Welcome to Grid Brief! Today, we’re looking at power generation in America’s traditional monopoly areas with relevant news items.

Monopoly Area Monday

Here’s a snapshot of generation nation-wide:

Total generation stayed within its familiar spring bounds, with natural gas and nuclear as the top two generations nation-wide.

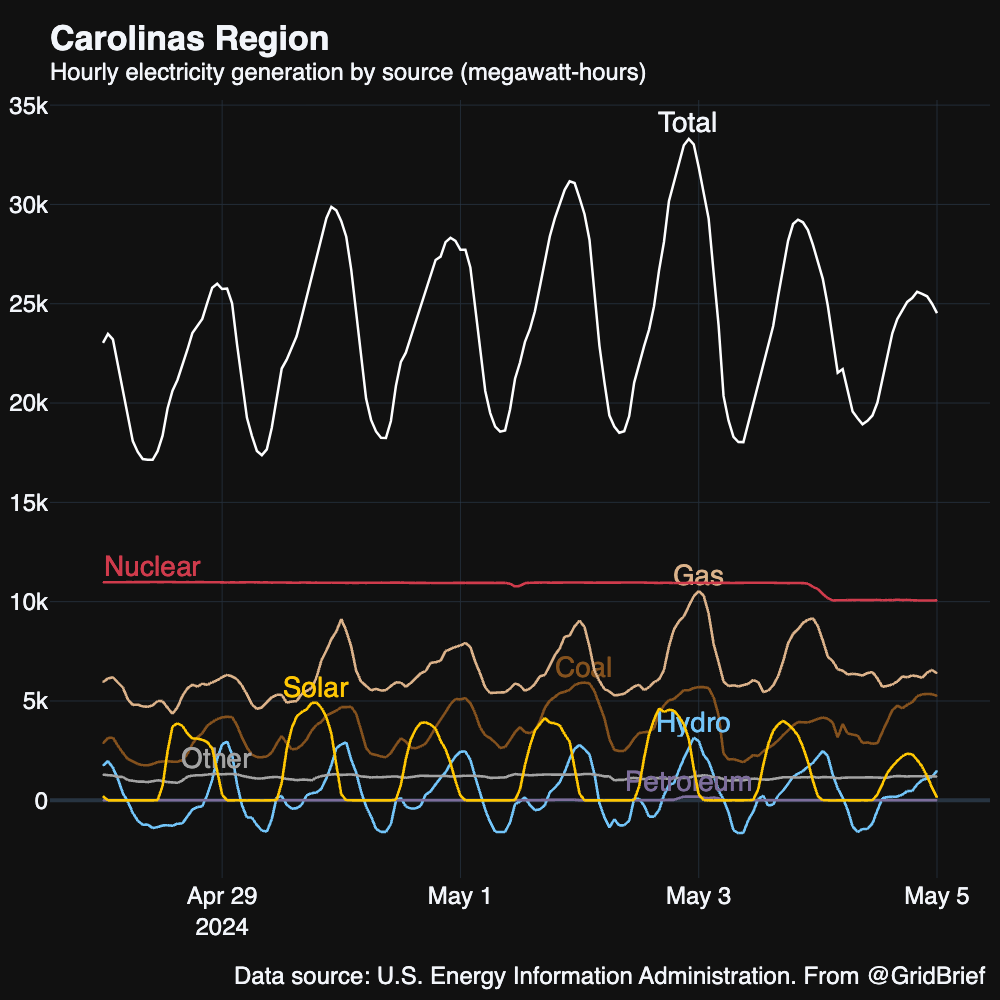

Carolinas

The Carolinas saw total generation rise and fall, with gas and coal ramping under nuclear to keep the lights on.

TVA

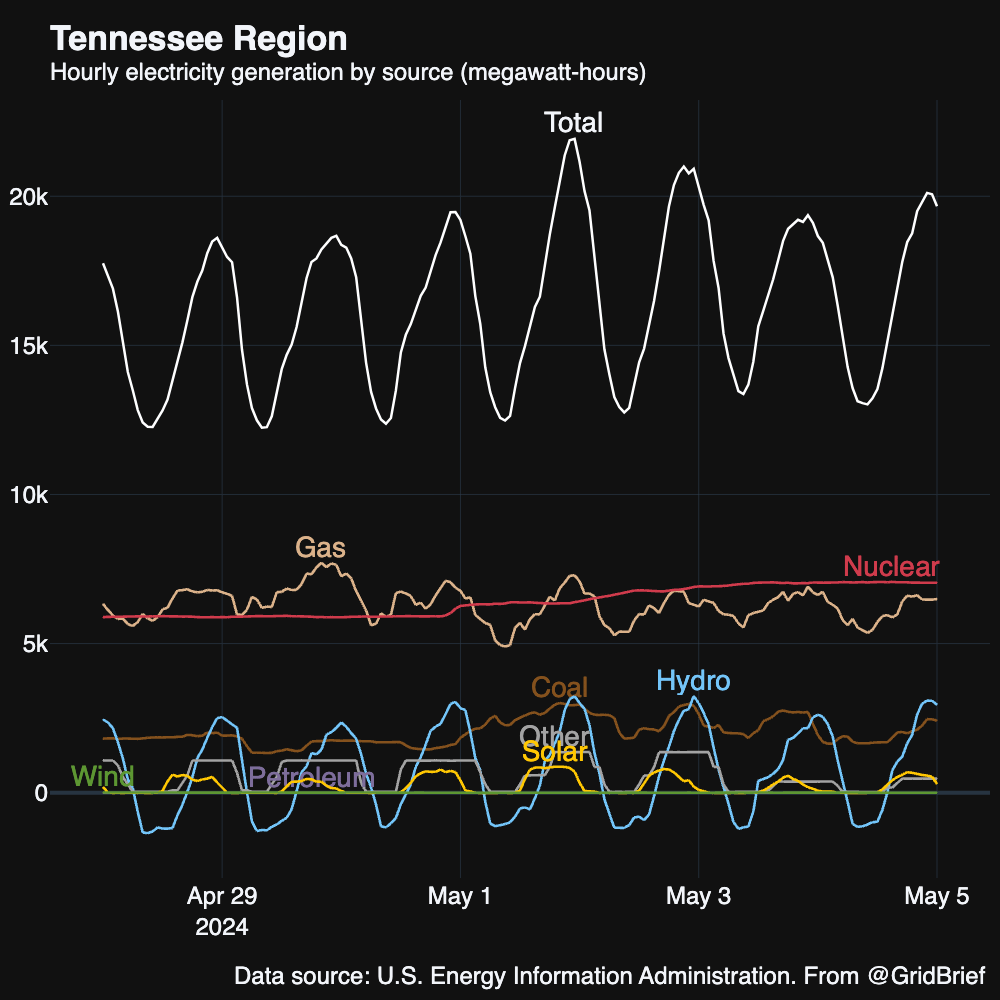

Natural gas and nuclear were the workhorses of America’s largest public power entity.

Green groups are suing the TVA to halt construction on its 32-mile natural gas pipeline that would connect to the Cumberland power plant. “The pipeline, which the Federal Energy Regulatory Commission (FERC) approved in January, would cut through Dickson, Houston and Stewart counties to reach the plant in Cumberland City. TVA announced last January that it is transitioning the facility from coal to a gas-fired plant,” reports the Nashville Tennessean. “The Sierra Club and Appalachian Voices, represented by the Southern Environmental Law Center, are suing the commission in the federal appeals court in Washington to try to stop the pipeline. The lawsuit was filed on Monday.”

The TVA has also invested $3 million into energy efficiency programs for Southeastern schools.

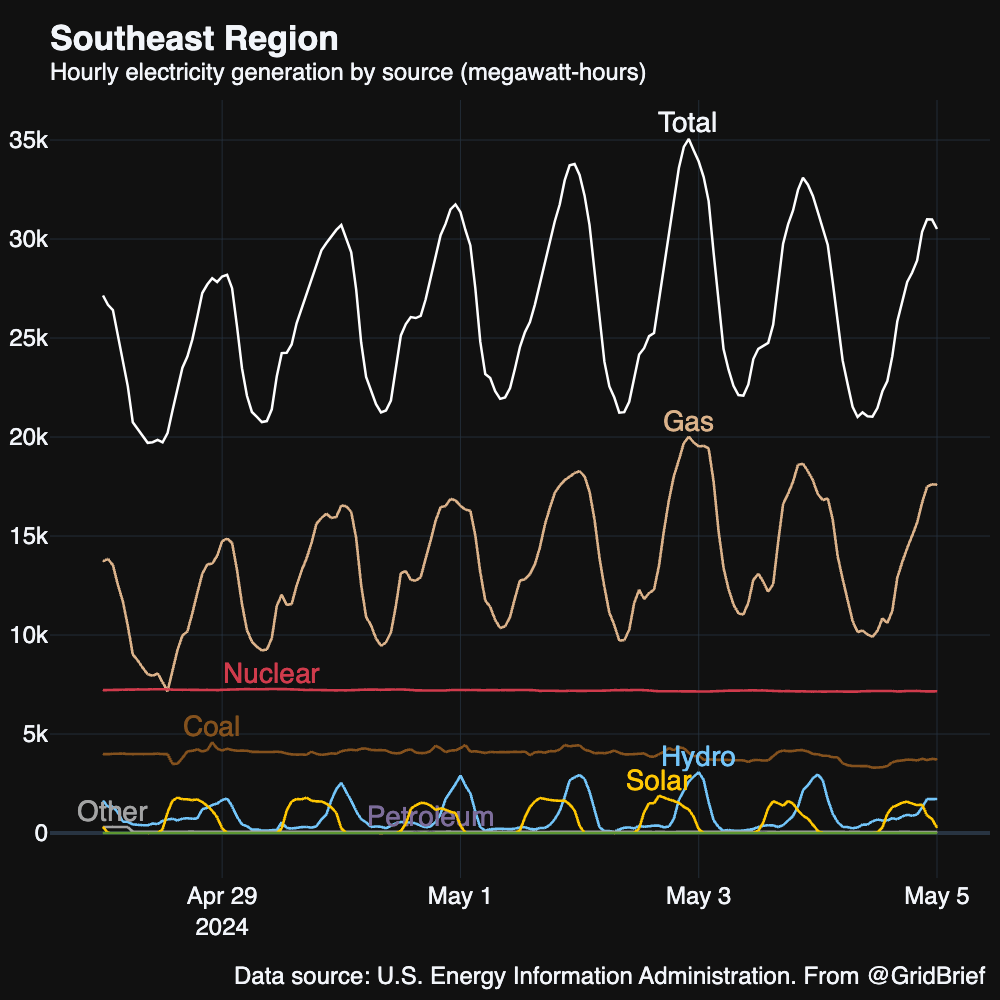

Southeast

Natural gas, nuclear, and coal retained their spots in the Southeast’s top three.

Thanks to a 12% rise in electricity sales to data centers, Southern Co. beat its Q1 profit estimates. The news comes just a few days after the Unit 4 reactor at its Vogtle plant entered commercial operations.

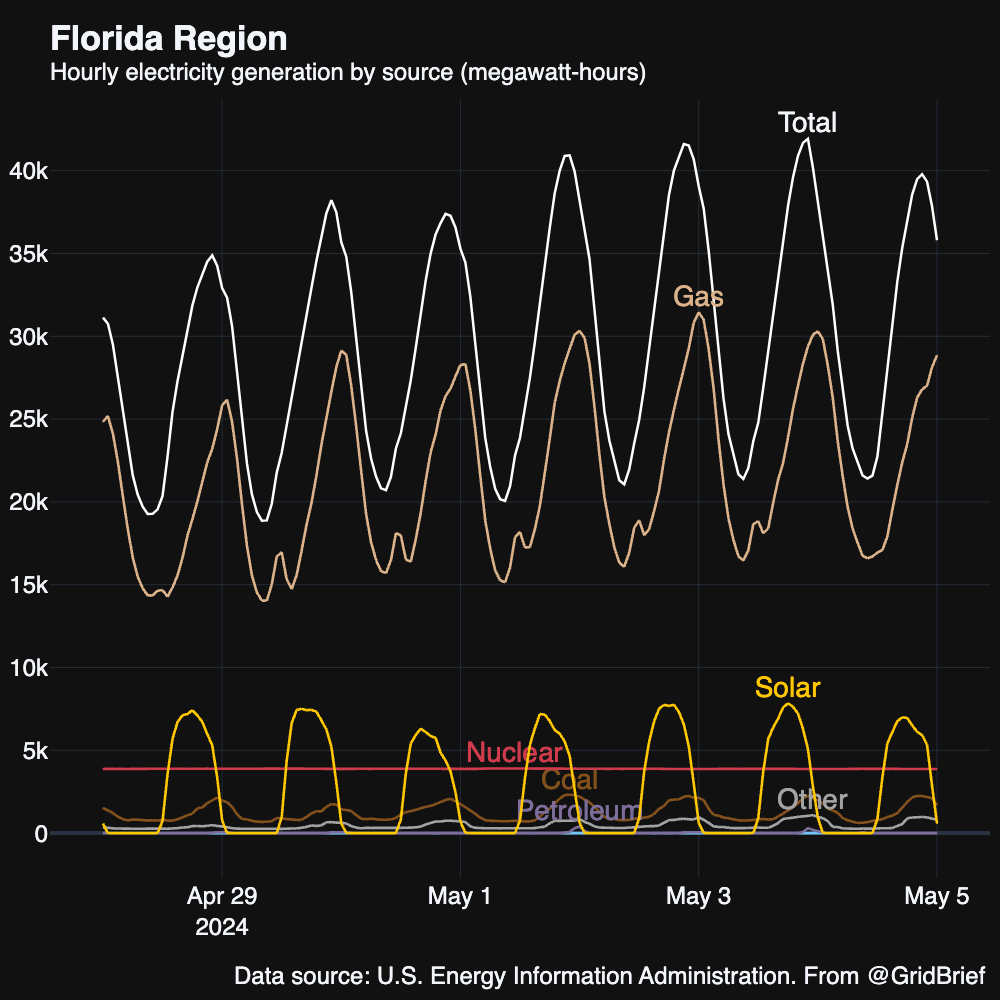

Florida

Florida’s basic mix—an eye-popping share of gas generation backgrounded by solar and nuclear—carried the Sunshine State through a week of rising load.

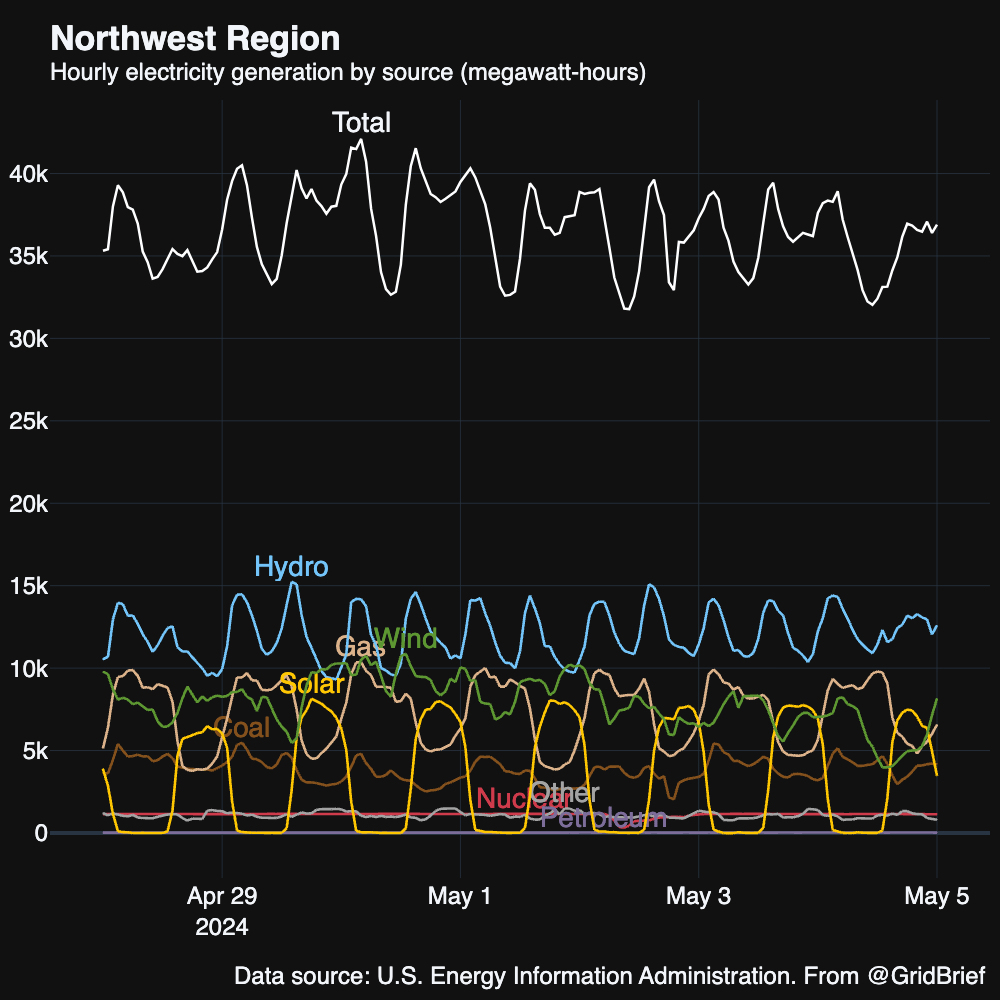

Northwest

Low load in the Northwest was satisfied primarily by hydro, but its peers were never far behind.

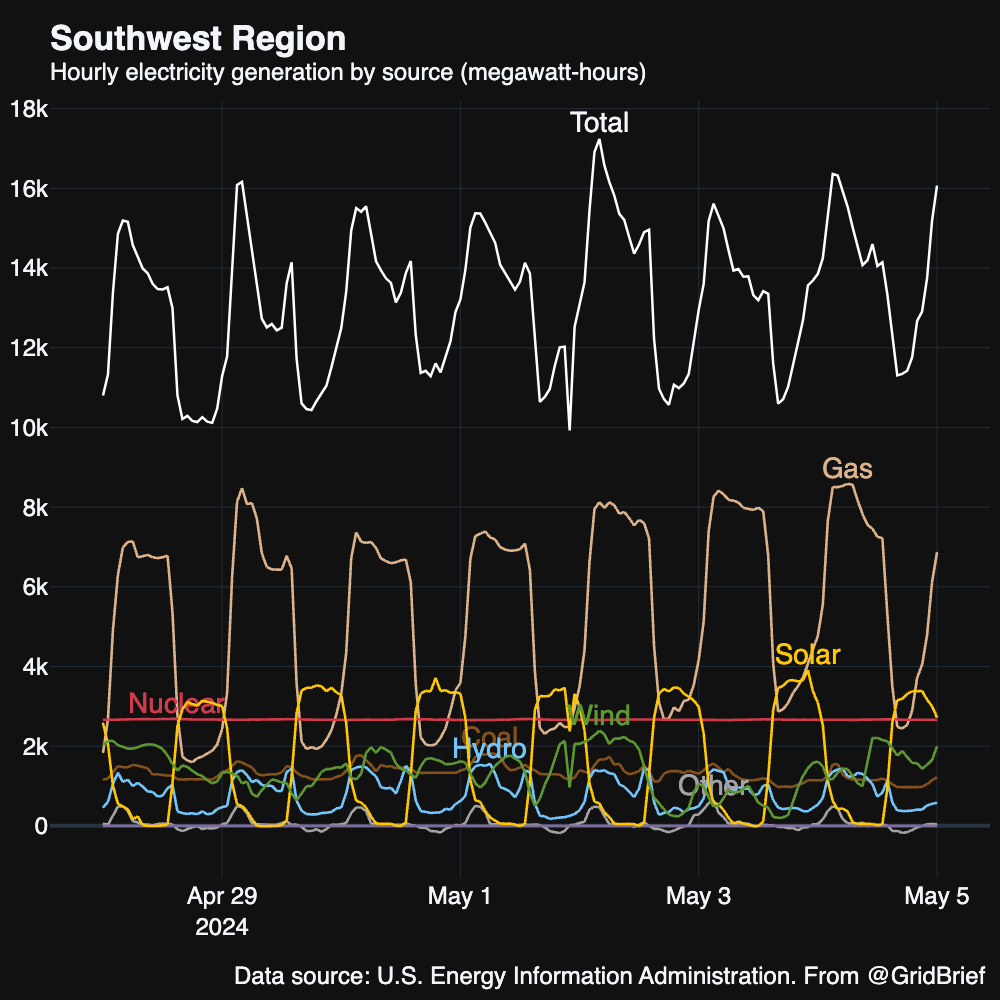

Southwest

Natural gas, nuclear, and solar kept the Southwest’s lights on.

Last Thursdays, Arizona Public Service reported first quarter net income of $16.9 million.

“In the first quarter, APS saw 1.8% year-over-year growth in the number of its retail customers, and weather-normalized sales growth of 5.9%, the company said. State regulators in February approved new rates which went into effect last month,” reports Utility Dive. “The company says it expects 2024 weather-normalized retail electricity sales to grow 2% to 4%, driven by new manufacturing facilities and several large data centers. Longer-term, new production facilities built by Taiwan Semiconductor Manufacturing Co. will further increase sales, officials said.”

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

Russia did $1 billion in damages to Ukraine’s power system. “Recent Russian massive drone and missile attacks on Ukrainian energy system have caused more than $1 billion worth of damage to the sector, Ukraine's energy minister German Galushchenko said on Sunday. Since March 22, the Russian forces have been attacking Ukrainian thermal and hydropower stations as well as main networks on an almost daily basis, leading to blackouts in many regions,” reports Reuters. “‘Today, we are talking about the amounts of losses for more than a billion dollars. But the attacks continue, and it is obvious that the losses will grow,’ Galushchenko said in a statement. Galushchenko said the main damage was to thermal and hydro generation facilities, as well as power transmission systems.”

Egypt temporarily acquires a floating LNG plant to avoid summer shortfalls. “Höegh LNG, Australian Industrial Energy (AIE), and Egyptian Natural Gas Holding (EGAS) have signed an agreement to deploy the FSRU Höegh Galleon to Egypt. The FSRU will be deployed to support energy security in Egypt. The unit will be located in Ain Sokhna for a likely period of 19-20 months, after which it will be deployed to AIE’s LNG terminal currently under construction at Port Kembla, Australia,” reports Splash247. “Höegh LNG and AIE agreed on a 15-year charter agreement for the 2019-built FSRU in June 2022. The Australian firm has early termination options after years 5 and 10. The AIE charter for the 170,000 cbm unit officially started in late 2023 even though the Port Kembla terminal was not yet complete. The agreement with EGAS is for an interim period of June 2024 to February 2026.”

Gorgon output will take weeks to restore. “Chevron is repairing a mechanical fault in a turbine at one of the three LNG production trains at its Gorgon LNG facility in Australia, with works expected to take weeks, the local unit of the U.S. supermajor told LNG Prime on Friday,” reports Oilprice.com. “The fault at the turbine occurred in the afternoon local time on Tuesday, April 30, the company said on Friday.

Chevron Australia has already started working to repair the fault, with works expected to ‘take a number of weeks,’ a spokesperson for Chevron Australia told LNG Prime.”

Crom’s Blessing

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!