Welcome to Grid Brief! Today we’re looking at power generation and updates in America’s monopoly utility areas.

Monopoly Area Monday

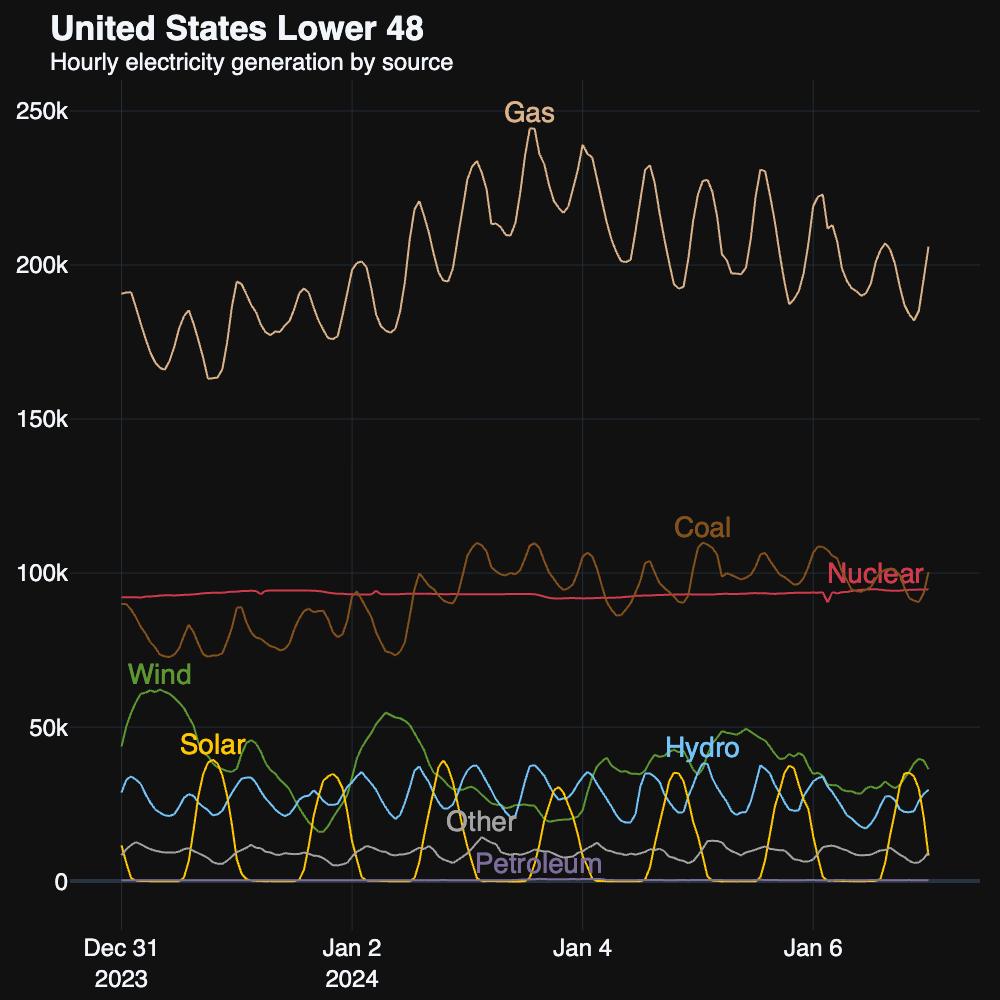

Here’s a look at generation nation-wide.

Natural gas, nuclear, and coal were the top three, with coal overtaking nuclear multiple times as the week rolled on.

A General Forecast

This was a slow week for utility news, but that might not be the case for the coming week. A serious arctic air looks to blanket much of the country at a time when its grid looks particularly vulnerable to extreme weather. We’ll be taking another look at the American grid, in particular its power markets, on Wednesday.

Carolinas

Nuclear, coal, and natural gas powered the Carolinas, though coal dipped below solar early in the week.

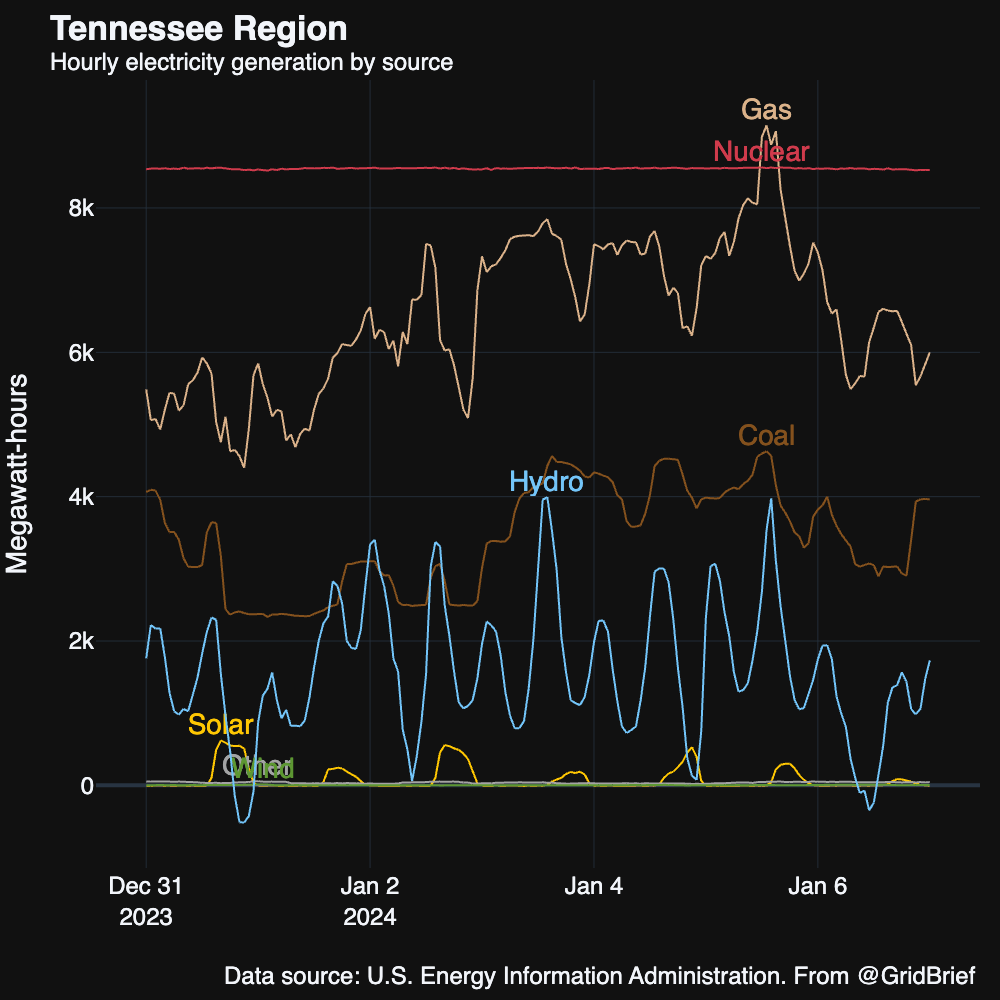

TVA

Nuclear, natural gas, coal, and hydro were all in the top three generators for America’s largest public power entity.

Last week, the TVA alerted the Federal Energy Regulatory Commission that unless the commission approves a gas pipeline project, the TVA may need to keep a 2,470-MW coal plant online past its scheduled its retirement.

Southeast

Natural gas, nuclear, and coal kept the Southeast humming.

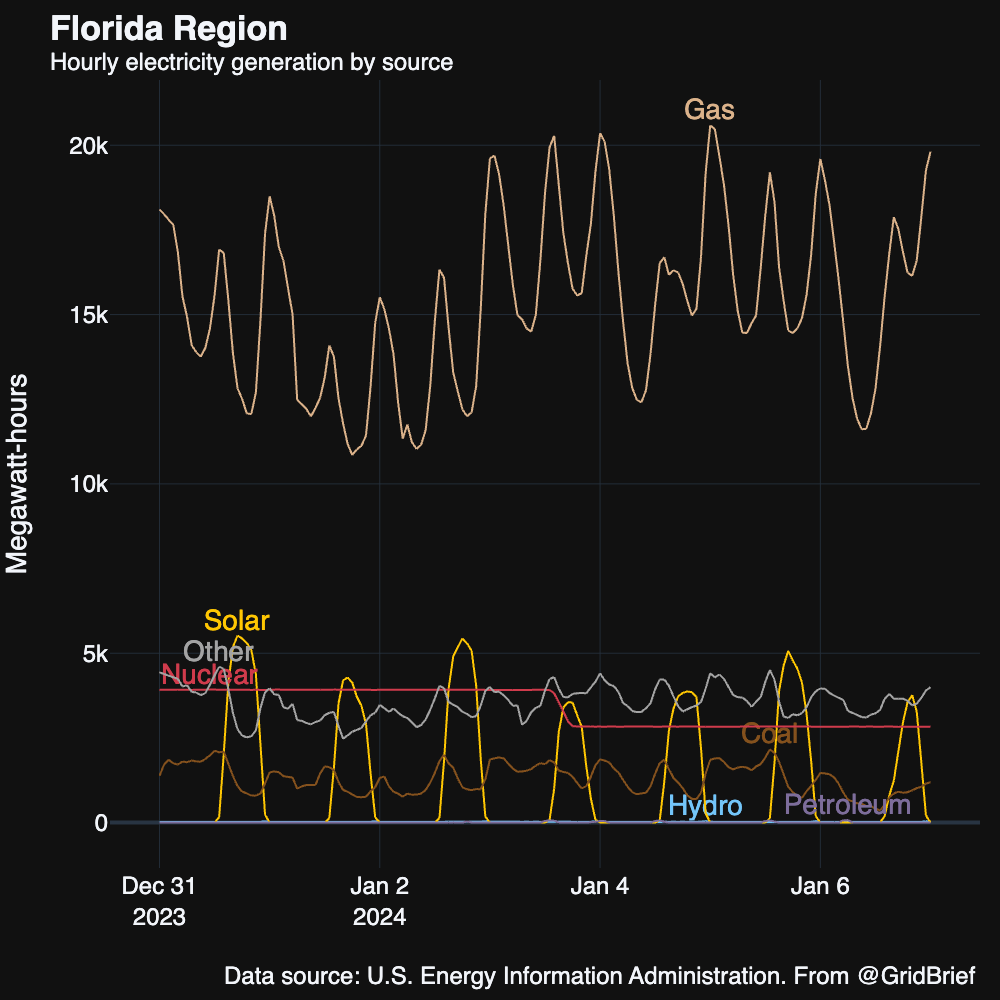

Florida

Natural gas remained the top generator in the Sunshine State, while solar, nuclear, and “other” traded places in the second and third spots.

Northwest Region

A typical week in America’s Northwest: hydro, natural gas, and coal were the main players. However, wind picked up as the week rolled on, eventually claiming the number one spot.

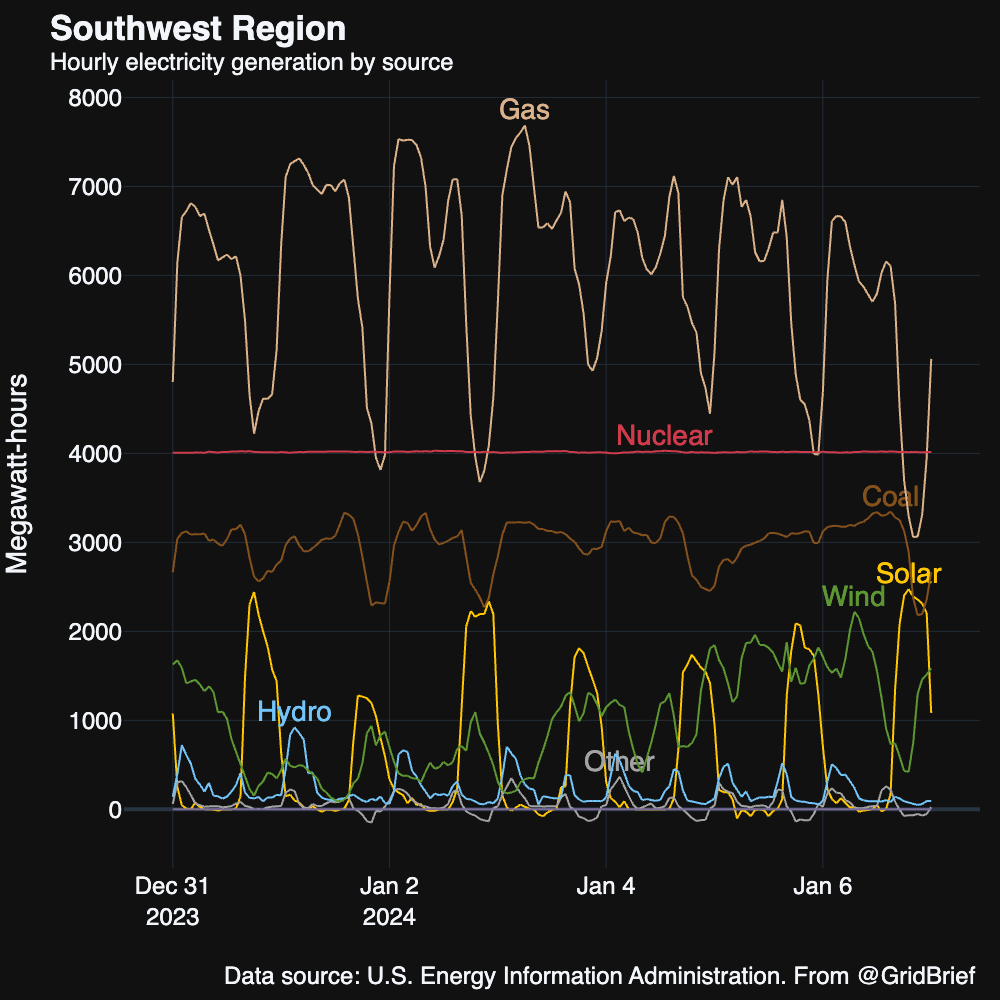

Southwest

Natural gas, nuclear, and coal kept the Southwest’s lights on this week.

New Mexico’s Public Utility Commission rejected Public Service Co. of New Mexico’s attempt to recoup investments in coal and nuclear plants through rate increases. The utility is the largest in the state, serving 500,000 customers.

As we covered last week, the SunZia renewable energy project finally got underway after over a decade of delay.

Upgrade to Grid Brief Premium to get extra deep dives into energy issues all over the world.

Conversation Starters

Beijing and Tehran clash over oil prices. “China's oil trade with Iran has stalled as Tehran withholds shipments and demands higher prices from its top client, tightening cheap supply for the world's biggest crude importer, refinery and trade sources said. The cutback in Iranian oil, which makes up some 10% of China's crude imports and hit a record in October, could support global prices and squeeze profits at Chinese refiners,” reports Reuters. “The abrupt move, which one industry executive called a ‘default’, could also represent the backfiring of an October U.S. waiver on sanctions of Venezuelan oil, which diverted shipments from the South American producer to the U.S. and India, elevating prices for China as shipments dwindled.”

Europe’s power prices surges during cold snap. “Day ahead power prices across Northern Europe spiked due to a combination of falling temperatures and calm weather reducing output from renewables, thereby raising demand for the more expensive natural gas and coal, Ole Hansen, Head of Commodity Strategy at Saxo Bank, said on Friday,” reports Oilprice.com. “Following a warm autumn and a milder start to the winter, the expected prolonged cold snap will grip most of northwestern Europe to last for most of January and to test Europe’s natural gas supply and energy infrastructure.”

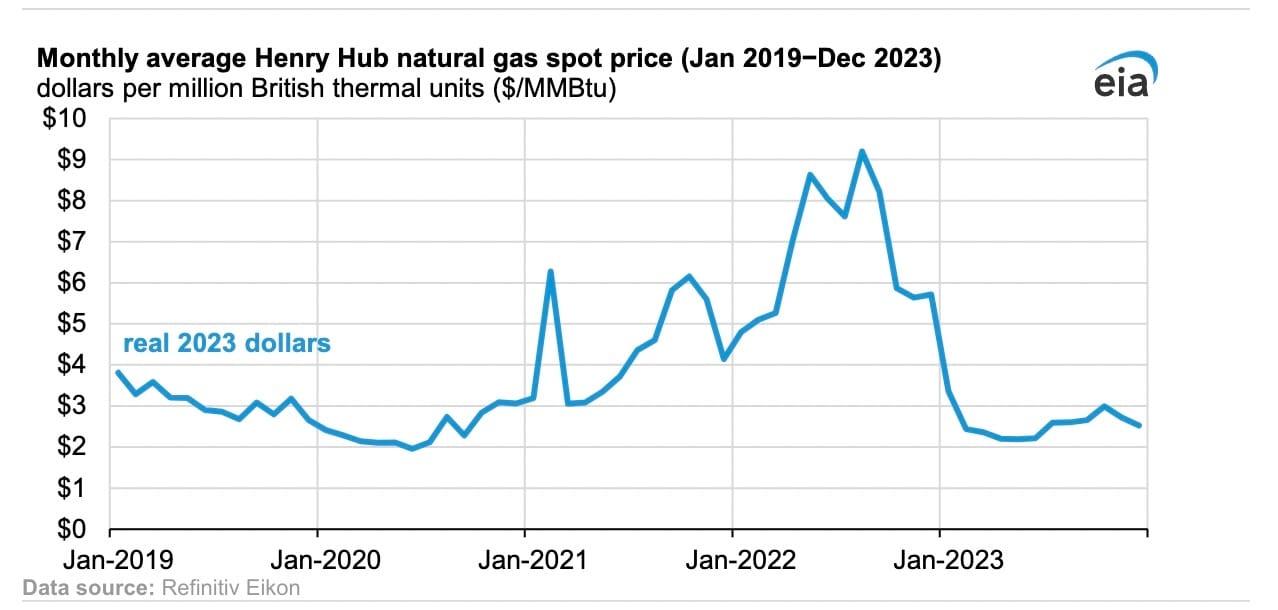

In 2023, US Henry Hub prices hit lowest level since mid-2020. “The U.S. benchmark Henry Hub natural gas price averaged $2.57 per million British thermal units (MMBtu) in 2023, about a 62% drop from the 2022 average annual price,” reports the Energy Information Administration. “Record-high natural gas production, flat consumption, and rising natural gas inventories contributed to lower prices in 2023 compared with 2022. The monthly average Henry Hub price was below $3.00/MMBtu in every month except January, with the lowest monthly average in May at $2.19/MMBtu.”

Crom’s Blessing

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!