Japan's PM: Reconsider Nuclear

Japanese Prime Minister Kishida stated that the country needs to consider using more nuclear energy. “We must think about nuclear power given rising electricity and gas prices,” Kishida said.

Japan is heavily import-dependent and struggling with a weakened yen. Restarting more of the reactors shuttered after Fukushima would alleviate the energy crisis's strain on their economy.

Yet the regulations put in after Fukushima have inhibited Japan's ability to do so. Kishida wants to streamline the regulations to bring more nuclear online. Bloomberg reports, "Of 33 operable reactors overseen by Japan’s Nuclear Regulation Authority only 10 have restarted under rules imposed since Fukushima."

It appears public sentiment is warming to the atom, but long restart inspection processes and frequent lawsuits filed from nuclear opponents have hindered reactor restarts.

Japan's utilities import almost all of their fuel and have had their profits slashed. The yen sits at a twenty-year low.

Playing Limbo With Oil Inventories

Rory Johnston over at the Commodity Context has just written an illuminating piece on global oil inventories.

Here are some takeaways:

Global inventories have dropped by more than 600 million barrels due to production's inability to keep up with spiking demand. This tumble has moved at the "fastest pace on record over the past year and a half."

It's been about a decade since these inventories have hit such a low level.

The levels sit below the "presumed 'logistical requirement' or 2010-14 average," a stretch a time notable for its high oil prices.

"Crude inventories have fallen most drastically, while refined products remain slightly better stocked—however, within products middle distillates like diesel, gas oil, and jet fuel have experienced the steepest drawdown, which helps explain the wildly high refining margins witnessed for those fuels."

Johnston concludes that it's too soon to say we're in crisis mode for inventory levels, but we're closer to that than we have been. We might be moving into "uncharted territory."

European Firms Look to Pay for Gas in Rubles

Here's a list of the some of the firms/countries that are in the process of dealing with Gazprombank so that their payments can be converted into rubles:

Germany's Uniper

Austria's OMV

Hungary

Slovakia

Italy's Eni

It's worth taking a look at what some of these companies have said about the current scenario.

Uniper: “Uniper can say for its contracts, we consider a payment conversion compliant with sanctions law and the Russian decree to be possible. For our company and for Germany as a whole, it is not possible to do without Russian gas in the short term; this would have dramatic consequences for our economy.”

OMV: “We have analyzed the Gazprom request about payment methods in light of the EU sanctions and are now working on a sanctions-compliant solution.”

Eni: "Eni and Gazprom have signed an agreement to revise the terms of existing long-term gas supply contracts in the light of the current and future market evolution, including the settlement of the ongoing disputes between the parties. The agreement underlines the importance of the role played by gas in the ongoing decarbonization process and sustainability strategies."

All of these companies either insist or imply what they're doing is above board. Some make the case that they really have no choice. This is the reality of energy commodities: they are non-optional.

The European Commission does not appear happy with the situation. After Germany's Habeck said that a sanctions-compliant purchase could be possible through Gazprombank, the EC said, "Complying with the decree is a breach of sanctions. If companies pay in euros, they are not in breach of the sanctions. What we cannot accept is that companies are obliged to open a second account in roubles and that the payment is complete only when payment is converted into roubles."

But if Russia rejects straight-up euro payments, then core European industries will tank.

The divide between those who need to deal with Russia and those who either don't need or don't think they need to deal with Russia will continue to create tension in the European Union. For instance, Poland's Anna Moskwa said that she is "counting on there being consequences for these countries [which seek to comply with Putin’s ruble payment decree] and that as a result they will cease paying in roubles," according to The Guardian.

What kind of consequences? Hard to say. Maybe sanctions. Matthew Lynn over at The Telegraph has suggested as much. In which case, the EU becomes an economic circular firing squad.

Conversation Starters

Democrats have announced that they will propose legislation meant to go after Big Oil for price gouging. The announcement comes after major oil executives were brought before the House Committee on Energy and Commerce and explained how the oil market works to lawmakers.

US GDP shrank by 1.4% in the first quarter due to a rush of imported goods and fading fiscal stimulus.

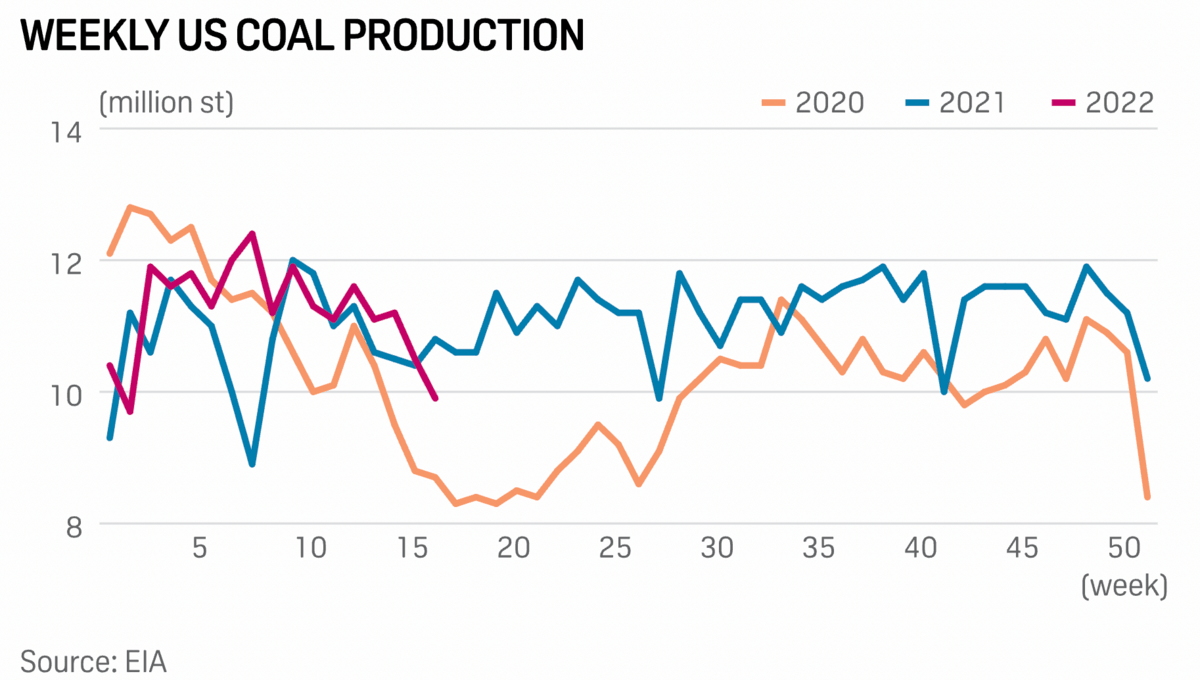

US coal production has dropped by 6% in a week.

Nuclear Barbarians: A CANDU Attitude ft. Chris Keefer

Dr. Chris Keefer, the host of the Decouple podcast, stopped by to update me on the incredible progress being made in Canada for nuclear energy.

Crom's Blessing

This and his thirty-inch thighs are why they called Tom Platz the Quadfather.