of its imported coal from Russia.

Will the Inflation Reduction Act Bring More Drilling?

The Inflation Reduction Act is a grab-bag energy policy that has something for everyone, and therefore something for everyone to hate. For climate hawks, the provision that allows for greater leasing of federal lands for oil drilling stank up the joint.

But will that provision do what it says on the tin? A recent piece from Grist casts doubt on its ability to spur oil and gas production.

"Even if the government does keep auctioning off federal territory, it’s far from certain that oil and gas companies will want to build new drilling operations on that territory," reports Grist. "The industry has shifted resources away from federal lands and the Gulf of Mexico in recent years, and there’s currently less capital available than ever for new production in these areas."

New production opportunities have opened up elsewhere, shifting the industry's focus away from federal lands, especially onshore sites.

“In terms of oil, our view is that virtually all of the highly prospective [onshore] acreage is already leased and held,” Raoul LeBlanc, a vice president for energy at the financial analytics firm S&P Global and a former strategist for the oil company Anadarko Petroleum, told Grist. “In that sense, opening up a lot of auctions for more development is unlikely at this point to yield a lot of actual activity.”

In a rich twist, the American Petroleum Institute, along with 60 other oil and gas trade groups, wrote a letter to Senators Nancy Pelosi and Kevin McCarthy in opposition to the IRA. Their letter cites the new onerous tax increases on the industry and chides the legislation for failing "to address permitting reform, which is desperately needed and is essential to effectively deliver affordable, reliable energy to consumers in a growing economy."

Coal Curbs Green Goals

Two laws are necessary to understand what's happening with coal's recent resurgence:

Climate scientist Roger Pielke Jr.'s Law of Climate Policy: when forced with the choice between their economy and the environment, people will pick the economy.

Robert Bryce's Iron Law of Electricity: People will do whatever they can to get the electricity they need.

That's why six coal plants have forestalled their retirement in America this summer.

Alliant's 400 MW Edgewater plant in Sheboygan and its 1.1 GW Columbia Energy Center in Portage--both in Wisconsin--have delayed their closures by 18 months.

"WEC Energy Group Inc. has delayed the closure of remaining units at its 1,135 MW Oak Creek power plant near Milwaukee for up to 18 months until May 2024 and late 2025," reports Reuters. Indiana's NiSource Inc. has postponed the closure of its 877 MW Schahfer coal plant until 2025. Omaha Public Power has made a similar decision about its 645 MW North Omaha plant, and New Mexico's PNM Resources Inc has decided to delay the closure of one of its coal plants by three months--it will switch off in September.

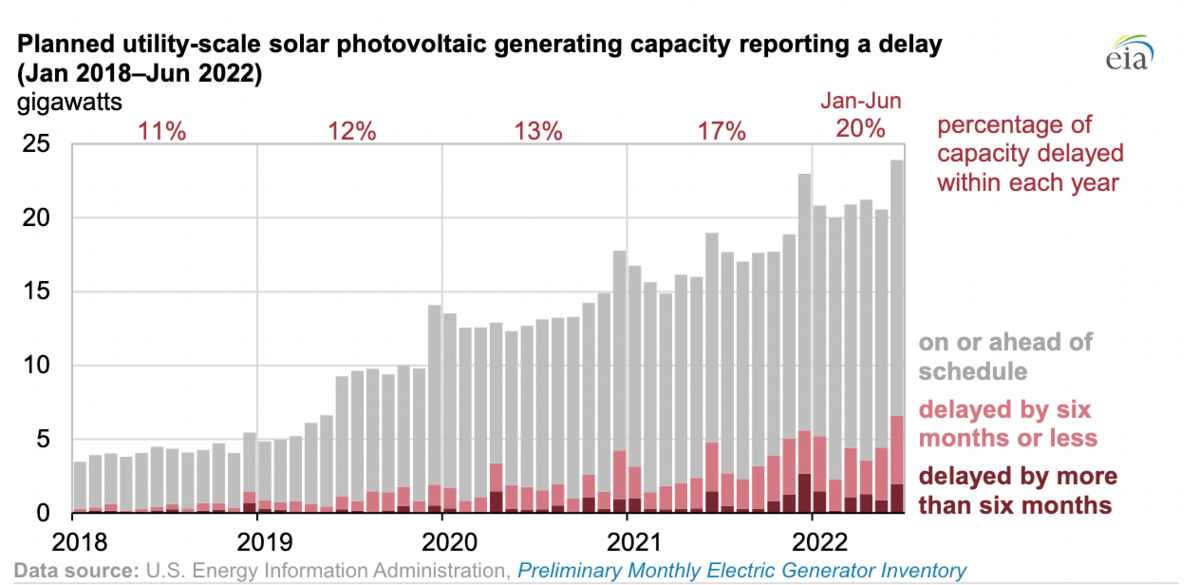

Many of these decisions were brought about by the often 18 month delay in utility-scale solar deployments. Supply chain and tariff issues still dog the solar industry and have stymied its ability to move quickly and affordably.

No doubt, this will mean emissions will go up. But it's also unclear if solar can actually replace coal plants, which are dispatchable baseload--solar's neither. As Mark Nelson says, "If you don't learn to love coal, you'll never get rid of it."

For a deep dive on coal's global resurgence, check out Mark's master class on its merits:

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

American refiners expect the high demand for oil to keep on until the year's end. "U.S. refiners said during earnings calls in July that there was no indication across their channels that America's fuel demand was weakening, contrary to recent data about gasoline consumption," reports Oilprice.com.

Gordon Brown, former UK Prime Minister, has called for the nationalization of England's grid. In a recent op-ed for The Guardian, Brown writes, “government should pause any further increase in the cap; assess the actual costs of the energy supplies being sold to consumers by the major companies; and, after reviewing the profit margins, and examining how to make standing charges and social tariffs more progressive, negotiate separate company agreements to keep prices down."

Utility-scale solar projects are seeing delays per the EIA's latest analysis.

Crom's Blessing