The federal government is having an identity crisis. In one breath, agencies want to nationalize pieces of the energy industry; in the next, Congress wants to unwind rules those same agencies spent decades tightening. Meanwhile, utilities and private operators are the only ones actually adding electrons to the grid. Today’s theme: government is rediscovering the limits of government, and the market keeps politely offering the exit ramp.

Washington Decides to Become a Nuclear Developer (What Could Go Wrong?)

The U.S. government is preparing to buy nuclear reactors outright—the first time in American history the feds would act as a direct customer, developer, and operator of commercial-scale nuclear plants.

The plan pairs two moves:

The Army named potential microreactor sites (Alaska, Hawaii, Utah, Washington, and more), signaling a push for military-anchored micro-nukes.

DOE is exploring federal ownership of full-scale reactors, following Trump’s $80B deal with Westinghouse.

The logic: America “can’t wait for the market” to build nuclear fast enough.

The problem: Every time the federal government decides to “accelerate” nuclear, it adds a decade and doubles the cost.

Private SMR developers—from Oklo to X-energy—are finally gaining momentum. The last thing they need is Uncle Sam becoming a competitor with infinite time, infinite budget, and zero price discipline. Nationalizing demand is how you get a nuclear USPS.

Still—microreactors on defense bases make sense. They always did. The question is whether the federal footprint grows into yet another overbuilt, overpromised industrial policy project… or whether they can restrain themselves to the things only government can do.

Constellation Gets a DOE Lifeline to Restart the Iconic Clinton Plant

DOE is preparing a major loan package to restart the 1,065-MW Clinton Clean Energy Center—once a symbol of nuclear retrenchment, now a centerpiece of demand-response strategy and data-center baseload.

Constellation already told investors it wants:

1 GW of demand-response capability (“basically a nuclear unit’s worth”),

5.8 GW of new generation + storage in Maryland,

And a major national expansion of bespoke nuclear PPAs for hyperscalers.

DOE stepping in to support a restart signals two things:

Demand growth is real, not hypothetical, and even the feds know it.

DOE is reverting to its pre-1990s role: financing nuclear because nobody else can match the timelines.

There’s risk—government-backed restarts can turn into government-managed headaches. But unlike the first nuclear story, this is more targeted: support a plant the private operator actually wants to run, and let Constellation lead.

Congress Finally Admits DOE Efficiency Policy Was a 50-Year Detour

A House subcommittee advanced a bill to loosen federal appliance-efficiency rules, reversing decades of one-size-fits-all standards that distorted prices, wiped out product variety, and delivered questionable savings.

The bill:

Prevents DOE from issuing standards that remove products from the market.

Bars new rules unless DOE actually proves energy savings.

Forces DOE to respect consumer choice.

Efficiency rules from the 1970s onward helped create the very reliability and affordability issues Congress now complains about: higher upfront costs, slower equipment turnover, and appliances engineered to satisfy Washington instead of consumers.

This bill won’t solve grid stress, but it finally acknowledges the original sin: Washington tried to manage demand instead of enabling supply. Now they’re trying something radical—getting out of the way.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

C3 Magazine – Getting Emissions Numbers Right

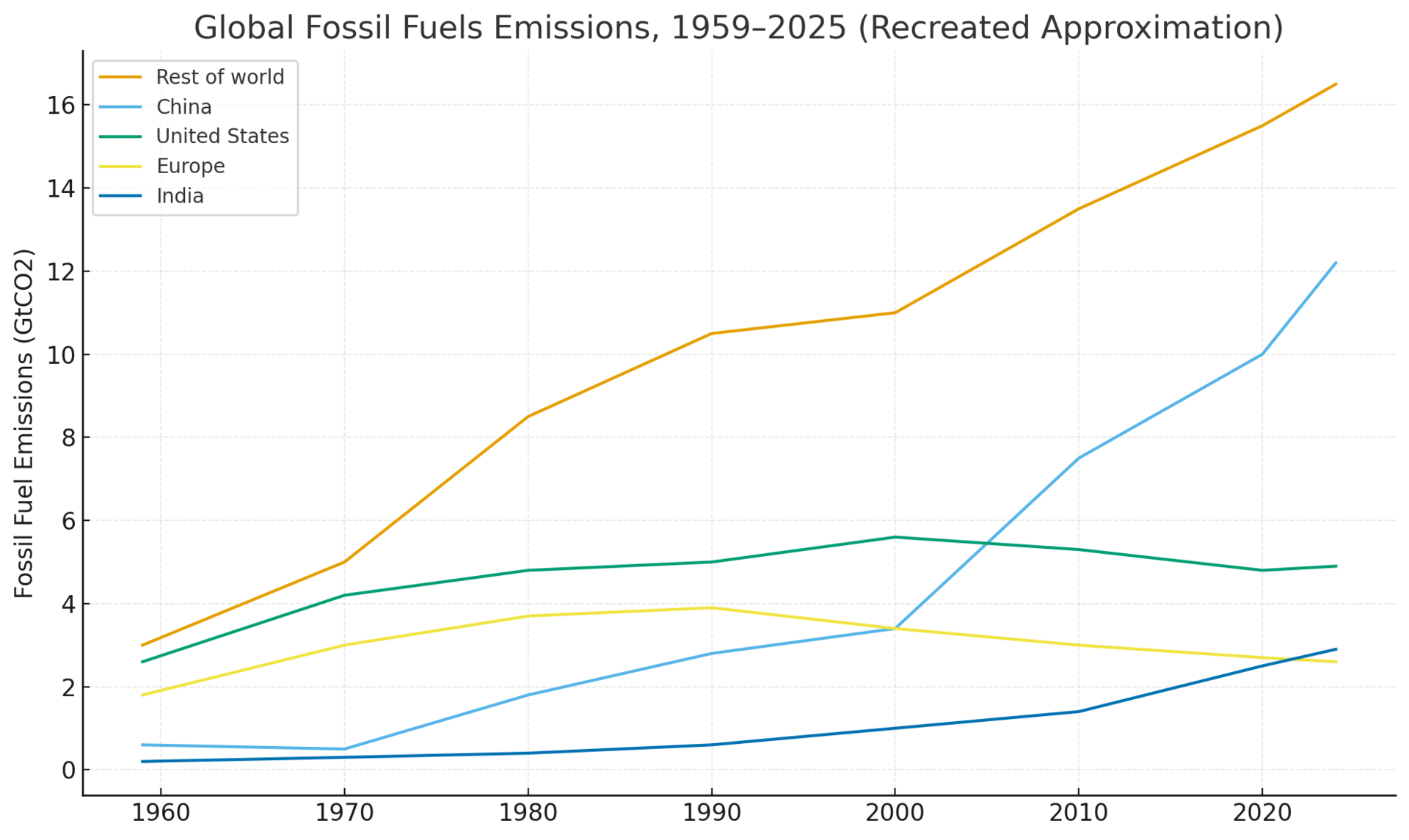

David Kemp makes the obvious but forbidden point: global emissions math is broken because it ignores reality—namely, that U.S. emissions are flat-to-down while the developing world is driving the global curve.

Why read: It grounds the debate in actual carbon physics instead of vibes. Also provides our Chart of the Day below.

Earth.com – Japan Turns Saltwater Into Power

Japan just launched Asia’s first osmotic power plant, using the energy difference between fresh and saltwater to generate electricity.

Why read: It’s niche now, but if scalability improves, osmotic generation could become the geothermal of coastal nations—small, steady, and immune to fuel shocks.

Moscow Times – Russia Installs First Reactor at Egypt’s El-Dabaa Plant

Putin celebrated installation of the first reactor at Egypt’s largest-ever energy project.

Why read: Russia continues to dominate global nuclear buildout while the U.S. debates permitting forms. This is what losing industrial capacity looks like in real time.

Chart of the Day

Global Fossil Fuel Emissions, 1959–2025

from David Kemp’s C3 analysis

The chart tells the whole story:

• U.S. and Europe flat or declining.

• China still rising.

• India accelerating.

• “Rest of World” climbing relentlessly.

It’s the geopolitical carbon map policymakers pretend doesn’t exist.

Good Bet: Constellation Energy (CEG)

Constellation is quietly becoming the U.S. nuclear utility. Today’s DOE loan support for the Three Mile Island restart tells you everything you need to know: Washington wants more electrons and fewer headlines. CEG is the only company with the fleet, the balance sheet, and the political goodwill to scale quickly.

Demand response? They’re already building AI-assisted DR capacity and signing hyperscaler PPAs like it’s a new sport. Nuclear uprates + federal backstopping + data-center load growth = a decade of tailwinds.

Bad Bet: Publicly Traded Home-Efficiency Manufacturers (e.g., Emerson / Carrier’s legacy segments)

With Congress trying to unwind efficiency rules they helped create in the 1970s, the compliance-driven revenue stream for appliance and HVAC manufacturers gets shakier. Their margins depend on federal marching orders; loosen those rules and suddenly high-efficiency SKUs compete as commodities instead of mandates.

Anything built around DOE efficiency diktats — test procedures, certification costs, regulatory moat — is now at risk of shrinkage.

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!