The Natural Gas Crisis

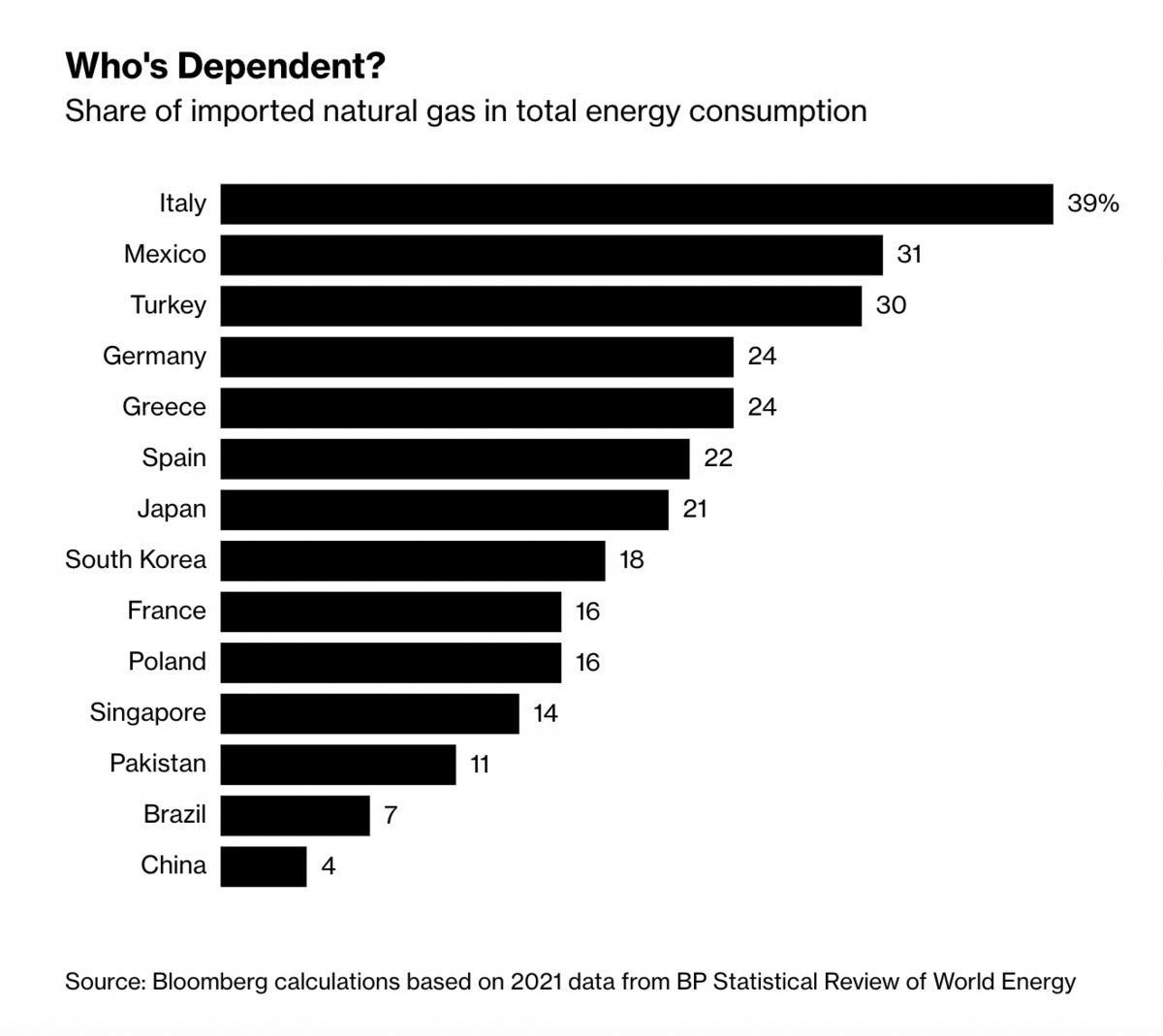

Natural gas is the new geopolitical prime mover next to oil. As many countries have pivoted to renewables, just-in-time natural gas has taken on greater importance in their energy portfolio. With much fo the developed world now dependent on a newly globalizing fossil fuel, its price increases have become a main driver of inflation. This is especially true in Europe, where the price has seen a 700% increase since the start of last year.

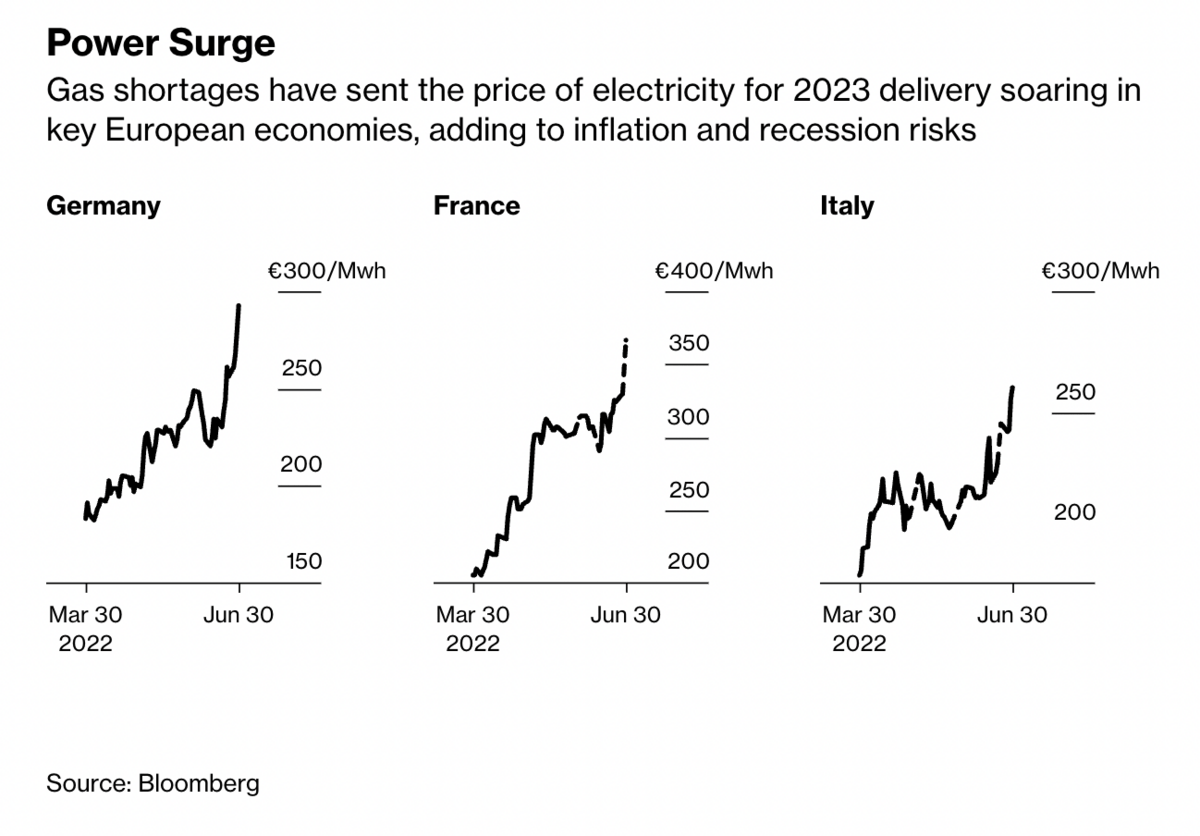

The tightening gas supply spells serious trouble. Germany's notoriously reliant on Russian gas and has pivoted to coal to make up waning flows from the east. German energy minister Robert Habeck has said that gas shortfalls could spark a Lehman Brothers '08-style economic collapse.

"Gas prices in Europe and Asia surged more than 60% in the weeks since Freeport [a refining facility in TX] was forced to temporarily shut down, a period that’s also seen further supply cuts by Russia," reports Bloomberg. "In the US, by contrast, prices for the fuel plunged almost 40% — because the outage means more of the gas will remain available for domestic use."

But even the US saw natural gas futures double before the Freeport shutdown.

The G7 have met and decided what's needed to dig the world out of this crisis:

More LNG export facilities

More LNG import terminals

More pipelines

More tankers

But even if Europe moves at Usain Bolt-level speeds in this direction that won't save them. "[A]ccording to Bloomberg Intelligence, which calculates that LNG imports could meet 40% of the region’s gas needs by 2026 — double last year’s figure, but still far short of the volumes that Russia has been supplying."

Gas shortages have wreaked havoc on the European electricity sector, as the above graphic shows. Its impact on non-European countries is less discussed.

Pakistan built its energy system on cheap LNG. Now it's rolling out planned blackouts to "are plunging regions into darkness during the sweltering summer months," reports Bloomberg. "Shopping malls and factories in major cities have been ordered to shut early, and government officials are working shorter hours."

Meanwhile, Thailand has been curbing its LNG imports due to high prices. But now the country risks fuel shortages.

"Myanmar, which is grappling with political instability," writes Bloomberg, "stopped all LNG purchases late last year when prices started to rally. India and China have also cut back imports."

The major questions I have are about whether or not ESG can survive this and what this means for the future of oil and gas more generally. There are troubling signs on the horizon, as the item below this indicates.

Oil Industry Sees 83% Drop in Graduate Matriculation

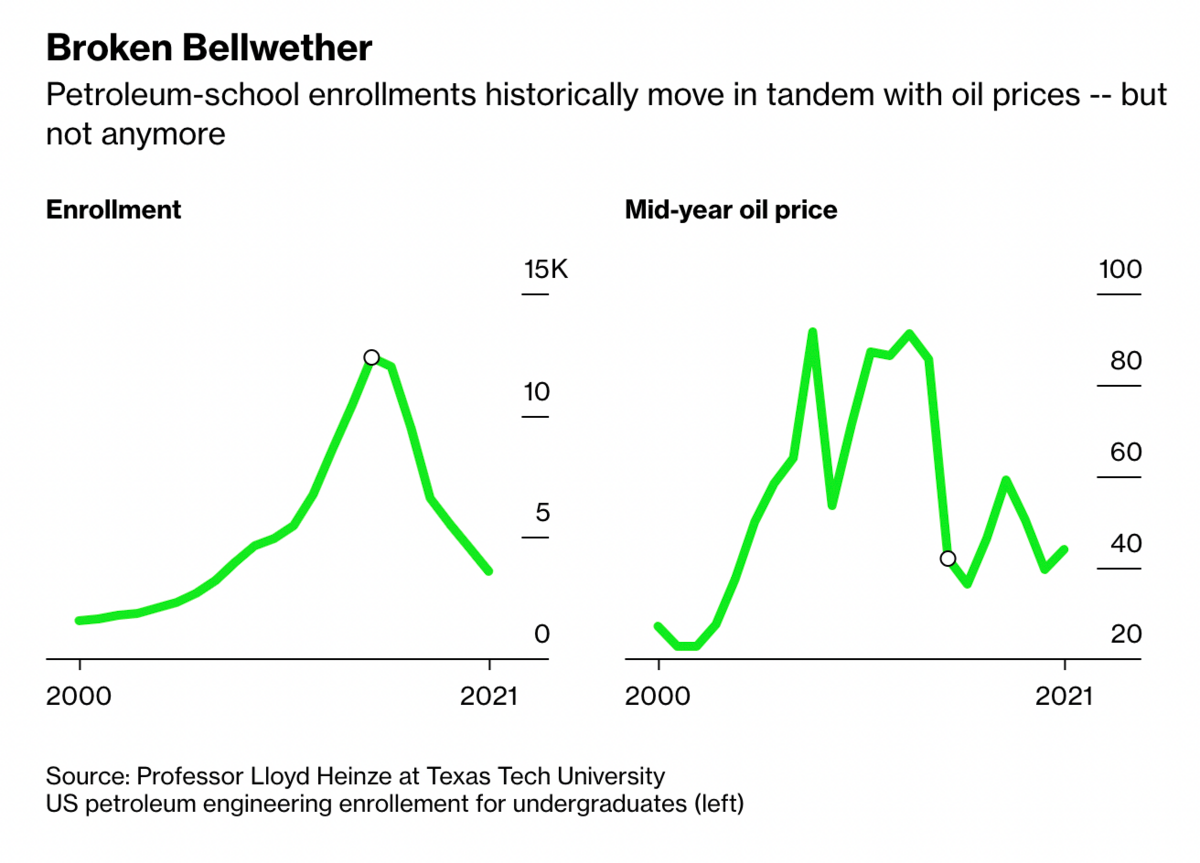

ESG is killing the oil industry from the inside. Over the last five years, the industry has seen an 83% drop in petroleum-engineering graduates. This is, in large part, because many don't think the industry will be around much longer due to environmental policy.

"During the shale revolution that unfolded during the first decade-and-a-half of this century, enrollments soared and bachelor’s degrees reached a record 2,326 in 2017," according to Lloyd Heinze, a Texas Tech professor who tracks enrollment at a few dozen petroleum schools worldwide. Heinze estimates that the number "will tumble to about 400 this year and remain in the 200-to-400 range annually for the next 10 years or so."

It used to be the case that enrollment numbers followed the price of oil, but that's no longer true.

"The reason why enrollment numbers no longer correlate with oil prices, according to Colorado School of Mines’s Miskimins, is partly due to the energy transition," Bloomberg reports. "More students and parents are turned off by the sector not necessarily because they are environmental advocates, but because they have concluded the switch will make oil and natural gas obsolete in five or 10 years, she said."

The utility industry saw similar losses in the post-war era as engineers (including the top talent) moved into electronics and aerospace. The problem dogged the industry for decades and likely still does. This pattern will entrench tacit knowledge loss along with stagnation as older engineers disappear and younger ones fail to show up in significant numbers.

Brussels: Gas and Nuclear Are Green

The votes are in: nuclear and natural gas are green in Europe. The European Parliament has agreed to include them in their green taxonomy in a historic vote yesterday.

"A European Parliament meeting in Strasbourg, France, voted in favor of accepting a proposal by the European Commission, the E.U. executive, with 328 votes backing the proposal and 278 against," reports the New York Times.

Naturally, environmentalists are miffed. Anything that isn't wind and solar can't be good. The NYT reports, "A 'green' classification for gas and nuclear provides financial incentives for European countries and companies to invest in those energy sources, and, critics say, would delay fully switching to renewable sources that are much better for the environment, such as wind and solar energy."

Johanne Schroeten, a policy adviser at the E3G climate thinktank, told the Guardian: “Vested interests seem to have gotten the upper hand. The EU has now set a dangerous precedent of low ambition for other countries and jurisdictions to follow.”

And the WWF said that in partnership with Client Earth, yet another green NGO, it would “explore all potential avenues for further action to stop this greenwashing and protect the credibility of the whole EU taxonomy."

Regardless, this is a wind for energy policy sanity. The world needs more dispatchable thermal energy, not less of it.

Like what you're reading? Click the button below to get Grid Brief right in your inbox.

Conversation Starters

Millions of barrels from America's historic SPR release went to Europe and Asia. "More than 5 million barrels of oil that were part of a historic U.S. emergency reserves release to lower domestic fuel prices were exported to Europe and Asia last month, according to data and sources, even as U.S. gasoline and diesel prices hit record highs," reports Reuters.

America's largest refiner just cut production. It turns out you can't run at 94% capacity forever. "Motiva Enterprises MOTIV.UL cut production at its 626,000-barrel-per-day (bpd) Port Arthur, Texas, refinery, the nation’s largest, sources familiar with plant operations said on Tuesday."

Austria is pivoting from gas to oil to power its industry. "Power plants and industrial companies will be instructed to upgrade their systems for dual operation to the extent that it is technically and economically feasible. That means that plants can run on natural gas as well as on other energy sources - in most cases it will be crude oil," Austrian energy minister Leonore Gewessler told the press.

Crom's Blessing