Guest Op-Ed: Battery Storage is 141 Times More Expensive Than Liquefied Natural Gas Storage

The Christmas blackouts caused by Winter Storm Elliot taught the energy industry an important lesson: energy storage matters. Unfortunately, the Union of Concerned Scientists wants to store electricity in the most expensive way possible.

Elliot and the Aftermath

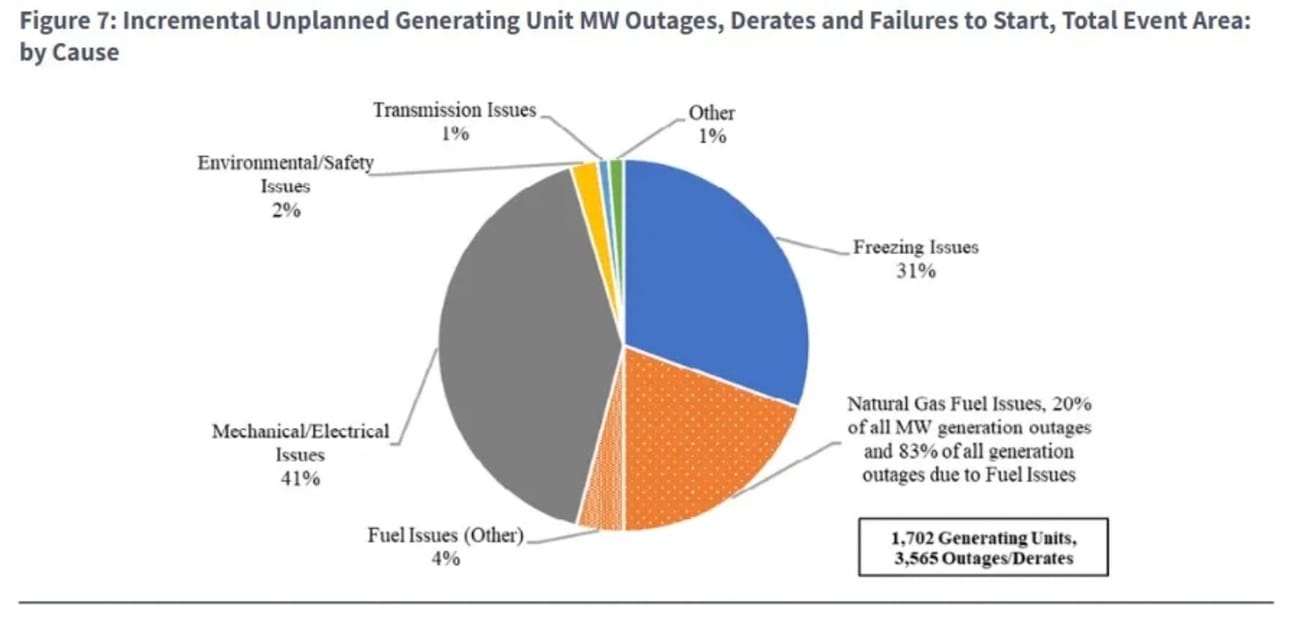

According to a joint report filed by the North American Electric Reliability Corporation and the Federal Energy Regulatory Commission, natural gas fuel supply disruptions accounted for 20 percent of all generation outages during Elliot and 83 percent of all generation outages due to fuel issues, as shown in the graph from the report below.

has pointed out many times that just-in-time fuel delivery is a reliability liability for natural gas power generators. However, in the wake of the storm, a number of utility companies are seeking to build liquefied natural gas (LNG) storage tanks next to their natural gas power plants to guard against future supply disruptions.

In Virginia, Dominion Energy is proposing to add a 25 million-gallon LNG storage tank to serve the 1,588 megawatt (MW) Greensville County Power Station and the 1,358 MW Brunswick County Power Station. This tank would be able to power both stations operating at full capacity for four days - enough to alleviate rolling blackouts and mitigate skyrocketing fuel costs.

In South Dakota, Otter Tail Power Company (OTP), a Minnesota-based Investor-Owned-Utility is planning to add gas storage at its Astoria Station combustion turbine plant (285 MW) in Deuel County to replace the capacity and dispatchable attributes of Otter Tail’s Hoot Lake 100-year-old coal-fired generating plant, retired in 2021.

According to OTP’s filings, Astoria Station functions very well to replace the capacity lost at Hoot Lake, but its dependency on just-in-time delivered fuel limits its ability to serve as a dispatchable hedge against energy market disruptions [emphasis added].

These hedges are significant. During Winter Storm Uri, natural gas prices skyrocketed as demand surged due to frigid temperatures and the cold weather caused natural gas generation to plummet.

As a result, natural gas spot prices rose to $23.86 per million British thermal units, which means the fuel costs for power produced from the plant would have cost $238 per megawatt-hour (MWh) if the plant had been operational at the time of the storm, a nearly 10x in the cost of gas just 24 hours before the storm.

Despite the obvious benefits of building LNG storage facilities to store fuel on-site and derisk much of the nation’s power plant capacity from dependence on just-in-time fuel delivery, a January 2024 report by the Union of Concerned Scientists (UCS) claims that onsite fuel storage for natural gas plants is not the answer.

Instead, UCS argues for more solar, onshore wind, offshore wind, geothermal, hydropower, transmission, and battery storage. But running some numbers on the cost to store LNG onsite compared to building an equivalent amount of energy storage capacity with batteries shows lithium-ion batteries are 141 times more expensive to build LNG storage facilities.

The Math

According to OTP’s 2022 Earnings Conference Call, the company’s proposed LNG storage facility at Astoria Station will cost between $70 and $90 million. For the sake of our calculations, we will use $80 million.

According to company filings with the Minnesota Public Utilities Commission (PUC), the facility will be able to fully power the 285 MW facility for five days, running 24 hours per day. This means that the facility will have 34,200-megawatt hours (MWh) of storage capacity at a cost of $2,339 per MWh, which amounts to $2.34 per kilowatt hour (kWh).

Battery cost data from the U.S. Energy Information Administration’s Assumptions to the Annual Energy Outlook shows a cost of $1,316 per kilowatt of four-hour battery storage. Dividing this value by four gives us a cost of $329 per kWh of storage capacity, which translates into $329,000 per MWh.

This means that building enough battery storage capacity to provide five days of electricity would cost a cool $11.25 billion, 141 times more expensive than the proposed LNG storage facility at Astoria Station and three times more than the company’s entire market capitalization.

Proposals to reduce the risk of blackouts using wind turbines, solar panels, and battery storage are laughably unrealistic and cost-prohibitive. Even if you were to build the battery storage instead of the natural gas storage facility, it might not necessarily be charged, which was the case in Hawaii earlier this year.

The most practical way to maintain the resiliency of the electric grid is to stop retiring existing coal and nuclear plants because compared to batteries or LNG facilities, these power plants have virtually unlimited onsite fuel storage. Short of doing the most reasonable thing, requiring natural gas power plants to have onsite fuel storage is the next best option to maintain reliability at a relatively low cost.

Onsite fuel storage for natural gas plants is better for reliability and the environment

Onsite fuel storage for natural gas plants isn’t just a smart move to improve the reliability of the electric grid. It’s also a win for the environment.

Fracking and the increased usage of natural gas power generation have resulted in the United States reducing emissions more than any other country in the world. As Robert Rapier wrote in Forbes:

Per the 2023 Statistical Review of World Energy, over the past 15 years, the U.S. has experienced the largest decline in carbon dioxide equivalent emissions of any country. From the report, this reflects “the sum of carbon dioxide emissions from energy, carbon dioxide emissions from flaring, methane emissions, in carbon dioxide equivalent, associated with the production, transportation and distribution of fossil fuels, and carbon dioxide emissions from industrial processes.” Thus, this includes leak estimates, as explicitly noted in the report.

The U.S. reduced carbon emissions by 879 million metric tons, or 14%. Here’s how that compares to the ten countries with the greatest carbon emission reductions over that timeframe. The numbers are in million metric tons per year.

He included the chart below showing countries that have reduced emissions the most over the last 15 years.

Rapier also explains how natural gas generation was the main cause of the massive decline in emissions in America.

The focus on 15 years was primarily because that’s when fracking began to substantially boost U.S. oil and gas production. In addition to seeing the largest decline in carbon emissions over the past 15 years, the U.S. also saw the largest growth in energy production. That may seem counter-intuitive, but there is a simple explanation.

Coal produces more than double the amount of carbon dioxide per unit of power production than natural gas (source). The displacement of coal by natural gas in power production enabled the huge decrease in U.S. carbon emissions.

So, while the USC would like us to focus on a combination of renewables and battery storage for reliability and emissions, they’re overlooking the energy source that has led to the greatest decline in emissions in the world, and that is far more reliable due to its ability to produce electricity on a moments notice and without backup power - natural gas.

Conclusion

We believe that the closure of coal and nuclear plants results in a grid that is less resilient in the face of severe weather events like Elliot and that requiring natural gas plants to be dual fuel with oil or have onsite LNG to participate in capacity auctions is the next best option.

Any way you slice it, building battery storage facilities that cost 141 times more than LNG storage and may not be charged is the dumbest possible way to power a society that has never been more dependent upon always-on electricity and will never be less dependent upon it in the future.

Isaac Orr and Mitch Rolling are independent energy analysts who run the Energy Bad Boys Substack, where this piece was initially published.