The nuclear tide keeps rising. New Jersey regulators are openly flirting with more atomic power, Google is underwriting advanced reactors like it’s a venture fund, and the largest U.S. transmission line in decades just locked in $1.7 billion to move electrons from Kansas to Chicago. Meanwhile, electricity bills climb, tax abatements stack, and the country’s data center land grab starts to look like the stadium scam of the 2020s. Let’s get into it.

New Jersey Flirts with the Atom Again

The New Jersey Board of Public Utilities has issued an RFI on whether new nuclear should be part of the state’s Energy Master Plan—specifically to meet an anticipated 10 GW shortfall in clean, firm capacity by 2035. That’s not just climate planning—it’s a quiet admission that intermittent sources aren’t scaling fast enough, especially with AI demand lurking.

For context: nuclear already supplies 40% of NJ’s electricity and 85% of its zero-emissions power. The state’s three reactors—Salem 1 & 2 and Hope Creek—do more heavy lifting than all its solar panels combined. The BPU now wants feedback on financing models, environmental trade-offs, and whether to ringfence power for data centers without torching ratepayers.

Read between the lines: This is a state saying the quiet part out loud. Clean power isn’t cheap, and reliability isn’t optional.

Google Bets on 3 New Nuclear Sites

Google has inked a deal with Elementl Power to fund the early-stage development of three advanced reactor sites. No location disclosures yet, no technology picked, but the sites will each clock in at 600+ MW. This is Google throwing serious weight behind baseload—because data centers don’t run on vibes.

Google gets early buy-in rights and some narrative control. Elementl, a 2022-founded dev shop run by NuScale alumni, gets capital to secure permits, queue positions, and siting approvals. The endgame? 10 GW of new nuclear from Elementl by 2035—exactly the number New Jersey says it needs. Coincidence?

If tech giants are the new utilities, this is their first serious blueprint for energy independence.

$11B Grain Belt Express Breaks Ground

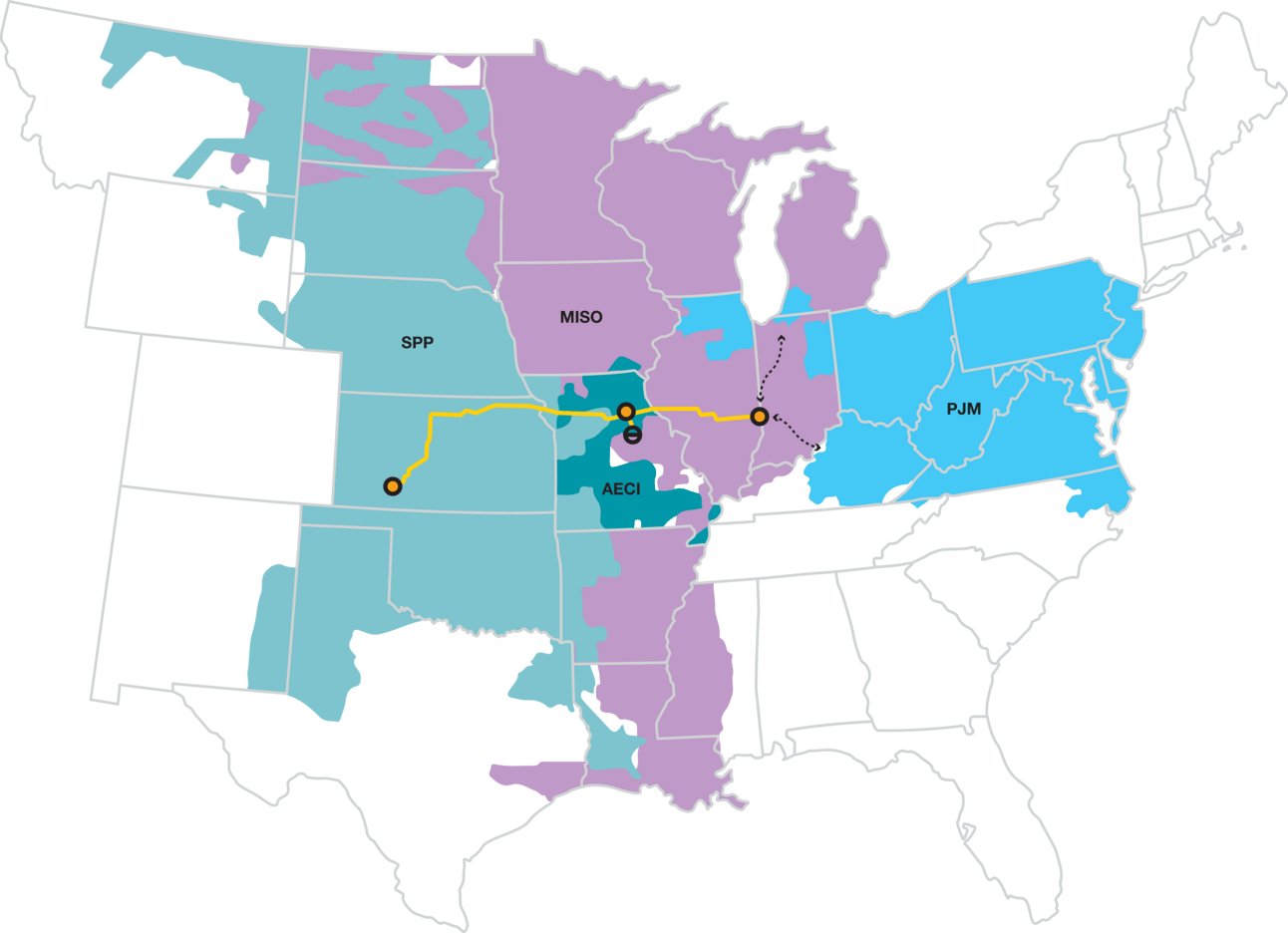

Invenergy just handed $1.7 billion in contracts to Quanta and Kiewit to start building the Grain Belt Express—an 800-mile, four-state transmission line designed to haul 5 GW of power from Kansas to Indiana. Total project cost? $11 billion. Job creation? 22,000. Timeline? Three years.

Polsky, Invenergy’s CEO, made the rounds this morning, framing the project as the physical manifestation of Trump’s energy independence order. Whether that’s spin or not, the project reflects something real: the era of cheap electricity is over, and big iron is back in style.

This also cements Quanta as the go-to contractor for the next grid buildout wave (see Good Bet below).

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

CashNetUSA: Electricity affordability by city. Fresno and Detroit lead the misery index. Surprisingly, Connecticut’s sky-high bills are still “affordable” thanks to income levels. But Louisiana wins the prize for worst bang-for-buck—high prices, low income, and more outages than anyone.

Earth.com: Some bacteria can breathe by producing electricity. Yes, really. They may power future biosensors or wastewater plants, but for now they’re just beating PG&E at reliability.

Reason: The Stadium Scam Is a Server Farm — yours truly writes on how Microsoft’s billion-dollar data center in La Porte got a 40-year tax holiday and public utility upgrades. Today’s boondoggles just have more fiber optics.

Good Bet, Bad Bet

Good Bet: BWX Technologies (BWX)

Want a pure-play on the nuclear renaissance? BWX is quietly winning. While Google grabs headlines and states issue RFIs, BWX is the one actually building the fuel and components advanced reactors need—especially those targeting microreactor or SMR applications. They've got long-term military contracts, commercial growth, and deep expertise in HALEU fuel, which everyone from TerraPower to Kairos will need.

As policymakers finally admit that firm, clean power isn’t optional, BWX becomes less a niche supplier and more a national linchpin.

Bad Bet: Constellation Energy (CEG)

Yes, they own big nuclear. Yes, they’re riding the zero-carbon halo. But Constellation is playing defense. Most of their fleet is legacy—regulated, aging, and politically vulnerable. In New Jersey, they co-own the Salem plants that may soon be tapped to backstop data centers. Sounds good… until regulators ask who’s footing the bill when demand spikes and politicians demand capped rates.

Their exposure to the mid-Atlantic market (and PJM’s unreliability dramas) makes them less agile than nuclear startups with clean sheets and zero baggage. If politics turns against them, CEG could get squeezed between activist demands and rising maintenance costs.

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!