Nordstream 1 Flow Woes

Gazprom has halted yet another turbine on Nordstream 1 for repairs. Flows from Russia to Germany through the pipeline will drop from 50% to 20% on Wednesday and look to stay there for the time being.

This poses a major problem for Germany. Bloomberg's Javier Blas writes that "Germany will NOT have enough natural gas to make it throughout the whole winter **unless big demand reductions are implemented**. Berlin will need to activate stage 3 of its gas emergency program."

German industry is already suffering. Low flows from Russian mean more pain and less production. Currently, one in six firms in Germany has had to cut production due to high energy prices. A recent survey from the Association of German Chambers of Industry and Commerce, DIHK, reveals that about 25% of companies have cut production already with another 25% in the process of scaling back production.

The survey of 3,500 companies also showed that only half of Germany's industrial firms have their gas supplies for the rest of 2022 covered by contracts. "More than a third of industrial firms still have to buy more than 30% of their annual gas needs," reports Oilprice.com. "A total of 63% of German industrial companies see high power and gas prices as a threat to Germany's competitiveness, according to the survey. "

Meanwhile, the second-largest real estate agency in Germany, LEG Immobelien, has called for heat reductions this winter. "I believe that in the current war situation, the population in Germany must be made aware that renunciation is now the order of the day," said CEO Lars von Lackum to the Handelsblatt. "And that will be a renunciation of heat."

MISO: Let's Do $10 Billion in Transmission

The Midcontinent Independent System Operator has a capacity problem--it expects to see some staggering shortfalls over the coming years as reliable power plants like coal and nuclear switch off. Right now, it has a 1.2 GW shortfall that could mushroom into a 10.9 GW shortfall within the next decade.

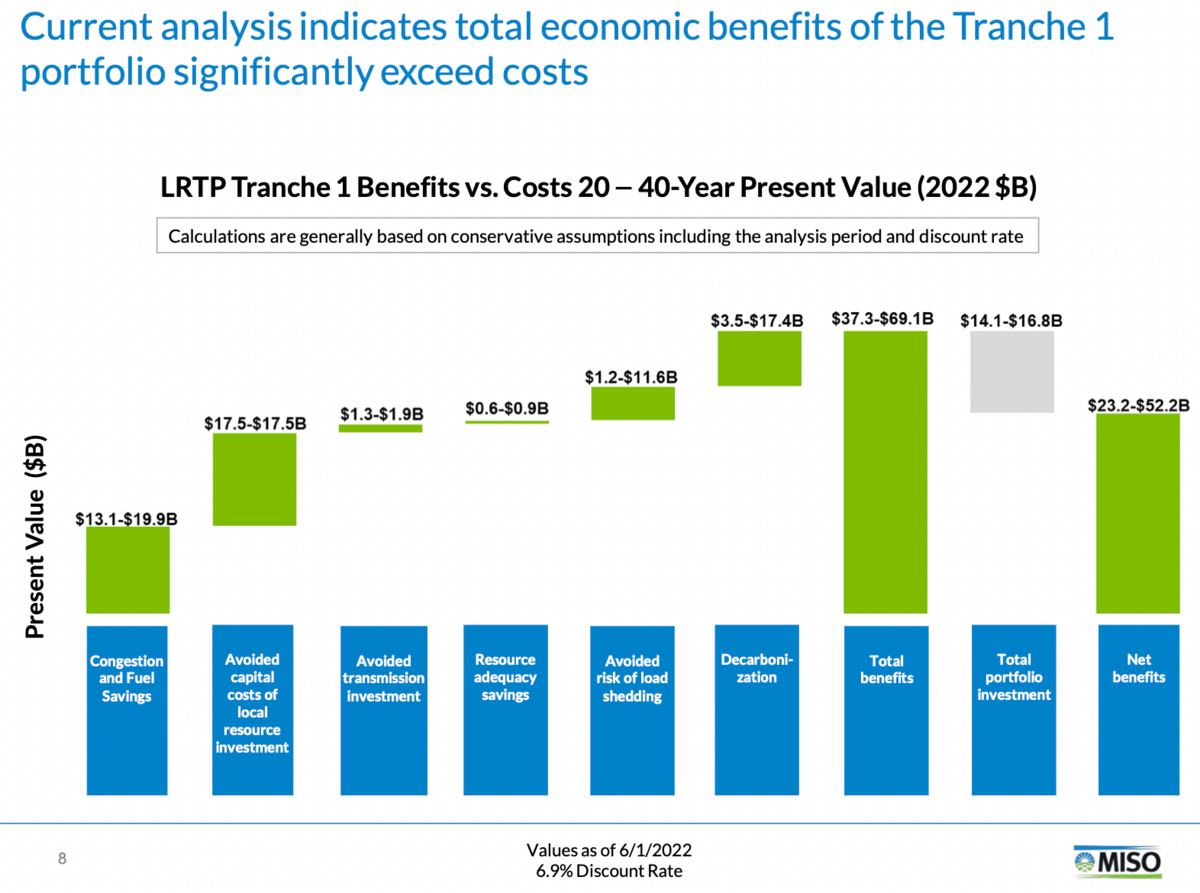

To help remedy the situation, MISO's Board of Directors has approved a massive transmission buildout to help wind and solar projects get their power to customers. It is the largest transmission plan in American history and will cost just north of $10 billion.

The transmission will enable 53,000 MW of wind and solar projects to come on the grid. MISO's analysis found that the benefits from the transmission will outstrip the $10 billion cost, netting $37 billion over the next twenty years.

“We appreciate the spirit of collaboration and the hard work that MISO members and stakeholders have invested in these projects and look forward to continued discussion around future tranches,” said MISO’s Chief Executive Officer John Bear in a press release. “We also recognize the effort and strong support for LRTP from various regulators and policymakers in the states – including state utility commissions and governors.”

Many are celebrating this bold move from MISO. Kevin O'Rourke, VP, Strategic Partnerships and Public Affairs at the American Council of Renewable Energy, praised MISO's ambition but noted that much more transmission is still needed.

The Southern Renewable Energy Agency said, "The Southern Renewable Energy Association would like to congratulate MISO North on working together to build a more robust transmission system. We are looking forward to working together in MISO South to prepare for a more resilient, reliable, and renewable future."

But not everyone is so happy. "These lines will help undercut the daily remuneration to firm generation without removing their need during massive low-wind events," said Mark Nelson, President of the Radiant Energy Fund, in an email. "That money will need to be made up for somehow. We must prevent further nuclear closures that could result from this extra $10 billion in equipment not required by firm plants to meet existing needs."

"Wind and solar advocates love to pretend that these energy sources are the lowest cost sources of energy, but their calculus is entirely dependent upon ignoring the cost of transmission. This creative accounting trick conveniently forgets to include the cost of multi-billion dollar projects like the ones MISO approved today," Isaac Orr over the Center of the American Experiment said.

"Instead of focusing on approving more transmission lines as a cross-subsidy to the wind and solar industry, MISO should be looking for ways to preserve the reliable generators they already have on their systems," Orr added. "The CREZ line didn't save Texas during Uri, and more transmission is not a serious solution to the reliability challenges we will face as more dispatchable capacity retires."

This transmission build-out, Tranche 1, is the first entry in a series of transmission projects MISO hopes to enable.

“While Tranche 1 represents an important start, further work is needed to ensure reliability,” said Aubrey Johnson, MISO’s vice president of system planning in a press release. “Tranche 2 will focus on the MISO Midwest Subregion, Tranche 3 in MISO South, and Tranche 4 will address the limitations on power exchange between the MISO Midwest and South Subregions.”

The Reason Behind Texas's Energy Shortages

In his latest, Robert Bryce writes that this chart is the key to understanding ERCOT's energy shortages. Read it and weep:

"The chart shows that when power demand in Texas surges (the black line), wind generation (green line) often goes to Cancun with Ted Cruz," Bryce writes. "Indeed, when power demand zigs, wind production usually zags. That’s what happened during the middle of the day on July 13. As demand in the state was soaring, the output from the 35,391 megawatts of installed wind capacity on the ERCOT grid fell to less than 1,000 megawatts. That’s a capacity factor of less than 3%."

Bryce points out that while wind is "reliably unreliable" ERCOT's in danger of becoming reliably unreliable, too. Over the twenty years, Texas hasn't built out more thermal generation to keep up with its rising electricity demand. Wind's reliably poor performance puts the grid at risk.

And yet, despite this poor performance, renewable energy advocates have been praising the developments in Texas because solar has happened to produce when wind hasn't. I'm not sure about you, but I don't think running essential infrastructure like the grid should be this exciting. Nor should it be this expensive--electricity prices in Texas cost an arm and a leg.

And yet, as Texas onboards more and more renewables, everyone seems to think crossing your fingers is a plan. Pray to the wind and sun gods for Texas.

Like what you're reading? Click the button below to get Grid Brief right in your inbox.

Conversation Starters

Libya has resumed its oil exports, but violent clashes have broken out in Tripoli. Fighting broke out amongst militia forces just after the deal ended the country's months-long force majeure.

Holtec, a nuclear plant decommissioning giant, now wants into the nuclear reactors construction game. The company "is moving forward on a $7.4 billion plan to build up to four small modular reactors in New Jersey and a "supersize" reactor factory," reports Axios.

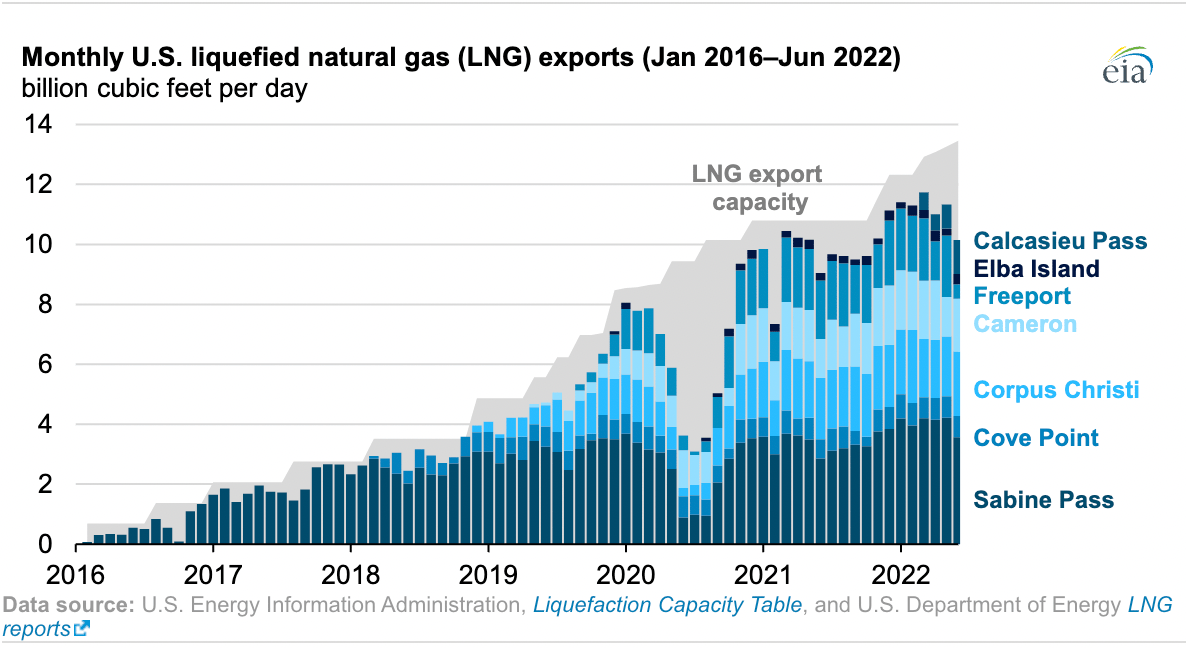

According to the Energy Information Administration, America became "the world's largest LNG exporter in the first half of 2022."

Crom's Blessing