Fool's Golden State

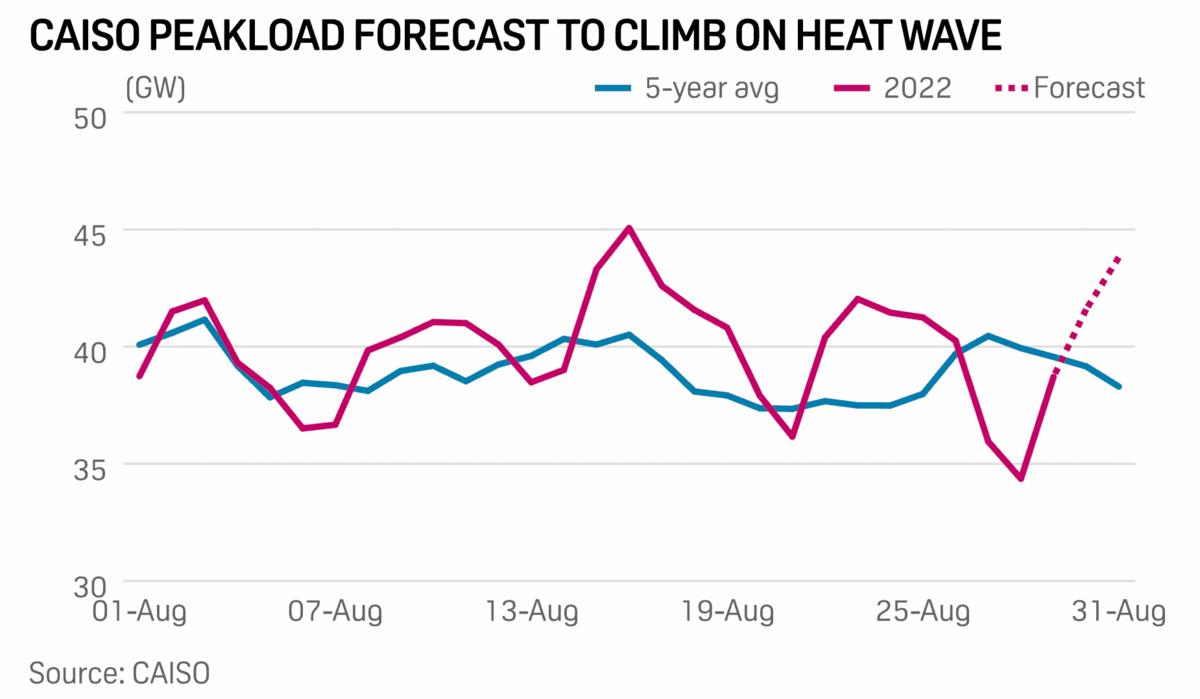

California's grid operator, CAISO, has just announced a statewide flex alert to preserve their electric grid. A heatwave will engulf the West Coast until next Wednesday when CAISO will relieve the flex alert.

The heatwave will persist into next week. "The weather service forecast that the daily high temperature in Los Angeles would climb into the 90s Fahrenheit through Sept. 3, with triple-digit highs between 100-102 F expected for Sept. 4-5," reports S&P Global.

A flex alerts encourage customers to cut energy use when it's most needed--between 4 and 9pm. Right when solar stops producing and demand climbs. It's when people return home from work, families eat and do chores, and children do their homework. According to CAISO's press release, "The top three conservation actions are to set thermostats to 78 degrees or higher, avoid using large appliances and charging electric vehicles, and turn off unnecessary lights. Lowering electricity use during that time will ease strain on the system, and prevent more drastic measures, including rotating power outages."

The warning comes at a time when California is debating whether or not to keep its Diablo Canyon nuclear plant running. Diablo Canyon produces 10% of the state's electricity and California imports more electricity than any other state. Plus, according to Utility Dive, solar buildouts this year fell 40% short of expectations.

When asked for comment, Paris Ortiz-Wines, Global Direct of Stand Up for Nuclear, said, "It comes as no surprise that California is once again struggling to keep the lights on. For the past twenty years, we have confidently shuttered our fossil fuel plants, invested heavily in solar, and allowed ourselves to become the country’s top importer of electricity. We claim to be a climate leader, yet the state’s legislature votes today whether or not to extend the life of our single, greatest source of zero-carbon energy--Diablo Canyon-- while still receiving 50% of our electricity from natural gas."

"Our energy demand and the likelihood of heat wave events are only increasing-- California will always need Diablo Canyon," she added.

California hopes to phase out most of its gas-burning cars by 2035, which would put further strain on a grid already embrittled by its green policies--the "renewables-only" solution to climate change. CAISO, in its press release, called for Californians to avoid charging their electric vehicles. The Golden State is in no position to reduce any aspect of its energy portfolio, especially not a source as clean and reliable as Diablo.

Can Shale "Regain Its Mojo"?

Mark Mills over at the Manhattan Institute has just released a new report entitled, "The Energy Transition Delusion: A Reality Reset." Mills often provides a clear-eyed look at energy realities. I have yet to read the entire report, but one section stood out: "How Shale Can Regain Its Mojo."

"If U.S. production could expand by as much—or even half as much—as it did over the past decade," writes Mills, "that would shift geopolitical alignments and, non-trivially, almost certainly drive down energy prices again." But that depends on three major factor:

Whether or not technological advances can cheapen oil and gas extraction from American shale both onshore and off

Whether or not "capital markets provide the necessary funding, despite active campaigns for divesting from or penalizing firms for such investments"

The severity of state and federal regulation and permitting restrictions on the oil and gas industry

Mills supplies no definite answers to these three challenges. He points out that the second and third factors are mainly political. They could be resolved with the stroke of the pen, but of course, the pressure required to get that pen uncapped for writing at all is extreme. Yet Mills writes that we shouldn't worry over the politics of it all. Money and tech matter most: "whether another great expansion of shale production is fundamentally possible is anchored not in legislative ambitions—though legislative permissions matter—but with what technology makes possible."

How's the money situation? Snarled. We have high prices, which, he argues, eventually lead to production expansion somewhere. But location and speed are the determinate elements of expansion. "The production response to price is determined by the conviction of producers that prices will remain high enough for long enough to recover new capital invested," writes Mills, "by whether regulatory permissions will be granted in a timely fashion, and by the available workforce."

Certainly, we have enough resources. We're only at about 30% of potential capacity in the Marcellus region, for instance.

As for tech--oil and gas is a mature industry, so innovation will arrive in the domains of "planning, managing logistics for materials and people, and operating relevant machinery." Mills points to improvements in the domains, especially for offshore, that supply the reader with hope that shale can, in fact, regain its mojo. High prices + technical improvement = more oil and gas. How lucky!

I'm less bullish on the "money and tech over everything" school of thought. Politics remains a salient and powerful domain of human life. Its impact on energy in America cannot be oversold. Ignore the pen at your own peril.

Negative Price-a-Palooza

As energy prices shatter ceilings worldwide, America has regions where prices have been plunging into the negatives. What's going on?

In the electricity spot markets where renewables have been massively built out, prices tend to go negative nearest their location. Renewables are built far from where energy is most needed, and because no one ever includes the costs of new transmission or distribution to onboard them (this is also why they can be considered "cheap"), they often don't have enough transmission. So, when they start producing fat bands of heavily subsidized kilowatt-hours, there's nowhere else to move the power. Thus, they bury the price needle in their respective regions.

Transmission takes a long time to build--people defend their property in the courts--and is highly expensive (also because people defend their property in the courts). The bottleneck in T&D construction breeds the negative price phenomenon.

"Wholesale prices went negative about 200 million times across the seven US grids in 2021, more than twice as often as five years earlier," reports Bloomberg. "That record will be broken this year as bottlenecks worsen on three renewable-rich grids in Texas, California, and the Southwest, the data show."

Negative prices, over time, force reliable generation off the grid. They don't meet the clearing price dictated by the renewables and slowly the business case for keeping a coal or nuclear plant running falls apart, as we saw in Palisades. This rings even truer for electricity markets that have failed to pry apart the major monopoly utilities--why would a utility hold onto a depreciating coal plant when they could scoop up more subsidized wind and solar?

Permitting reform may make it easier to build transmission and distribution, of course. But then we'll be faced with the real question behind these ambitions: what could Rube-Golberging our grid possibly improve?

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Let the rationing begin! Many European countries have begun banning or restricting different types of energy consumption ahead of this winter. Everything from leaving monuments unlit, to slashing hot shower times by 60%, to reducing heating levels, and much more are getting put into effect all over the bloc. For a full rundown, check out this piece from Bloomberg.

Hungary's adding two more nuclear reactors to its fleet. "Hungary’s nuclear energy agency has issued a license for construction of two reactors for Paks II, a power generation project first launched in early 2014 as part of an inter-governmental agreement between Hungary and Russia," reports Power Magazine. "Officials said Paks II would be the first nuclear plant in the European Union to use Rosatom’s Generation III+ VVER-1200 reactor technology."

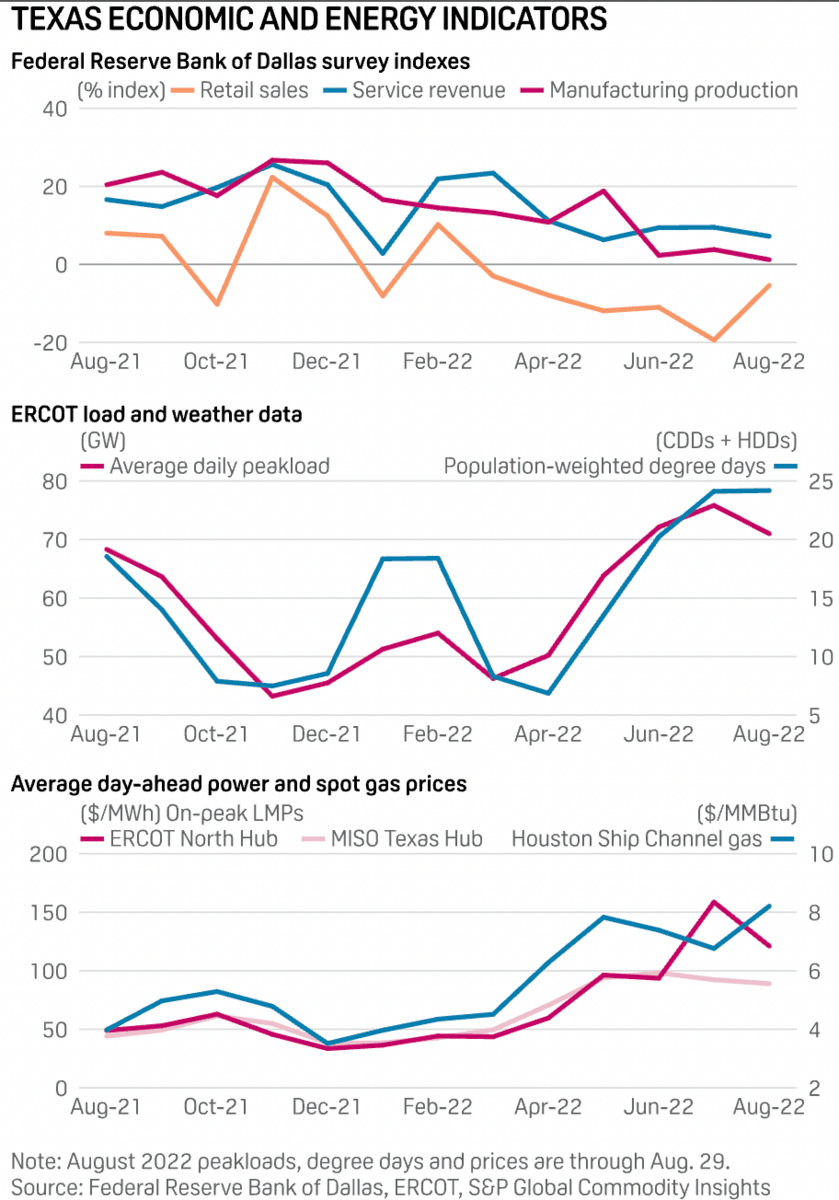

Power prices are crippling Texas's manufacturing growth. "Texas manufacturing growth in August dropped to its lowest level since May 2020 and the retail sales index stayed negative for the sixth consecutive month, also similar to the pandemic recession, new Federal Reserve Bank of Dallas surveys show," reports S&P Global. "The statistics were reflected in lighter loads and weaker power prices."

Crom's Blessing