Welcome to Grid Brief! Today, we’re looking at power generation in America’s traditional monopoly areas with relevant news items.

Monopoly Area Monday

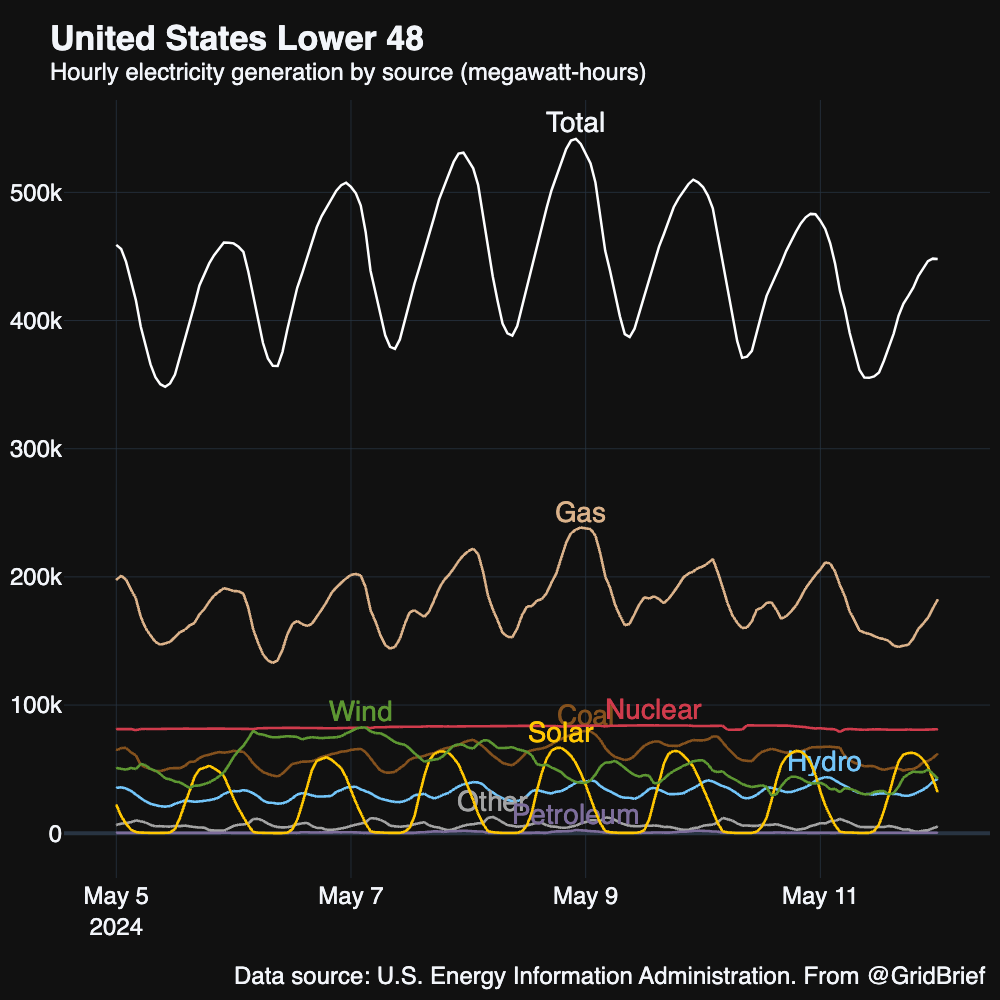

Here’s a snapshot of generation nation-wide:

And here’s a map to orient you as we move through the areas:

Carolinas

Nuclear, natural gas, and coal were the stars of the Carolinas.

The South Carolina Congress is battling over a bill that seeks to handle the state’s growing power demand. At issue is how much or how little the bill should help the state’s utilities.

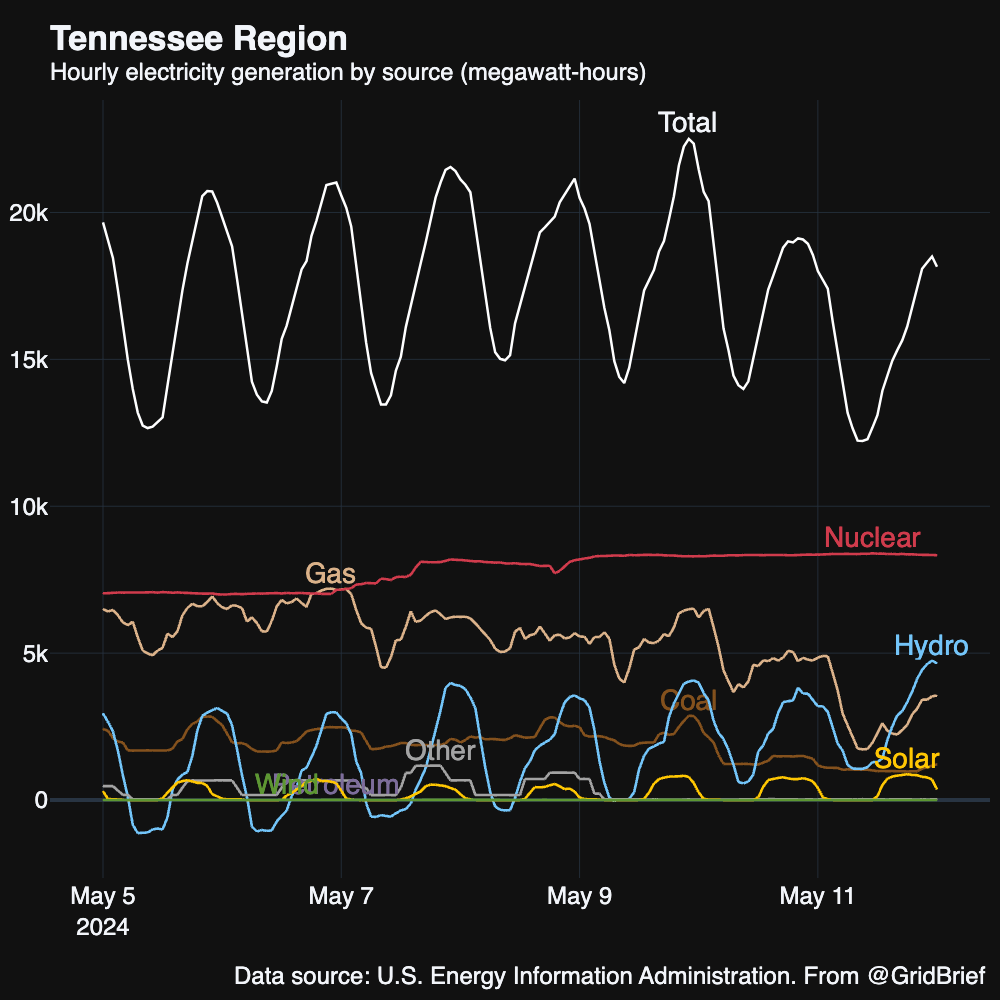

TVA

Nuclear and natural gas were the top two generators in America’s largest public power entity’s footprint.

In response to heavy rainstorms, the TVA has started to spill water from all nine of its dams.

“The nation's largest public utility on Thursday pledged to be more transparent after it took months to disclose that a general budget vote by its board last year also gave the CEO the final decision over several proposed natural gas power plants,” reports AP.

Southeast

Natural gas, nuclear, and coal were the most prolific generators in the Southeast.

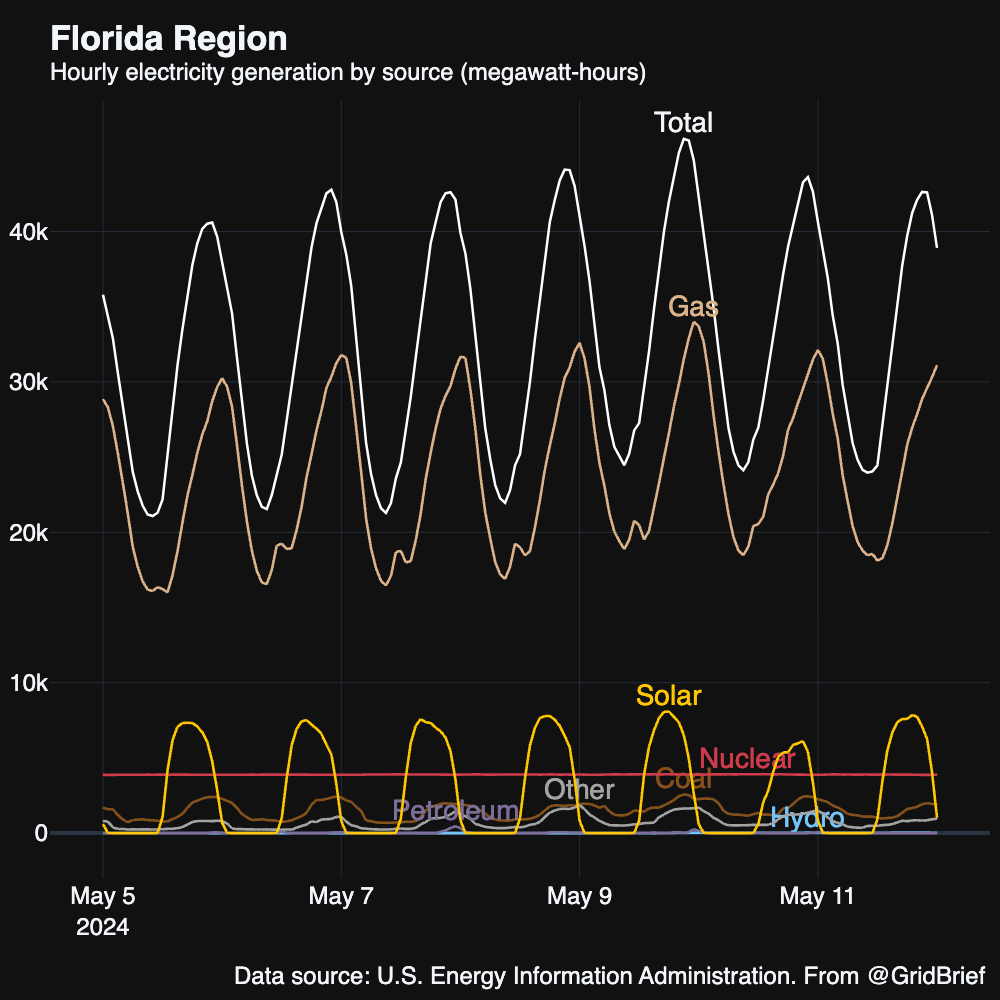

Florida

Natural gas, nuclear, and solar kept the Sunshine State humming.

Gov. Ron DeSantis has declared an emergency in 12 of Florida’s northern counties after devastating storms have left tens of thousands of Floridians in the dark.

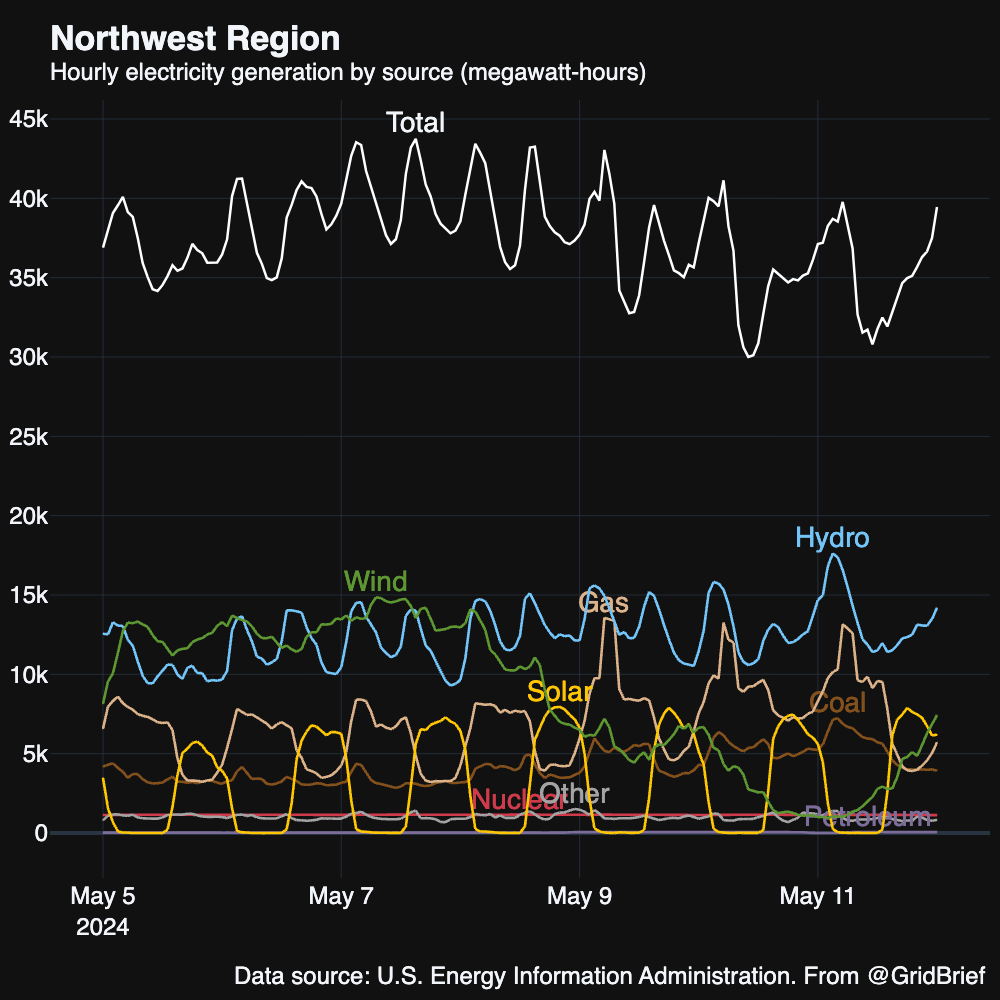

Northwest

The Northwest saw its usual rambunctious variety of power generators in its top three.

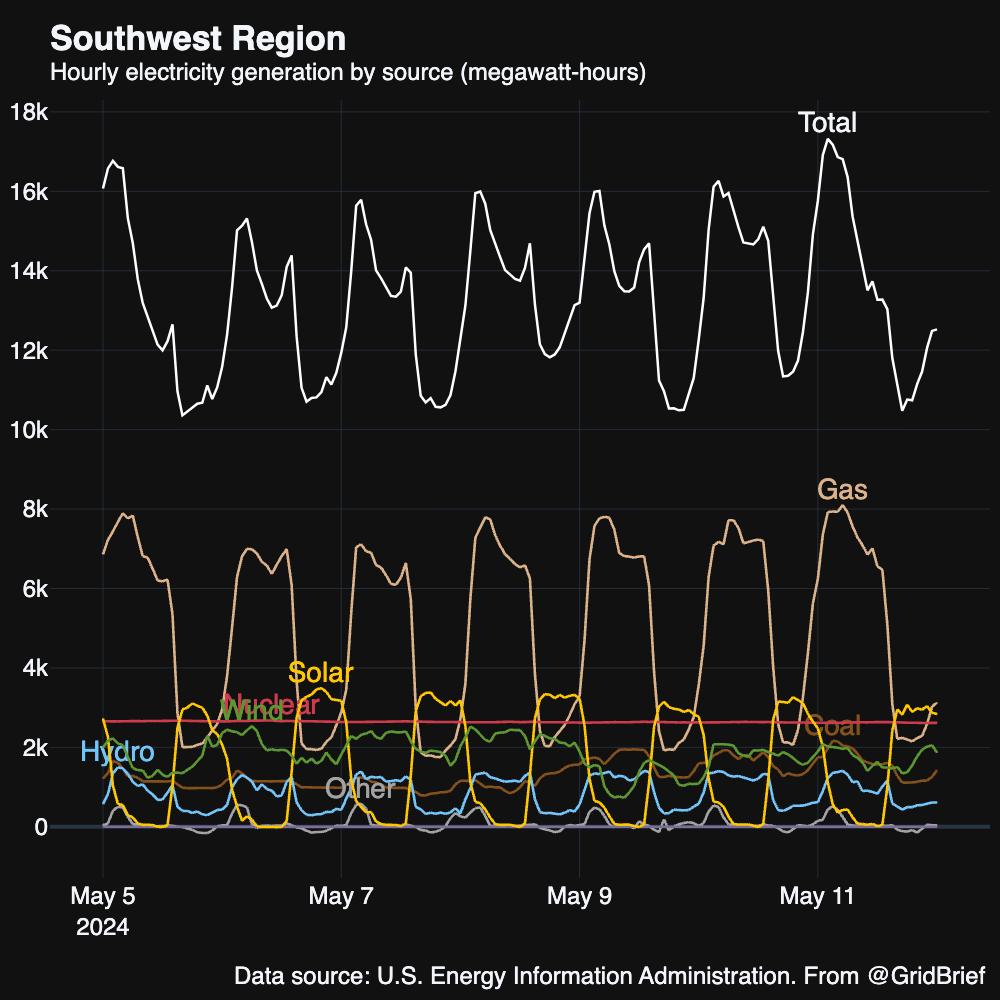

Southwest

Natural gas, solar, and nuclear were the top generators in the Southwest.

Intel and TSMC are building factories in Arizona, which should increase its power demand.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

Cheap imports flatten Biden’s domestic solar plan. “President Joe Biden’s signature climate law unleashed a $16 billion flood of promised investments in solar manufacturing, as companies unveiled plans for factories across the US and raised hopes of eroding China’s green tech dominance,” reports Bloomberg. “But less than two years later, manufacturers have quietly shelved or slowed plans for at least four of those plants. High borrowing costs and record-low panel prices — the result of cheap imports pouring into the market — have made some projects uneconomical. The decisions underscore the limits of US government subsidies when it comes to wresting control of established clean energy supply chains from China.”

US extends license for transactions with Venezuelan oil company. “The United States has extended a general license through November 15, allowing certain transactions with Venezuelan state oil company PDVSA that are necessary for wind-down operations, according to a notice from the U.S. Treasury Department. The extension covers key players in the industry, including Halliburton, Schlumberger, Baker Hughes Holdings, and Weatherford International PLC,” reports Oilprice.com. “This extension comes amid ongoing political tensions and economic challenges in Venezuela. Recent contract cancellations by entities like Polish refiner Orlen underscore the impact of geopolitical uncertainty on global energy markets, highlighting the complexities faced by industry stakeholders.”

South Korea in talks with UK on new nuclear. “South Korea’s state energy monopoly is in talks with the UK government about building a new nuclear power station off the coast of Wales, in what could be a big boost to Britain’s plans for a new nuclear fleet,” reports FT. “Kepco has held early-stage discussions with British officials about a new facility at the Wylfa site in Anglesey, and a ministerial meeting is expected this coming week, according to people briefed on the matter.”

Crom’s Blessing

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!