Welcome to Grid Brief! Here’s what we’re looking at today: utilities and other industry groups request a meeting with the White House over new transformer rules, the UK is preparing its grid for the worst, the EIA cuts its hydropower generation estimates, and more.

Industry Groups Appeal to White House on Transformer Rules

Utilities, home builders, and grid component manufacturers have banded together to request a meeting with the White House’s clean energy advisor, John Podesta, over the Department of Energy’s proposed efficiency rules for transformers. The coalition argues that the new rule could worsen already painful supply chain problems.

The coalition stated that they have been alerting the DOE about its transformer supply chain problems for years.

“Despite this information and our organizations’ close work with DOE to explore short and longterm solutions to this crisis, the Department issued a notice of proposed rulemaking (NOPR) that would, through its various requirements, further exacerbate the supply chain situation,” they said. “The proposed rule would dictate that manufacturers increase the efficiency of distribution transformers by a mere tenth of a percentage point.”

Due to the complexity of transformers, even “a mere tenth of a percentage point” in efficiency gains can take its toll on production lead times.

UK Risks Winter Power Crunch

The UK is prepping for a potential power crunch this winter.

“Electricity consumption is projected to climb to a high during the first two weeks of January, just as nuclear availability is forecast to drop, according to National Grid’s winter outlook report published Thursday,” reports Bloomberg. “Blackouts are a less likely than last winter but can’t be ruled out, the grid’s Electricity Supply Operator said.”

“There’s a risk of small blackouts,” said Craig Dyke, head of national control at the ESO. But, he clarified, the probability of them happening this winter is low.

The UK and the EU are, on the whole, in better shape than they were going into last winter; gas storage is more robust this year than last. More of France’s nuclear fleet switching on when demand increases during cold months should also help.

In the meantime, the UK’s power sector is diligently running stress tests to prepare for the worst.

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

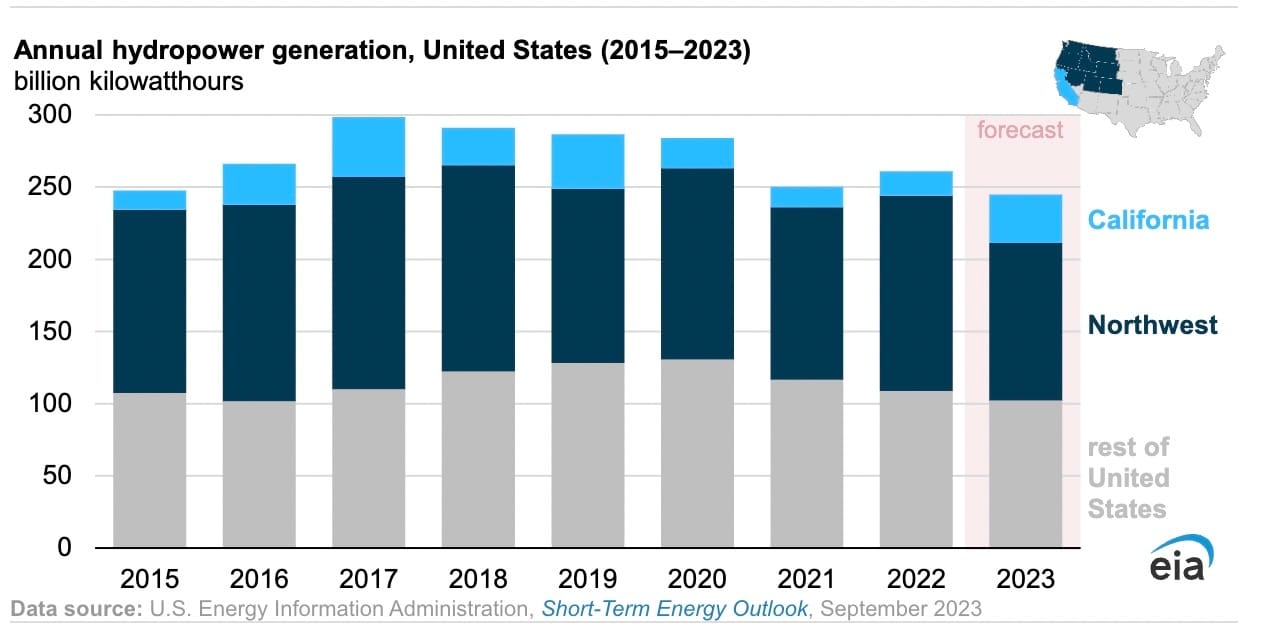

EIA Cuts Hydropower Forecast by 6%

Weather impacts have forced the Energy Information Administration to reduce its hydropower generation estimate for the year by 6%.

A warmer spring in the Northwest melted the snow pack quicker than usual, thus cutting water supply.

“With less water available, the region generated 24% less hydropower in the first half of this year than during the same period in 2022,” reports the EIA. “This year, we expect 19% less hydropower generation in the Northwest than in 2022.”

California’s year of heavy rain has restocked its snowpack in the Sierra Nevada Mountains, which offsets the Northwest’s reduction.

“California had 94% more hydropower generation in the first six months of this year compared with the first half of last year,” reports the EIA “We forecast 99% more hydropower generation in California this year compared with 2022.”

Drought conditions in the Columbia River Basin are also impacting water supplies, but Il Nino weather is wetter than usual and should bring more rain starting in October.

“So far this year, power operators have raised gas-fired electricity supply to offset lower hydropower generation in the Pacific Northwest and lower wind speeds in the Midwest while delivering power amid increased demand during the summer heatwaves,” reports Oilprice.com. “Between January and August, electricity generation from coal continued to drop in all major U.S. power markets, while clean power generation was essentially flat as lower wind speeds and lower hydropower generation offset a surge in solar power output.”

Conversation Starters

The DOE closed a big loan for solar. “The Department of Energy has made the federal government’s largest-ever commitment to solar energy, finalizing a partial loan guarantee agreement with Sunnova to back loans for distributed energy resources in disadvantaged communities, the agency said Thursday,” reports Utility Dive. “Sunnova ‘anticipates the loan guarantee agreement will support over an estimated $5.0 billion in Sunnova loan originations, reduce the company’s weighted average cost of capital, and generate interest savings,’ the company said in a statement. With DOE’s support, the company expects to provide loans to between 75,000 and 115,000 homeowners in the U.S. through its 568 MW Project Hestia program.”

Germany closes in on a big grid deal. “The German government is close to agreeing a deal to buy its biggest grid from TenneT in a deal estimated at around $21 billion (20 billion euros), as Germany looks to strengthen its transmission systems with the rise in renewable capacity,” reports Oilprice.com. “In February this year, Dutch state-owned operator Tennet Holding said that it was exploring a potential sale of its German activities to the German State.”

Saudis may start unwinding its production cut soon. “Saudi Arabia may be getting closer to declaring its oil-market mission accomplished than traders realize, according to Rapidan Energy Group,” reports Bloomberg. “Riyadh has propelled Brent crude toward $100 a barrel by slashing production just as global fuel demand hit record levels. That may soon be enough for the kingdom to start reviving output again, rather than risk a further price surge that damages the economy, according to Rapidan.”

Crom’s Blessing

Interested in sponsoring Grid Brief?

Email [email protected] for our media kit to learn more about sponsorship opportunities.