It was a week of grid whiplash. While national demand eased off the accelerator, the gears of the energy sector kept grinding forward—quietly reshaping the way power is generated, stored, and regulated. From battery booms in the Pacific Northwest to peaker plant deals deep in Texas, the headlines tell the story of a grid under transformation.

Here’s what moved the market (and the electrons) this week:

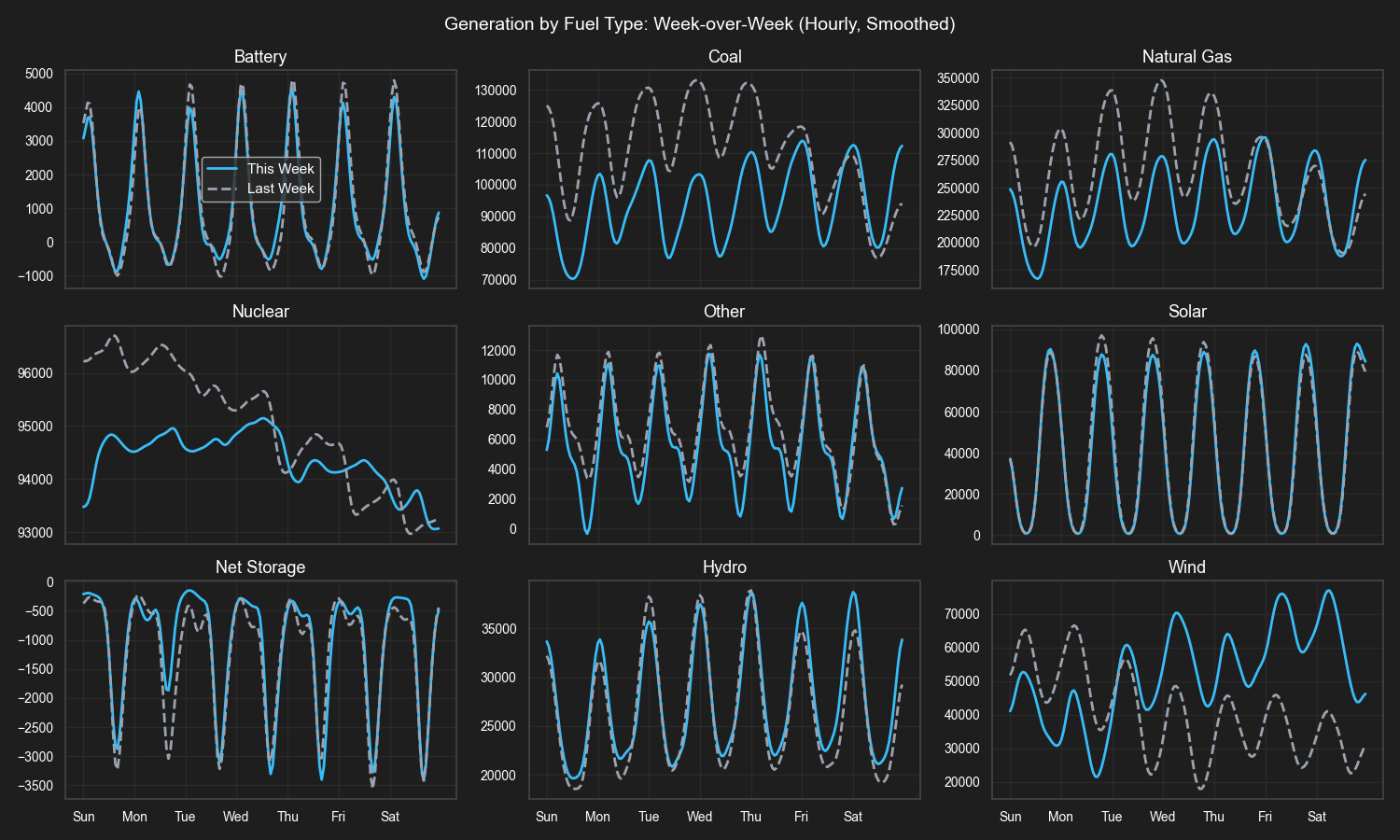

Nationwide demand fell -6%, dragging down total generation -5.7%. Cooler weather in the East and storms in the Midwest put a lid on peak loads.

Portland General lit up 1.9 GWh of new lithium-ion storage, making Oregon a surprise battery power player.

3 Arizona utilities hit peak demand records, thanks to 110°F+ heat and swelling data center load.

PJM fast-tracked data center reforms amid a surge in hyperscale interconnect requests.

Texas loaned NRG $216M for a new 456-MW gas peaker—part of a broader push to firm up ERCOT.

FERC Commissioner Mark Christie stepped down, setting up a Democratic majority and possibly shifting federal support toward colocating data centers with power plants.

Sunrun says 70% of new installs include batteries, signaling that distributed storage is now the default, not the add-on.

US48 Summary

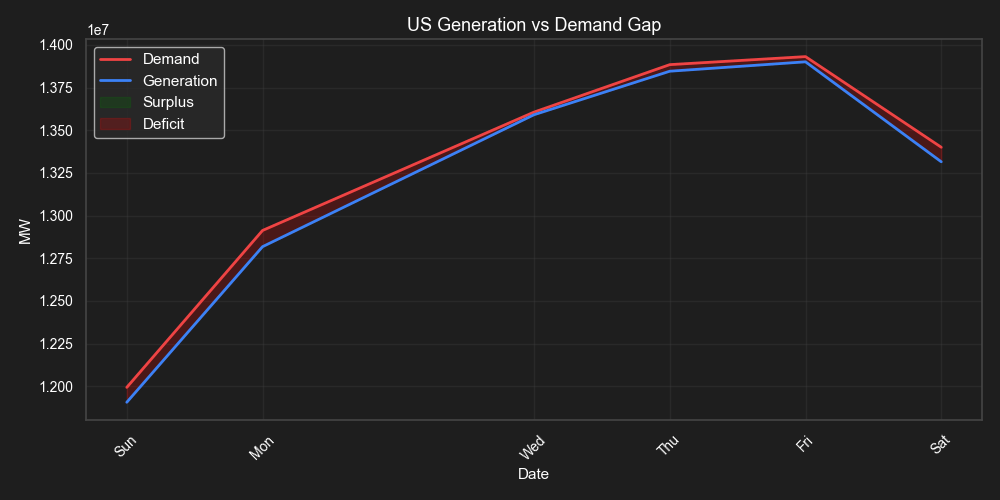

US48 Total Gen: 92.6M MWh (⬇ -5.65%)

Demand: 93.0M MWh (⬇ -6.01%)

Renewables Share: 19.98%

Volatility Index: 46.96 (still high, still rising)

| Total | Change |

Total Generation (7d) | 92,597,932.0 MW | -5.65% |

Total Demand (7d) | 93,030,103.0 MW | -6.01% |

Demand Gap | -432,171.0 MW | -48.34% |

% Renewables | 19.98% | +0.00% |

% Fossil Fuels | 62.51% | +0.00% |

Volatility Index | 46.96 | N/A (30-day metric) |

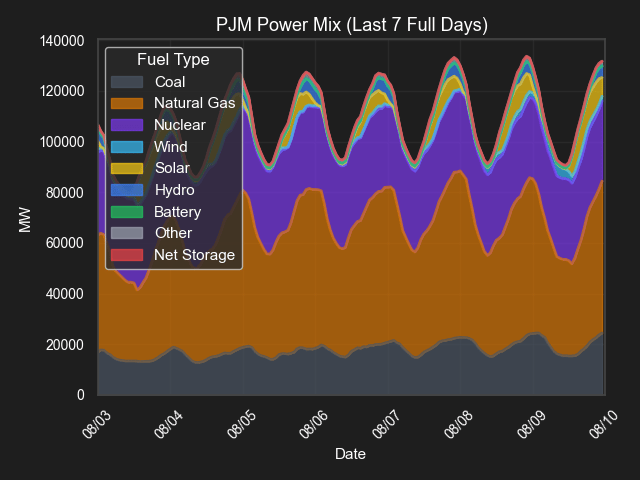

US48 Power Mix

This chart shows how different generation sources contributed to US48 power output over the last 7 full days. Lorem ipsum placeholder for commentary.

US Generation vs Demand

US Total Generation: Week-over-Week

Generation by Fuel Type: Week-over-Week

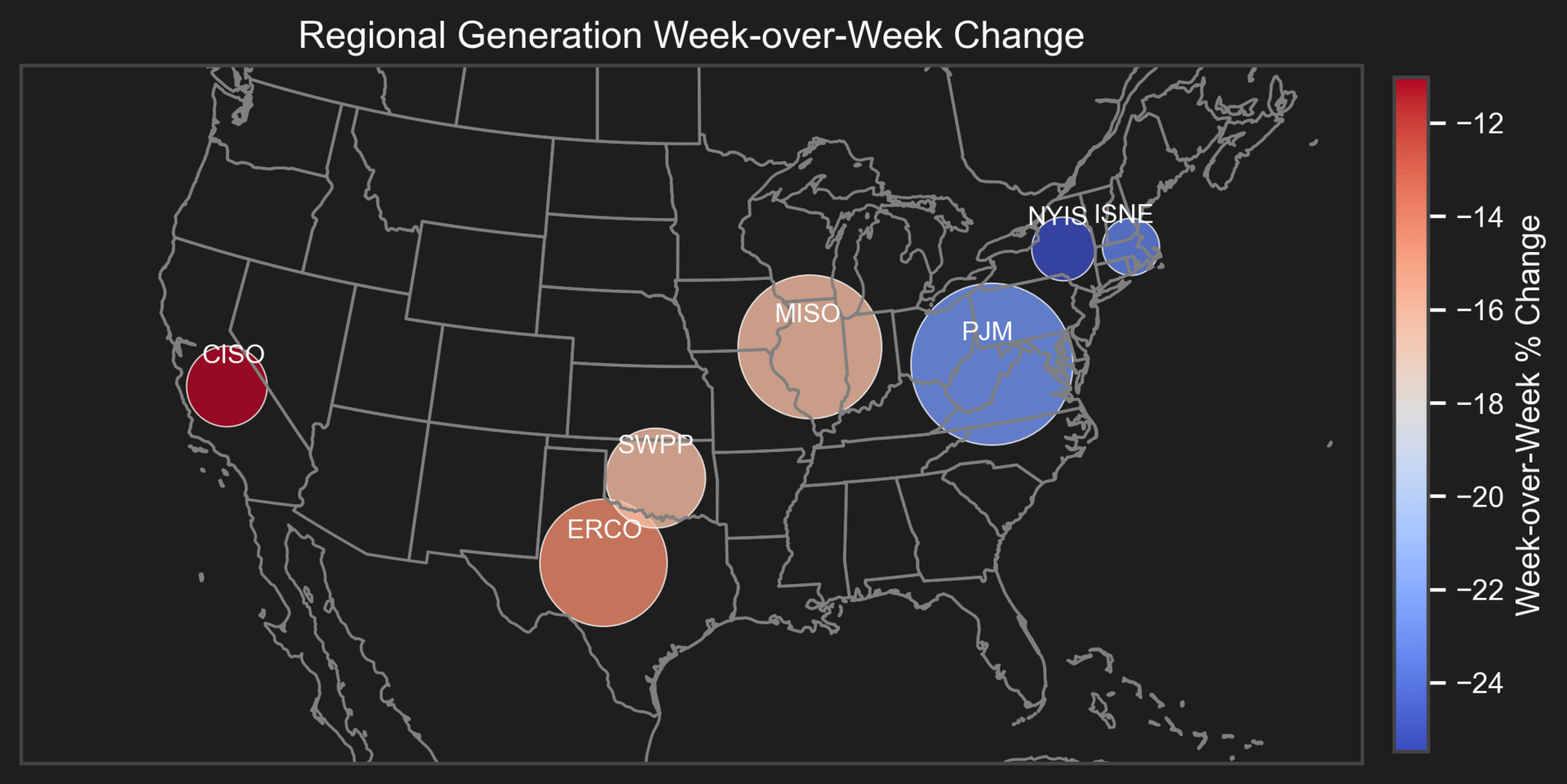

US Regional Generation Change Map

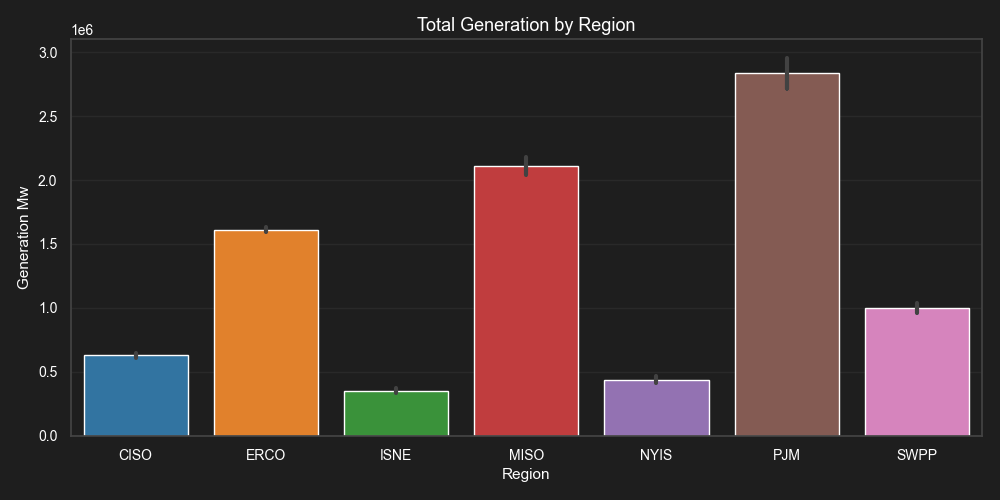

Total power generated in each region over the past 7 days.

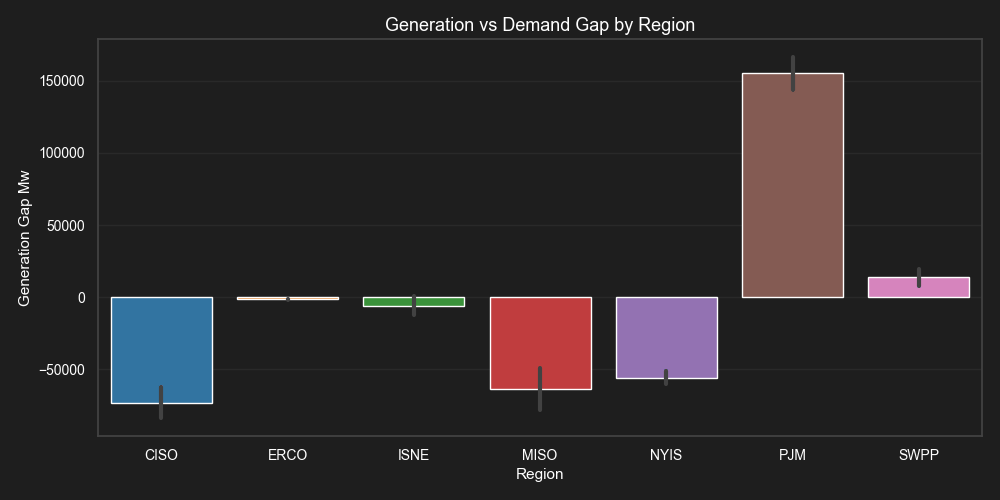

Difference between generation and demand by region.

Detailed Regional Breakdowns

SWPP

Wind lost steam midweek, and coal filled the gap as demand remained strong. SPP’s big story this week was stability—barely—thanks to careful load balancing across state lines.

| Total | Change |

Total Generation (7d) | 6,926,897.0 MW | -2.22% |

Total Demand (7d) | 6,853,090.0 MW | -1.07% |

Demand Gap | 73,807.0 MW | -52.80% |

% Renewables | 34.24% | +0.00% |

% Fossil Fuels | 60.86% | +0.00% |

Volatility Index | 87.27 | N/A (30-day metric) |

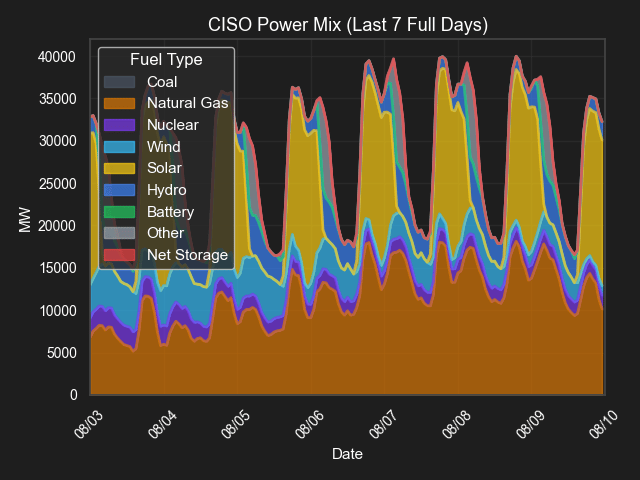

CISO

Solar surged across California, pushing renewables above 52%. Wildfire threats near NorCal transmission lines were contained—barely—keeping blackouts off the headlines for one more week.

| Total | Change |

Total Generation (7d) | 4,487,521.0 MW | +3.16% |

Total Demand (7d) | 5,160,543.0 MW | +8.82% |

Demand Gap | -673,022.0 MW | +71.61% |

% Renewables | 52.95% | +0.00% |

% Fossil Fuels | 39.78% | +0.00% |

Volatility Index | 32.94 | N/A (30-day metric) |

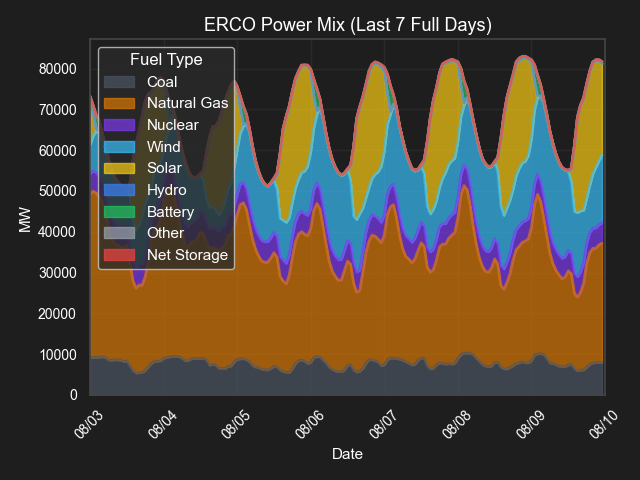

ERCOT

Texas coasted through another scorcher with solar and batteries doing the heavy lifting midday. That $216M gas plant loan to NRG? A clear sign the state’s not betting it all on sunshine.

| Total | Change |

Total Generation (7d) | 11,247,119.0 MW | -0.05% |

Total Demand (7d) | 11,260,522.0 MW | -0.04% |

Demand Gap | -13,403.0 MW | +3.61% |

% Renewables | 37.07% | +0.00% |

% Fossil Fuels | 56.48% | +0.00% |

Volatility Index | 80.59 | N/A (30-day metric) |

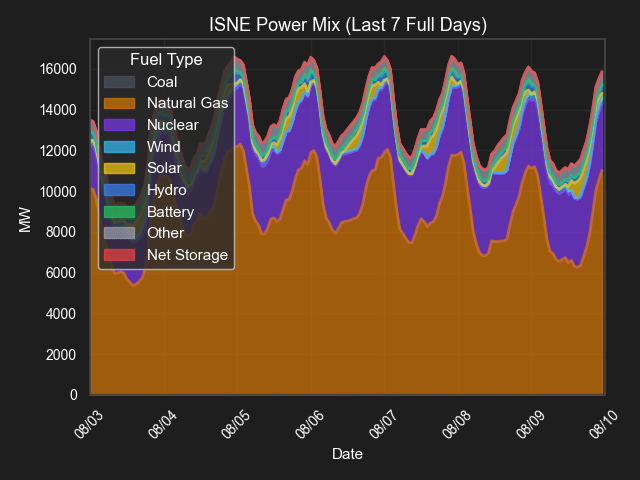

ISNE

New England cooled off—literally. Generation and demand both nosedived, but ISNE still showed the most volatility nationally as nuclear units flexed and storage picked up slack.

| Total | Change |

Total Generation (7d) | 2,296,062.0 MW | -9.87% |

Total Demand (7d) | 2,269,238.0 MW | -13.52% |

Demand Gap | 26,824.0 MW | -135.12% |

% Renewables | 6.50% | +0.00% |

% Fossil Fuels | 67.53% | +0.00% |

Volatility Index | 187.14 | N/A (30-day metric) |

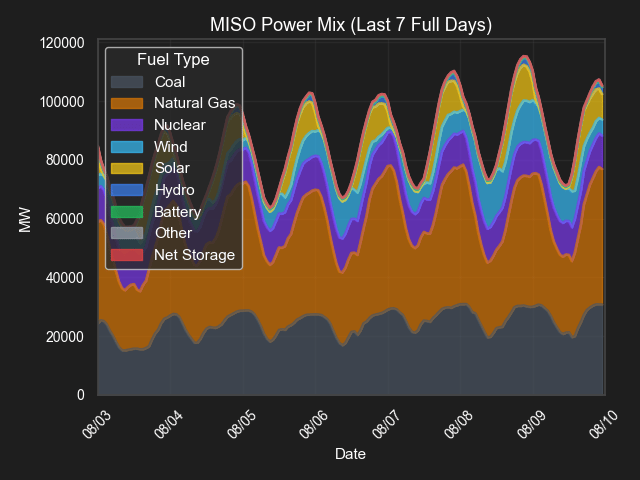

MISO

Thunderstorms swept the upper Midwest, taking wind offline and sending gas demand up. Entergy doubled down on transmission upgrades in Louisiana to prep for more outages—natural or not.

| Total | Change |

Total Generation (7d) | 14,324,950.0 MW | -2.45% |

Total Demand (7d) | 14,760,591.0 MW | -1.80% |

Demand Gap | -435,641.0 MW | +26.16% |

% Renewables | 14.55% | +0.00% |

% Fossil Fuels | 71.90% | +0.00% |

Volatility Index | 77.05 | N/A (30-day metric) |

NYIS

Rainy weather took a bite out of wind and solar, while gas kept the grid steady. Storage helped shave peaks downstate, and NY battery operators want more market access ahead of winter.

| Total | Change |

Total Generation (7d) | 2,855,677.0 MW | -11.87% |

Total Demand (7d) | 3,182,922.0 MW | -12.24% |

Demand Gap | -327,245.0 MW | -15.39% |

% Renewables | 16.32% | +0.00% |

% Fossil Fuels | 64.19% | +0.00% |

Volatility Index | 20.56 | N/A (30-day metric) |

PJM

Heat receded across the region, trimming demand and letting gas plants coast. Meanwhile, PJM announced new reforms to clear its data center interconnection backlog—expect volatility to return once those loads start landing.

| Total | Change |

Total Generation (7d) | 18,293,345.0 MW | -9.84% |

Total Demand (7d) | 17,290,582.0 MW | -10.14% |

Demand Gap | 1,002,763.0 MW | -4.23% |

% Renewables | 6.42% | +0.00% |

% Fossil Fuels | 64.65% | +0.00% |

Volatility Index | 22.11 | N/A (30-day metric) |