MISO Falls Short

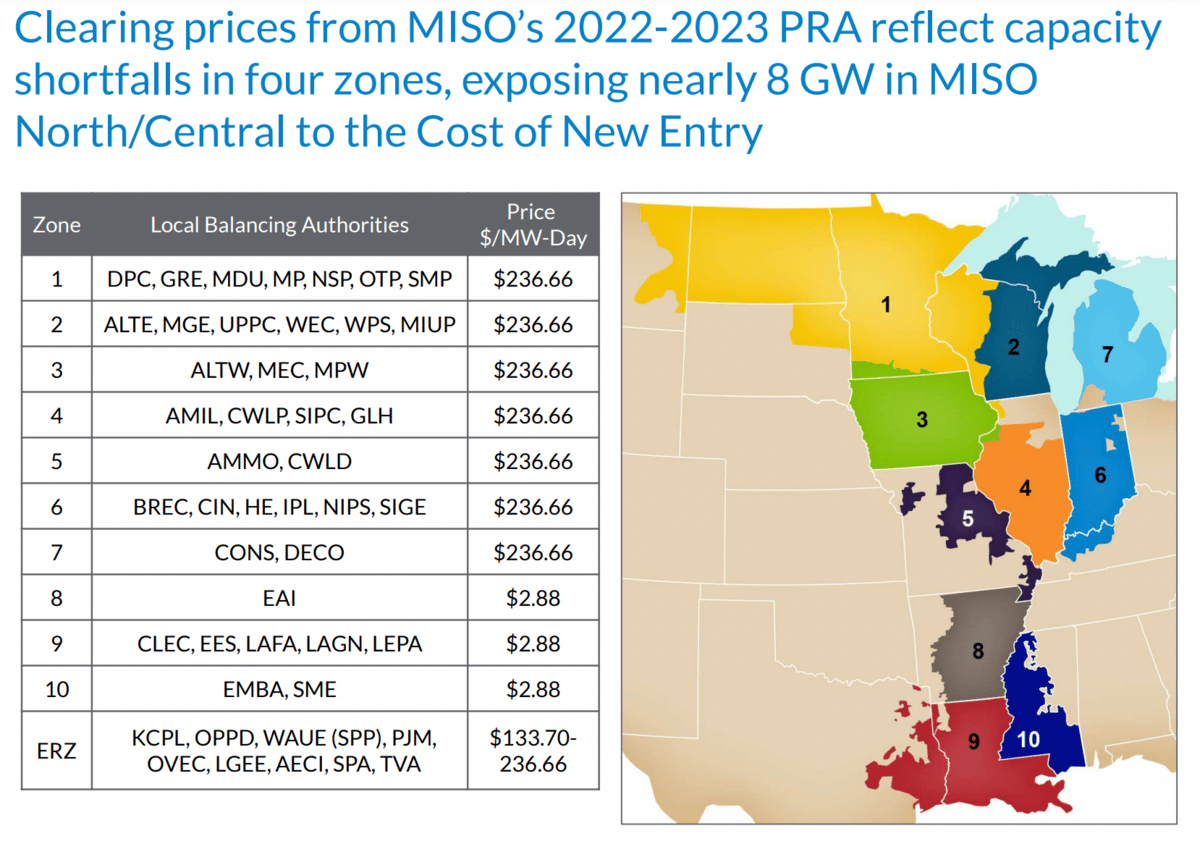

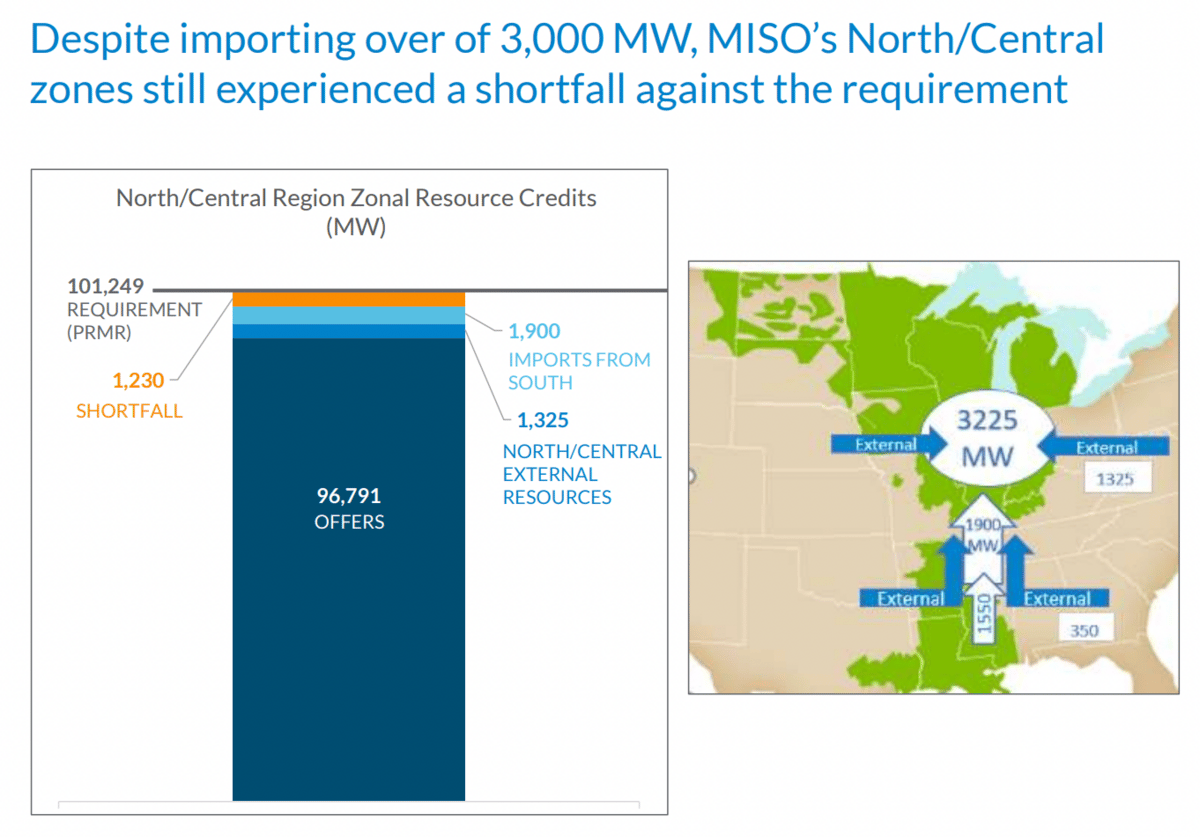

The Midcontinent Independent System witnessed huge price jumps due to a capacity shortfall. On Good Friday, MISO presented the information to stakeholders during its annual Planning Resource Auction presentation. The price jump was alarming. Utility Dive reports that the price leaped "to $236.66/MW-day from $5/MW-day a year ago across the grid operator's central and northern regions" due to an increase in projected electricity use coupled with a drop in power supply.

MISO has been a historically beleaguered ISO. As portions of the country were gathered into capacity auction areas (for more on this, read our interview with Meredith Angwin), the midcontinent region has struggled the most to create a sensible market compared to RTO areas. This is because unlike PJM, which hugs the mid-eastern seaboard, MISO did not have roots in a power pool scenario before becoming an RTO. In other words, the institutional knowledge to run a more successful market was nonexistent when MISO was formed.

David Patton, president of Potomac Economics, said during the Q&A portion of the call, "If we're going to say that reliability is an imperative, we need to fix this market because we can't expect the market to support reliability if we know that it's not designed to produce efficient economic signals."

"Our capacity market doesn't price capacity efficiently, so it sends out a clear economic signal to retire," Patton continued. Potomac found no evidence that any power plants withheld power, so the call must be coming from inside the house.

But that's not all. "Although installed capacity has increased in the last five years," reads a slide, "accredited capacity has decreased due to thermal retirements and the increasing transition to renewables." MISO has lost firm (or reliable) generators while adding more intermittent renewable capacity which cannot replace it. Thus, they're struggling to meet their capacity needs. Imports haven't been able to fill in the gap.

In a conversation with Isaac Orr of the Center of the American Experiment after the stakeholders' call, he expressed apprehension that things could be worse than MISO's already bad news. "The main theme of the story is that the problem of retirement of reliable coal and nuclear plants with high capacity accreditation with low accredited renewable capacity may be understated due to phantom firm resources."

"Phantom Firm" refers to the amount of capacity renewables MISO puts in the "firm" stack that can be used to meet peak demand.

"MISO gives wind an accreditation equivalent of 15 percent of its installed capacity, and an accreditation of 50 percent for solar," Orr explained. "The problem with this situation is that wind and solar are non-dispatchable, so they may not be generating any power when needed. This means MISO is expecting about 6 GW from renewables in its 'firm' stack that may or may not be there."

Zak Joundi, MISO executive director, said on the call that this indicates MISO may have to run to the "top of our emergency procedures" which means "controlled load sheds" to handle the shortfall in capacity.

Translation: blackouts.

AMLO's Struggle for Energy Sovereignty

Mexico's President Andres Manuel Lopez Obrador tried to nationalize the Mexican grid through a constitutional reform this week. The attempt failed, in large part due to a lack of support from the left. It needed a 2/3 majority to pass.

AMLO hoped to restore national ownership after the grid was largely privatized in 2013 for several reasons. Mexico suffered shortfall and problems before privatization. "Private companies, mainly from Spain and the United States, invested billions of dollars in Mexico to build wind, solar and gas-fired plants under the terms of the 2013 reform," reports ABC. This firmed up and cleaned up the Mexican grid.

But the state-owned utility, Comision Federal de Electricidad, lost both market share and a substantial portion of its income. Yet it still had to maintain transmission lines. And when some government plants idled, fuel oil built up until there was no place to store it.

Plus, the private generators received preferential treatment in pricing and purchasing. They weren't required to pay the CFE fees for moving power through government-owned transmission lines.

This was an especially sore spot when it came to renewables.

Two years ago, Manuel Bartlett, head of the CFE, said, “Wind and photovoltaic (plants) don’t pay the CFE for the backup. Do you think it’s fair for the CFE to subsidize these companies that don’t produce power all day?”

Bartlett maintained that wind and solar farms should have to pay for transmission as well.

“That’s not a free market, it’s theft,” he concluded.

AMLO's bill was meant to restore CFE's market share to keep it from going bankrupt under the strain. It also aimed to give government-owned generators preferential treatment. But it failed likely because renegotiating power contracts previously made with private generators, which would have been made illegal by the bill, seemed particularly unappetizing.

However, his bill to declare lithium, a key element in batteries for EVs and other devices, a strategic mineral that only the Mexican government can mine, seemed to be seeing more success. It has been approved by the lower house.

Clean Energy's Toxic Chinese Pond

SkyNews recently reported on a miles-long toxic tailing pond filled with waste from China's rare earth minerals mining industry, which provides renewables with their necessary minerals. The video's brief, but here's the rundown:

The waste is exposed to the open air and seeping into the ground.

It has ruined daily life in nearby villages--one man said that a large portion of a nearby village got cancer as a result of exposure, but it's unclear if that's actually true.

The reporters were followed by what seem to be government officials who interrupt interviews and sabotaged their drone with a GPS spoofer.

The tailings pool has been draining towards the Yellow River--its basin is home to 160 million people.

Conversation Starters

Blackouts ripped through Pakistan after energy prices spiked. The country's been weathering an energy crisis that dates back to last year along with a political crisis that has left its national coffers in disarray. The Ukraine war has exacerbated these pressures.

Japan's wholesale power price hit double the 5-year average. Its utilities are now turning away high-wattage clients.

The Department of Energy has finally offered guidance on its $6 billion in relief for endangered nuclear plants. It's unclear if Palisades in Michigan, set to switch off soon, will benefit in time.

Crom's Blessing

Laguna Verde Nuclear Power Station in Mexico.