Welcome to Grid Brief! Today, we’re looking at power generation in America’s traditional monopoly areas with relevant news items.

Monopoly Area Monday

Here’s a snapshot of generation nation-wide:

Natural gas and nuclear were the top two generator in America, while wind and coal swapped third place. Total generation fell over the week.

And here’s a map to orient you as we move through the areas:

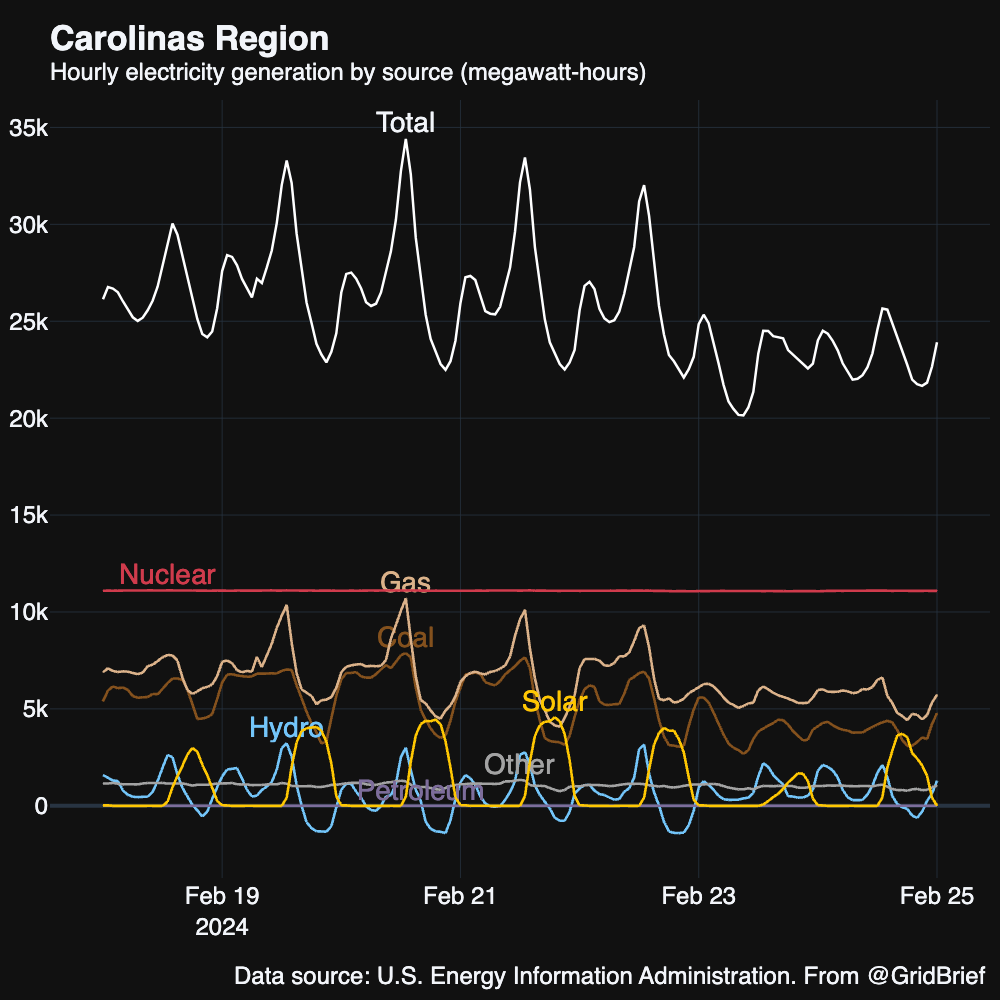

Carolinas

Nuclear, gas, and coal kept the Carolinas humming, though solar jumped above coal several times.

Duke Energy is hitting the brakes on its climate goals.

“North Carolina’s policy targets for carbon emission reduction are expected to face challenges as Duke Energy seeks to postpone its originally proposed goal by five years. While the precise environmental impact of the delay remains uncertain, experts caution that it could undermine North Carolina’s policy targets to reduce carbon emissions and hinder progress toward combating climate change,” reports the Winston-Salem Journal. “In its newly proposed plan submitted to the Utilities Commission last month, Duke Energy unveiled a strategy aimed at addressing a projected surge in electricity demand while navigating mandates to lower carbon emissions from the state. Central to this plan is using natural gas plants capable of running on hydrogen, as well as incorporating more solar power and electricity storage in batteries.”

TVA

Natural gas ramped above nuclear—TVA’s usual number one—to meet an increase in demand at the beginning of the week. As total generation fell, the TVA’s generation pattern conformed to precedent.

The TVA is pioneering fusion energy.

“US fusion energy developer Type One Energy Group has announced plans to build Infinity One - its stellarator fusion prototype machine - at Tennessee Valley Authority's Bull Run Fossil Plant in Clinton, Tennessee,” reports World Nuclear News. “The company - currently based in Madison, Wisconsin - will establish its headquarters in East Tennessee as part of Project Infinity. The project is the result of a tri-party memorandum of understanding signed in 2023 between Tennessee Valley Authority (TVA), Type One Energy and the US Department of Energy's Oak Ridge National Laboratory (ORNL), in which the partners expressed an interest in the successful development and commercialisation of economic and practical fusion energy technologies.”

Southeast

Natural gas, nuclear, and coal were the kings of the Southeast.

The Environmental Protection Agency has raised concerns about Southern Co.’s coal ash disposal plan. “In the letter last week, shared with The Hill, EPA officials expressed concerns with Georgia Power’s plan for disposal of coal ash from retired Plant Hammond, near the town of Rome. Coal-fired power plants prevent the release of waste into the atmosphere through the use of ash ponds, or pits containing ash and water. However, environmentalists have warned such ponds pose a major threat to groundwater,” reports The Hill.

Florida

Natural gas, nuclear, and solar powered the Sunshine State.

Northwest

The Northwest saw its usual scrum of hydro, natural gas, coal, and wind.

The Bonneville Power Administration missed its Q1 revenue target by nearly $200 million.

“The administration is forecasting a negative $102 million in net revenues, which is $197 million below its performance target, according to a press release,” reports The Peninsula Daily News. “The administration points to increased power purchases due to the dry winter for the decrease in revenues this quarter.”

Southwest

Natural gas and nuclear were the top generation in the Southwest, while coal, wind, and solar duked it out for third.

Some Arizonans are about to see their power bills rise.

“About 1.4 million customers in Arizona will be paying more for electricity now that regulators have approved a rate hike proposed by the state’s largest utility, and an extra fee for customers with rooftop solar systems is prompting more criticism,” reports the AP. “The average monthly bill for Arizona Public Service Co. residential customers will increase by about $10 to $12 starting in March, and those with solar panels will be on the hook for an extra $2.50 to $3 per month under the changes adopted by the Arizona Corporation Commission following an hourslong hearing Thursday.”

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

DOE halts bitcoin mining survey. “The U.S. Department of Energy has agreed to temporarily suspend its mandatory survey of cryptocurrency miner energy use following a lawsuit by prominent miner Riot Blockchain and an industry group, according to a notice filed on Friday with the United States District Court for the Western District of Texas Waco Division,” reports Reuters. “The DOE's statistical arm, the Energy Information Administration, will halt its survey and sequester the data received after it began collecting details from bitcoin miners early this month, the notice said.”

FERC hands more power to tribes over hydropower. “The Federal Energy Regulatory Commission (FERC) has granted Native American tribes more power to block hydropower projects on their lands if they oppose the plans,” reports Oilprice.com. “FERC has previously applied the general policy of granting permits to planned hydropower projects even where Tribes have raised issues over the impact of such projects, which require enormous amounts of water in areas such as the Southwest, where water is scarce. However, FERC denied last week preliminary permit applications for seven pumped storage hydroelectric projects proposed on Navajo Nation land, and said it has recently revised the ‘general policy of granting permits.’”

Scotland peers into the future. “A boom in Scottish diesel imports offers a glimpse into the country’s future energy security ahead of the potential closure of its only oil refinery,” reports Bloomberg. “Imports to a key port on the east coast surged to the highest in at least eight years in January, data from analytics firm Vortexa Ltd. show. Usually, much of the nation’s diesel is processed from crude at Petroineos’s Grangemouth plant, which may close as soon as next year after losses over the past decade. The sudden flurry of imports highlights why the potential closure of the refinery outside Edinburgh has become a political hot potato. The site accounts for about 13% of the UK’s fuel production and contributes to about 4% of Scotland’s economy, while also supplying fuel into northern England and parts of Northern Ireland. A shutdown would increase Scotland’s reliance on imports.”

Crom’s Blessing

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!