Korea Joins Coal Club

Fuel switching has been a major theme this year. The natural gas market's been tight, prices have been high, and everyone's starting to remember who was king in the first place: coal. Korea's no different.

Korean firms "haven’t been curbing coal power generation since July, ignoring voluntary limits put in place by the government last year, according to people familiar with the matter," confidential sources told Bloomberg.

Former President Moon had committed the republic to ending its reliance on coal. Ten coal plants have been retired since 2017. In 2019, a new program forced state-run generators to cut their coal usage during the winter months. Voluntary coal curbing was encouraged for the remaining seasons.

"Between December 2020 and February 2021, as many as 46 coal plants were subject to the mandatory curbs, with operation halting at 17 facilities during the period," Bloomberg reports.

The Korean Electric Power Corp. has asked that the curbs be eased. Kepco has incurred incredible losses due to high energy prices, so burning cheap coal would ease their pain. It's not clear what move Korea will make as the government is still sorting out its winter energy strategy.

But even if Korea sticks to coal, prices may still rise. Just because coal isn't as pricey as natural gas these days doesn't mean it's inexpensive. Recently, coal prices in Asia have surged.

UK Wants Longterm US LNG

The United Kingdom is tracking to lock in longterm LNG contracts to help it survive the winter.

Unnamed people familiar with the matter told Bloomberg that the government's asking exporters to commit contracts with importers for as long as 20 years.

The British government's inquiries "come as other European nations are also trying to stock up on natural gas ahead of the coldest months and diversify their fuel sources in the long term," reports Bloomberg. "But unlike countries such as Germany, the UK isn’t reliant on Russian gas. Instead, it gets the fuel from domestic production, Norwegian supplies arriving via undersea pipelines, and LNG shipments."

Still, this week the British government announced a six-month cap on wholesale prices that will cost an estimated $45 billion. Eleven percent of the British population is already foregoing food to cover their energy bills.

“Clearly the Truss government is engaged on this issue at the highest levels of government to lock in long-term supplies at affordable prices just like the Germans,” Fred Hutchison, president of US industry lobby group LNG Allies told Bloomberg. “The other European nations better step up pretty fast. What’s left in the United States is almost sold out.”

No one outside of the negotiations knows exactly what volumes the Brits are trying to procure. But people familiar with the matter say that they're trying to "buy LNG indexed to the US benchmark Henry Hub gas price, and delivered on an ex-ship basis, where the seller has to deliver the cargo to a fixed buyer and location."

Europe's Folly, America's Gift

Will America inherit Europe's manufacturing sector? As long as energy prices stay high, it seems likely.

"As wild swings in energy prices and persistent supply-chain troubles threaten Europe with what some economists warn could be a new era of deindustrialization, Washington has unveiled a raft of incentives for manufacturing and green energy," reports the Wall Street Journal. "The upshot is a playing field increasingly tilted in the U.S.’s favor, executives say, particularly for companies placing bets on projects to make chemicals, batteries and other energy-intensive products."

Here's some of the industry that's coming America's way:

Amsterdam-based chemical firm OCI NV announced the expansion of an ammonia plant in Texas this month.

"Danish jewelry company Pandora A/S and German automaker Volkswagen AG announced U.S. expansions earlier this year."

Tesla has paused its plans for a battery facility in Germany to see if the Inflation Reduction Act doesn't help get a better deal stateside.

"Luxembourg-based ArcelorMittal SA, which this month said it would cut production at two German plants, reported better-than-expected performance by an investment this year in a Texas facility that makes hot briquetted iron, a raw material for steel production."

But is this a structural change or a short-term trend? Some hold out hope for blue hydrogen as a route to replace natural gas, which would help keep industry in Europe. But hydrogen's a tough nut to crack and fuel switching takes a long time. It all depends on how long and how deep the energy crisis gets. Few businesses will be willing to go bankrupt just to stand on ceremony.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Protests over energy prices are beginning to sweep through Europe. "Thousands of people protested against soaring electricity prices and costs of living in the Belgian capital Brussels on Wednesday, following a similar protest the day before in Slovakia, and earlier this month in the Czech Republic," reports Oilprice.com. "In what has been dubbed “a national day of action" [...] some 10,000 people protested across the country, demanding solutions to soaring electricity and natural gas prices and skyrocketing costs of living."

Banks might begin to flee the ESG space for fear that it's illegal. "Banks including JPMorgan Chase & Co. and Morgan Stanley may leave the Glasgow Financial Alliance for Net Zero, Mark Carney’s coalition to fight climate change, because they fear the organization’s strict requirements for decarbonization may make them legally vulnerable," reports Bloomberg.

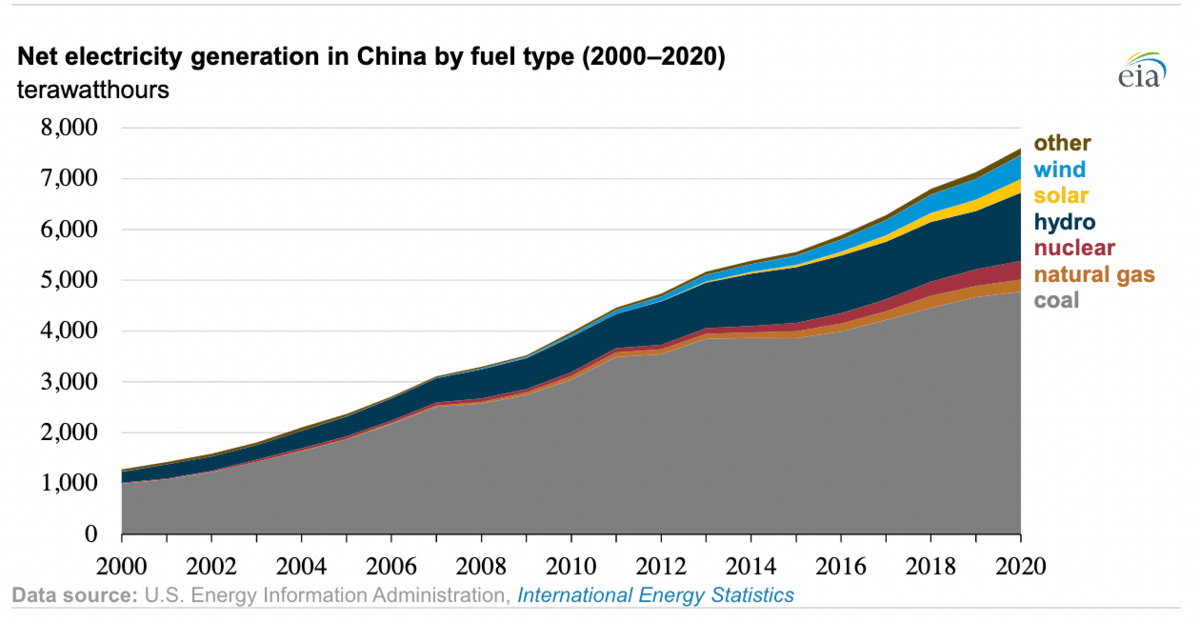

China has greatly expanded its electricity sector over the last twenty years. "China has steadily increased its electricity generation over the past 20 years, reaching 7,600 terawatthours (TWh) in 2020 from 1,280 TWh in 2000...Despite COVID-19 mitigation efforts in 2020, China still expanded its electricity generation by 5% in 2020," reports the Energy Information Administration.

Crom's Blessing