Oil Tanker Market Madness

Six weeks remain before the EU's embargo and price cap on Russian oil kick in. Uncertainty about what this means for the tanker market has ratcheted up disarray in the sector.

According to estimates from the International Energy Agency, Russia exported about 7.5 million barrels per day of crude and refined products last month. "If those volumes are to continue flowing, Russia will have to either agree to sell its oil at or below the price cap as the G7 and the EU want, or find a large enough shadow fleet of tankers, insurers, and financiers willing to deal with Moscow," reports Oilprice.com.

But Russian leadership is unanimous in their commitment to halt sales to countries that participate in the price cap. Thus, both the oil and tanker markets can only guess what comes next. Will there be a tanker fleet big enough to ship embargoed Russian oil to non-European buyers after December 5th?

Some experts have said that a tanker shortage looms on the horizon. Others say that tanker sales to undisclosed buyers hint that Russia is taking pages from Iran's oil export playbook.

Whatever the case, Russia is preparing itself for December. "State-owned Rosneft, the biggest oil producer in Russia, has reportedly expanded its tanker chartering business to ease oil shipments for buyers [...] Rosneft typically sells its oil at the port of loading, meaning the buyer has to hire tankers and handle freight and insurance costs," reports Oilprice.com. "However, with the embargo looming, Rosneft’s customers are asking the company to handle delivery to the final destination, meaning the company will now assume freight and insurance costs."

And commodities traders remain confused about what impact the price cap will actually have.

Poland Closer to Picking Westinghouse

Poland is moving towards picking Westinghouse to build the nuclear power plants that will replace its coal plants. Westinghouse is competing against Korea Hydro & Nuclear Power Co. and France's EDF.

"Polish Deputy Prime Minister Jacek Sasin and Climate Minister Anna Moskwa announced their preferred option after meeting with US Energy Secretary Jennifer Granholm over the weekend," reports Bloomberg.

“We cannot put aside that the US is our strategic partner for whole Polish security architecture,” Sasin said at a press conference in DC. Pointing to the war in Ukraine, he continued, “Such factors have to be taken into account. There is a big chance that we will finally pick Westinghouse.”

Poland hopes to start its first reactor in 2033 as part of a plan to add 6 to 9 gigawatts of capacity to its electric grid. "The government has identified Choczewo near the Baltic Sea as the site of an initial three-reactor plant and plans to pick the technology supplier by the end of 2022," reports Bloomberg.

Westinghouse improved its odds by suing its Korean competitor over intellectual property--some of Westinghouse's IP is bound up in the Korean reactor design, as we reported yesterday.

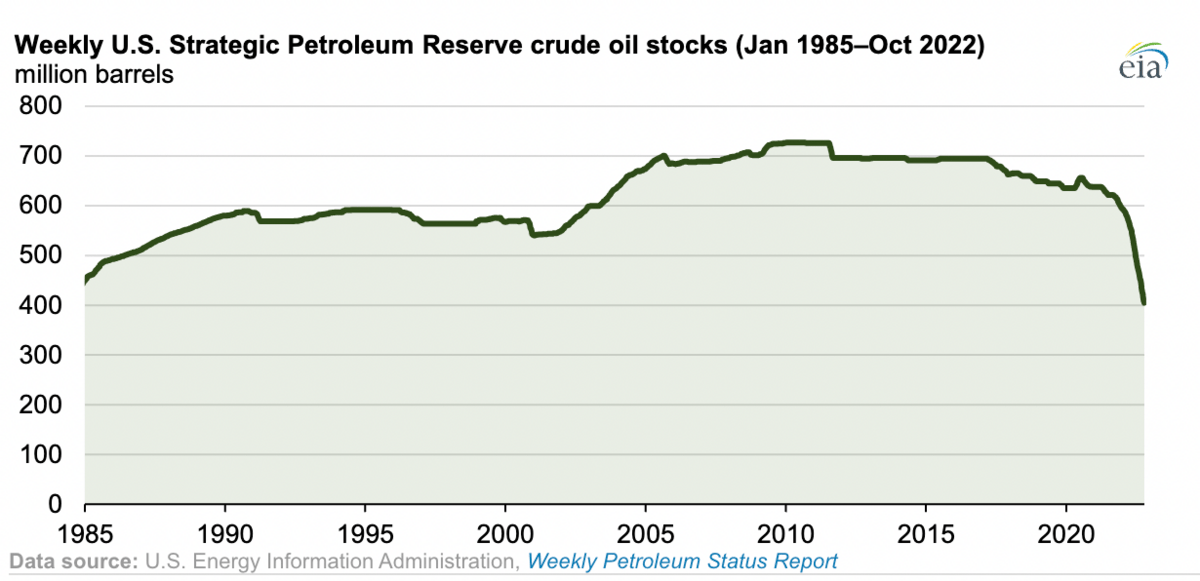

Strategic Petroleum Reserve Perspectives

How should we think about Biden's SPR releases? New data from the Energy Information Administration brings more insight into what's going on.

The Department of Energy held sales from the SPR on October 19th and sold as many as 15 million barrels. Some saw it as a response to Biden's tense interactions with OPEC+ and Saudi Arabia who've remained steadfast in their reduction of production.

But the sales are supposed to be delivered in December, just when Europe enforces its embargo and price cap. It could be that the administration is trying to undercut Russia's exit from the export market. The release could help keep fuel prices low just when the weather gets tough and Europe needs it most.

"On October 14, 2022, the SPR held 405 million barrels of crude oil, the lowest inventory level the SPR has held since June 1984. SPR crude oil stocks have been declining in recent years, largely because of legislated drawdowns authorized in bills passed in previous years," reports the EIA. But the DOE just approved a rule that allows fixed-price purchases when West Texas Intermediate crude prices are between $67-$72 per barrel or lower. This is the Biden administration's attempt to put a "floor" on the price of oil to coax the oil and gas industry into expanding production.

It's unlikely that the industry will bite--it's still worried Biden's party could turn on it and recommit to their "end fossil fuels" policy at any given point in the future. Moreover, the industry's still enjoying fat profits after several lean years in a row. But Biden's SPR release may just bail Europe out for the time being.

Like what you're reading? Click the button below to get Grid Brief right in your inbox!

Conversation Starters

A GE Hitachi nuclear facility will add 500 jobs to North Carolina. "The new hires will support advanced nuclear growth and commercial deployment of BWRX-300 small modular reactors, according to a GE release," reports WECT. "The BWRX-300 was designed to reduce construction and operating costs that are typically associated with nuclear power generation technology; GEH has plans to potentially deploy the reactors at several facilities."

China's coal hub has curbed output due to the country's Covid policy, which demands lockdowns for virus flare-ups. "In Datong, Shanxi province, a key rail route hauling coal eastwards saw volumes shrink as much as 30% because of crew shortages," reports Bloomberg. "Meanwhile, coal sales in Ordos in Inner Mongolia fell over the past week after the city implemented a 3-day lockdown, according to the report."

The Supreme Court has just held oral arguments about the EPA's Waters of the US (WOTUS) regulation to bring clarity to permitting energy projects. "In Sackett v. EPA, the Supreme Court could clarify how WOTUS is defined, with that determination potentially affecting pipelines and other energy projects," reports S&P Global. "And the Supreme Court's eventual decision will likely affect the Biden administration's work on rulemakings to finalize a more detailed WOTUS definition."

Crom's Blessing