Welcome to Grid Brief! Here’s what we’re looking at today: the House GOP passes a bill cutting Inflation Reduction Act energy spending, transmission projects are getting funding and approval across America, and renewable curtailments continue to grow in California.

House GOP Takes Aim at IRA Money

After prolonged turmoil, the Republicans in the House finally have a new speaker, Louisiana Rep. Mike Johnson. Johnson and the Republican-controlled House have put billions of Inflation Reduction Act money on the chopping block last week.

“The $58 billion measure, which funds the Energy Department and other agencies, rescinds more than $5.5 billion from the Inflation Reduction Act, including a $4.5 billion program for homeowners to switch to more energy efficient appliances and a $1 billion grant program to help states craft more stringent building energy codes,” reports Bloomberg.

The bill passed by a 210-199 vote. It is unlikely to clear the Democrat-controlled Senate.

DOE & PJM Go Big On Power Lines

Two big news items in electrical transmission.

The first: The US Department of Energy is buying capacity on three major powerlines. “The Department of Energy The projects were selected as part of a solicitation issued by DOE for access to the department’s Transmission Facilitation Program, a $2.5 billion revolving fund that was part of the bipartisan infrastructure law,” reports Utility Dive. “The $1.3 billion in conditional commitments announced Monday marks the first time the program has been used.”

The three lines are the Cross-Tie 500kV Transmission Line (Nevada, Utah), Southline Transmission Project (Arizona, New Mexico), and the Twin States Clean Energy Link (New Hampshire, Vermont). According to a press release form the DOE, the projects will add 3.5 GW of capacity to the grid. That’s about $371.4 million per GW—not cheap. The Cross-Tie and Southline projects are supposed to unlock more renewables, which means the capacity added will, in part, be intermittent and non-dispatchable. The Twin States projects hooks into Canadian hydropower; clean and firm, but imported from a neighbor.

The second piece of transmission news comes out of America’s largest power markets, PJM.

“The PJM Interconnection has selected at least two FirstEnergy transmission projects totaling $372 million to help handle load from data centers, a move that reflects the company’s expectations for transmission development, FirstEnergy officials said Friday during the company’s third quarter earnings conference call,” reports Utility Dive.

Some of the transmission will help connect New Jersey wind power, according to FirstEnergy’s CEO, Brian Tierney.

Share Grid Brief!

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

Wind and Solar Curtailments Rise In CA

Readers familiar with our weekly look at power generation in America’s power markets have likely noticed that solar plays a big role in the Golden State.

Unfortunately for California, more and more of that solar power is getting curtailed. Wind, too.

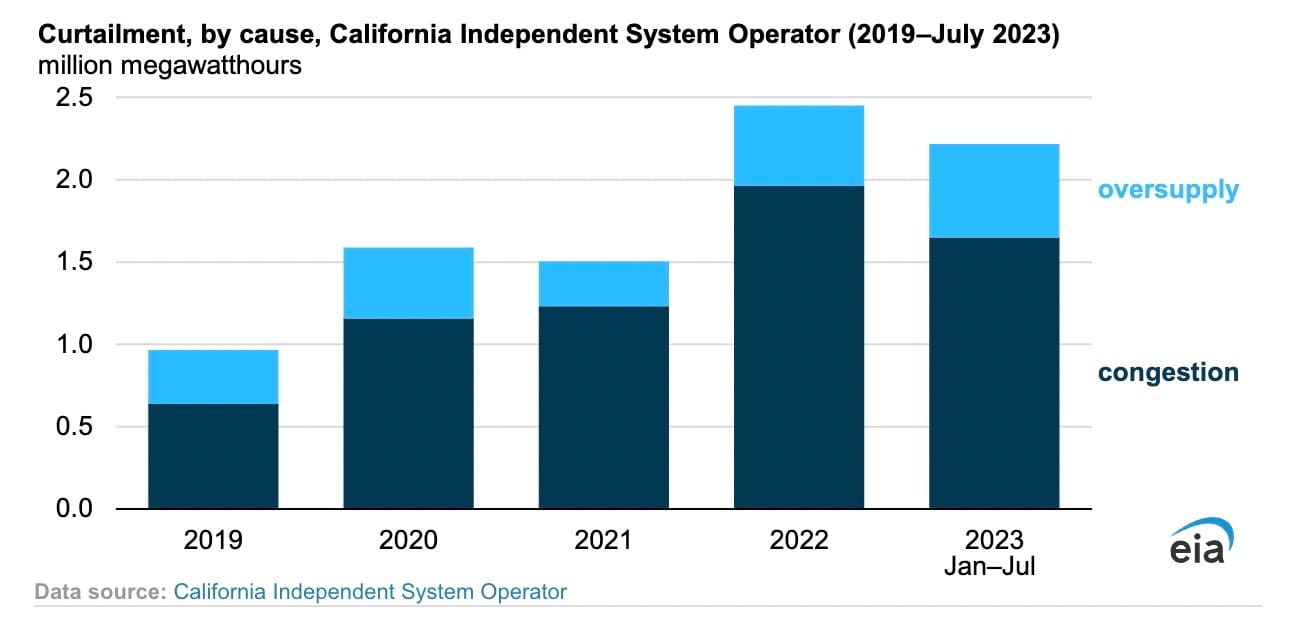

“In 2022, CAISO curtailed 2.4 million megawatthours (MWh) of utility-scale wind and solar output, a 63% increase from the amount of electricity curtailed in 2021. As of July, CAISO has curtailed more than 2.2 million MWh of wind and solar output so far this year,” reports the Energy Information Administration. “Solar accounts for almost all of the energy curtailed in CAISO—95% in 2022 and 94% in the first seven months of 2023.”

The EIA notes that curtailments have grown with California’s renewable energy capacity. In 2014, California had 9 GW of wind and solar, which has grown to 17.6 GW as of 2023. California is pursuing various strategies to tackle the curtailment problem: more transmission, battery storage, trading into Western Energy Imbalance Market, etc.

But how much do these curtailments cost consumers? “What will happen in 2025 when new solar facilities are eligible for a $27.50/MWh production tax credit?” wrote Travis Fisher, the director of energy and environmental policy studies at the Cato Institute. “At $27.50/MWh, the lost subsidies from curtailing 700,000 MWh of solar energy would be over $19 million. The trend line indicates these figures could run much higher.”

Conversation Starters

China expects a winter surge in power demand. “China expects its peak power demand could rise by 12.1%, or by 140 gigawatts (GW), this winter, a spokesperson for the National Energy Administration (NEA) said on Monday,” reports Oilprice.com. “Generally, China is certain that its winter power supply is guaranteed, but shortages could occur in the Yunnan province and in Inner Mongolia, according to NEA spokesperson Zhang Xing, quoted by Reuters. Previously, figures by the NEA have shown that the peak power demand in China was at 1,159 GW last winter.”

Finns find key rare earth minerals. “Two rare earth minerals have been found in Finland for the first time in what could be a boost to Europe’s supply of critical minerals necessary for the energy transition,” reports Oilprice.com. “Finnish Minerals Group said on Monday that Sokli and the Geological Survey of Finland had identified two new minerals, kukharenkoite and cordylite, through mineralogical characterization—the first such deposits identified in the country. The recently completed mineralogical analysis was aimed at charting the occurrence of rare earth elements (REE) in minerals.”

Siemens stock dropped last week. “Shares of Siemens Energy tumbled 35% on Thursday after the company sought guarantees from the German government,” reports CNBC. “The wind power giant made headlines earlier this year, when it scrapped its profit forecast, citing a ‘substantial increase in failure rates of wind turbine components’ at its wind division Siemens Gamesa. German business news weekly WirtschaftsWoche reported Thursday that Siemens Energy was seeking up to 15 billion euros ($15.8 billion) in guarantees.”

Crom’s Blessing

Interested in sponsoring Grid Brief?

Email [email protected] for our media kit to learn more about sponsorship opportunities.