FERC On the Lookout

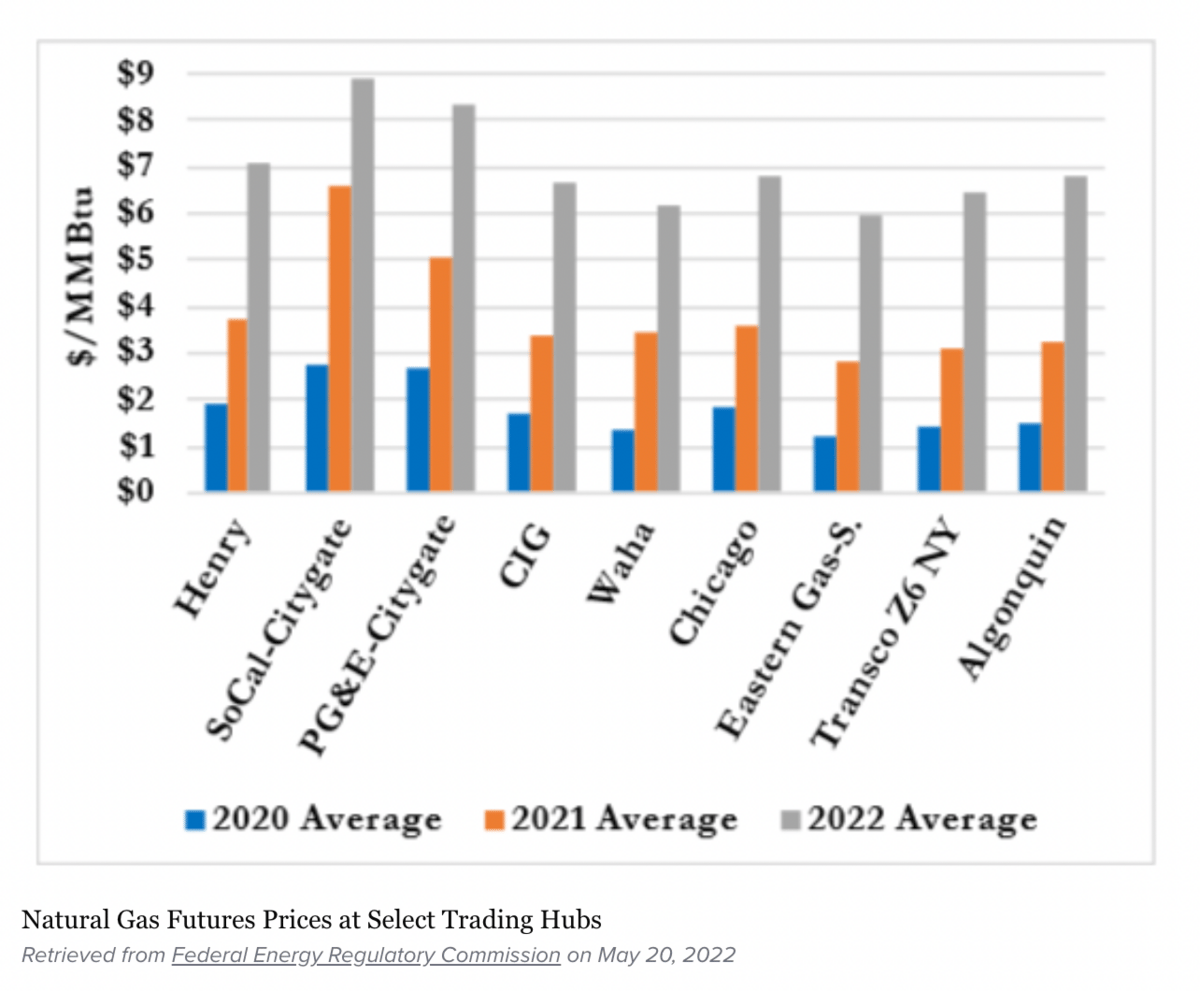

The Federal Energy Regulatory Commission is sounding the alarm on high energy prices. Natural gas and electricity prices often move together--both are spiking hard, a trend that looks to be this summer's theme. FERC has announced it's on the lookout for market manipulation.

Utility Dive reports, "Average futures prices at the Henry Hub, a key trading hub in Louisiana, jumped 88%, to $7.06 per million British thermal units, for May through September from last summer’s settled price average of $3.75/MMBtu, FERC staff said."

“Really, it’s all LNG, and I think we know LNG demand is not going to go down. It’s going to continue to go up,” Glick told UD. “Obviously, that has a big impact on electricity prices.” The substantial increase in LNG exports to Europe seems to be a major contributor.

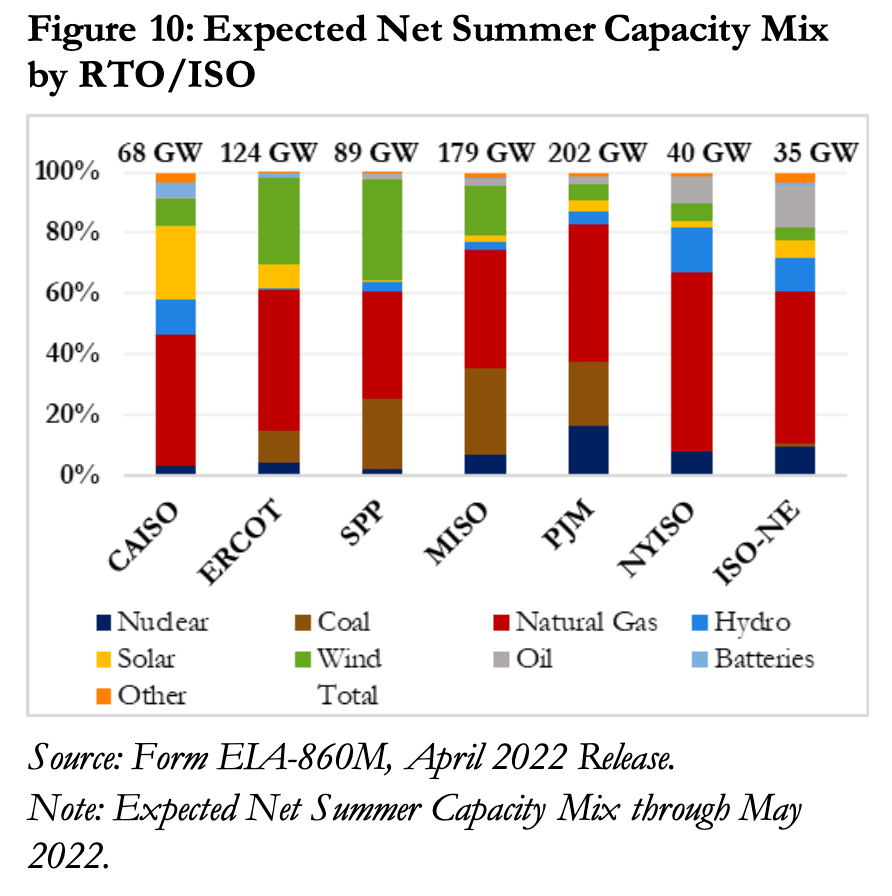

According to FERC's Summer Assessment, "As of May 13, futures prices for some major U.S. electric price points are up over last year’s settled prices by between 77% to 233% [...] Despite having planning reserve margins that exceed reference margin levels, all regions may face energy shortfalls during extreme operating conditions, although these risks are more acute in parts of MISO, SPP, ERCOT and the West."

The report features these maps from NOAA, saying, "Above-normal temperatures are more than 50% likely to occur throughout the contiguous United States."

“There’s certainly market fundamentals supporting a price increase from what it was last summer, but [industry executives] say it’s a lot higher than it should be,” Glick said during a media conference call. “So that’s something we’re taking a look at, but I don’t want to suggest that we found anything.”

DFC and EBRD: Solar's Human Rights Problem Still a Problem

The U.S. International Development Finance Corporation has frozen its investments in solar. Devex reports that DFC has done so because "[k]ey components in solar panels — principally polysilicon — are allegedly manufactured using the forced labor of the Uyghur population in China’s northwestern Xinjiang region."

While the agency looks to figure out how to resolve this problem, it stands to lose about $1 billion in potential investments.

According to Devex, DFC is "tweaking contract language to stop borrowers from buying from companies tied to forced labor, and it’s developing certifications and improved traceability in the supply chain. But it’s a work in progress, and traceability efforts could take years."

No doubt. One of the major difficulties the agency will run into is the polysilicon spot market. Polysilicon is a necessary element in solar panels. The slave labor in question has to do with its production. According to renewable energy scholar Dustin Mulvaney, as many as 80% of solar panels could have polysilicon from Xinjiang because it gets blended at the market.

Meanwhile, across the Atlantic, PV Mag reports, "The European Bank for Reconstruction and Development (EBRD) has compiled a list of Chinese PV module manufacturers [...] that will not be eligible for financing from May 23."

Solar's in for a hard year with all of this increasing scrutiny coupled with the spike in input costs the energy crisis has made ubiquitous.

The View From Davos: No Fossil Future

On Monday, International Energy (IEA) chief Fatih Birol told Davos delegates that the Ukraine War should not inspire anyone to invest long term in fossil fuels.

"We need fossil fuels in the short term, but let's not lock in our future by using the current situation as an excuse to justify some of the investments being done, time-wise it doesn't work and morally in my view it doesn't work as well," Birol said.

Oilprice.com reports, "The Paris-based IEA, created in the aftermath of the Arab oil embargo in the early 1970s, issued a report last year, suggesting that the world would not need more investments in any new oil and gas projects if it is to reach net-zero emissions by 2050."

"The best way to protect people from future price shocks is to invest as much as possible of this in an accelerated & secure clean energy transition," Birol said.

These are quite the astonishing comments, as the energy crisis begins its blossom into a food crisis. Climate change is definitely real, but if we want an "accelerated, secure, and clean transition," we will have to position nuclear at its forefront. I'm not sure the IEA is willing to push for that.

Birol's statements also elicit selective amnesia. The problems we're facing aren't just because Putin sent tanks over the border. As Tsvetana Paraskova points out, the crisis is "also the result of years of persistently low investment in conventional energy sources, the energy ministers of two of OPEC's top producers, Saudi Arabia and the United Arab Emirates (UAE), said earlier this month."

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Renewables have gone bust after a boom in Vietnam. "After an unprecedented boom in renewable energy investment in recent years, the transmission lines that connect solar and wind projects to the national grid lack the capacity to deal with spikes in supply."

India removed its import duty on coal as the country suffers a brutal heatwave, spiking energy costs, and depleting inventories.

ICYMI check out my deep dive on the downfall of nuclear energy in America and what we can do to revive it.

Word of the Day

Naphthas

Refined or partly refined light distillates with an approximate boiling point range between 122 and 400 degrees Fahrenheit. Blended further or mixed with other materials, they make high-grade motor gasoline or jet fuel. Also, used as solvents, petrochemical feedstocks, or as raw materials for the production of town gas. (source)

Crom's Blessing