Japan's Post-Fukushima Era Is Over

Japan is going to restart nuclear reactors and build more! The decade of nuclear fear that followed the meltdown at Fukushima Daiichi has come to an end. The energy crisis has forced policy back in favor of the atom.

“As a result of Russia’s invasion of Ukraine, the global energy situation has drastically changed,” Prime Minister Fumio Kishida said. “Whatever happens globally, we need to prepare every possible measure in advance to minimize the impact on people’s lives.”

The government will unveil its specific plans for a nuclear energy policy later in the year, once research on what's possible for the Japanese nuclear industry has born fruit. But the government has already agreed to restart many of the plants that were shuttered after 2011, aiming to "bring back 17 out of a total 33 operable reactors by summer next year and also to extend the life of existing plants," reports the Financial Times.

Japan, a resource-poor island, is right to see nuclear power as the future for their grid stability. Nuclear is incredibly energy dense and can operate for extended periods of time without refueling.

Could the IRA Save Palisades Nuclear Power Plant?

Earlier this year, the Palisades nuclear plant in Michigan switched off a month before its scheduled closure. Like many reliable power plants, Palisades fell victim to the fatal combo of cheap natural gas and heavily subsidized renewables which slowly pushed it off the grid. Could the Inflation Reduction Act save it?

A recent piece from the New York Times claims that the loans for clean energy within the IRA are the "sleeping giant" of the bill and could help save Palisades. The law authorizes as much as $350 billion in additional federal loans and loan guarantees for energy and automotive projects and businesses," reports NYT.

Since switching off, Palisades has switched owners to Holtec, a nuclear power plant decommissioning company that has aspirations to build small modular reactors. Holtec told the NYT "it was reviewing the loan program and other opportunities for its own small reactors as well as bringing the shuttered plant back online."

“There are a number of hurdles to restarting the facility that would need to be bridged,” Holtec said in a statement, “but we will work with the state, federal government and a yet to be identified third-party operator to see if this is a viable option.”

The IRA also provides money to the Diablo Canyon nuclear power plant in California, which is profitable, but apparently needs $1.5 billion to make its continued operation more politically comfortable for the politicians beholden to crazed anti-nuclear environmentalists.

20 Million American Households Are Behind On Power Bills

Many Americans are struggling to pay their power bills as inflation spikes and the energy crisis deepens. Some 20 million Americans--about 1 in 6 households--are behind on their utility bills. The National Energy Assistance Directors Association is calling it the worst crisis they've ever documented.

"Underpinning those numbers is a blistering surge in electricity prices, propelled by the soaring cost of natural gas," reports Bloomberg. “I expect a tsunami of shutoffs,” said Jean Su who works as a senior attorney at the Center for Biological Diversity, which tracks utility disconnections across the US.

But the US is getting hit with the least of the pain so far.

"In Germany, the government slapped a levy of $296 on households to pay for natural gas as Russia squeezes energy flows to Europe after the invasion of Ukraine," reports Bloomberg. "In the UK, government support for energy bills doubled, to $482 for every household starting in October, but prices are rising so fast that the support might not be enough. More than 100,000 people have signed a pledge from campaign group Don’t Pay UK to cancel their direct-debit energy payments beginning in October."

As discussed above, the energy crisis has been hard on Japan as well. Thailand's in a similar boat. Perhaps most tragic of all is Pakistan's position--its grid is heavily reliant on natural gas which has seen soaring prices on the international market. Germany can afford to eat the cost of pricey LNG shipments to keep their stocks full for winter (so it seems). But whatever flows to Germany misses Pakistan.

Even China has struggled to keep the lights on. In the Sichuan region, where a combination of drought and a stubborn heatwave have sapped its hydropower, manufacturers like Toyota and Foxconn have had to halt operations.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

The Freeport LNG, which shut down in June when a fire broke out, has pushed back its date to restart operations from October to November. "Freeport LNG accounts for 20 percent of the United States' total LNG export capacity, capable of processing 2.1 billion cu ft of gas per day," reports Oilprice.com. "According to Freeport LNG, it is the seventh-largest liquefaction facility in the world and the second-largest in the United States."

Finland's grid operator has announced that the country might see blackouts this winter. "We are working closely with the authorities and transmission system operators in the Baltic Sea region to promote measures related to the adequacy of electricity. The reliable operation of the electricity market, domestic power plants and inter-country electricity transmission connections will be absolutely essential for the adequacy of electricity in the coming winter," Tuomas Rauhala, Senior Vice President, Power System Operation at Fingrid said in a statement.

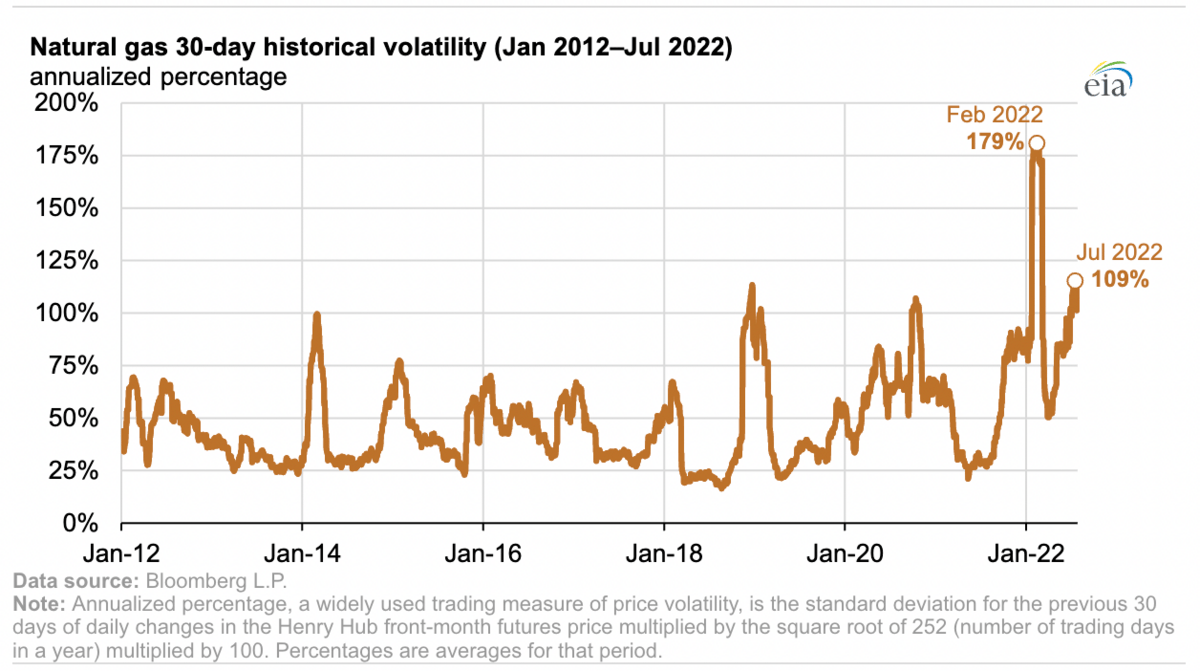

American natural gas hit record volatility in Q1 of this year according to a new report from the EIA. "U.S. natural gas price volatility (a measure of daily price changes) reached its highest level in 20 years, hitting record highs in the first quarter (January–March) of 2022. The 30-day historical volatility of U.S. natural gas prices, which is based on the U.S. benchmark Henry Hub front-month futures price, averaged 179% in February compared with 57% during the first quarter of 2021," reports the EIA.

Crom's Blessing