Macron Accuses US of Energy "Double-Standard"

“The North American economy is making choices for the sake of attractiveness, which I respect, but they create a double standard," French President Emmanuel Macron said at a Brussels press conference after a meeting between EU leaders. What's the double standard? That Americans buy their domestic natural gas at a lower price than the LNG they sell to Europe.

“In addition they allow state aid going up to 80% on some sectors while it’s banned here--you get a double standard. It comes down to the sincerity of transatlantic trade,” Macron continued. He was referencing the subsidies for America's EVs via the Inflation Reduction Act. In other words, as high energy prices force manufacturers off the continent, America offers them cheaper hydrocarbons and better subsidies.

Macron isn't the first European leader to voice such concerns. But Europe sanctioned Russia, on whose gas they had become reliant. Now they're reliant on LNG. It appears everyone wants the credit for "helping Ukraine" but no one really wants to foot the bill. Had the Europeans committed to fracking and building nuclear plants (let alone maintaining their current fleets), none of this would be a problem.

But as the Russians say: "If grandma had a beard, she'd be grandpa."

IEA's New Warning on Europe's Natural Gas Supplies

Speaking of Europe's natural gas supplies, the International Energy Agency's Executive Director Fatih Birol recently said, "I expect if there are no surprises--political and technical surprises--and if the winter is a normal winter, Europe can go through this winter with some bruises here and there, but we can come to February and March" with enough gas.

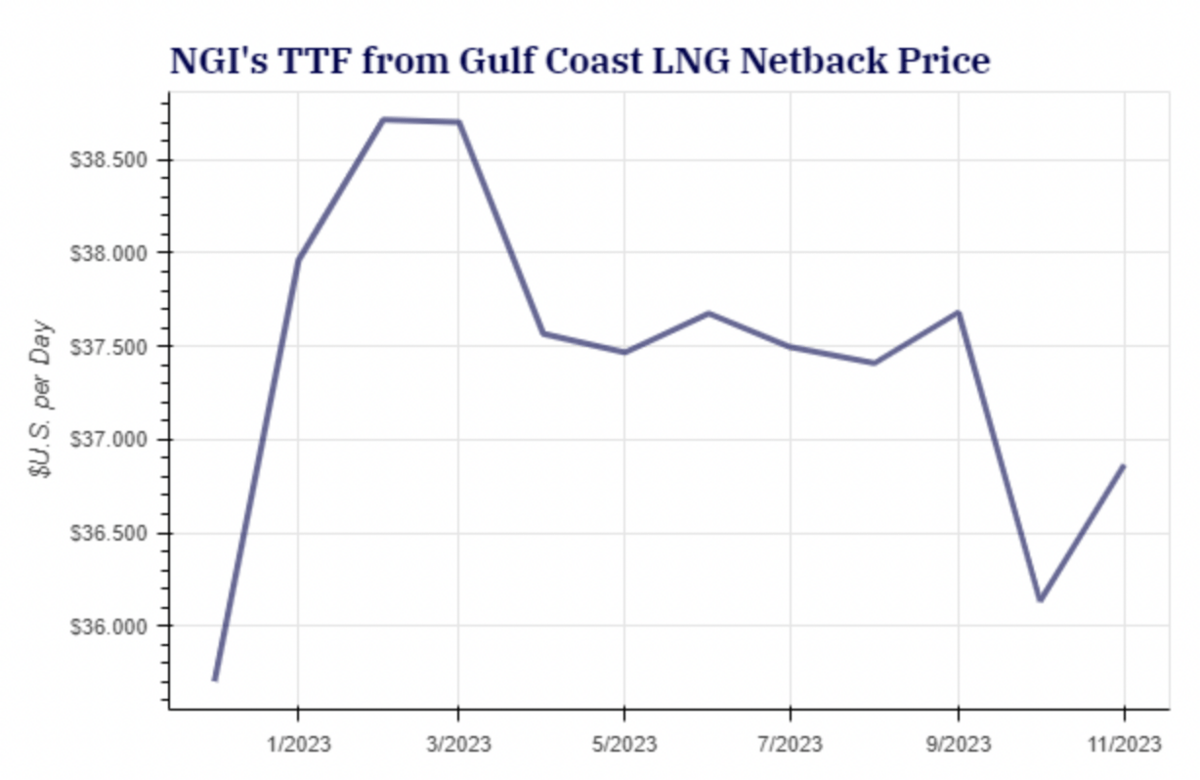

It appears he has good reason to be optimistic. "[M]ore than 90% of natural gas storage was full in Europe, according to a readout from the meetings provided by IEA this week. Prices in Europe this month recently fell to their lowest level since June amid benign fall weather and increased confidence in storage levels," reports Natural Gas Intelligence.

But that's not the full story. First, "if everything goes perfectly during a season of adverse weather conditions, we'll be fine" doesn't necessarily inspire. Second, the international gas market remains tight and shows no sign of loosening. Third, a potential increase in China's LNG demand will make it difficult for Europe to refill its gas storage for next winter. Europe's storage was built with regular flows from Russia in mind.

In fact, the IEA forecasts that "Europe’s LNG imports would increase in December by 60 Bcm compared with year-earlier volumes. That demand is more than double worldwide LNG export capacity expansions, which could lead to higher prices as Europe battles with Asia over spot cargoes."

So, if things go perfectly this winter, the Continent isn't out of the woods. When I was in Hungary for a conference hosted by the Mathias Corvinus Collegium on the state of the European Economy earlier this month, the one thing everyone seemed to agree on is that next winter will be crueler than this one.

Nigeria-Morocco Pipeline Closer to Supplying Europe

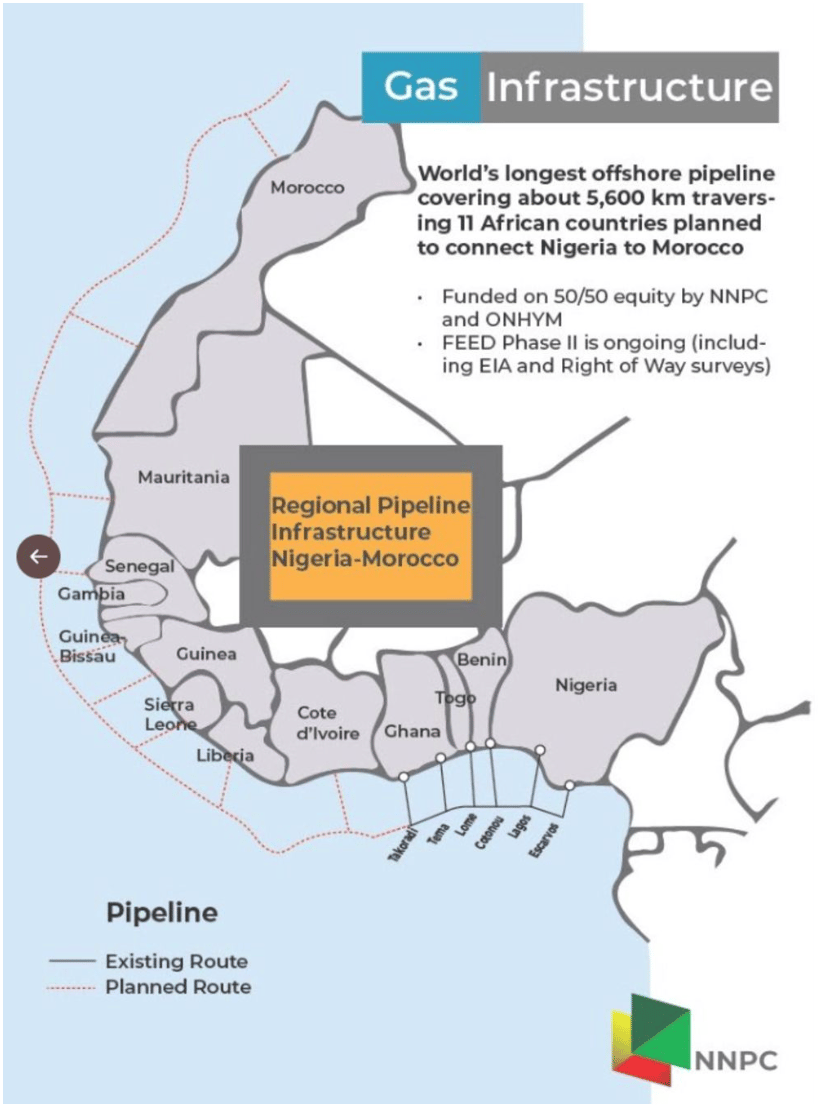

Nigeria and Morocco signed an agreement that moves them closer to linking up via pipeline.

"The Nigerian National Petroleum Co. and Morocco’s National Office of Hydrocarbons and Mines signed a memorandum of understanding in Rabat on Thursday," reports Bloomberg. "While the project could take decades to complete and cost billions of dollars if it goes ahead, the ceremony comes with European nations increasingly hungry for new sources of gas following Russia’s invasion of Ukraine."

The pipeline would run 3,840 miles along the coast of West Africa and supply gas to the Economic Community of West African States, which includes 15 countries that co-signed the agreement. It would also allow fuel to be shipped to Spain and thus the rest of Europe.

"If the Nigeria-Morocco pipeline advances, it will be many years before it delivers any gas. Signing a previous agreement in 2018, the two governments said the project could take 25 years to finish," Bloomberg reports.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

Westinghouse has sued Korea Hydro and Nuclear Power over intellectual property rights. The American company alleges a Korean nuclear reactor design contains some of Westinghouse's intellectual property and thus needs permission before the design can be transferred to Poland. "The filing appears to have been made because Westinghouse learned that Poland's government was preparing to sign a preliminary agreement to buy nuclear reactors from government-owned KHNP instead of Westinghouse or some other source. Poland is evaluating offers from Westinghouse, KHNP and France's EDF for acquisition of its first nuclear power plant," reports S&P Global.

The energy crisis is bearing down on the UK. "The axing of the energy price guarantee from April next year could lead to almost 11m UK households falling into fuel poverty, campaigners have warned, which is about 26m people," reports Oilprice.com. "It means more than one in three British households face the grim prospect of hardship: there are an estimated 28.1m households in the UK. The average household in Britain has 2.36 people."

Bad news for the G7's price cap on Russian oil. "Russia can access enough tankers to ship most of its oil beyond the reach of a new G7 price cap [...] underscoring the limits of the most ambitious plan yet to curb Moscow's wartime revenue," reports Reuters. "The Group of Seven countries agreed last month to cap Russian oil sales at an enforced low price by Dec. 5 but faced consternation from main players in the global oil industry who feared the move could paralyse the trade worldwide."

Crom's Blessing