Europe's Wind Industry Falters

The European elite believe renewables can provide the energy security they so sorely need. It should be primetime for the continent's wind turbine industry. And yet, it stumbles. Competition from China, supply chain issues, and the rising cost of materials have ragdolled the major wind companies this year.

"This month, Siemens Gamesa Renewable Energy, a Madrid-based company that is the premier maker of offshore wind turbines, reported an annual loss of 940 million euros ($965 million)," reports the New York Times. "The company has announced a cost-cutting program that is likely to lead to 2,900 job losses, or nearly 11 percent of its work force."

Another wind giant, Vestas Wind Systems, posted $151 million in losses last quarter. General Electric has also struggled. Last month, GE forecasted its renewable energy unit would see $2 billion in losses.

Supply chain snags and increases in the cost of materials have meant that many manufacturers are building turbines to fulfill pre-energy crisis orders. The industry has also raced to build bigger turbines to stay competitive. Bigger turbines mean more materials. A good recipe for higher costs. Thus, they're selling at a loss.

“Every time we sell a turbine, we lose 8 percent,” Henrik Andersen, the chief executive of Vestas, told NYT. Vestas is the world's largest turbine maker.

EPA's Shocking Social Cost of Carbon Calc

The Environmental Protection Agency has offered a new estimate for the social cost of carbon: $190 per metric ton of CO2. That's nearly four times the last estimate: $51.

"The metric puts a price tag on the damages created by each metric ton of greenhouse gas emissions," reports E&E News. "Agencies can then use it as part of their analyses of the costs and benefits of more stringent climate regulation on sources ranging from power plants and automobiles to the oil and gas sector."

Oil and gas states have been resisting an increase in the social cost of carbon, which they read as a serious threat to their industries. States like Missouri and Louisiana have tried and failed to fight the EPA's increase in the social cost of carbon calculations.

"But the federal government has already faced strong opposition from red states on its adoption of the interim value of $51 per metric ton," E&E News reports. "That figure is far more than the Trump administration, which used a value of just $1 per metric ton, significantly undercutting the estimated benefits of regulating carbon emissions."

Right now, the new calculation will not immediately impact regulations as it hasn't been finalized. However, some say the new number may be useful in pursuing litigation against carbon emitters "because it contains a more detailed analysis of the reasons for looking at global damages, which was the biggest difference between the Obama estimates and Trump’s [which only included direct climate impacts in U.S. territory].”

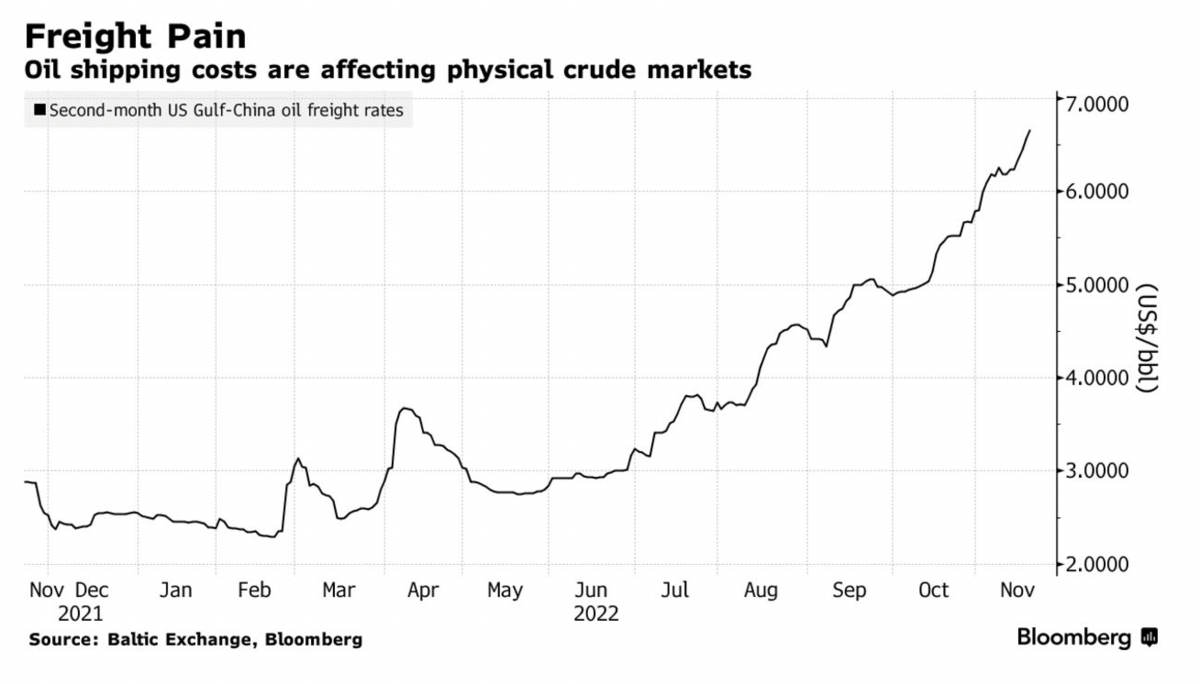

$100k Oil Freight Costs Pressure Market

Shipping costs in oil freight are putting the squeeze on physical oil markets. And crude is already struggling with ongoing uncertainty due to China's flagging consumption and the unforeseeable impacts of Europe's upcoming price cap on Russian oil.

"Earnings on the industry’s benchmark trade route breached $100,000 a day on Monday, the highest since early 2020 when Covid-19 caused a surge in tankers storing cargoes," reports Bloomberg. "With sanctions on Russia now forcing ships to take longer routes -- drying up the pool of available vessels -- oil companies and traders are having to pay ever-higher prices to transport cargoes. That’s adding to the cost of crude."

As a result, he per barrel cost of shipping from the US Gulf to China has tripled since February to $6.60. The tanker shortage problem has also increased demurrage--late delivery--difficulties. "Demurrage costs for so-called very large crude carriers are now estimated at about $120,000 to $130,000 a day, up by about $50,000 from two months ago," reports Bloomberg.

How long will problems like these persist? As American shale is no longer booming, OPEC+ isn't increasing production, and Russia has lost over 90% of its European oil market share, it could be that volatility will become a prominent feature in oil and gas in the medium term. Especially if China re-enters in the market in the spring and tightens it further. Early next month will reveal the effects of the European price cap, too.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

The European diesel crisis might deepen. "Refinery workers at BP’s biggest refinery in Europe are on a partial strike over demands for higher wages and will not cooperate in efforts to restart the Rotterdam refinery, which is currently offline," reports Oilprice.com "Employees at the 400,000-bpd refinery, a major supplier of diesel to northern Europe, threatened earlier this month to go on a strike if their pay rise demands are not met. The Rotterdam refinery accounts for almost 3% of northern Europe’s refining capacity, and delays to its restart could exacerbate the diesel crunch in Europe."

The European Commission is flirting with a natural gas price cap. "The European Commission on Tuesday proposed introducing a gas price cap for a year from Jan. 1 at 275 euros [~$285] a megawatt hour (MWh) EU energy commissioner," reports Reuters. "The Commission hopes the ceiling will help member states curb energy prices for homes and business that have reached record highs this year following Russia's invasion of Ukraine, leading to inflation and a cost of living squeeze."

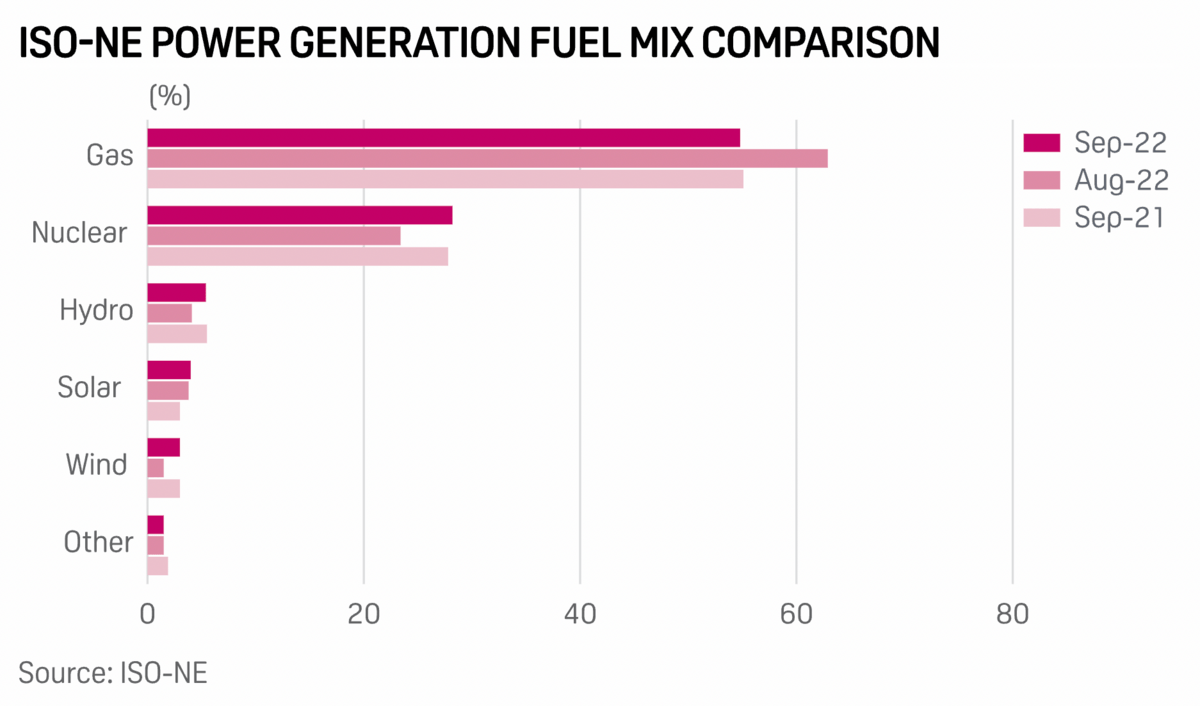

The New England grid operator feels prepared for winter. "ISO New England expects to have adequate power generation resources this winter to meet anticipated power demand under normal weather conditions of 20,009 MW and demand of 20,695 MW under extremely cold conditions, the grid operator said Nov. 14," reports S&P Global. "ISO-NE remains focused and vigilant [in] monitoring fuel inventories ... to meet the energy needs of New England," Steven Gould, the grid operator's director of operations said.

Crom's Blessing