The U.S. power system is no longer drifting toward stress. It’s improvising in real time. This week, PJM found itself squeezed between emergency procurement discussions, judicial reversals, and governors openly challenging market outcomes. At the same time, nuclear policy is shedding symbolism and being treated, again, like infrastructure.

This is what an inflection point looks like when demand doesn’t wait for governance to catch up.

Major Stories

INTERCONNECTIONS

PJM Enters the Emergency Phase

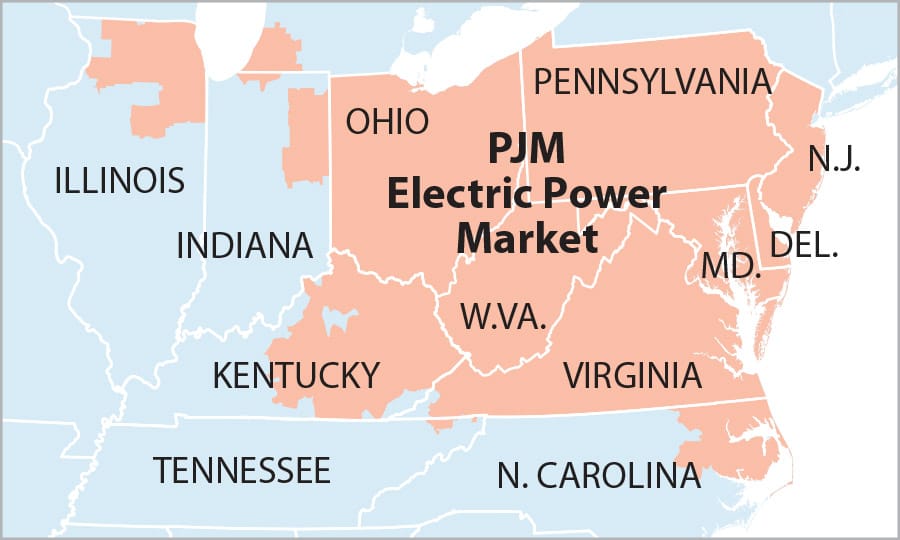

Federal officials are now pressing PJM Interconnection to consider an emergency capacity auction aimed specifically at fast-arriving data center load. These auctions bypass the normal multi-year forward process to procure power on compressed timelines when planners fear capacity won’t show up in time. The fact they’re even being discussed signals concern that PJM’s standard machinery isn’t moving fast enough.

At the same time, PJM has trimmed its near-term load forecast after tightening data-center vetting standards and factoring in a softer macro outlook. The goal is separation: real projects from speculative queue placeholders.

Layer onto that a federal appeals court vacating Federal Energy Regulatory Commission’s approval of PJM’s most recent capacity auction results for the Delmarva zone. Zonal results matter because they reflect local transmission constraints. When they’re tossed, prices, obligations, and reliability assumptions all get reopened in the places where load growth is hottest.

Meanwhile, New Jersey’s governor is seeking changes to state legislation that would weaken PJM’s proposed large-load tariff framework, designed to assign costs when hyperscale customers connect faster than the grid can expand. Because PJM spans multiple states, this move complicates efforts to apply uniform rules across the market.

Why It Matters - PJM is being pulled in four directions at once: federal urgency, court reversals, state-level political pressure, and private-sector demand that refuses to wait. Emergency tools are being discussed not because markets failed, but because sequencing did.

Grid Take - This is what happens when demand moves at cloud speed and governance moves at regulatory speed. Emergency auctions aren’t a solution. They’re a flare.

REGULATION

FERC Is Being Forced to Re-Write the Load Playbook

Two separate fights this week point in the same direction: rules built for slow, predictable growth are colliding with structural demand shocks.

First, Illinois’ attorney general filed objections at FERC over ComEd agreements that would give large data centers customized rate treatment. The concern is straightforward: whether utilities are shifting costs and risk from hyperscale customers onto ordinary ratepayers without clear guardrails.

At the same time, a federal appeals court vacated FERC’s approval of PJM’s recent capacity auction rule changes, ruling the commission failed to adequately justify its decision. That throws uncertainty back into the country’s most important capacity market and reopens questions about price formation and reliability risk.

Why It Matters - The assumption that load is passive and supply does the adjusting is gone. Data centers behave like infrastructure, not customers.

Grid Take - FERC is being forced to choose between speed and symmetry. Accommodate large loads without rewriting the rules and invite backlash. Rewrite the rules without speed and lose investment. Litigation is now doing the forcing function.

NUCLEAR BUILDOUT

China and Russia Are Setting the Global Nuclear Build Rate

Global nuclear construction is no longer evenly distributed. Of the roughly 60 reactors currently under construction worldwide, China accounts for about half on its own, with Russia responsible for most of the rest through a mix of domestic builds and export projects. Combined, Chinese and Russian firms are involved in well over two-thirds of active reactor construction globally, and nearly all new groundbreakings outside the West.

China is building at scale at home, typically starting 6–10 GW of new nuclear capacity per decade, with projects moving from approval to construction in roughly 12–18 months. Russia remains the dominant exporter, with reactors under construction or nearing completion in countries like Turkey, Egypt, Bangladesh, and China itself. Its model bundles financing, construction, fuel supply, and long-term operations — a turnkey offer most Western developers cannot currently match.

By contrast, the U.S. and Europe have only a handful of reactors under construction, most of them delayed, over budget, or limited to life-extension adjacent projects rather than fleet expansion.

Why It Matters - Nuclear leadership is no longer about who has the best reactor design on paper. It’s about who can move from approval to concrete. The countries that build reactors today define fuel supply chains, operating standards, and grid architecture for the next 60–80 years.

Grid Take - This isn’t an ideological contest — it’s a throughput problem. China and Russia win by offering speed, certainty, and delivery. Until the U.S. can permit, finance, and build at something resembling global pace, it won’t lead the nuclear future — it will just comment on it from the sidelines.

RATES & POLITICS

Governors Discover Electricity Prices

Pennsylvania Governor Josh Shapiro formally escalated pressure on PJM this week, joining a bipartisan group of governors urging changes to how the regional grid operator sets electricity prices amid sharp cost increases.

In a letter coordinated with governors from several PJM states, Shapiro called on PJM to take immediate action to rein in rising capacity and transmission costs, warning that current market outcomes are driving unsustainable bill increases for households and employers. The governors specifically pointed to recent capacity auction results and transmission cost allocations as contributors to double-digit percentage increases in retail electricity prices across parts of the region.

Shapiro’s intervention follows state-level data showing Pennsylvania residential electricity prices have risen roughly 30% since 2020, with capacity charges now one of the fastest-growing components of utility bills. His administration is backing both regulatory engagement and potential legal challenges at FERC, signaling that states are no longer willing to accept PJM pricing outcomes as technocratic fait accompli.

Why It Matters - This is no longer background noise. Governors are now coordinating across state lines to pressure PJM directly, inserting political accountability into markets designed to operate independently of election cycles.

Grid Take - Once governors collectively lean on capacity pricing, the center of gravity shifts. The risk isn’t debate—it’s distortion. If political pressure weakens forward price signals without replacing them with faster build timelines, today’s relief becomes tomorrow’s reliability problem.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

The Conversation

Quick Signals

Electricity prices are now a gubernatorial problem, not just a utility one.

PJM is being asked to improvise because normal timelines can’t keep up with AI demand.

Courts are increasingly shaping capacity outcomes after the fact.

Large-load policy fights are shifting from regulators to statehouses.

Corporate clean-power frameworks are advancing faster than physical infrastructure.

Things to Read

Axios: Electricity prices are rising, but not how Trump claims.

A super quick reality check on what’s actually driving increases and what isn’t, useful for separating rate reality from campaign rhetoric.Washington Examiner: Don’t risk the AI revolution over electricity populism.

A sharp and important warning about sacrificing long-term growth to short-term political pressure on power prices.Wired: China’s renewable buildout is real — and complicated.

Worth reading not for climate optimism, but for understanding scale, speed, and state capacity differences.Cato Institute: Travis Fisher: Rejecting climate policy isn’t a crime.

A clean argument for separating climate goals from coercive energy controls that distort markets and reliability.

nes that can will look very different from the last decade’s playbook.

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!