Germany Defies Reason

German Chancellor Olaf Scholz reiterated this week that the country will continue with the phase-out of its nuclear fleet. Germany began to phase out its nuclear plants in 2011 after Fukushima.

When asked about statements from other politicians who are calling into question the phase-out, Sholz pointed out that Germany has to import its nuclear fuel rods from abroad anyway. Nuclear plants refuel every one to two years.

Instead, Germany hopes to replace its dependence on Russian coal this fall by building out wind and solar. Of course, if it phases its nuclear plants out, then it will be more indebted to imported Russian fossil fuels and its dirty domestic lignite. That will increase the amount of baseload that intermittent renewables need to replace.

“We decided for reasons that I think are very good and right that we want to phase them out," Sholz said of the country's nuclear plants.

According to Bloomberg, Sholz "did not address a European Union proposal announced Tuesday that includes a phased-in import ban on coal from Russia" of which the country is the main opponent.

CAISO's Long-Term Storage Problem

California plans to use battery storage tools to help solve its intermittency problems.

California has about 3,100 MW of energy storage capacity is installed, an increase of 1,500 MW from last summer.

Most of the storage comes from lithium-ion batteries, which provide around four hours of energy. They're only useful for short-term intermittency. California will be facing seasonal in additional to diurnal grid balancing challenges if it grows it renewables out extensively.

"The hardest times will be during multi-day periods when we have low wind and low solar availability, which is more prevalent in the winter than it is in the summer," said Gabe Murtaugh, the storage sector manager with the California Independent System Operator, at a California Energy Commission (CEC) workshop recently.

The question is how to position storage to maintain reliability and how they will impact CAISO's markets, which function in a day-ahead manner. Longer-term storage owners aren't sure how to recover costs as is. If CAISO develops tools to help it navigate this issue, it will be a pioneer among the nation's ISOs.

It's unlikely California will be able to onboard enough storage, which cannot replace any form of generation, to stabilize its grid in a meaningful sense.

Tanker Rates Soar

Many countries have banned Russian crude in response to the Ukraine war. Now they're also turning away from Russian crude tankers.

Increasing tanker costs means greater inflation for the energy market and increase costs for refineries, which will continue to jack up prices for crude products like diesel and gasoline.

More sanctions, which the EU and US are continuing to roll out, could compound this and deprive the markets of yet more containers exert more inflationary pressure.

Conversation Starters:

Japanese Minister of Economy, Trade, and Industry Koichi Hagiuda announced the country is considering cutting its dependency on Russian energy by finding new suppliers, building renewables, and repowering nuclear plants.

US Congress voted to ban Russian crude, coal, and LNG imports. The United States imports around 500,000 bpd of Russian crude and other products.

The crisis in the natural gas market could be here to stay as war, the energy transition, extreme weather, and pandemic recovery have sent it into a long upheaval.

Nuclear Barbarians: Hanging With @NuclearHazelnut ft. Jenifer Avellaneda

Jenifer is a Nuclear Risk Analyst at Westinghouse and a fantastic nuclear safety communicator. She and I had a great chat about her background and our mutual love of fission.

Crom's Blessing

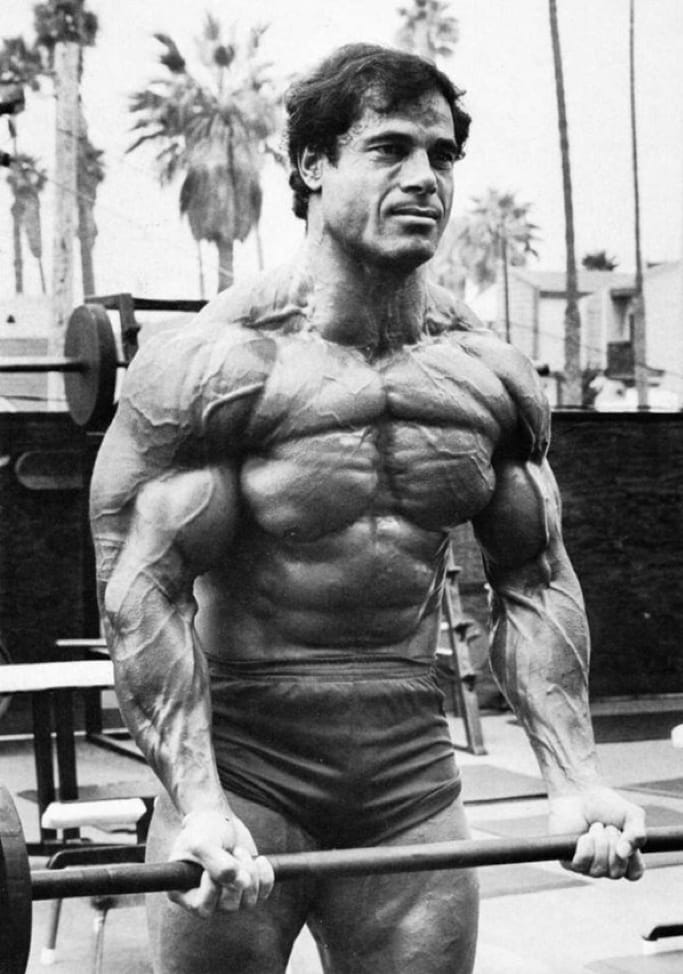

Franco Columbu lifting weights at Muscle Beach.