Happy Friday. Here's what we're looking at today.

Me and Joe Biden Down by the Strategic Petroleum Reserve

On Thursday, President Biden announced his plan to ease pain at the pump. It consists of three parts.

The first part is to release a historic 1 million b/d from the US Strategic Petroleum Reserve for the next six months.

The second part is to call on Congress "to make companies pay fees on wells from their leases that they haven’t used in years and on acres of public lands that they are hoarding without producing."

And the third is to provide incentives for Americans to buy electric vehicles and to invoke the Defense Production act "to secure American production of critical materials to bolster our clean energy economy by reducing our reliance on China and other countries for the minerals and materials that will power our clean energy future."

Let's take these in order.

First, it's unclear if releasing oil from the SPR will do anything to alleviate prices. There are no guarantees. And the downsides for security seem more certain than the possible upsides for prices. SPG reports, "The six-month drawdown by the US would amount to about 180 million barrels, depleting almost a third of the SPR and taking the stockpile to its lowest level since 1984. Barrels from this SPR release are expected to hit the market starting in May." Draining strategic reserves on "maybe" doesn't inspire confidence.

It might be that Biden is trying to provoke OPEC+ to produce more, but The Washington Examiner reports that "OPEC and its allies, including Russia, announced today that they will move forward with a modest monthly output increase of 432,000 barrels per day in May, resisting calls from the IEA and the U.S. to greatly scale up production. The group has continued to resist calls to ratchet up production, citing the group’s desire to “stay out of politics” (and avoid making an enemy of Russia)." So there's even less clarity about what kind of signal this is to OPEC if it's even a signal at all.

As for the second part, drillers are naturally angry with the administration. How can you tell between "hoarding land" and not being able to produce due to supply chain bottlenecks? Will taking a sterner approach with O&G encourage more production? Will it help train up more crews of roughnecks and alleviate the tight supply of frac sand? And doesn't dumping reserve petroleum into the market discourage drilling? Despite all of this, American crude production has increased for the first time in ten weeks.

EVs require oil and steel to make the tires and frames. It's unclear how an expensive, boutique item like EVs are 1) immune to the problems every other hydrocarbon-dependent commodity is and 2) a viable solution to everyday Americans. As for the massive renewables dream--there is still no viable solution to intermittency issues related to those energy sources. This means we would end up buying petroleum from somewhere anyway. And Defense Production Act or not, they couldn't be scaled up fast enough to alleviate price volatility now anyway.

All in all, this makes for a confusing gesture from the Biden administration. No doubt because it's serving two masters: national energy needs and its green base. But there's also some unfortunately historical rhyming. According to historian Peter Grossman, the Democrats a using their 1974 play. During the OPEC crisis, here's what they did

—Blamed the oil companies.

—Demanded investigations of the oil industry.

—Called for a “windfall profits” tax against energy producers.

—And appealed for laws against “price gouging.”

Nothing came of these investigations and none of this resolved the crisis.

Rubles for Gas

President Putin did not mince words when he announced that the EU would now have to pay for gas in rubles, a move he telegraphed in the preceding weeks. “If these payments are not made, we will consider it a failure of the buyer to fulfill its obligations, with all the ensuing consequences,” Putin said.

SPG reports that "the order stipulates that when buyers from "unfriendly" countries pay for Russian gas, they should transfer forex to a Russian bank, which will then use it to buy rubles. Gazprombank, which has not been sanctioned, will process the transactions."

EU countries have, for their part, insisted that they will continue to pay in euros. If the Europeans gave because, like Italy and Germany, they need Russia's energy, then their sanctions on Russia will be neutered. Putin has put them in a position where they can only buy gas if they prop up Russia's currency. The ruble's recent rise is already casting doubt on the effectiveness of the sanctions.

Tim Ash, senior emerging markets sovereign strategist at BlueBay Asset Management, told AP that "the solution here is to call Putin’s bluff and say, sure, cut off energy supplies and see who breaks first.” I'll leave that suggestion here without further comment.

Headlines

Nuclear Barbarians: The Great Ethiopian Renaissance Dam ft. Wiliam Davison

Wiliam Davison of Crisis Group joined me to talk about GERD. It's a hugely informative episode about the hurdles developing countries face in scaling up the energy ladder.

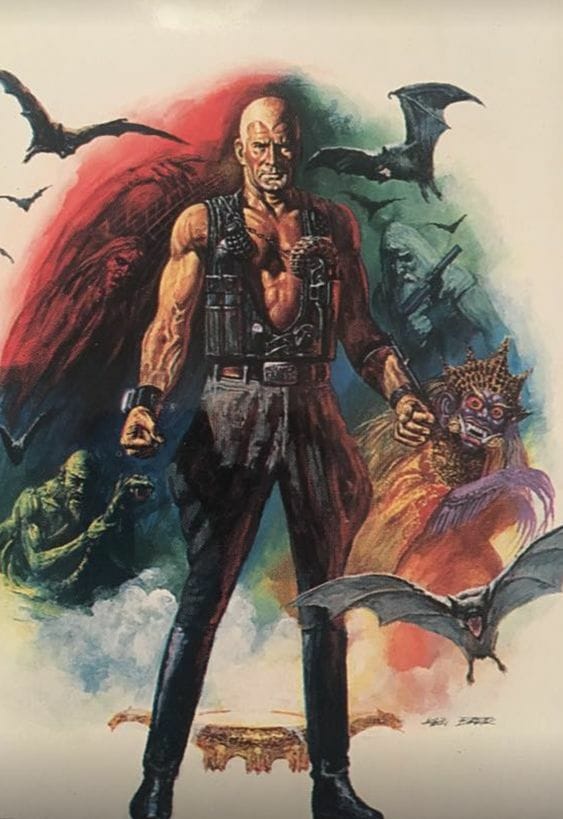

Crom's Blessing

Ken Barr.