Welcome to Grid Brief! Today, we’re looking at power generation in America’s traditional monopoly areas.

Monopoly Area Monday

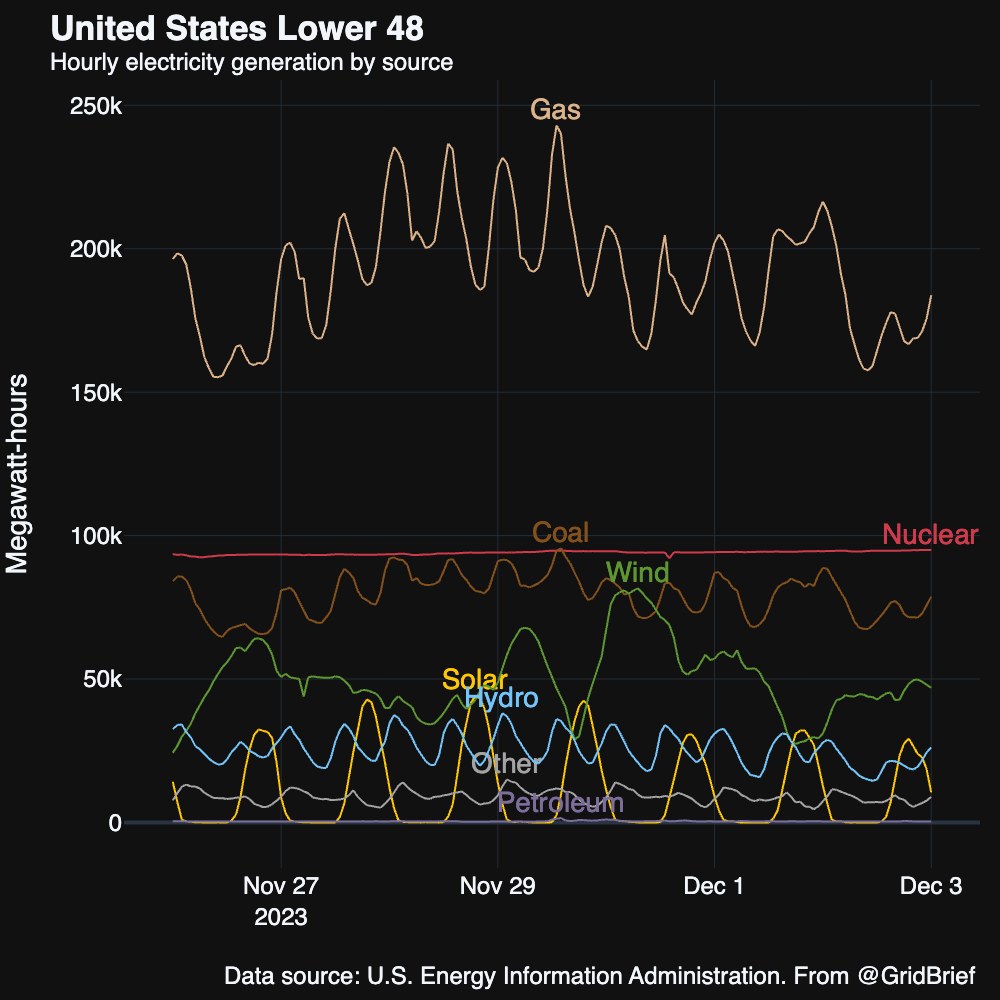

Here’s a snapshot of this week’s nation-wide generation:

Natural gas, nuclear, and coal were the top three generators across the country, but wind had a productive week, too. It peaked over coal on November 30.

And here’s the map to orient you as we move through the monopoly regions:

Carolinas

Nuclear retained its position as the top generator in the Carolinas, but natural gas had a big week, too. Coal traded second place with natural gas as the week rolled on, but on November 28, solar peaked above it. See the hydro going negative: that’s likely hydro pumped storage.

TVA

A surprising week in for America’s largest public power entity: natural gas ramped above nuclear, which is usually the top generator there. The natural gas ramp coincided with a period of export to the Midwest and a general uptick in demand in the TVA footprint. Hydro and coal swapped third place.

The TVA’s Bull Run coal plant in Claxton, TN retired this week. According to the TVA, Bull Run generated 270 million megawatt hours of electricity between 1967 when it switched on and when it retired. The TVA has yet to disclose its plans for the site that hosted the plant. Bull Run’s closure comes at a time when coal retirements threaten system reliability nation-wide.

Southeast

Natural gas, coal, and nuclear were the biggest generators in the Southeast.

Southern company, which serves this entire region, has recently decided to take advantage of the Inflation Reduction Act’s subsidies for renewable energy. However, the 350 MW of solar capacity Southern is building is not located in the South, but in Texas and Wyoming, both of which participate in restructured power markets.

Florida

Natural gas was the top dog in the sunshine state. It was a brawl between solar, other, and nuclear for the second and third spots throughout the week.

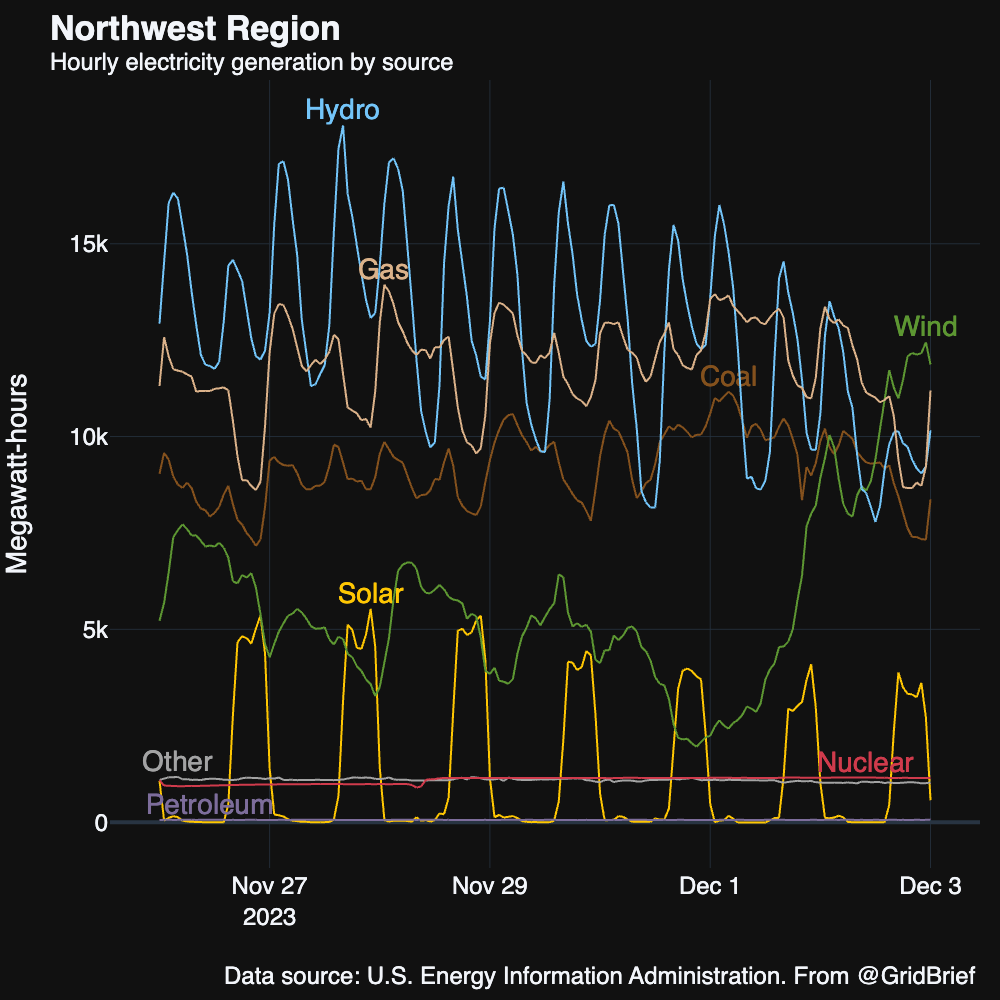

Northwest

Hydro, natural gas, and coal were the top three generators in the Northwest, often trading places. Wind roared up into first place by the end of the week.

Hydrodam controversy has rippled through the Pacific Northwest as a secret deal between several indigenous tribes and the Biden administration was leaked to the press. The draft agreement between Washington, Oregon, four native tribes, and the federal government would green light over $1 billion to breach four hydro dams in the region.

“Among spending in the draft agreement is $5 million for Pacific Northwest National Laboratory to identify the best ways to meet the region’s energy resource needs and clean energy goals while accounting for breaching of the dams and the loss of their hydropower,” reports the News Tribune.

The dam’s power customers were not included in the parties that brokered this draft agreement.

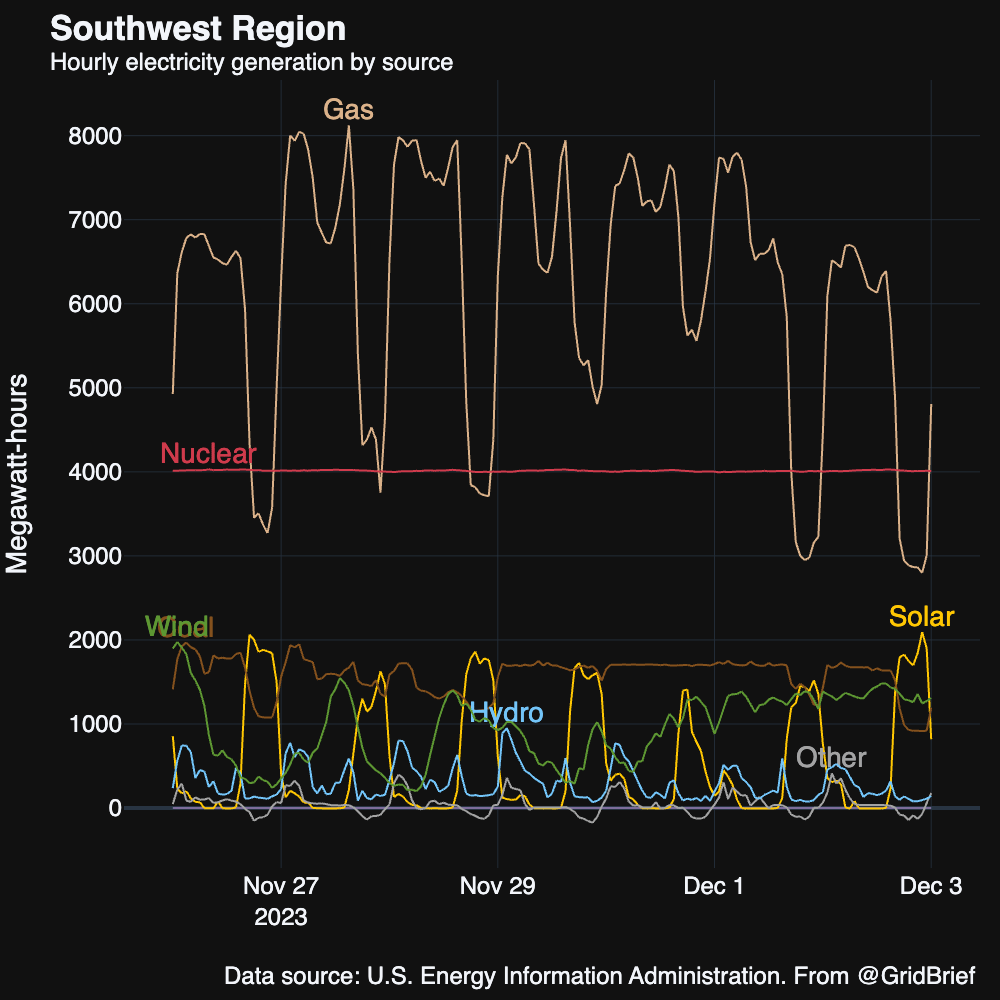

Southwest

Natural gas and nuclear were the top two generators in the Southwest. Coal, wind, and solar all battled for third place.

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

Conversation Starters

Brookfield’s bid for Origin Energy is expected to fail. “The outcome of a Brookfield consortium's $10.6 billion bid for Australia's Origin Energy will be officially known on Monday, with investors expected to vote down its year-long attempt to buy the country's largest power retailer. Origin’s largest shareholder, A$300 billion ($198.36 billion) pension fund AustralianSuper, has said it would reject the A$9.39 per share offer,” reports Reuters. “AustralianSuper owns about 17% of Origin, which should be enough to block the bid that requires at least 75% support from the votes cast at the investor meeting in Sydney. Origin said on Nov. 23, when the vote was adjourned after the consortium lodged a revised proposal, that proxy votes showed the bid would have failed to win had the meeting gone ahead. Origin shares closed at A$8.19 on Friday, the lowest in about nine months.”

COP28 president dowses fossil fuel phase-out dreams. “Newly reported comments by COP28 President Sultan Al Jaber, which throw cold water on a potential commitment to phase out fossil fuels, were condemned by activists and observers at the UN climate summit in Dubai,” reports Bloomberg. “Al Jaber’s remarks deepened controversy around the COP28 leader — who is also the chief executive officer of the Abu Dhabi National Oil Co. — and raised new questions over whether the conference will be able to unite behind a strong pledge targeting the elimination of fossil fuels. Just before the summit started, a British Broadcasting Corp. story alleged Al Jaber was ready to use COP meetings to discuss oil business, a claim he denies.”

Japan abstains from coal phaseout commitment. “It has been revealed that the Japanese government will not participate in the upcoming coalition led by France and the United States to ban coal-fired power generation,” reports Nikkei. “The coalition is expected to include a timeline for decommissioning existing power plants. Japan, which relies on coal-fired power for a certain amount of its domestic power generation, is not in a position to indicate when it will abolish coal-fired power, so it will postpone joining the coalition of the willing.” [translated w/ Google]

Crom’s Blessing

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.