Welcome to Grid Brief! Here’s what we’re looking at today: Pakistan secures a new long-term LNG deal, US natural gas prices dropped in the first half of this year, a White House panel pushes for tougher soot and smog regulations, and more.

Pakistan Inks LNG Deal with Azerbaijan

Pakistan finally got a new long-term LNG deal—now with Azerbaijan.

“The agreement was signed between the Pakistan LNG Limited (PLL), a state-owned entity mandated to procure LNG, and Azeri firm, SOCAR, in Lahore, with PM Sharif in attendance,” reports Arab News. “Under the deal, Azerbaijan will offer Pakistan 12 low-cost LNG cargoes per annum, however, Islamabad will not be bound for compulsory buying of the gas.”

Pakistan has struggled to get new long-term LNG deals since last year when a domestic financial crunch collided with a global energy crisis, and Europe priced the country out of the market. Pakistan is continuing to diversify its energy sources with nuclear and coal, but this new LNG deal signals a cooling market for the chilled fuel. Pakistan offered tenders earlier in the season; no suppliers took them up on the offers.

“The life of this agreement is one year which is extendable to one more year,” PM Sharif said. “SOCAR will offer an LNG cargo to Pakistan every month and Pakistan would decide whether we have to buy this cargo at this price.”

US Natural Gas Prices Fall First Half of 2023

American natural gas prices dropped in the first half of this year amid mild weather and surging production.

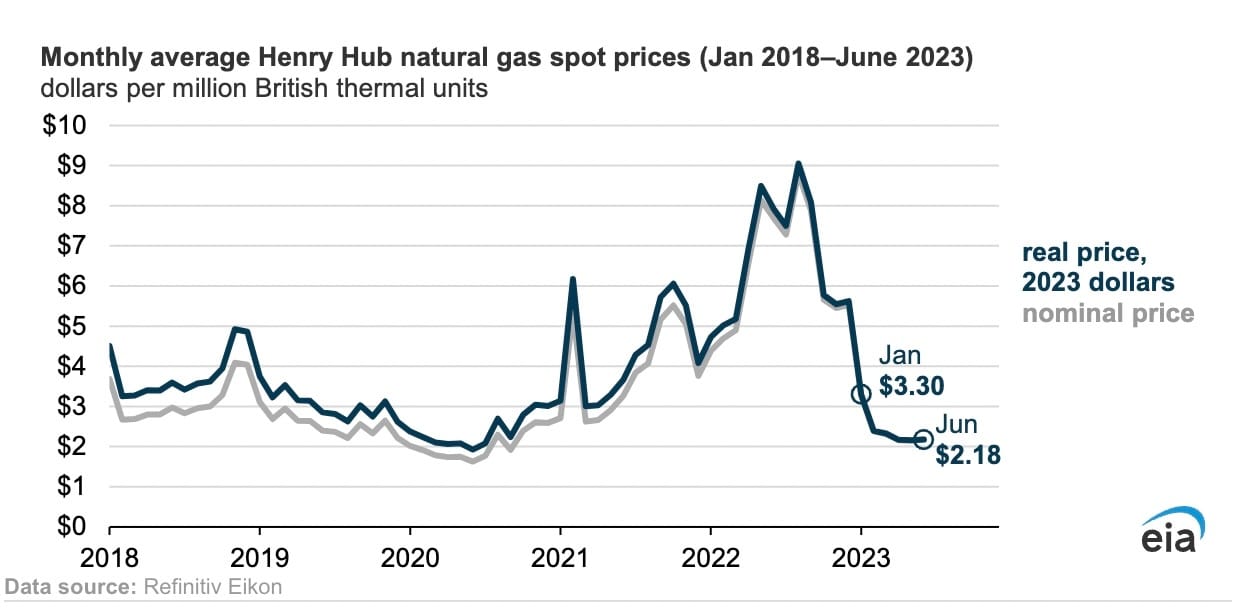

“The average monthly spot natural gas price at the U.S. benchmark Henry Hub fell 34%, or $1.12 per million British thermal units (MMBtu), to $2.18/MMBtu between January and June, according to data from Refinitiv Eikon,” reports the Energy Information Administration. “The Henry Hub price averaged $3.30/MMBtu in January on an inflation-adjusted basis and then dropped below $2.50/MMBtu starting in February. Relatively mild temperatures, record production, and higher-than-average inventories reduced natural gas prices. When adjusted for inflation, this year has seen the lowest average monthly Henry Hub price since June 2020.”

Between January and April 2023, U.S. natural gas consumption averaged 103.0 Bcf/d, a 1.0 Bcf/d decrease from 2022. Residential and commercial sectors saw an 18% and 12% decline, while industrial usage dropped 3% in Q1 2023. However, the electric power sector set a record with 30.78 Bcf/d consumption, up 8.4% due to heightened winter heating demand in the West.

“U.S. dry natural gas production has outpaced demand so far in 2023, contributing to lower natural gas prices,” reports the EIA. “Dry natural gas production has remained at record highs in 2023, averaging over 101.0 Bcf/d each month. In the first quarter of 2023, dry natural gas production increased 7%, or 6.9 Bcf/d, from the same period in 2022.”

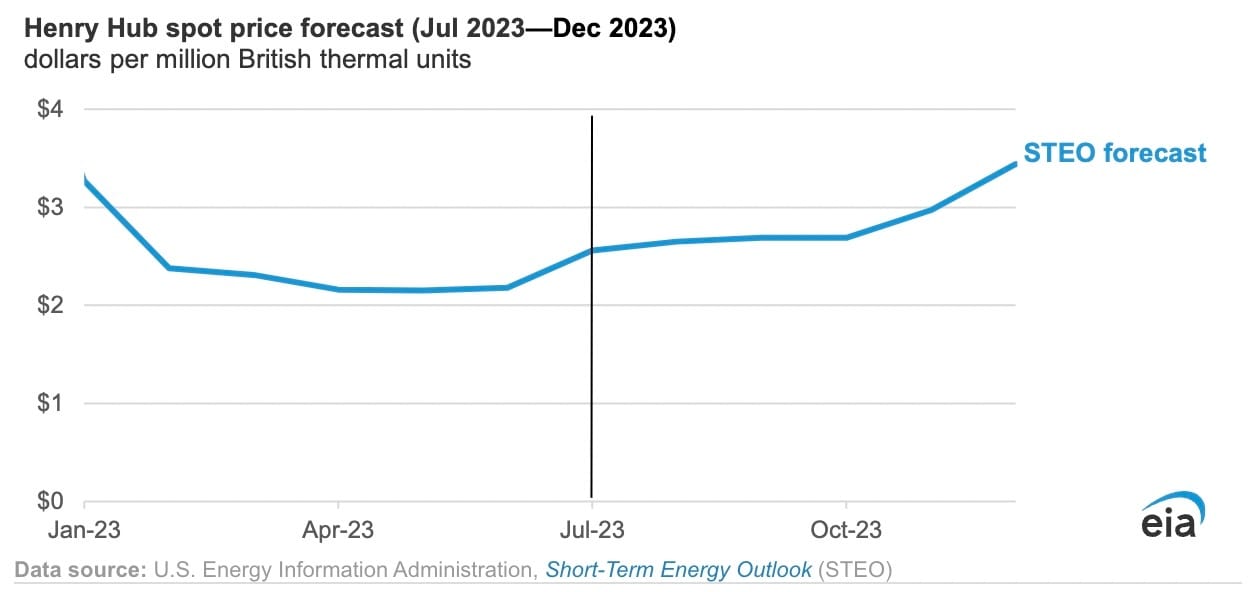

The EIA anticipates a price increase in Henry Hub natural gas from its current level between July and December 2023. The average price is projected to be $2.83/MMBtu by the end of 2023, peaking at $3.44/MMBtu in December (compared to $2.18/MMBtu in June). Additionally, consumption is expected to rise to 107 Bcf/d in December 2023, reflecting a 2.1 Bcf/d decline from December 2022. Meanwhile, dry natural gas production is forecasted to average 102.6 Bcf/d from July to December.

Share Grid Brief

We rely on word of mouth to grow. If you're enjoying this, don't forget to forward Grid Brief to your friends and ask them to subscribe!

White House Panel Wants Stronger Soot and Smog Rules

The White House Environmental Justice Advisory Council is asking for stricter regulations on soot and smog.

“We strongly recommend action that is sufficiently bold to address the gross inequities in how different communities are impacted by these pollutants,” the panel told Brenda Mallory, chair of the White House Council on Environmental Quality (CEQ), in a letter. “Equally important, the administration must act on a timeline that does not delay alleviating the deadly burden that communities face.”

The letter comes as the Environmental Protection Agency approaches its final decision on whether or not the agency will harden its national soot standards.

“Currently, the average annual exposure limit is 12 micrograms per cubic meter of air; the 24-hour standard is 35 micrograms. Under the proposal, released in January, the annual standard would be cut to 9-10 micrograms, while the 24-hour standard would not change,” reports E&E News. “But most members of the Clean Air Scientific Advisory Committee, an EPA panel made up mostly of university-based scientists, had earlier recommended that the annual limit be further reduced to 8 micrograms, accompanied by a cut to the 24-hour standard to 25 micrograms.”

WHEJAC’s letter boosted the harsher path against the pollutants, calling soot and smog “public health menaces” that put vulnerable communities at risk for a variety of health problems.

Conversation Starters

The American EPA continues its march against emissions. “The U.S. government will provide up to $1.55 billion in funding to monitor and reduce methane emissions from the oil and gas sector, two agencies said on Monday,” reports Reuters. “The funding will be accompanied by technical assistance for companies to rein in emissions of the planet-warming greenhouse gas from leaks and daily operations, the U.S. Environmental Protection Agency said. ‘The amount of methane emitted from oil and gas operations is enough to fuel millions of homes a year, and is a major driver of the climate crisis,’ said Joe Goffman at EPA's Office of Air and Radiation.”

CAISO petitions FERC to intervene on a transmission issue. "“The California Independent System Operator asked federal regulators Friday to reject a proposal by a Starwood Energy Group Global affiliate to recover more than double a cost cap for the 500-kV Ten West Link transmission project,” reports Utility Dive. “DCR Transmission asked the Federal Energy Regulatory Commission late last month to approve a transmission tariff based on a $553.3 million estimated project cost compared to a $259 million binding cost cap, CAISO said. ‘Allowing DCR [Transmission] to exceed the agreed-upon cap in a manner not permitted by the Approved Project Sponsor Agreement would undermine the enforceability of cost containment mechanisms across all transmission planning regions in the U.S.,’ CAISO said.”

The world’s largest battery storage plan gets the go-ahead. “Local authorities in the Greater Manchester area in the UK have issued planning permission to UK energy infrastructure development company Carlton Power to build what would be the world’s largest battery energy storage scheme, which will cost $963 million (£750 million),” reports Oilprice.com. “Carlton Power plans to build and operate a 1GW (1040MW / 2080MWh) project located at the Trafford Low Carbon Energy Park in Greater Manchester, the company said on Monday announcing it had obtained the planning permission from Trafford Council, the local planning authority. Subject to a final investment decision (FID), construction of the battery storage scheme is expected to begin in the first quarter of 2024 and enter commercial operation in the fourth quarter of 2025.”

Crom’s Blessing

Interested in sponsoring Grid Brief?

Email [email protected] for our media kit to learn more about sponsorship opportunities.