The grid doesn’t break all at once. It frays. This week’s stories show the strain lines clearly: hyperscale demand colliding with capacity markets, federal intervention slowing plant retirements, nuclear credibility taking a hit overseas, and geopolitics quietly reshaping energy prices. None of these stories live in isolation. Together, they sketch the pressure map for 2026.

Major Stories

MARKET DESIGN

Data Centers Collide With Capacity Markets in PJM and ERCOT

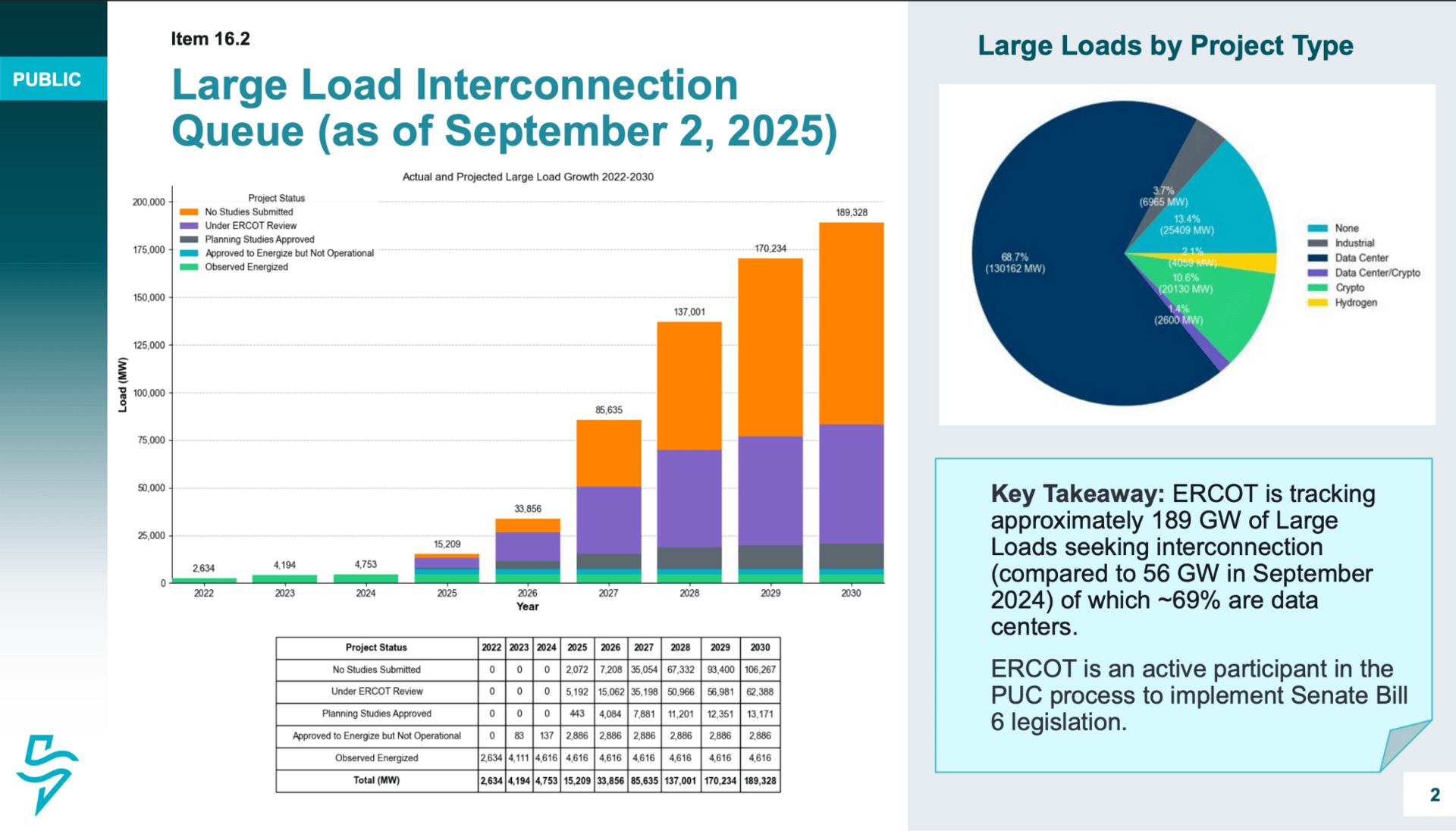

PJM’s latest capacity auction again cleared at the price cap, driven by sharply higher demand forecasts tied to data center growth. Meanwhile, ERCOT reported its large-load interconnection queue nearly tripled in 2025, with data centers accounting for the overwhelming majority of new requests.

The contrast is instructive. PJM’s capacity market translates load growth into higher prices almost immediately, while ERCOT’s energy-only market absorbs the same demand shock through queue congestion and planning strain. Different designs, same pressure point: concentrated, fast-moving load is outrunning grid processes built for a slower era.

Why It Matters - Data centers are no longer a marginal planning assumption. They are now shaping prices, reliability margins, and infrastructure timelines across fundamentally different market structures.

Grid Take - Markets don’t eliminate scarcity, they decide how it shows up. In PJM it’s higher capacity prices. In ERCOT it’s interconnection chaos. Either way, demand has become the binding constraint.

FEDERAL POLICY

DOE Forces Colorado Coal Plant to Delay Retirement

The Department of Energy ordered a coal unit at Colorado’s Craig Station to remain online beyond its scheduled retirement, citing reliability risks. The move uses emergency authority to override utility plans amid concerns about shrinking reserve margins in the region.

This action follows a growing pattern of federal intervention to slow thermal plant retirements as load rises and transmission expansion lags. What was once a utility-level economic decision is increasingly treated as a national reliability issue.

Why It Matters - Federal involvement in plant retirements changes risk calculations for utilities, investors, and regulators, with cost recovery and precedent-setting implications.

Grid Take - When markets and planning fall behind reality, intervention fills the gap. Expect more of this unless new capacity comes online faster.

NUCLEAR SAFETY

Japanese Operator Admits to Fabricating Seismic Risk Data

Japan’s nuclear regulator halted safety reviews for reactors operated by Chubu Electric after the company admitted to fabricating seismic risk assessments. The disclosure has triggered renewed scrutiny of data integrity and regulatory oversight in Japan’s nuclear sector.

Although geographically distant, the episode underscores a universal vulnerability: nuclear power depends as much on institutional trust as on engineering excellence.

Why It Matters - Nuclear timelines are already long. Governance failures stretch them further and complicate global efforts to rely on nuclear for grid stability.

Grid Take - Baseload power only works if the data behind it is credible. Trust failures can sideline capacity just as effectively as mechanical ones.

GEOPOLITICS

Venezuela’s Energy Reentry Could Shift Power Economics at the Margin

Analysts see potential for expanded energy exchange between the U.S. and Venezuela as sanctions enforcement evolves. Increased oil supply could place downward pressure on global fuel prices, indirectly affecting electricity costs and dispatch economics.

These effects won’t resolve grid bottlenecks, but they do influence marginal pricing and investment decisions, particularly for energy-intensive industries.

Why It Matters - Fuel prices still shape electricity markets, even as grids become more complex and capital-intensive.

Grid Take - Geopolitics rarely fixes grid problems, but it can change the math around them.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

The Conversation

Quick Signals

Demand growth has escaped the planning layer and reached the market layer.

This week’s stories show load growth no longer living in forecasts or white papers — it’s now shaping prices, queues, and federal action.Reliability is quietly reasserting primacy over transition sequencing.

When governments intervene to stop retirements, it’s a signal that planning assumptions about timing have already failed.Institutions, not technology, are becoming the limiting factor.

Whether it’s nuclear data integrity or interconnection backlogs, governance capacity is now as scarce as generation capacity.Market design determines how stress is felt, not whether it exists.

PJM prices stress; ERCOT queues it; geopolitics shifts it — but none of these systems avoid it.Large capital is adapting faster than public systems.

Self-supplying data centers and vertically integrated projects are a rational response to slow, uncertain grid processes.

Things to Read

C3 NewsMag: AI Can Lower Energy Bills With Data Centers That Power Themselves

A clear-eyed argument that hyperscale data centers don’t have to be pure grid parasites — but only if they’re treated as energy infrastructure, not just load.Anthropocene Magazine: The Strange New Economics of Negative Electricity Pricing

A useful explainer on how distorted price signals emerge when subsidized generation, inflexible supply, and constrained transmission collide — and why “free power” is often a symptom of system stress, not abundance.CoStar: Batteries, On-Site Power Plants May Accelerate Launch of New Data Centers

Evidence that on-site generation and storage are becoming table stakes for new projects as interconnection timelines stretch.Tom’s Hardware: U.S. Electricity Grid Stretches Thin as Data Centers Rush to Turn On Onsite Generators

A useful look at how tech giants are quietly bypassing grid constraints with self-supply — and what that means for planners left holding the bag.New York Times: Kairos Power and the New Nuclear Bet

A reminder that next-generation nuclear is no longer theoretical — but still deeply constrained by regulatory pacing and local politics.

Chart of the Day

State electricity prices vary widely across the U.S., reflecting differences in generation mix, infrastructure, and long-run policy choices.

Source: U.S. Energy Information Administration (EIA), All-Sectors Average Retail Electricity Prices, Jan–Aug 2025. Visualization adapted from Always On Energy Research & Institute for Energy Research.

State Electricity Prices vs. the U.S. Average

This map shows average all-sector electricity prices by state from January–August 2025, with blue shading indicating prices above the national average and red shading indicating prices below it. The national average over the period was 13.54¢/kWh, but state outcomes vary widely, from under 9¢/kWh to well above 25¢/kWh.

What stands out is not a single cause, but a pattern: states with higher prices tend to combine tighter generation constraints, higher capital costs, and more policy-driven resource mandates, while lower-price states generally rely more heavily on dispatchable generation and simpler regulatory structures.

Why It Matters

Electricity prices are increasingly shaping where data centers, manufacturers, and new housing can locate. As demand rises nationally, these state-level cost differentials become economic signals, not just household budget issues.

Grid Take

Price dispersion across states isn’t an accident of geography alone. It reflects long-run policy and market structure choices colliding with a period of accelerating demand.

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!