As Washington heads into the holidays, the grid isn’t getting any downtime. Offshore wind is on ice. Permitting reform is suddenly moving. PJM is juggling data-center demand, capacity rules, and co-location questions in real time. And across the system, prices are doing exactly what constrained supply tells them to do.

Major Stories

POLICY FRONTIER

Trump Administration Halts New Offshore Wind Projects

The Trump administration ordered a halt to new offshore wind development, with Interior Secretary Doug Burgum directing agencies to pause permitting and approvals while the administration reviews economic, environmental, and grid-reliability impacts. Existing projects already under construction are not affected, but the move effectively freezes new offshore wind capacity along the U.S. coastline.

Why It Matters - Offshore wind has been one of the most capital-intensive and politically protected generation sources of the past decade. A federal pause reshapes developer timelines, utility resource plans, and regional decarbonization strategies overnight.

Grid Take - This isn’t an anti-renewables move so much as a reality check. Offshore wind’s economics were already strained, and its grid integration costs were routinely downplayed. Pausing now may hurt near-term targets, but it forces an overdue reckoning on cost, reliability, and transmission.

POLICY FRONTIER

Congress Pushes Permitting Reform Through the SPEED Act

Both the House and Senate advanced versions of the SPEED Act this week, a sweeping permitting reform package designed to shorten federal approval timelines for major energy infrastructure. The bill would impose firm deadlines on environmental reviews under NEPA, limit serial agency consultations, and streamline judicial challenges that currently allow projects to be stalled for years after approval. In its Senate form, the legislation also prioritizes energy and transmission projects deemed critical to reliability and national security.

Supporters argue the bill targets process, not outcomes. It does not eliminate environmental review, but forces agencies to complete it on a predictable schedule, often within two years. For grid operators and utilities facing load growth from AI and electrification, that predictability is increasingly essential.

Why It Matters - Permitting delays are now the single largest bottleneck in U.S. energy deployment. Even projects with financing, customers, and regional support routinely die in procedural limbo.

Grid Take - The SPEED Act is the most serious attempt in years to realign permitting with physical reality. Its tradeoff is obvious: less process means fewer veto points. Some Democrats worry that faster timelines weaken environmental safeguards or reduce community leverage, particularly for projects in disadvantaged areas. That concern isn’t imaginary. But the alternative is already playing out in real time: a grid that cannot add capacity fast enough to meet demand. At some point, delay becomes its own environmental and economic harm.

MARKETS & GRID

PJM Grapples With Data Centers, Capacity, and Co-Location

PJM’s latest capacity auction cleared 134,479 MW of resources for the 2026–27 delivery year, but the result fell short of what many expected given the region’s surging load forecasts. At the same time, PJM is facing mounting scrutiny at FERC over how it treats data-center co-location, where large loads are physically paired with generation assets, often gas or nuclear, either behind the meter or through bespoke interconnection arrangements.

Co-location matters because it blurs long-standing grid boundaries. Traditionally, generators inject power into the grid and loads draw from it. Co-located data centers compress that model, raising questions about whether their paired generation should count toward regional capacity obligations, how much risk they impose on the broader system, and whether they can bypass queue backlogs that other projects face. PJM has warned that poorly structured co-location could undermine reliability planning if large loads disconnect from the grid during stress events or if their generation isn’t fully available when needed.

The auction outcome itself is part of the story. While PJM procured enough capacity to meet its formal requirement, the clearing prices and resource mix reflected a system still struggling to attract new firm generation at scale. Demand continues to grow faster than new supply clears the market, leaving PJM increasingly reliant on existing plants and incremental fixes rather than meaningful expansion.

Why It Matters - Co-location isn’t a loophole; it’s a response to interconnection paralysis. But it also forces PJM to confront whether its market rules are keeping pace with how large, strategic loads actually build.

Grid Take - This is what happens when demand moves faster than planning frameworks. Data centers are solving their own reliability problem because the system can’t do it for them. The risk isn’t co-location itself. The risk is pretending the old rules still describe the grid we’re operating.

GRID RELIABILITY

San Francisco Power Outage Highlights Urban Fragility

A late-December power outage left parts of San Francisco without electricity, disrupting transit and public services. Officials cited equipment failure amid ongoing strain on aging infrastructure.

Why It Matters - Urban grids remain brittle even as demand rises and redundancy shrinks.

Grid Take - This isn’t about weather or bad luck. It’s about systems stretched thin after years of deferred investment and overconfidence in planning models that assumed flat demand.

GLOBAL NUCLEAR

Japan Restarts Kashiwazaki-Kariwa Reactor Units

Japan approved the restart of additional units at the Kashiwazaki-Kariwa nuclear plant, the world’s largest by capacity, as part of its broader push to stabilize energy supply and reduce dependence on imported fuels.

Why It Matters - Japan’s restart signals a global shift back toward firm, domestic power after a decade of hesitation.

Grid Take - While the U.S. debates hypotheticals, other advanced economies are making hard choices. Nuclear restarts are not symbolic. They are acts of energy realism.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

The Conversation

Quick Signals

Supply is finally pricing itself honestly after years of distortion.

Transmission alone cannot save a grid short on firm generation.

Permitting reform is moving from talking point to necessity.

Nuclear is regaining global credibility faster than U.S. policy is adapting.

Things to Read

KOSU: Kansas will host what could become the world’s first mile-deep nuclear reactor, a next-generation geothermal-nuclear hybrid experiment located near the Oklahoma border. A glimpse at how extreme-depth drilling may reshape firm power.

Interesting Engineering: Russia’s floating nuclear power plant continues quietly producing electricity offshore, generating roughly 1 billion kWh annually. Odd, expensive, and worth studying as a case of nuclear mobility under constrained geography.

Harvard T.H. Chan School of Public Health: A new study reexamines cancer risk near nuclear plants, reopening a decades-old debate with updated data. The findings complicate simple narratives about proximity and public health.

Politico: California’s climate establishment is wrestling with how to rewrite its own “résumé” as emissions targets collide with affordability, reliability, and voter patience. A candid look at policy messaging in retreat.

RealClear Energy: An argument for why natural gas and nuclear remain the backbone of the U.S. energy economy, even as political attention drifts elsewhere. A reminder that reliability still matters.

Chart of the Day

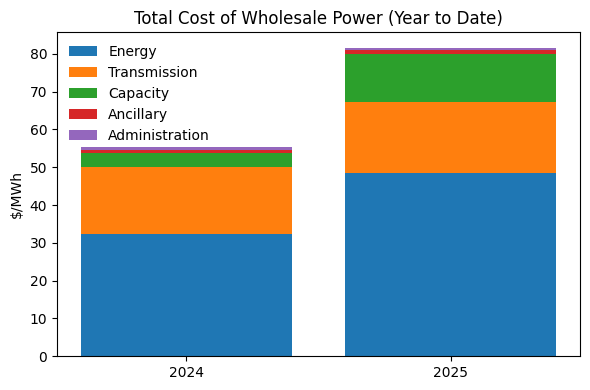

Wholesale Power Costs Are Rising — Transmission Isn’t

The chart breaks down total wholesale power costs in 2024 versus 2025, showing a sharp increase driven almost entirely by energy and capacity, which are up roughly 70% year-to-date. Transmission costs, by contrast, rose only about 5%.

What This Shows - This is not a transmission-driven price story. It’s a supply story.

Energy and capacity costs surged as baseload generation faced punitive market treatment, delayed approvals, and regulatory uncertainty. Transmission did what it could, but it cannot compensate for underinvestment in firm supply.

Grid Take - You can’t regulate your way to abundance. When you suppress supply and punish reliability, prices rise exactly where you told them not to. The 2025 power bill didn’t come from wires. It came from scarcity.

(h/t William Sauer; data from market monitor reporting)

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!