Welcome to Grid Brief! Today, we’re looking at power generation in America’s traditional monopoly utility areas.

Monopoly Area Monday

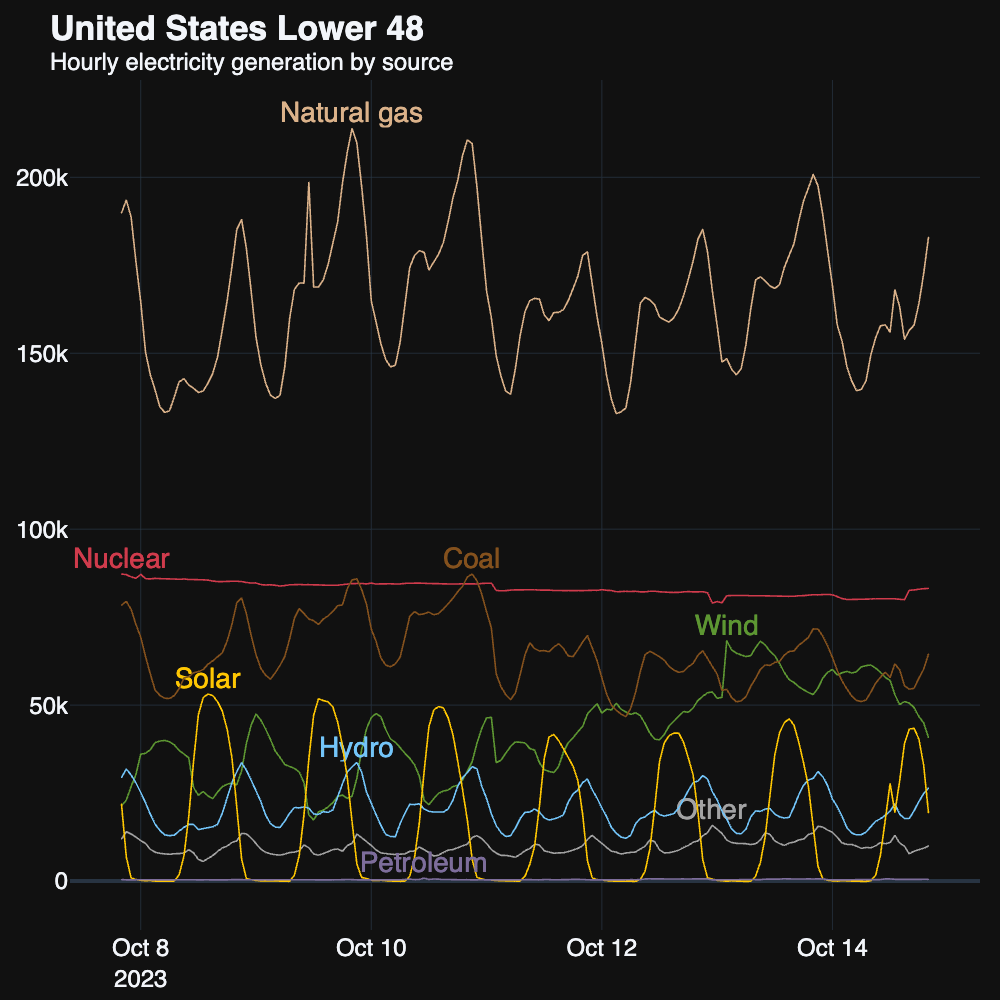

Before we dive into the monopoly areas, let’s take a look at nation-wide power generation.

The Big Three—natural gas, nuclear, and coal—stayed on top except three brief moments where wind overtook coal.

And here’s a map to orient you before we jump in:

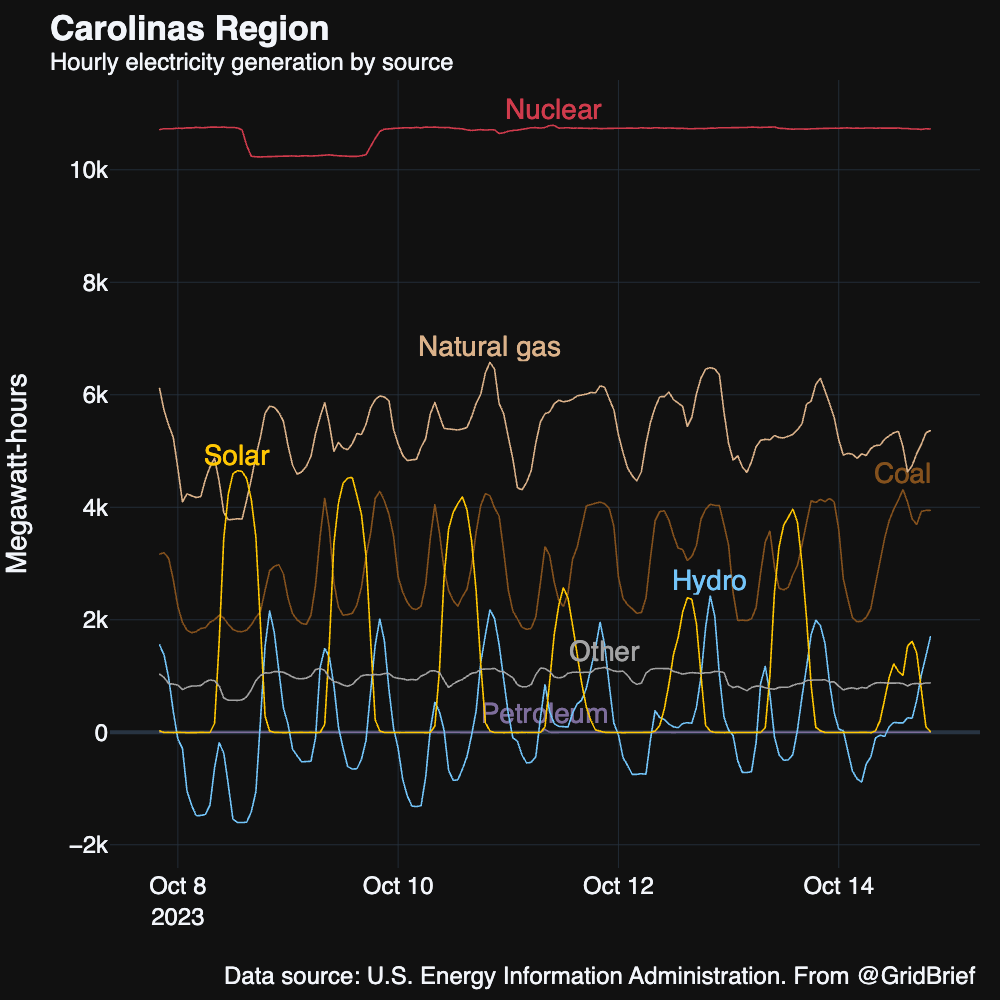

The Carolinas

Nuclear remained far and away the biggest producer in the Carolinas. Solar out-produced both natural gas and coal on October 9th. The hydro going negative is likely pumped storage facilities charging up.

As we covered earlier this week, North Carolina’s general assembly overrode its governor’s veto of a bill that slated nuclear energy as clean, thus giving it all the benefits wind and solar receive from the state.

Tennessee Valley Authority

The TVA saw heavy nuclear output over the week with natural gas in distant second. Otherwise, hydro and coal swapped third place. As in the Carolinas, hydro pumped storage charged wherever the blue line went negative.

The TVA is currently considering using coal ash covered land for a solar farm and has proposed a new gas plant in South Memphis.

Southeast

The Southeast saw a massive spike in natural gas generation on the 9th. It’s unclear if that’s a data anomaly, or emergency imports to a neighbor, or what.

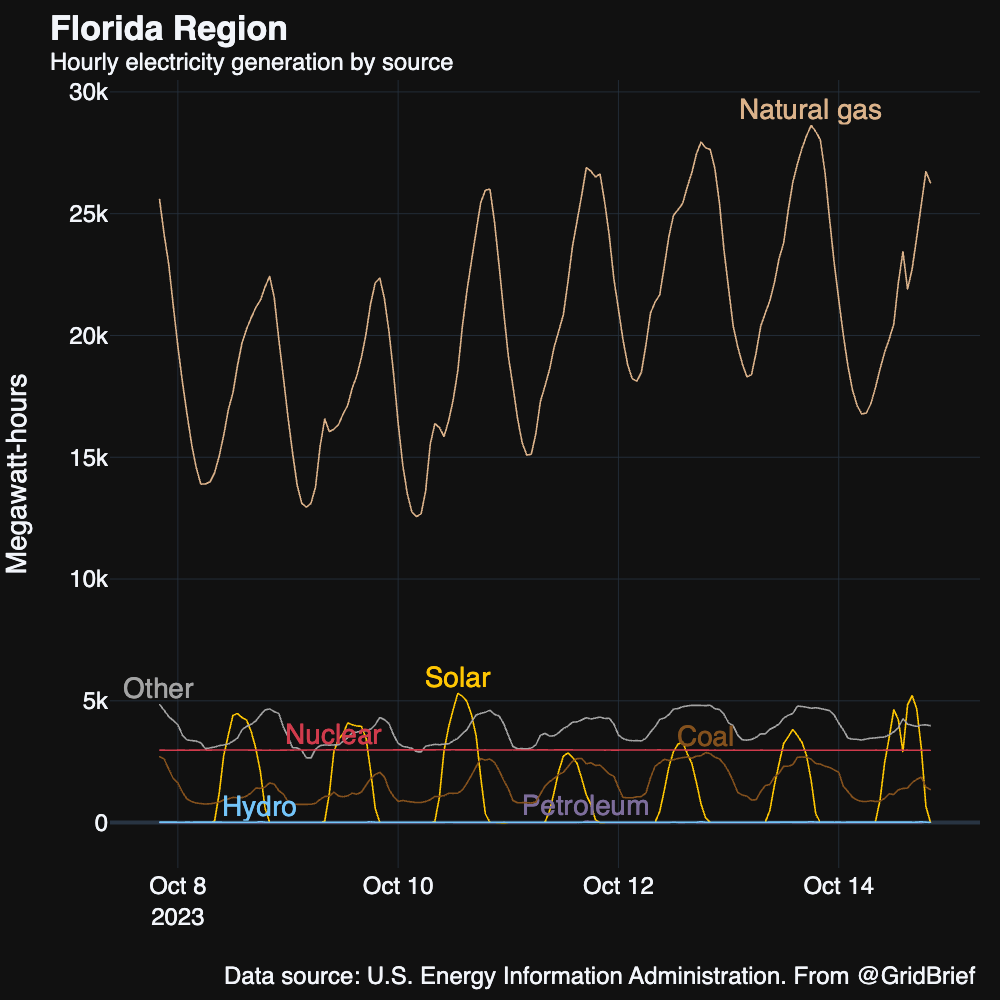

Florida

As usual, natural gas had a great week in Florida. Solar also has some productive moments where it outworked both nuclear and “other” which were the reliable second and third place

“Other” had a good week, too. Here’s what the EIA has to say about that resource category: “To maintain generator confidentiality, generation may sometimes be reported in the Other category if too few generators are reported for a particular energy source category.”

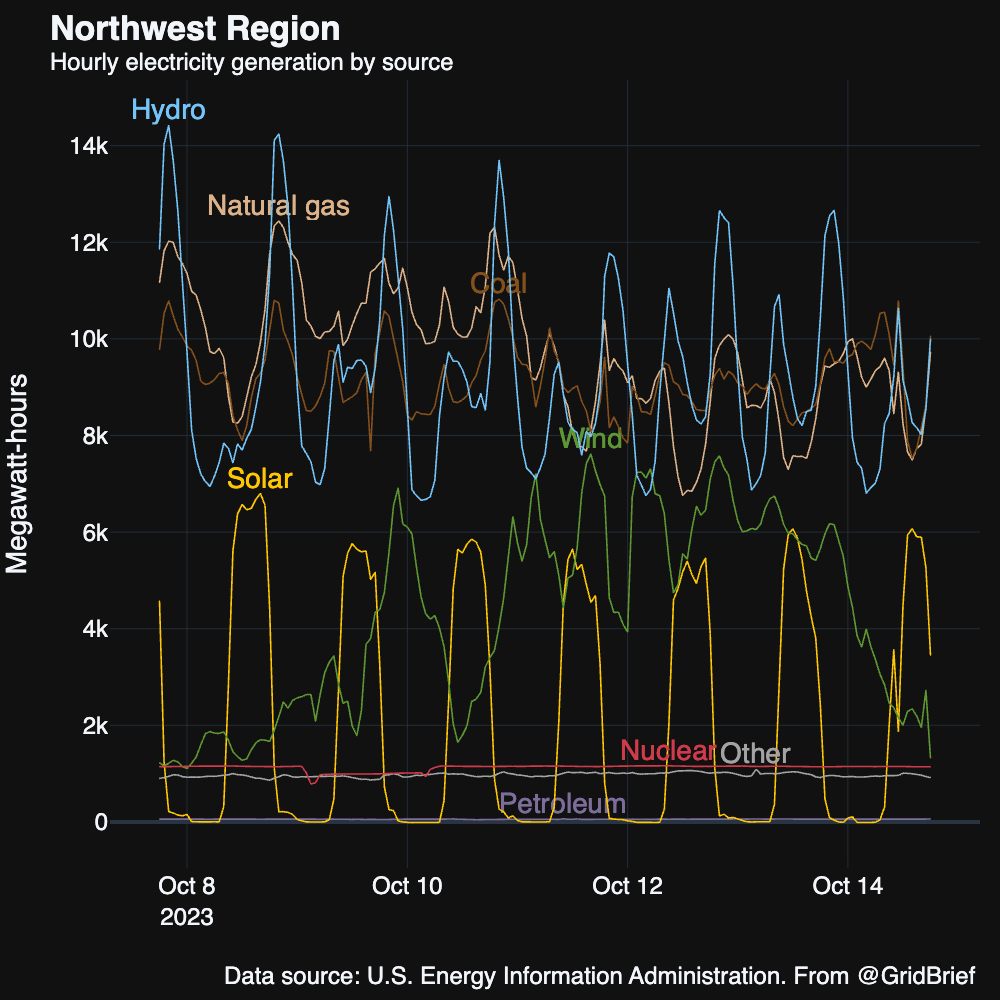

Northwest

The Northwest saw its usual top three performers trade paint for first place: hydro, natural gas, and coal. Wind roared upward over the course of the week.

The Northwest Power Council met on October 12th to report that the region is making progress on its energy efficiency goals. Seattle City Light announced that it will raise rates to recoup on the millions it lost in hydro production over due to wildfires and a hot summer.

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

Conversation Starters

Chinese diesel exports are set to bail out the West this winter. “As the northern hemisphere heads into winter, the U.S. and European oil sectors are counting on rising exports from Chinese refineries to ease tight global supplies of diesel, heating oil and jet fuel. China is the world's top oil importer and largest energy consumer. Typically, energy has flowed into China, not out of it. Growing Chinese refining capacity has, however, made the country an important fuel exporter in recent years,” reports Reuters. “Chinese supplies were key in 2022 after global oil trade was disrupted by Russia's invasion of Ukraine and subsequent sanctions imposed by many of the world's top importers on imports of Russian crude and fuel. Along with mild winter weather in much of the northern hemisphere, Chinese fuel exports helped avert widespread shortages of diesel, heating oil and gasoil.”

North Asian LNG buyers hit pause on purchases. “Liquefied natural gas buyers in North Asia are pausing plans to procure additional fuel for winter after the conflict between Israel and Hamas compounded supply risks, boosting global prices. Following a jump in European prices, Asian spot LNG shipments are being offered in the range of the high-$10s per million British thermal units, according to traders. That is the highest price in about eight months,” reports Bloomberg. “Prices have rallied as the Israel-Hamas war threatens to embroil the Middle East, home to major gas exporters and trade chokepoints. Meanwhile, the market is monitoring discussions between Chevron Corp. and Australian worker unions to avoid LNG strikes that are set to begin next week.”

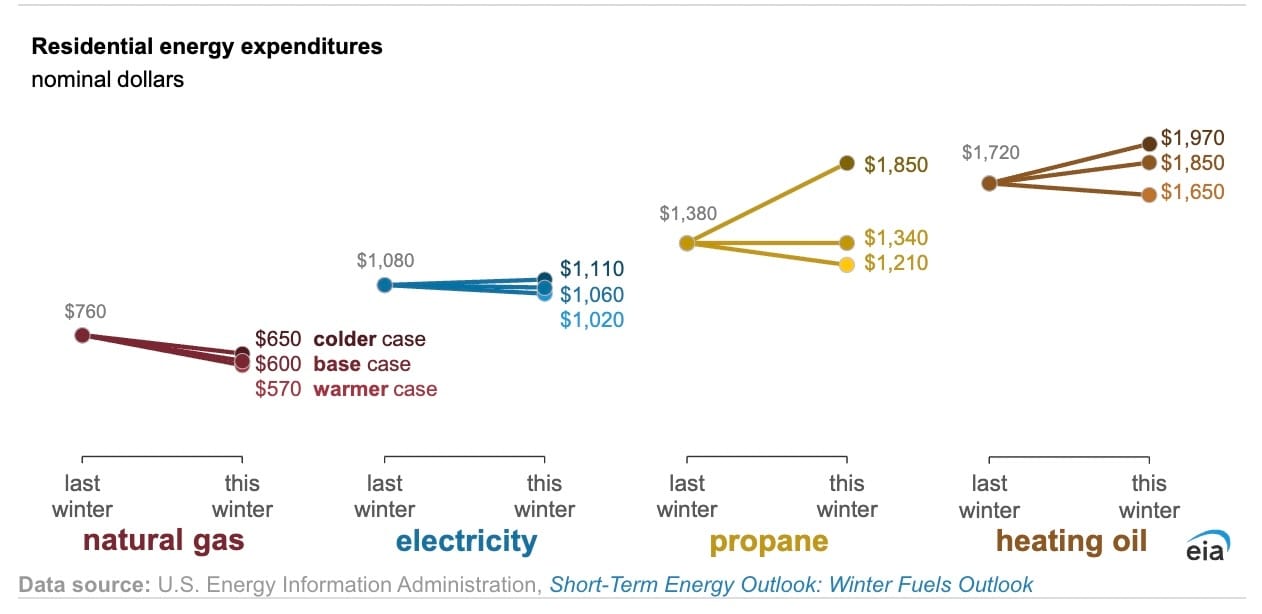

The Energy Information Administration expects American households to pay less this winter than last for heating. “We expect wholesale natural gas prices to be 14% lower this winter than last winter, driven by higher U.S. natural gas production and robust natural gas inventories, leading to 21% lower retail natural gas prices for households. Because natural gas is the most common fuel used to generate electricity in the United States, we expect that retail electricity prices will also be down slightly (2%) from last year, as the lower price that power plants pay for natural gas passes through to retail electricity rates,” reports the EIA.

Crom’s Blessing

Interested in sponsoring Grid Brief?

Email [email protected] for our media kit to learn more about sponsorship opportunities.