ISO-New England Lets Go of Reliability

The Independent System Operator of New England, which oversees grid reliability in the region, has proposed to phase out its minimum offer price rule (MOPR--pronounced "moper) by 2025. This will have a negative impact on reliability.

To get into why this is important, it's important to know how capacity auctions work. Every year, capacity owners (power generators like gas plants, wind farms, nuclear plants, etc.) offer to make capacity available in the future at a specific price. ISO-NE then tallies those offers from lowest to highest. It accepts the cheapest bid and then goes higher until it has gotten the generation it needs in the future. The highest of the offers then becomes the "clearing price" that all the lower accepted offers get paid. Bids above that price get rejected--they have not "cleared the auction." Their owners get nothing.

Meredith Angwin, in her book Shorting the Grid, offers this clarifying example:

"IF the grid operator needs 300 MW over the next hour, and plant A bids in 100 MW $10/MWh, plant B bid in at 100 MW at $15/MWh, plant C bids in 100 MW at $20/MWh, and plant D bids in 100 MW at $25/MWh, plants A, B, and C will be selected to meet the 300 MW demand. Plant C will set the clearing price at $20/MWh, and plants A, B, and C will all receive the clearing price. In this example, plant C is the price maker, and plants A and B are price takers."

The market is designed to drive down prices by boxing out expensive bids, thus punishing pricey capacity owners. But there's a problem: if, say, heavily subsidized low-capacity renewables can bid in even in the negatives then that forces out more reliable and comparatively expensive power generators like coal, nuclear, or even natural gas which can't clear the auction. But unlike wind and solar, those resources are all dispatchable: you can call upon them when you need them. Thus the renewables undermine the stability of the grid.

That brings us back to MOPR, which was supposed to solve this problem. By putting a floor in on prices, MOPR effectively provided more reliability to the grid by keeping it from being overwhelmed by intermittent power generators, i.e. wind and solar.

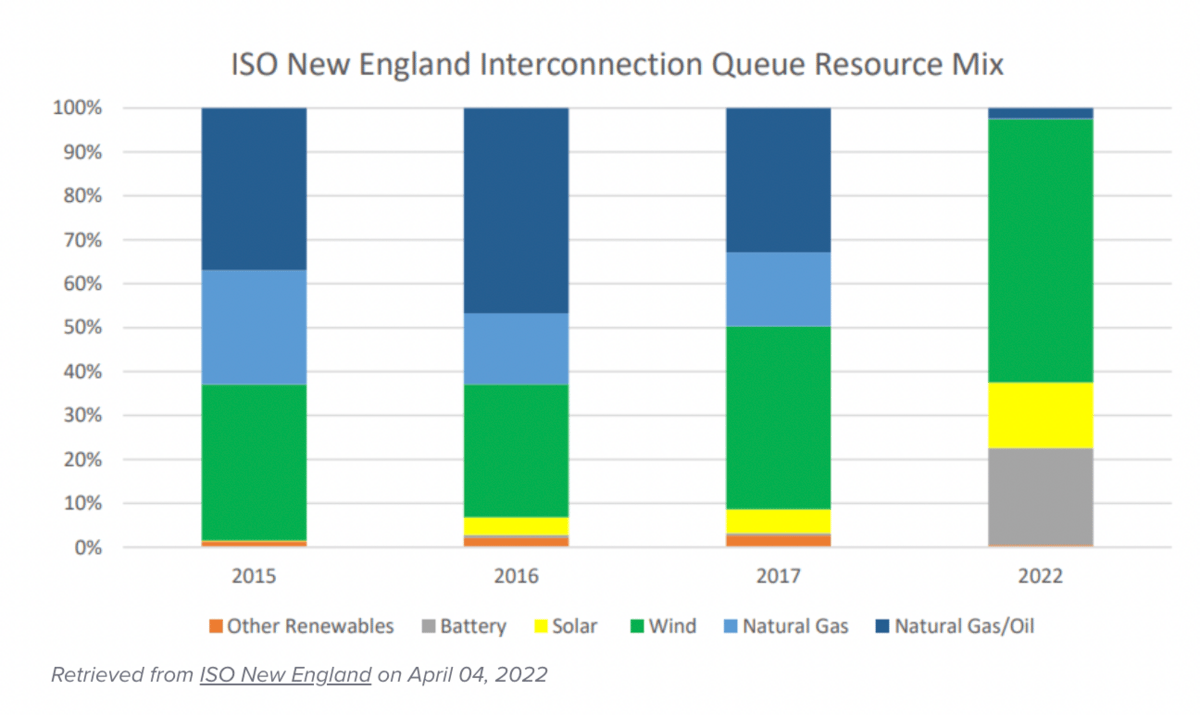

New England states and the Federal Energy Regulation Committee do not like this because it interferes with their climate goals because to them net-zero can only be achieved through wind and solar, it seems. Reflecting New England's aggressive climate coals, "fossil-fueled power plant proposals make up 3% of ISO-NE's interconnection queue, down from almost half in 2015, the grid operator said in its proposal," Utility Dive reports.

But in a proposal to stakeholders, ISO-NE cautioned that "[a]n immediate elimination of the MOPR threatens to cause the retirement of existing capacity resources upon which the region relies to maintain reliability. Those retirements could occur before the state-sponsored resources are commercially available and able to replace the capacity of the retiring resources, and before the region has had time to develop the tools to properly assess and account for the relative reliability contributions of the exiting and entering resources."

In other words, ISO-NE understands exactly what getting rid of MOPR will do and it's trying to stall to maintain as much reliability as possible. Unfortunately, it's relatively powerless to stop this--the states and FERC outweigh it.

As we look westward to California, it's clear what this will mean for New England consumers: unreliable and therefore expensive electricity.

California's Shocking Electricity Bills

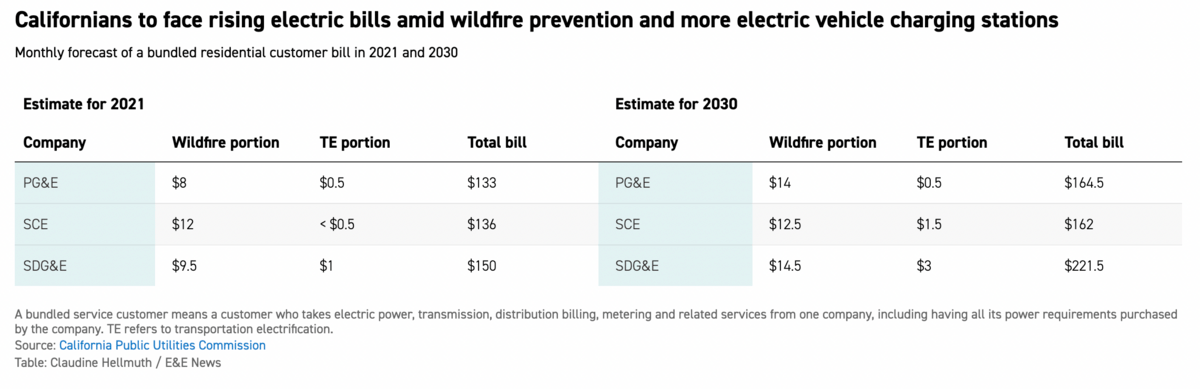

California has aggressive climate goals and consumers are paying for them. The state boasts some of the highest electricity prices in the country. Some worry this will hurt their decarbonization efforts, which rely on increasing demand for electricity by electrifying "everything," like cars.

E&E reports, "Surging electricity prices of the three biggest utilities in the Golden State have reached levels that now are more than double the national average, as posted by the U.S. Energy Information Administration...Since 2013, rates have increased 48 percent for SDG&E customers, 37 percent for PG&E ratepayers and 6 percent for those with SCE. That's far faster than inflation, according to the CPUC. Those calculations were made before those utilities raised rates in January."

Some of this has to do with wildfires. California's wildfires have gotten worse due to drought and mismanagement. That's made for higher bills. But California's notoriously regressive net metering scheme for rooftop solar panels is also to blame.

Net metering gives homeowners credits for adding renewables onto the grid. "The utilities said that cost transfer is $3.4 billion per year 'and growing,' in a filing with the CPUC," reports E&E. "That's in part because solar customers get a 20-year agreement through the net energy metering program when they install rooftop panels. People who add them now get paid for energy they send to the grid at the current retail rate, about 30 cents. But that amount will go up as electricity rates rise."

The California Public Utilities Commission hopes to correct this, but solar advocates are furious to see it go.

Still, a CPUC report says that electricity demand in 2030 could rise by about 13 percent if California meets its greenhouse gas reduction goals. California still plans on shutting down the Diablo Canyon nuclear plant by 2025, which cranks out an annual net of 16,165 GWh--about 15% of California's clean electricity and 8% of its in-state electricity.

CAISO delenda est.

Headlines

US wants more oil from Canada, but not a new pipeline to bring it. (WSJ)

US gasoline price shocks go deeper than crude's surge. (BBG)

Iowa farms to lose 5 million birds to bird flu. (CBS-MN)

Government of OPEC heavyweight Kuwait resigns. (OP)

White House releases analysis of climate risk to government. (E&E)

Word of the Day

embrittlement

n. [Drilling]

The process whereby steel components become less resistant to breakage and generally much weaker in tensile strength. While embrittlement has many causes, in the oil field it is usually the result of exposure to gaseous or liquid hydrogen sulfide [H2S]. On a molecular level, hydrogen ions work their way between the grain boundaries of the steel, where hydrogen ions recombine into molecular hydrogen [H2], taking up more space and weakening the bonds between the grains. The formation of molecular hydrogen can cause sudden metal failure due to cracking when the metal is subjected to tensile stress. This type of hydrogen-induced failure is produced when hydrogen atoms enter high-strength steels. The failures due to hydrogen embrittlement normally have a period where no damage is observed, which is called incubation, followed by a sudden catastrophic failure. Hydrogen embrittlement is also called acid brittleness. (source)

Crom's Blessing

Consolidated Edison - City of Light Diorama - Artist painting model.