PJM votes just got a whole lot more public—at least in Maryland. Gavin Newsom wants to fix California’s budget by gutting the state’s grid reliability programs. And NuScale inches closer to an actual order after years of PowerPoint. Plus: the true size of America’s electricity boom, why utilities are finally saying no to ghost data centers, and why every private equity firm suddenly loves natural gas.

Maryland Utilities Must Disclose PJM Votes Under New Law

Maryland just passed a bill forcing public electric utilities to disclose how they vote at PJM stakeholder meetings—a move designed to pull back the curtain on utility behavior at the nation’s most powerful RTO.

The new law requires annual filings to the state PSC showing both public and confidential votes on PJM market rules, capacity auctions, and transmission planning. It’s the first of its kind, but similar bills are now pending in Delaware, Pennsylvania, and Illinois.

Why it matters:

PJM governs $100+ billion in power transactions annually. One tweak to its capacity rules can shift hundreds of millions between merchant generators and ratepayers. For decades, utilities cast votes in near-secrecy, often supporting rules that raise rates or entrench incumbents. That era is ending.

Flashback:

This isn’t Maryland’s first stab at utility reform. A 2024 bill tried to ban lobbying expenses from being rate-based and require PJM membership. That one stalled. This year’s package? Leaner, meaner—and law.

The subtext:

Lawmakers are frustrated that utilities, generators, and data center clients are shaping grid rules with zero sunlight. As transmission fights intensify, expect more states to follow Maryland’s lead.

Newsom Proposes $423M in Grid Reliability Cuts

California’s $12 billion budget hole is coming for the grid. Gov. Gavin Newsom’s revised 2025–2026 budget proposal zeroes out funding for two key emergency power programs: Demand Side Grid Support (DSGS) and Distributed Electricity Backup Assets (DEBA)—both created post-2020 blackouts to help during grid emergencies.

The optics:

These cuts arrive just as the state’s energy commission says California is “in good shape” for the summer. That confidence might be misplaced. DSGS already enrolled 500+ MW in flexible resources, much of it behind-the-meter batteries. DEBA was slower out of the gate, but critical for scaling new virtual power plants.

Historical context:

California has a habit of investing in grid resilience after the crisis. Then comes the short memory. The same lawmakers that panicked in 2022 are now treating distributed energy like it’s optional.

Bonus irony:

The funding cut stems from Newsom’s plan to rename cap-and-trade to cap-and-invest—by disinvesting in the very programs cap-and-trade was funding.

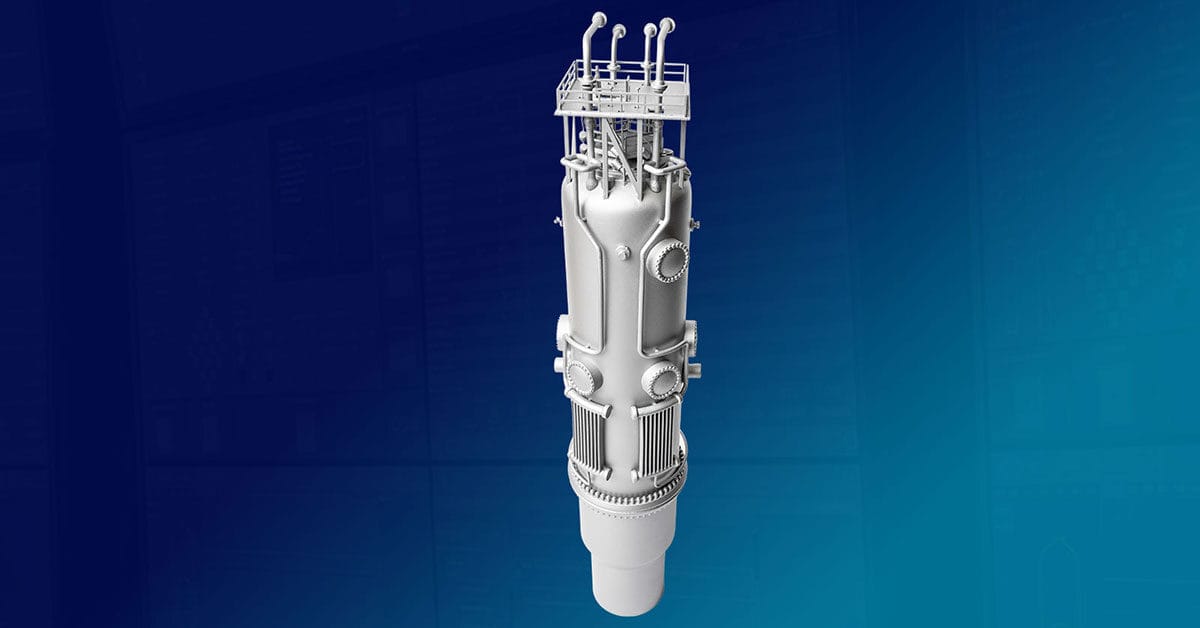

NuScale Expects First SMR Order by Year-End

After years of teasing and term sheets, NuScale says it could finally ink its first SMR order by December. The company expects NRC approval for its 77 MWe uprated design in July and is already producing modules with Doosan. CEO John Hopkins says they’re done with MOUs and now working on actual contracts. Customers likely include data center operators and heavy industrials.

Why this matters:

The SMR hype cycle has been long on slides, short on steel. If NuScale lands a real customer and books revenue from module sales in 2026, it could become the first commercially viable SMR vendor in the U.S.

The fine print:

Even NuScale admits the nuclear supply chain is tight. The first sale may break even—but if they hit volume, they print cash. Just don’t expect a fleet of reactors overnight.

Compare and contrast:

TVA this week became the first U.S. utility to file for an SMR construction permit. The race is real now.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

Axios – Electricity Demand to Rise 78% by 2050: ICF’s new forecast says the U.S. needs 80 GW of new generation per year to stay ahead of demand—double our recent pace. EVs, AI, and electrification are pushing us into a new consumption era. Hope your substation is ready.

Barron’s – Natural Gas Plants Are Energy’s Hottest Buyout Targets: Vistra, NRG, Constellation, and Blackstone are gobbling up legacy gas fleets at bargain-bin prices. With build times long and turbines scarce, the secondhand market is suddenly king.

US News – TVA Files First SMR Construction Permit: The Tennessee Valley Authority is betting big on small nuclear. The Clinch River project would be the first utility-owned SMR in the U.S. and could pave the way for more public-private hybrid builds.

Good Bet, Bad Bet

Good Bet: Constellation Energy (CEG)

Forget the nuclear branding—Constellation is morphing into a buyer of last resort for America’s gas fleet. The $27B Calpine acquisition gives it massive dispatchable firepower just as power prices climb and clean buildouts stall. With private equity paying $1B per GW for gas plants (half the cost of new builds), Constellation’s portfolio looks like a discount fortress in a reliability-hungry market.

Bad Bet: Enphase Energy (ENPH)

Newsom’s budget would gut California’s demand-side incentives and freeze out behind-the-meter programs—right as retail solar softens nationwide. Enphase depends on home battery and inverter sales fueled by state subsidies. If California pulls the plug, they’re stuck waiting for red states to pick up the slack—and that’s a long bet.

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!