Welcome to Grid Brief! Here’s what we’re looking at today: offshore wind struggles in New York, the US is adding more natural gas generating capacity, the US and Venezuela strike a sanctions easement deal, and more.

New York Rejects Wind Power Petitions

More US offshore wind projects are imperiled. New York’s Public Service Commission denied Ørsted, Equinor, and BP’s pleas to adjust the contracts for their respective offshore wind projects.

“State municipal utilities and other intervenors warned the PSC that allowing the contract adjustments would ‘increase ratepayer costs by a total of $29.76 billion over the contract terms,’” reports Utility Dive. “This would result in cost increases of between 2.3% and 6.7% in each energy bill for residential customers, and between 2.5% and 10.5% for commercial customers, NYPSC estimated.”

The developers sought new contracts because inflation and supply chain issues have plagued the offshore wind industry for over a year. Without adjustments, their projects are now likely unviable.

“It is a bit of a mess, frankly,” Samantha Woodworth, an analyst who tracks the industry at the consulting firm Wood Mackenzie, told ClimateWire. “These developers have already sunk so much money into these projects.”

Several other coastal states have also denied the wind industry contract renegotiations. The trend has endangered the Biden administration’s goal of installing 30 GW of offshore wind by 2030.

US to Add More NatGas Capacity

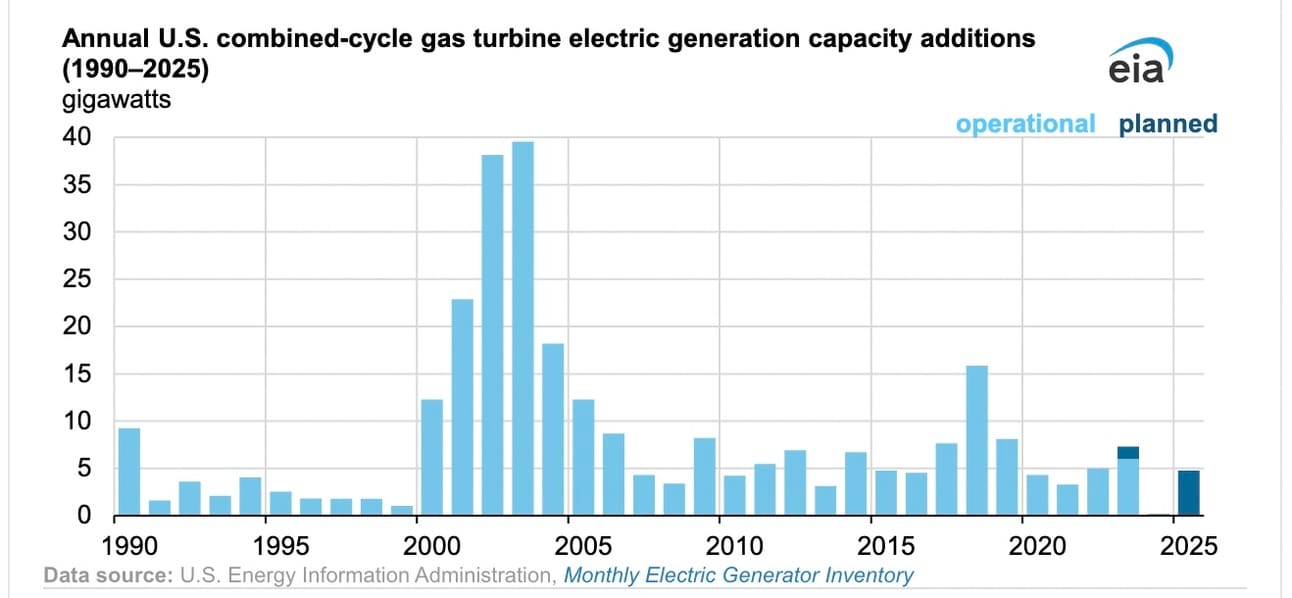

This year, America has added ten new gas turbines (6.8 GW total) to its grid. The Energy Information Administration expects to see six more turbines added, bringing the total addition of gas capacity for 2023 to 8.6 GW.

“In the next two years (2024 and 2025), we expect 20 new natural gas-fired power plants to come online with a total capacity of 7.7 GW,” reports the EIA.

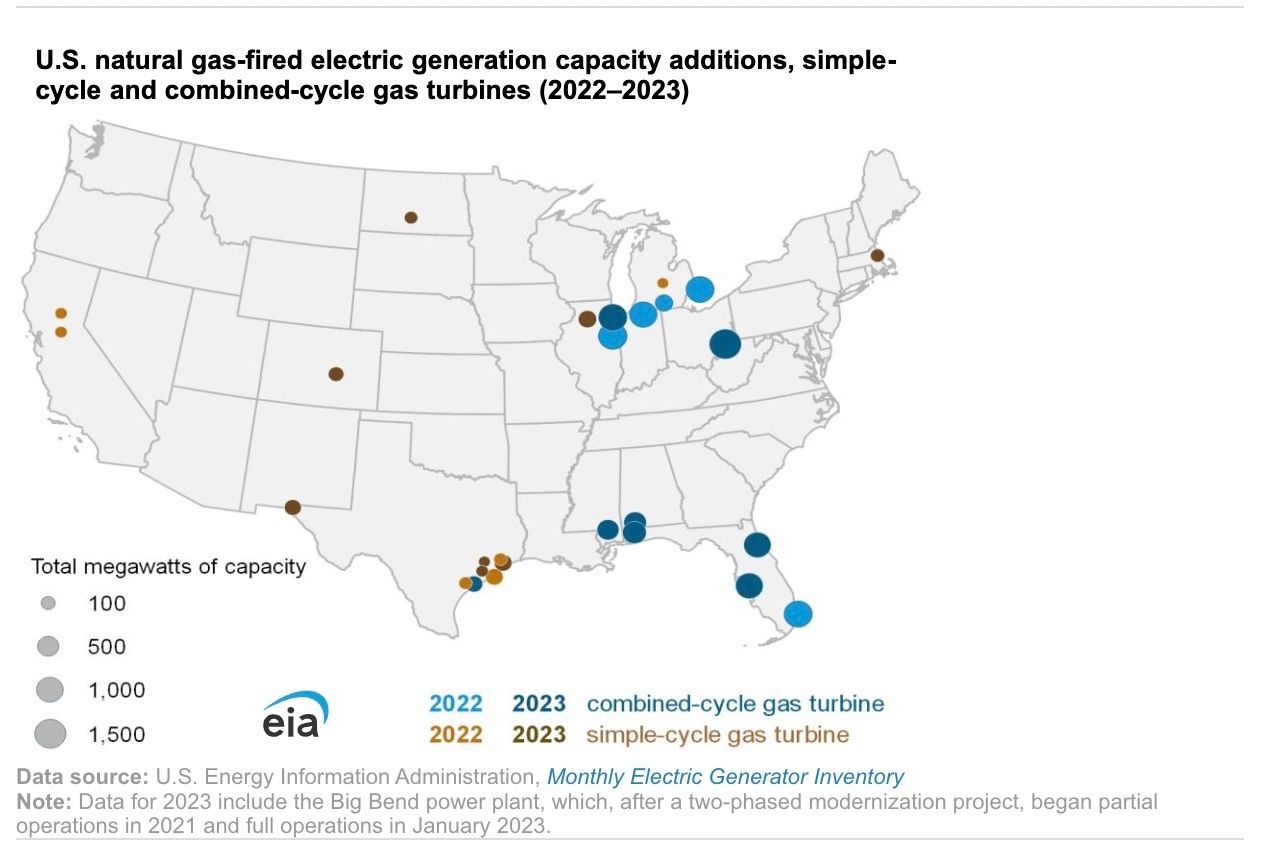

“During 2022 and 2023, a total of 13 new CCGT plants with a combined capacity of 12.4 GW will have entered service. The average output for each of the 13 CCGT plants is 0.9 GW of electric generating capacity. Approximately 5.8 GW of the total capacity is located in Florida and Michigan,” reports the EIA. Both of those states already rely on natural gas plants for most of their generation.

The EIA expects 4.8 GW of more CCGTs to come online in 2024 and 2025, but only 0.1 GW of that is planned for next year.

“During 2022 and 2023, 14 SCGT plants with total capacity of 1.9 GW will have begun operations,” reports the EIA.

More than half of SCGT capacity that has come online since 2022 can be found in Texas. A total 2.8 GW of new SCGTs capacity is expected to come online in the Lone Star state in 2024 and 2025.

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

US and Venezuela Strike Sanction Deal

The United States and Venezuela have struck a deal to ease sanctions on the South American country.

“The sanctions relief is to be announced after Maduro’s government and Venezuela’s U.S.-backed opposition sign an agreement to include commitments by the socialist government to allow a freer vote in 2024,” reports the Washington Post. “They’re expected to do that during a meeting in Barbados on Tuesday with U.S. officials in attendance.”

The Post notes that this is a departure from the years-long orthodoxy of putting pressure on Maduro’s regime. Venezuelan assets in the US will not be unfrozen as a part of the deal.

Conversation Starters

Output in American shale is set to fall again in November. “U.S. oil output from top shale-producing regions is set to fall for a third month in a row in November to its lowest since May, the U.S. Energy Information Administration (EIA) said in its monthly Drilling Productivity Report on Monday,” reports Reuters. “U.S. oil output is expected to fall to 9.553 million barrels per day (bpd) in November from 9.604 million bpd in October, EIA data showed.”

The EU is split over carbon pricing for shipping. “The European Union’s looming rules to put a carbon price on shipping emissions threaten economic growth by benefiting ports outside the region, according to six member states,” reports Bloomberg. “The countries — mainly along the bloc’s Mediterranean coastline — are worried that shipping companies will be able to dodge paying the price by docking at ports close to, but outside of, the EU. Italy called for the European Commission, the bloc’s regulatory arm, to look at possible solutions, such as financial compensation.”

US automakers decry fuel efficiency hike. “A group representing General Motors, Toyota Motor, Volkswagen and nearly all other major automakers, sharply criticized the Biden administration proposal to drastically hike fuel efficiency requirements,” reports Reuters. “The Alliance for Automotive Innovation said the National Highway Traffic Safety Administration Corporate Average Fuel Economy proposal is unreasonable and want significant revisions, arguing the plan will boost average vehicle prices by $3,000 by 2032 because of penalties automakers will face for not being in compliance.”

Crom’s Blessing

Interested in sponsoring Grid Brief?

Email [email protected] for our media kit to learn more about sponsorship opportunities.